The UK stock exchanges are closed due to the funeral of Queen Elizabeth II.

Investors this week will actively follow the meetings of the world’s largest central banks. The US Federal Reserve System (FRS) will announce the rate change decision on Wednesday, the Bank of Japan and the Bank of England – on Thursday. Most experts believe that the US and British regulators will again raise key rates to combat inflation that has been beating many years of records.

In addition, it is expected that meetings of the central banks of Switzerland, Sweden, Turkey and China will take place. The People’s Bank of China will announce the rate on loans to first class borrowers (LPR) for one year and five years on Tuesday.

The composite index of the largest enterprises in Europe Stoxx Europe 600 by 11:55 a.m. CST fell by 0.5%, to 406.34 points.

The French CAC 40 fell 0.9%, the German DAX – 0.4%. The Italian FTSE MIB fell 0.7%, while the Spanish IBEX 35 fell 0.2%.

Stock quotes of the automotive concern Volkswagen AG are growing by 1.2%. The company announced it could raise up to 9.39 billion euros in a listing of preferential shares in luxury sports car maker Porsche. In addition, VW signed an agreement with Porsche Automobil Holding SE to transfer 25% of the common (voting) shares. The capitalization of Porsche Automobil in the course of trading is growing by 3.1%.

Leading losses among Stoxx 600 components include Norwegian solar energy producer Scatec ASA (-7.6%), Sweden’s Orron Energy AB (-6.6%), operating in the field of renewable energy, and Norwegian gas station owner Aker BP ASA (-5.9%).

Among the leaders of the rise are the shares of the Polish video game developer CD Projekt S.A. (+4%) and the German manufacturer of military equipment Rheinmetall AG (+3.2%).

The Expert Club YouTube channel has released another video review of current events and activities for the next week. In the new issue, the founder of the Club of Experts Maksim Urakin spoke about the main news in Ukraine and the world from August 19 to 25, 2022.

So, in Ukraine next week, several major events are expected to be dedicated to economic recovery and business support during martial law. In particular, the largest conference on youth entrepreneurship and student startups in Ukraine Startup Campus will start on Wednesday, the main speaker of which will be the Deputy Prime Minister – Minister of Digital Transformation of Ukraine Mykhailo Fedorov, and on Thursday the annual Richelieu Forum dedicated to the architecture of a new model of public service will start.

In the world next week, the most anticipated event will be farewell to Queen Elizabeth II of Great Britain. The ceremony is expected to be attended by many world leaders. In the economy, the main news could be a possible change in the monetary policy of the US Federal Reserve System, analysts predict a 30% chance of raising the Fed’s discount rate by 1 percentage point.

Football will dominate next week’s sporting events. As part of the qualification for the 2022 World Cup and the European League of Nations, important matches of the national teams will be held, among which one can single out the fundamental confrontation between two old rivals – Brazil and Argentina. More about this on the sports portal sport.ua.

For a full review of these and other events, see the new video on the Club of Experts channel at the link:

You can subscribe to the Expert Club channel here –

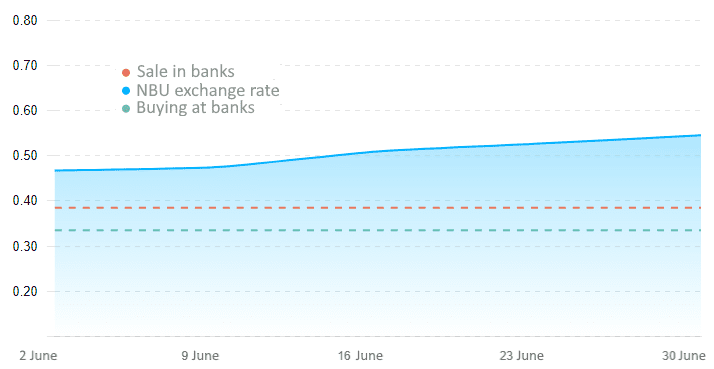

Quotes of interbank currency market of Ukraine (UAH for 1 RUB, in 01.06.2022-30.06.2022)

Stock indices of the largest countries in the Asia-Pacific region opened trading on Monday with a decrease on expectations of further tightening of monetary policy in the world.

Investors are preparing to follow the meetings of a number of central banks of the world this week. The US Federal Reserve System (FRS) will announce the rate change decision on Wednesday, the Bank of Japan and the Bank of England – on Thursday. Most experts believe that the US and British regulators will once again raise key rates to combat inflation that has been beating many years of records.

At the same time, trades in the Asia-Pacific region on Monday are inactive. Stock exchanges in Japan are closed due to the country’s celebration of Honoring the Elderly Day.

China’s Shanghai Composite fell 0.16% by 8:10 am KST, while Hong Kong’s Hang Seng shed 1%.

The stocks of pharmaceutical companies Sino Biopharmaceutical Ltd are depreciating most significantly on the Hong Kong Stock Exchange. (-6.6%) and Wuxi Biologics (Cayman) Inc. (-5.1%), development Longfor Group Holdings Ltd. (-5.9%) and Country Garden Holdings Co. Ltd. (-5%), as well as IT companies Alibaba Group Holding Ltd. (-3.4%) and Netease Inc. (-3.1%).

Construction Paper China Vanke Co. Ltd. lose 1.7% in price. A division of Onewo Inc. plans to list in Hong Kong and raise 6.15 billion Hong Kong dollars ($783.5 million).

The value of the South Korean index Kospi by 8:20 KSK decreased by 1.1%.

Shares of one of the world’s largest manufacturers of consumer electronics LG Electronics Inc. depreciate by 0.3%, the shares of its competitor Samsung Electronics Co. – by 0.2%. Capitalization of automaker Kia Corp. falls by 0.1%.

The Australian S&P/ASX 200 fell 0.07% since the market open.

The market value of the world’s largest mining company BHP is down 0.1%. Oil companies Woodside Energy and Santos lost 1% and 0.8%.

Oil prices rose on Monday as traders became more optimistic about the demand outlook amid news of the lifting of quarantine restrictions in China’s Chengdu, the capital of Sichuan province.

Chengdu, home to 21 million people, has become the largest city in China after Shanghai, where a strict lockdown was introduced to curb the spread of COVID-19. From Monday, major quarantine restrictions are lifted in Chengdu.

“The main reason for the fluctuation in oil prices is the change in demand expectations,” said Vishnu Varatan, an analyst at Mizuho Bank Ltd. in Singapore, quoted by Bloomberg. “Easing quarantine restrictions in China is an important factor for the market. We are talking about pent-up demand here.” , and that explains the immediate market reaction.”

The price of November futures for Brent oil on the London ICE Futures exchange by 8:10 am CST on Monday is $91.9 per barrel, which is $0.55 (0.6%) higher than the closing price of the previous session. As a result of trading on Friday, these contracts rose by $0.51 (0.6%) to $91.35 per barrel.

The price of futures for WTI oil for October in electronic trading on the New York Mercantile Exchange (NYMEX) rose by this time by $0.37 (0.43%), to $85.48 per barrel. By the close of the market on Friday, the value of these contracts increased by $0.01 to $85.11 per barrel.

As a result of the past week, Brent fell by 1.6%, WTI – by 1.9%.

The focus of traders this week – the meeting of the Federal Reserve System (FRS) and the Bank of England. Fears related to the fact that the rapid tightening of monetary policy by the world’s central banks will lead to a recession in the global economy and a drop in oil demand are one of the key factors pushing down the oil market in recent months. Oil prices are likely to end the third quarter with a decline, which will be noted for the first time in two years, Bloomberg notes.

The capacities of Ukrainian enterprises are sufficient to satisfy the need for roofing materials for the restoration of housing, social and critical infrastructure facilities affected by Russian aggression, Hanna Hontarenko, the acting director of the Ukrainian Steel Construction Center, told Interfax-Ukraine.

“Based on the results of work of the operational headquarters for the provision of construction materials in the Ministry of Regional Development, the needs of each region for roofing materials necessary for the restoration of housing, social and critical infrastructure have been determined. The internal potential of enterprises producing roofing materials in Ukraine allows us to meet these needs as soon as possible,” she said.

At the same time, the expert added that since the end of February 2022, the construction sector and the metallurgical industry have undergone significant changes.

“The destruction and occupation of the capacities of the largest metallurgical plants Azovstal and Illich Iron and Steel Works, a reduction in demand in the domestic market, an increase in the exchange rate and the cost of logistics – all these factors led to an increase in the cost of rolled metal. Since the beginning of the year, the price for certain assortment items has increased by more than 30%,” she said.

According to her, due to the aforementioned factors, steel structures manufacturers work with a low level of loading, however, due to stocks in warehouses and the work of metallurgical enterprises in Zaporizhia, Dnipro, Kryvy Rih, there is no shortage of rolled metal.

“But the situation will change when stocks are exhausted for certain assortment items that cannot be manufactured in Ukraine, and then demand will have to be met through imports,” the expert says.

As for the issue of steel roofing, the raw materials for it, namely rolled products, are produced by Zaporizhstal. Galvanizing and galvanizing/painting is carried out at the facilities of Unisteel LLC (the design capacity is 100,000 tonnes/year) or Modul-Ukraine LLC (the design capacity is 200,000 tonnes/year).

HOUSING, INFRASTRUCTURE, MANUFACTURERS, RAUTA, roofing materials