The seaports of Ukraine in 2018 handled over 135 million tonnes of cargo, which is 2.4 million tonnes or 1.8% more than in 2017. According to live information from the Ministry of Infrastructure, posted on its website, exports in ports amounted to 98.9 million tonnes, which is 383,000 tonnes more than last year, imports to 23.78 million tonnes.

In 2018, transshipment of containers in Ukrainian seaports amounted to 10.93 million tonnes (container handling grew by 11%).

Domestic shipments between the seaports of Ukraine amounted to 2.1 million tonnes, which is 14% (260,000 tonnes) more than last year. Dredging works are continuing at nine sites in the seaports, two projects in the ports of Olvia and Kherson have been prepared for concession. The number of ship journeys along the Dnipro River was 16,390, which is 11% more compared to last year. In general, in 2018 about 10 million tonnes of cargo were transported by river.

UkrAgroConsult in the current year expects a recovery in barley production, an increase in wheat production and a slight decrease in corn production.

“In 2019, the focus will probably change. We expect recovery in barley production, growth in the wheat harvest and, most likely, some decline in corn production. But the overall supply of grain from Ukraine will remain in a growing trend, Ukraine will remain a strong player in the global agricultural market,” founder and CEO of UkrAgroConsult Serhiy Feofilov said.

According to him, four seasons in a row Ukraine has been collecting record grain yields. After a slight decrease in harvest in 2017, the gross grain harvest showed a record high again.

“Of course, if to exclude weather disasters, there is every chance to further increase production. Technologies do not stand still and help reduce the risks of farmers,” he said.

The director general said that the record high harvest revealed weak points in Ukrainian logistics, which in the conditions of the record harvest could not cope with the efficient transportation of grain to elevators and ports. The second “problem area” was insufficient storage capacity, especially in the midst of harvesting a record harvest of corn and sunflower.

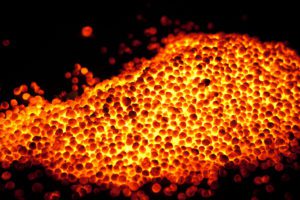

Ferrexpo Plc (the U.K.), controlling Poltava and Yeristovo mining combines, in 2018 increased total pellet production by 1.6% compared with 2017, to 10.607 million tonnes.

According to a press release of the company issued on Tuesday, over the period production of 65% Fe pellets (Ferrexpo Premium Pellets, FPP and Ferrexpo Premium Pellets plus, FPP+) totaled 9.95 million tonnes (a rise of 0.4%) and 62% Fe pellets (Ferrexpo Basic Pellets, FBP) – 682,490 tonnes (a rise of 22.2%).

Production of 65% Fe pellets from own ore was 9.824 million tonnes (a fall of 0.1%) and 62% Fe pellets – 682,490 tonnes (a rise by 22.2%).

In Q4 2018, total pellet production grew by 7.2% compared with Q3 2018, to 2.851 million tonnes.

“Total 2019 pellet production is expected to be in line with 2018 at 10.6 million tonnes as a result of ongoing maintenance,” the company said.

2018 sales volumes will be approximately 10.2 million tonnes (2017 sales volumes: 10.5 million tonnes). Sales volumes were impacted by reduced barge shipments given the low water levels on the Danube River in H2 2018. Slower than expected rail shipments in December 2018 and the timing of a capesize shipment falling into January 2019 also impacted sales volumes. The group expects these sales volumes to be caught up in H1 2019.

The group’s average received price was approximately 9% higher in 2018 compared to 2017, reflecting stronger premiums for higher quality iron ore, including higher average pellet premiums, offset by a slightly lower average 62% Fe iron ore fines price and higher international freight rates.

“The full year average 2018 cash cost of production is expected to be approximately $44 per tonne compared to $33 per tonne in 2017 due to higher energy prices and increased mining costs. Net debt as of December 31, 2018 was approximately $340 million (December 31, 2017: $403 million). The group’s cash balance as of December 31, 2018 was approximately $60 million while undrawn available debt facilities amounted to $205 million, the press service said.

KPMG in Ukraine in the 2018 fiscal year (ended on September 30, 2018) boosted revenue by 39%, to UAH 473 million and increased the number of employees, the company said in a statement on its website. The segment of advisory services showed the highest growth rates, as well as revenue from audit, tax and legal advice, the company said.

“The gradual integration of Ukraine into the EU is reflected in the improvement of business practices of Ukrainian companies, which, in turn, increases the demand for qualified advisory services,” the statement quoted Managing Partner at KPMG in Ukraine Andriy Tsymbal as saying.

In 2018 KPMG in Ukraine increased the number of its employees by 289, of which 167 are university graduates and entry-level specialists.

Globally, KPMG International in FY 2018 increased total revenue in local currencies by 7.1% from FY2017 to a record amount of $29 billion in the equivalent.

KPMG in Ukraine has been working on the Ukrainian market since 1992. It provides audit and assurance, tax and legal, advisory, risk consulting, and forensic services.