Ukraine’s FX payments on public debt will exceed $10 billion in the next 12 months, the National Bank of Ukraine said in its June Financial Stability Report.

“In the next 12 months, only FX payments by the government and the NBU on the state and guaranteed debt will exceed $10 billion. In the hryvnia segment of the market, repayment of principal and interest in the second half of the year will exceed UAH 130 billion,” the central bank said on its website.

The regulator said that the schedule of debt payments in the next three years remains tight. However, the load is distributed relatively evenly, which should not create significant problems for the Ministry of Finance, although the average volume of auctions should still grow.

According to the report, the financing needs may be mitigated by the additional issue of special drawing rights (SDRs) in the amount of $650 billion being discussed by the International Monetary Fund (IMF) to support the global economic recovery.

“If the IMF Executive Board approves the decision, Ukraine will increase its FX reserves by about $2.7 billion, the NBU said in the report.

SkyUp Airlines (Kyiv) has launched charter flights from Lviv to Al-Qassim (Saudi Arabia), the company’s press service said on Tuesday.

“On 20 June, Lviv International Airport welcomed the first SkyUp charter aircraft from Al-Qassim, Saudi Arabia. It is expected that this flight will launch a number of planned flights by the airline from the Arabian Gulf countries to Ukraine,” the report said.

According to Head of the State Agency for Tourism Development Maryana Oleskiv, who is cited by SkyUp, the countries of the Arabian Gulf, together with the Central Asia region, are priority areas for the development of inbound tourism in Ukraine.

In addition, on June 20, SkyUp launched regular direct flights from Kyiv to Pula (Croatia). They will be operated on Thursdays and Sundays.

From June 23, the airline will also launch flights from Kyiv to Split, Croatia (flights will be operated on Wednesdays and Saturdays), and from June 25 – to Dubrovnik (flights will be operated on Fridays).

Direct flights to Pula are also operated by Ukraine International Airlines (UIA) and Windrose Airlines, and to Split – by UIA.

As reported, Flynas Airlines (Saudi Arabia) on June 11 launched its first flight from Kyiv to Riyadh. Prior to that, Ukraine did not have regular direct flights with Saudi Arabia.

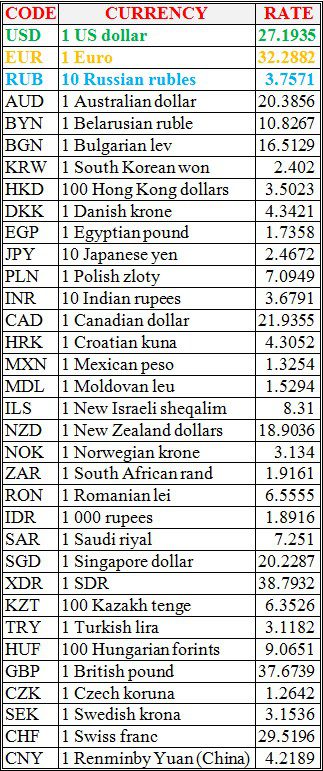

National bank of Ukraine’s official rates as of 22/06/21

Source: National Bank of Ukraine

The Ministry of Foreign Affairs of Ukraine and the Ministry of Health of Ukraine have been instructed to prepare proposals on the advisability of installing additional controls and restrictions on migration between Ukraine and countries where the Delta coronavirus (COVID-19) strain is rapidly spreading.

According to the presidential press service, during a conference call at the President’s Office, its participants heard information from the National Academy of Sciences of Ukraine on the spread of COVID-19 Delta strain.

According to the National Academy of Sciences, “this strain of coronavirus is 1.6 times more infectious than the Alpha strain, some 2.26 times more likely to lead to hospitalization, and the risk of resuscitation in case of infection increases 1.45 times.”

The Global Affairs Canada, implementing the Ukraine Horticulture Business Development Project (UHBDP), has decided to extend the project until March 31, 2022, whereas it was previously planned to be completed in 2021, project manager Dmytro Nikolayev said during a press conference in Kyiv. According to him, UHBDP for the period from 2014 to 2021 provided financial support for a total of UAH 43.25 million for 2,780 clients.

He clarified that by March 31, 2022, the project will additionally support clients under various programs in the amount of about UAH 20 million. He clarified that at present UHBDP focused on informing farmers about the legislative features of the land market launched from July 1, developing and implementing educational and online trading platforms, and providing grants for business restoration to the most vulnerable groups of agricultural producers.

As reported, UHBDP finances 30% of the total cost of projects, which are at least estimated at $ 200,000. The term of their implementation is a year and a half.

The Ukraine Horticulture Business Development Project (UHBDP) is funded by the Global Affairs Canada, implemented and co-financed by the Mennonite Economic Development Associates (MEDA). MEDA works with Israel’s Agency for International Development Cooperation(MASHAV) and international service companies to provide technical support.

UHBDP works with producers from Zaporizhia, Kherson, Mykolaiv and Odesa regions, engaged in fruit and vegetable growing, berry growing, viticulture and beekeeping.