Ukrainian athletes won thirteen medals on the seventh day of the Deaflympic Games in Caxias do Sul (Brazil), the Ministry of Youth and Sports reported.

According to the press service of the ministry, at the XXIV Summer Deaflympics, the national deaflympics team of Ukraine won 13 awards on the seventh day – 8 gold, 1 silver and 4 bronze.

In particular, the gold medals for Ukraine were won by: Elisaveta Topchanyuk (cycling, criterium), Nazar Levitsky, Anna Fedoseyeva (orienteering, mixed relay), Oleksiy Lazebnik, Inna Afonchenko (ball shooting, 10 m air pistol, mixed), Natalka Ursulenko ( shot put), Maxim Ovcharenko, Roksolana Budnik (table tennis, mixed team), Irina Tereshchenko (swimming, 100 m breaststroke), Dmitry Rudenko, Sergey Drach, Solomiya Kuprich, Kristina Kinyaikina (athletics, mixed relay 4×40) and swimmers Artem Karnysh , Ivan Zinenko, Maxim Dudnik, Vladislav Adamovich in the 4x200m free style relay.

Athlete Yekaterina Potapenko won silver in the heptathlon.

Bronze was won by Nikolay Nosenko (athletics, 100m), Vladislav Kremlyakov (swimming, 50m backstroke), Maria Levanovich (taekwondo, up to 67 kg) and Gennady Zakladnoy and Yulia Khodko in table tennis among mixed teams.

In general, the national Deaflympic team of Ukraine won 77 medals: 39 gold, 16 silver and 22 bronze, and continues to occupy a leading position at the Summer Deaflympiad.

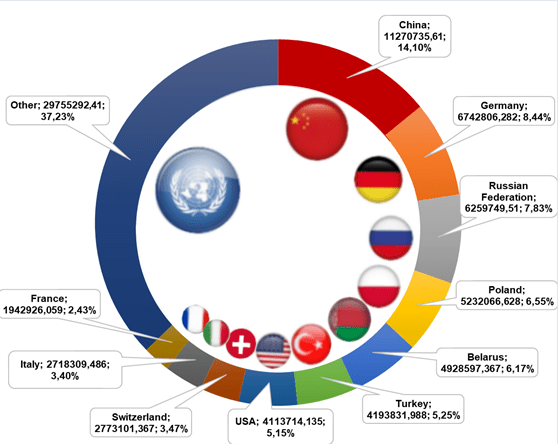

Main trade partners of Ukraine in % from total volume (import from other countries to Ukraine) in 2021

SSC of Ukraine

On Monday, May 9, US President Joseph Biden intends to sign law S. 3522 “Lend-Lease Act in Defense of Democracy in Ukraine of 2022,” according to Biden’s public schedule for Monday.

As noted, the signing will take place at 14.45 (21.45 Kyiv time).

The head of European diplomacy, Josep Borrell, believes that the EU could withdraw Russian reserves stored in Europe and send them to the restoration of Ukraine.

“I would strongly advocate for it, as it is completely logical,” he said in an interview published in The Financial Times on Monday.

“The European Commission has said that restoring Ukraine could cost hundreds of billions of euros, and European capitals could consider seizing Russian assets frozen abroad to help pay for Ukraine’s rebuilding (…)”, the FT quoted the words as saying. Borrell.

At the same time, Borrell drew an analogy with Afghanistan – the United States took control of billions of dollars of assets belonging to the Central Bank of Afghanistan in order to possibly use them in part to compensate victims of terrorism, as well as to provide humanitarian assistance to the country.

“We have money in our pockets, and someone has to explain to me why it’s good to do this with Afghan money, but not with Russian money,” Borrell said.

“EU representatives have considered whether it is possible in any way to direct Russia’s reserves to the reconstruction of Ukraine, but Brussels has not moved forward with any political proposals on this topic,” the publication notes.

The FT recalls that “shortly after the start of the conflict, the EU and its allies froze hundreds of billions of dollars of foreign assets of the Central Bank of Russia.”

BORRELL, EU, FINANCIAL TIMES, REBUILD UKRAINE, RUSSIAN FUNDS

Ukraine and Canada will return to work on expanding the Free Trade Agreement (FTA) and complete work on it in the coming weeks, the Ministry of Economy announced following an online meeting between First Deputy Prime Minister of Economy Yulia Svyrydenko and Minister of International Trade, Export Promotion and Small Business Canada Mary Ng.

“During the negotiations, government representatives decided to return to work on expanding the FTA Agreement between Ukraine and Canada and complete developments over the coming weeks,” the ministry said on its website on Sunday.

According to Svyrydenko, Ukraine is counting on Canada’s support in overcoming the food crisis provoked by the blocking of Ukrainian exports through seaports.

She said that an important step towards Ukraine could be the abolition of trade duties on Ukrainian goods by Canada following the EU and the UK.

“This will help exporters increase the volume of exports of products and thereby strengthen the Ukrainian economy and the defense of our state,” Svyrydenko was quoted as saying in the press release of the ministry.

Chargé d’Affaires of the United States in Ukraine Christina Quinn said that she had returned to Kyiv.

“Just arrived in Kyiv! Glad to be back here on Victory in Europe Day. Glory to Ukraine! We are together with Ukraine,” the embassy tweeted on Sunday evening.