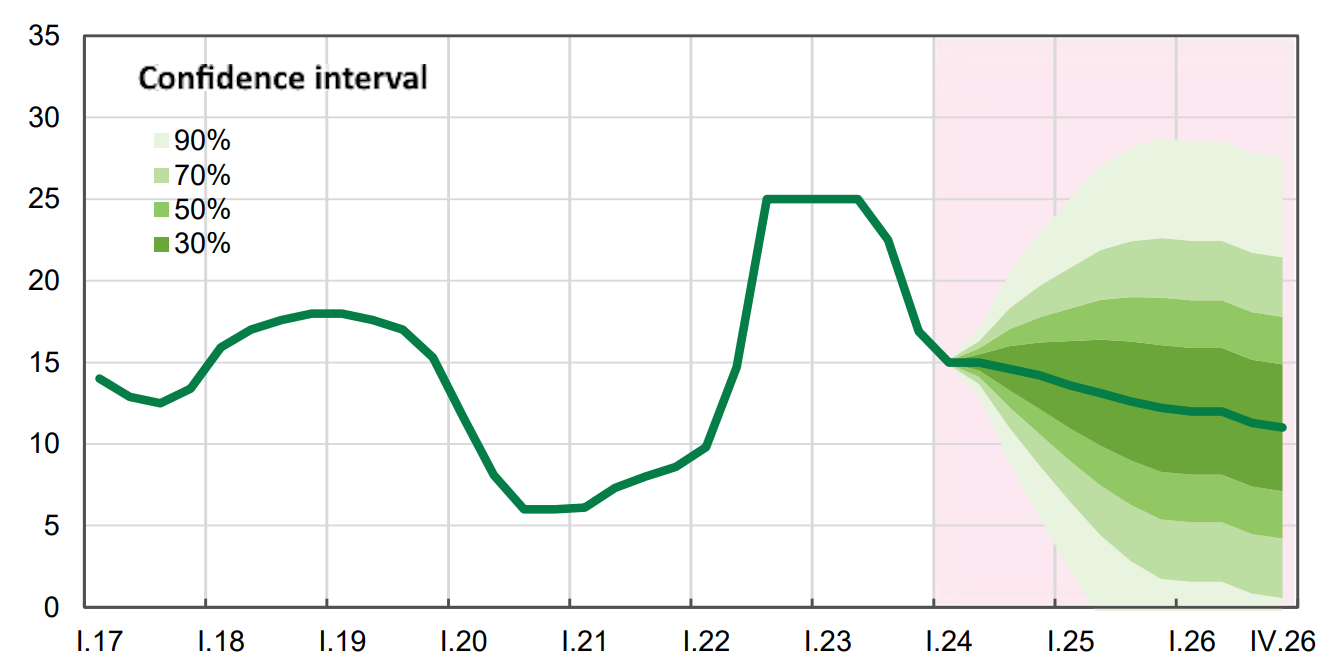

Forecast of changes in discount rate of National bank of Ukraine, %

Source: Open4Business.com.ua

The National Bank of Ukraine (NBU) has granted PJSC Insurance Company “Grandvis” (Chernihiv) permission to exit the market by executing the insurance portfolio and agreed on a plan for such exit, the regulator said on its website on Friday.

“After the completion of the procedure of exit from the market through the execution of the insurance portfolio “Grandvis” is obliged to apply to the National Bank with an application for annulment of the license for insurance activities,” the publication said.

It is specified that such a decision of the Committee on supervision and regulation of non-banking financial services markets of the NBU adopted on August 14. This was preceded by the decision of the company’s shareholders to withdraw from the market at the general meeting on August 9.

According to the regulator, in the first half of 2024, 86% of the insurance portfolio of IC “Grandvis” was formed at the expense of payments under hull insurance contracts, 8% – liability insurance and 4% – health insurance.

It is noted that the volume of insurance premiums of the company for January-June amounted to UAH 1,24 million, and formed insurance reserves – UAH 574 thousand. The NBU emphasized that the share of the insurer on the above-mentioned premiums in the market is 0.01%. For six months of 2024 IC “Grandvis” has paid out insurance indemnities in the amount of UAH 179 th.

IC “Grandvis” has been working in the insurance market since 1995. It specializes in risky types of insurance. The authorized capital of the company is UAH 14,3 mln.

As it was informed, in November 2023 the NBU has applied to PJSC IC “Grandvis” a measure of influence in the form of temporary suspension of licenses for activity on rendering financial services in the sphere of insurance.

The reason for the decision was the insurer’s failure to comply with the decision of April 24, 2023 on violation of accounting requirements and non-compliance with solvency and capital adequacy norms.

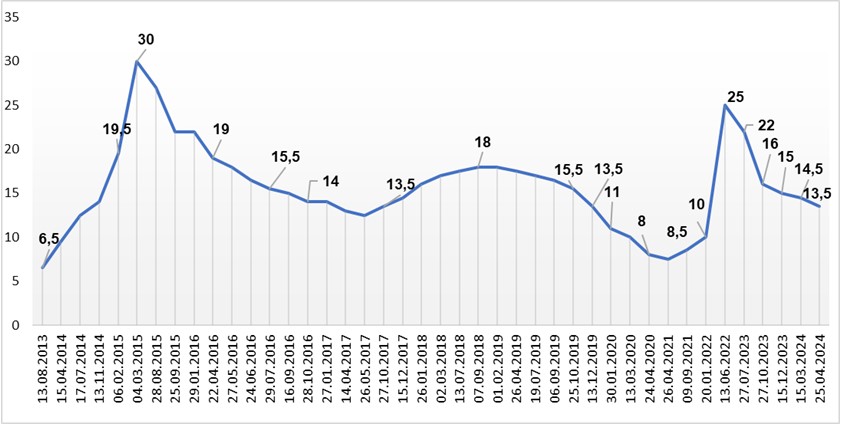

Dynamics of changes in discount rate of NBU – from 2013 to April 2024

Source: Open4Business.com.ua

Arricano Real Estate PLC (Cyprus), a leading Ukrainian shopping center developer, paid UAH 81.6 million in taxes and fees to the budgets of all levels in the first half of 2024, and transferred more than UAH 2.5 million in charitable assistance, the company’s press service reports.

“Despite the pressure of law enforcement agencies on Arricano Real Estate PLC’s business in Ukraine in 2023-2024, the leading developer of shopping malls does not lose faith in justice and victory of Ukraine and continues to reinvest in the development of its four shopping malls, the restoration of the Sun Gallery shopping mall (after a missile attack) and the construction of the Lukianivka shopping mall, work in frontline cities, create jobs and pay taxes and fees to the state budget of Ukraine,” the company said in a release.

It is noted that the group’s companies continue to systematically support the Ukrainian defense forces and help the military, charities and public organizations. Since the beginning of the year, the amount of financial assistance has amounted to more than UAH 2.5 million.

Investments in the renovation of frontline shopping malls and the restoration of the Sun Gallery shopping mall, which was damaged by a missile attack on Kryvyi Rih in January 2024, have amounted to about UAH 51 million as of today. The release emphasizes that it took less than a month to reopen some of the stores and facilities of the Sun Gallery shopping mall. Currently, the shopping center has 74 operators, and this number continues to grow.

In the first half of the year, 84 stores and establishments with a total area of 25.4 thousand square meters were opened and renovated in Arricano shopping malls.

As reported, on June 17, 2024, at the request of the prosecutor of the Kyiv Regional Prosecutor’s Office, the investigating judge of the Solomianskyi District Court of Kyiv seized the accounts of Prisma Alpha LLC and Livoberezheinvest PrJSC, which manage CITY MALL (Zaporizhzhia) and RayON shopping mall. Later, on July 25, 2024, the Solomyansky District Court of Kyiv decided to cancel the arrest of the RayON shopping center imposed in October 2023, recognizing the prosecutor’s arguments as insufficient.

Arricano Real Estate Plc specializes in the construction of shopping malls and is one of the leading developers in the Ukrainian real estate market. The company owns and operates five shopping centers in the country with a total area of 147.6 thousand square meters: RayON and Prospekt in Kyiv, Sun Gallery in Kryvyi Rih, and City Mall in Zaporizhzhia. The company also owns 49.9% in Sky Mall (Kyiv) and land plots for further construction of three projects that are currently under design. The company is also engaged in the construction of the Lukianivka shopping center in Kyiv.

According to Opendatabot, Arricano Real Estate Plc’s revenue for 2023 amounted to UAH 36 million 155.9 thousand, which is 52.8% higher than in 2022, while net profit increased 2.28 times to UAH 7 million 167.7 thousand.

During the first year of operation of the Ukrainian Sea Corridor, 64.4 million tons of cargo were transported, including 43.5 million tons of grain.

At the same time, 2,379 vessels used the “sea corridor” during this period, exporting products to 46 countries, the press service of the Ministry of Community Development, Territories and Infrastructure (Ministry of Reconstruction) reported on Friday.

“A strategic necessity for our country, which, despite all the risks, has shown its own alternative shipping route, is another step towards victory over Russia. Summarizing the results of the first year of operation of the temporary sea route, we thank those who made it possible – the Security and Defense Forces and civilian fleet workers,” the Ministry’s press service said on Facebook.

On August 16, 2023, the first vessel to use the sea route, commonly known as the “Ukrainian Corridor,” was the German container ship JOSEPH SHULTE, which had been blocked in the port of Odesa since the beginning of the full-scale invasion, the Ministry’s press service reminded.

According to the infographics of the Sea Ports Authority, in the second month of the corridor’s operation in September 2023, only 245 thousand tons of cargo were exported, including 34 thousand tons of grain, but in October the cargo turnover reached 1.4 million tons (582 thousand tons of grain cargo), in November – 2.9 million tons (1.14 million tons), in December – 4.9 million tons (1.89 million tons). In January 2024, cargo turnover reached 4.44 million tons (1.87 million tons of grain), in February – 5.2 million tons (2.65 million tons), in March – 5.14 million tons (2.57 million tons), in April – 5, 1 million tons (2.59 million tons), in May – 5.04 million tons (2.24 million tons), in June – 3.67 million tons (1.89 million tons), in July – 3.45 million tons (2 million tons), for two weeks of August – 1.73 million tons (938 thousand tons). t). t).

“The best greeting to the anniversary will be further development and support of the maritime infrastructure. This year, container traffic to the ports of Odesa and Chornomorsk has been restored. Further plans are to restore ferry service to seaports and involve seaports in the Mykolaiv region as soon as the security situation allows,” the Ministry of Reconstruction said in a statement.

Earlier, the spokesperson for the Ukrainian Navy, Captain Dmytro Pletenchuk, told Freedom TV channel that 2300 vessels used the grain sea corridor over the year and transported more than 60 million tons of cargo.

According to him, the “grain corridor” is actively used by European countries, with Spain and the countries of the global South leading the way.

JSC Slavic Wallpaper-KFTB (Koryukivka, Chernihiv region), a leading Ukrainian wallpaper producer, produced 9.9 million conventional pieces of wallpaper in January-July 2024, up 6.8% year-on-year.

According to statistics provided by UkrPapir Association to Interfax-Ukraine, the company’s production growth rate slowed in the first seven months of the year compared to the same period last year, which was 8.9% in the first half of the year.

At the same time, in monetary terms, the factory’s production volume in January-July increased by 5.3% to UAH 757.6 million.

In July, the company produced 1.57 million units of wallpaper, which is 3% less than in July 2023 and 8% less than in June this year.

The EBA has no data on the total production of wallpaper in Ukraine in January-July 2024, as the State Statistics Service has stopped providing it.

As reported, in 2023, Slavic Wallpaper-KFTP increased its wallpaper production by 19% compared to 2022, to 16.2 million meters, while production increased by 38.2% to UAH 1 billion 249 million, and net profit increased almost eightfold to UAH 47.7 million.

Earlier, the company noted that as a result of Russian aggression, sales volumes, especially through retail channels, had significantly decreased.

JSC Slavic Wallpaper-KFTB produces more than 10 types of wallpaper from the economy segment (paper, duplex, acrylic) to premium wallpaper (vinyl, non-woven, hot stamped).

In addition, the factory produces its own latex, water-dispersion paint under the Latex brand.