Major British clothing manufacturer Marks and Spencer’s has released a fun new Christmas game for the holiday season – chocolate in the form of everyone’s favorite Jenga game.

The £8 Chocolate Topple Towers is a selection of “milk, dark, white and light chocolate blocks”.

The viral clip, posted by the retailer’s employees, has already gained more than 300,000 views on the TikTok social network. It shows M&S employees taking turns removing the chocolate blocks before eating them, but without the tower collapsing.

However, people disagree on whether an edible version of the classic family game is needed. Still, it’s better not to joke with food.

Last week, net sales of dollars by the National Bank of Ukraine decreased extremely slightly – to $604.9 million from $608.5 million a week earlier, while in the previous two weeks they amounted to $862.0 million and $737.8 million, respectively.

According to the information of the National Bank on its website, from October 10 to October 14, it purchased $8.3 million, which corresponds to the usual purchase volumes during the war, while it sold $613.2 million compared to $615.7 million a week earlier.

In the cash market, the hryvnia strengthened by about UAH 0.3 over the week, to about UAH 40.7/$1, despite devaluation at the beginning of the week by about UAH 0.45 due to massive Russian shelling.

As reported, in September the volume of interventions of the National Bank amounted to $2.75 billion compared to $1.33 billion in August and $1.2 billion in July, but still remains much less than in June ($3.96 billion) and May ($3.3 billion). .4 billion).

In general, from the beginning of the year to October 14 inclusive, the NBU purchased $3 billion 142.2 million and EUR111.0 million on the market, and sold $20 billion 704.1 million and EUR1 billion 789.1 million.

Including since the beginning of the war, the purchase of foreign currency has reached $2 billion 485.3 million and EUR111.0 million, and the sale – $17 billion 933.9 million and EUR1 billion 789.1 million.

Ukraine’s international reserves as of October 1, 2022, according to the NBU, amounted to $23.93 billion (in equivalent), which is 5.9% less than at the beginning of September. At the same time, according to the new head of the NBU, Andriy Pyshny, as of October 7, they again exceeded $24 billion.

Moderately cool weather is expected in Ukraine in the next 24 hours.

According to Ukrgidromettsentr, on Monday, October 17, there will be no precipitation in Ukraine. In the western, central and eastern regions, it is foggy in places at night and in the morning. Wind southwest, in the southern part northeast, 5-10 m/s.

The temperature at night is from 3° to 2° below zero, in the extreme west and south of the country 3-8° warm; in the daytime 13-18°, in the western regions in some places up to 22°, in the north of the Left Bank 10-14°.

In Kyiv on Monday without precipitation. Wind southwest, 5-10 m/s. Temperature at night 1-3° warm, daytime 15-17°.

According to the Central Geophysical Observatory. Boris Sreznevsky in Kyiv on October 17, the highest temperature during the day (24.0 °) was in 2018, the lowest at night (-5.8 °) in 1976.

Tuesday, October 18, no precipitation in Ukraine. Wind southwest with transition to northwest, 5-10 m/s. Night temperature 0-5° heat, in western and northern regions 5-10°; daytime 15-20°.

In Kyiv on Tuesday no precipitation. Wind southwest with transition to northwest, 5-10 m/s. Temperature at night 8-10 ° heat; in the afternoon 17-19 °.

China will not seek hegemony and expansion in the world, instead, Beijing will focus on enhancing such universal values as peace, development, equality, justice, democracy and freedom, the Embassy of the People’s Republic of China in Ukraine reports.

“China will never strive for hegemony and expansion, but will increase human values such as peace, development, equality, justice, democracy and freedom. China will adhere to the full implementation of strict party discipline and promote the fight against corruption with zero tolerance and without the slightest connivance,” the embassy said in a statement dedicated to the opening of the 20th National Congress of the Communist Party of China.

It notes that the Congress was attended by 2,296 delegates on behalf of more than 96 million members of the CPC.

Xi Jinping, General Secretary of the CPC Central Committee, made a speech at the Congress, summarizing the major transformations and great achievements made in China over the past 10 years, including celebrating the centenary of the founding of the CPC, ushering in a new era of socialism with Chinese characteristics, and accomplishing the task of to combat absolute poverty and comprehensively build a moderately prosperous society.

“The report noted that China’s economic power has made a historic leap, with a total economic capacity of 18.5% of the world economy. The report presented the successful methods that China needs to follow for further development, and also described China’s grandiose plans and main political course for the development of China. for the next 5 years or longer, such as: improving the material condition and well-being of the people, improving their quality of life, promoting “green” development, increasing the importance of developing the state through science and education, building up state power through highly qualified personnel, as well as accelerating the creation world-class army,” the embassy stressed.

They note that, according to the report of the General Secretary of the CPC Central Committee, China will never seek hegemony and expansion in the world.

In addition, the report also clearly presented the central task of the Chinese Communist Party to lead the country’s multi-ethnic people unitedly on the road to building a “prosperous and powerful, democratic and cultural, harmonious and beautiful socialist modernized state, and through Chinese-style modernization to comprehensively promote great rejuvenation of the Chinese nation.”

“The China National Congress of the CCP, which is held every 5 years, is the most important meeting that pushes forward the building of the CCP, as well as development and reform in China. Since China has already successfully realized the first century goal of comprehensively building a moderately prosperous society and embarked on a new historical path to achieve the goal of the second century, this Congress is of paramount importance for the development of China,” the diplomatic mission concluded.

Ukraine in January-September this year reduced the export of titanium-containing ores and concentrate in kind by 40.8% compared to the same period last year – up to 244.076 thousand tons.

According to statistics released by the State Customs Service (STS), in monetary terms, the export of titanium-bearing ores and concentrate decreased by 10.4% to $98.542 million.

At the same time, the main exports were to the Czech Republic (48.94% of supplies in monetary terms), the USA (12.53%) and Romania (6.59%).

Ukraine in January-September 2022 imported 196 tons of similar products from Senegal (70.41%) and Turkey (29.59%) in the amount of $115 thousand, while in January-September 2021 it imported 832 tons of titanium-bearing ores in the amount of $798 thousand from Senegal (80.05%) and Germany (19.95%).

As reported, Ukraine in 2021 increased the export of titanium-bearing ores and concentrate in physical terms by 3% compared to 2020 – up to 553.051 thousand tons, in monetary terms, the export of titanium-bearing ores and concentrate increased by 17% – up to $161.914 million. the main exports were to Mexico (21.23% of deliveries in monetary terms), China (18.17%) and the Czech Republic (14.07%).

In 2021, Ukraine imported 1.172 thousand tons of titanium-containing ores worth $1.227 million from Senegal (87.03%) and Germany (12.97%), while in 2020 it imported 1.010 thousand tons worth $855 thousand.

In Ukraine, at present, titanium-bearing ores are mined mainly in the PJSC “United Mining and Chemical Company” (OGCC), under whose management the Volnogorsk Mining and Metallurgical Combine (VGMK, Dnepropetrovsk region) and the Irshansky mining and processing plant (IGOK, Zhytomyr region) were transferred .), as well as LLC “Mezhdurechensky GOK” and LLC “Valki-Ilmenit” (both LLC – Irshansk, Zhytomyr region).

In addition, the production and commercial company “Velta” (Dnepr) built a mining and concentration complex at the Birzulovsky deposit with a capacity of 240,000 tons of ilmenite concentrate per year.

Holding company Velta Group Global Ltd. registered in London in November 2011.

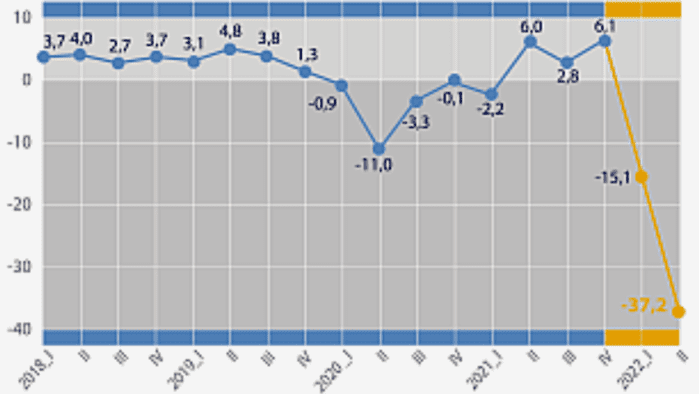

Real GDP percentage changes over previous period in 2018-2022

SSC of Ukraine , graphics of the Club of Experts