The loan portfolio of Ukrainian banks in January-March 2021 expanded by 0.8%, to UAH 1.06 trillion, while the volume of non-performing loans (NPL) fell by 1.8%, to UAH 422.6 billion, according to a report posted on the website of the National Bank of Ukraine (NBU).

According to it, the share of NPL in the banking system in the first quarter of 2021 decreased from 41% to 39.9%.

The National Bank said that in the first three months of 2021 the portfolio of loans to the corporate sector decreased 0.4%, to UAH 792.540 billion (including the share of NPL in it – by 1.2%, to UAH 366.7 billion), in turn, the portfolio loans to individuals grew by 3.3%, to UAH 215.29 billion (NPL decreased 5.6%, to UAH 54.92 billion).

At the same time, the volume of interbank loans increased by 15%, to UAH 39.15 billion (including NPL decreased 0.3%, to UAH 981 million), while the volume of loans issued to public and local authorities decreased 4.2%, to UAH 11.24 billion (NPL remained at zero).

According to the National Bank, at the end of the quarter, the share of NPL in the portfolio of loans issued to the corporate sector fell by 0.4 percentage points (to 46.3%), loans to the population – by 2.4 percentage points (to 25.5%), interbank loans – by 0.4 percentage points (to 2.5%), and loans to public authorities remained at the level of 0%.

According to the central bank report, the loan portfolio of state-owned banks without PrivatBank in January-March 2021 increased 1.3%, to UAH 299.07 billion (the NPL volume in it decreased 0.1%, to UAH 128.9 billion) , while the loan portfolio of PrivatBank increased 0.2%, to UAH 245.376 million (NPL decreased 1.8%, to UAH 177.99 billion).

In addition, in January-March 2021, the loan portfolio of banks with foreign capital decreased 1% (to UAH 340.7 billion), and with private ones increased 5% (to UAH 173.1 billion), while the volume of NPL in them decreased accordingly 3.1% (to UAH 92.9 billion) and 4.9% (to UAH 22.8 billion).

Thus, at the end of the first quarter of 2021, the share of NPL in the loan portfolios of state-owned banks (excluding PrivatBank) decreased 0.6 percentage points (to 43.1%), in PrivatBank – by 1.4 p.p. (to 72.54%), in banks with foreign capital – by 0.6 percentage points (to 27.28%) and in banks with private capital – by 1.4 percentage points (to 13.2%).

As reported, at the end of 2020, the loan portfolio of Ukrainian banks narrowed by 4.4%, to UAH 1.05 trillion, including the volume of NPL falling by 18.9%, to UAH 430.371 billion.

On 30 April 2021, Ukraine announced the successful settlement of its new $$1.25 billion eurobonds due 2029 placed with a yield of 6.875%. “The proceeds were transferred to the account of the State Treasury of Ukraine and will be used for general budgetary purposes,” the ministry said.

According to the report, the notes will be admitted to trading on London Stock Exchange’s main market on 4 May 2021. This is an inaugural listing of Ukraine’s sovereign bonds on London Stock Exchange. Earlier Ukraine’s notes were listed on the Irish Stock Exchange.

The ministry said that the notes were issued with a yield of 6.875%, receiving bids in excess of $3.3 billion from 223 investors. The investor base of the new issuance was dominated by asset managers, which accounted for 84% of the notes issued and followed by hedge funds (9%), insurance and pension funds (5%) and banks (2%).

Investors from the United Kingdom, the United States and continental Europe generated the majority of demand in the new eurobond’s primary offering with 42%, 34% and 21% of allocations, respectively. Investors from Asia and MENA amounted to 3% of the allocations.

BNP Paribas, Deutsche Bank, Goldman Sachs International and J.P. Morgan acted as joint bookrunners.

Government Commissioner for Public Debt Management Yuriy Butsa said that despite returning to the fiscal consolidation path, Ukraine’s financing needs are still high compared with the previous years. As a part of our debt management strategy, the decision was made to cover most of those needs from the local market and in national currency.

“Having successfully implemented this strategy in Q1, we returned to the international capital markets after their stabilization in order to cover part of our FX needs for this year. We are glad that in the less favorable market environment for the emerging economies, markets still remain accommodating for issuers with a track record of prudent fiscal and monetary policies and proactive engagement with the investor community,” he said.

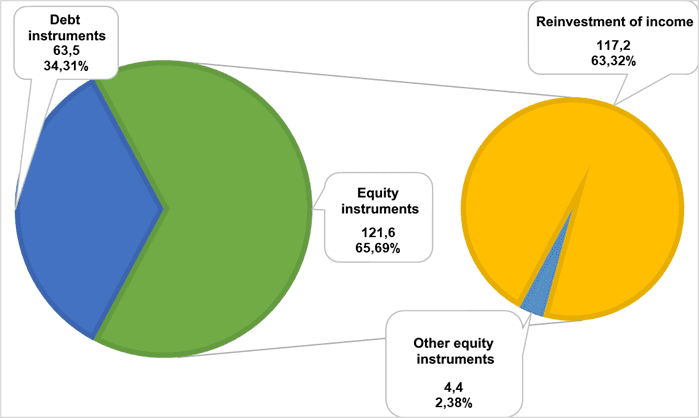

FOREIGN DIRECT INVESTMENTS IN THE ECONOMY OF UKRAINE FOR THE III QUARTER OF 2020 (OPERATIONS, $ MILLION)

Soul Partners, the independent investment banking boutique in Ukraine, under the USAID Economic Resilience Activity Project is raising over $8 million to develop four enterprises: Agro Master Plus LLC, Kod Zdorovia LLC, private enterprise Magistr and Azovtechgas LLC.

“Investment banking services are normally afforded by large companies. But USAID Project gives small regional enterprises an opportunity to attract investments,” Managing Partner of Soul Partners Vitaliy Provotorov said.

According to the document, the manufacturer of hydraulic cylinders and hydraulic distributors Agro Master Plus LLC (Melitopol, Zaporizhia region) needs, according to preliminary estimates, $1 million for the purchase of equipment and software, construction and repair of industrial buildings, replenishment of working capital.

The medical center of Kod Zdorovia LLC (Mariupol, Donetsk region) needs more than $3.6 million for the construction and launch of a department for cancer treatment, in particular for the purchase of high-tech equipment, the company said.

According to it, the manufacturer of hydraulic cylinders, private enterprise Magistr (Semenivka village, Melitopol district, Zaporizhia region) will receive over $3 million to expand production capacity in an effort to increase the volume of exports to global markets, and Azovtechgas LLC (Mariupol) requires about $1 million for the purchase of equipment for expanding the scope of activities.

Soul Partners said that the companies, which were selected for cooperation are the leaders in their niche and meet the defined criteria for investments attraction. Those are companies having fewer than 250 employees, an annual turnover of up to EUR 40 million or a balance sheet total of no more than EUR 20 million. Preferences were granted to SMEs in agriculture (excluding commercial grain production), IT, innovative manufacturing, alternative energy and tourism.

“The investment attraction process for the abovementioned companies is still ongoing: Soul Partners expects to finalize the process till the end of 2021,” the company said.

Pivdenne (Yuzhnoye) Design Bureau, Makarov Pivdenny (Yuzhny) Machine-Building Plant (Pivdenmash, Dnipro) and Italian Avio SpA have reached an agreement on additional supplies of 10 Ukrainian-made propulsion engine blocks for the Vega launch vehicle (LV) for a total amount of almost EUR 6 million, according to the press service of the Ministry of Foreign Affairs of Ukraine.

According to its Friday press release, the Italian side confirmed its readiness to expand cooperation on April 28.

“The expansion of participation in the European Vega program testifies to the reliability and competition of engineering developments in the Ukrainian rocket and space industry. Support of such contracts is one of the top priorities of the Ministry of Foreign Affairs, and the efforts of Ukrainian diplomats in Italy played an important role in reaching this agreement,” the press service said, citing Minister Dmytro Kuleba.

According to Chief Economist at Pivdenmash Dmytro Nikon, the current contract contains an option providing for the manufacture of additional 10 units.

“We are thankful to the Ukrainian diplomats who kept the case under control, repeatedly contacted both the company’s management and representatives of the Italian Space Agency, which led to a positive result,” he said.

Chief Designer of the Design Bureau of Liquid Propellant Rocket Engines of the Pivdenne Design Bureau Oleksandr Prokopchuk said that cooperation with Avio S.p.A. is a clear example of the integration of the Ukrainian rocket and space industry into European space programs.

According to the press release, the current contract for the supply of 11 propulsion engine blocks is effective until 2023. Seven blocks have already been delivered, one will be shipped to the customer in the near future, and three more are being manufactured.

The Vega light launch vehicle is a joint project of the European Space Agency and the Italian Space Agency. Pivdenne Design Bureau and Pivdenmash cooperate with the Italian Avio S.p.A. under the Vega program since 2004, during this time more than 20 propulsion engine blocks were manufactured and delivered, the last of which were at the beginning of 2021.

A feature of the propulsion engine blocks is the ability to launch multiple times during flight (up to five launches), which ensures the deployment of satellites into different orbits. Italy is one of the founding countries of the European Space Agency and is among the top three contributors along with Germany and France.

U.S. Secretary of State Antony Blinken will arrive in Kyiv for a two-day visit on May 5, Department Spokesperson Ned Price said in a statement released on Friday.

“The Secretary will travel to Kyiv, Ukraine, May 5-6, where he will meet with President [Volodymyr] Zelensky, Foreign Minister [Dmytro] Kuleba, other officials and representatives of Ukrainian civil society to reaffirm unwavering U.S. support for Ukraine’s sovereignty and territorial integrity in the face of Russia’s ongoing aggression,” the spokesperson said.

“He will also encourage continued progress on Ukraine’s institutional reform agenda, particularly anti-corruption action, which is key to securing Ukraine’s democratic institutions, economic prosperity, and Euro-Atlantic future,” the spokesperson said.

Earlier, Ukrainian Foreign Minister Kuleba said that during a meeting with Blinken he plans to discuss the assistance that the United States can provide to Ukraine in the reform process, as well as a number of economic issues, especially in the energy sector.