In Ukraine, law enforcement officers and authorized persons from now on, November 21, have the right to fine citizens for not wearing a mask in public places.

Law No. 1000-IX with amendments to the Code of Administrative Offenses of Ukraine regarding the prevention of the spread of coronavirus disease (COVID-19) was adopted by the Verkhovna Rada on November 6. Ukrainian President Volodymyr Zelensky signed it on November 19, and on November 20 it was published in the parliamentary newspaper Golos Ukrainy.

According to the law, people will be fined for being in public buildings, structures, public transport during the quarantine without wearing personal protective equipment, including respirators or protective masks that cover the nose and mouth, including those made by themselves. At the same time, the law stipulates that a respirator or protective mask must cover the nose and mouth.

The size of the fine will be from 10 to 15 non-taxable minimum incomes of citizens (UAH 170-255). Fines can be imposed by authorized representatives of local authorities, police officers, as well as employees of the State Sanitary and Epidemiological Service.

The Strauss Group international company, one of the largest coffee producers in the world, in the third quarter of 2020 put into operation a warehouse and distribution center at 56A, Novopyrohivska Street, in the Holosiyivsky district of Kyiv.

“An innovation distribution center in Ukraine opened in the third quarter,” the group said in its third quarter report.

According to the unified public register, Strauss Ukraine LLC on October 9 also changed its legal address to 56A, Novopyrohivska Street (formerly – 5B, Antonova Street).

“09/25/2020. Now this date has historical value for us. For 20 years of work in Ukraine, we have had many achievements in all areas of consumption, production and preparation of coffee. And today one of our achievements is the opening of the doors of a new home for all our employees! Congratulations to all our colleagues on moving to a new, very modern, functional, stylish location,” the company said on its Facebook page.

Strauss Group specializes in the production of food and beverages and is one of the five coffee companies in the world. It has 29 production sites in 22 countries. The staff includes 14,000 people.

In the Eastern European market, Strauss represents the brands Black Card, Ambassador, FORT, Totti Caffe, Elite Health Line, and Sucrazit.

COFFEE, COFFEE PRODUCERS, DISTRIBUTION, DISTRIBUTION CENTER, KIEV

The occupancy of beds by patients with COVID-19 in Ukraine as of Monday morning is 52%, Health Minister Maksym Stepanov said during a press briefing in Kyiv on Monday.

“Some 53,445 beds have already been introduced for the treatment of patients with COVID-19, of which 27,792 beds are occupied by patients. The occupancy of beds is 52%. We continue to introduce beds, we can increase the maximum to almost 90,000 (50% of all beds),” he said.

“Some 25.996 beds are provided with oxygen. In general, 12,168 beds are provided with oxygen throughout the country. But in some regions there is a tense situation – this is Kyiv, Cherkasy, and Kharkiv regions,” the minister added.

The Cabinet of Ministers has identified as a priority a project for production of ventilators, two waste incinerators and an air launch space rocket complex, a total of 103 priority investment projects in the approved list until 2023.

As the correspondent of the Interfax-Ukraine agency reports, the government approved the relevant order with a three-day revision at a meeting on Wednesday, November 18.

According to the draft decree, four out of 103 projects provide for financing entirely from the state budget, and another 43 projects partially from the state and/or local budget.

As indicated in the document, among the priority investment projects are the organization of the production of ventilators at the expense of the investor, the state budget and other sources, as well as the construction of a plant for solid household waste processing (ensuring environmental safety in Kyiv) at the expense of an investor.

In addition, among the priority projects is the construction of a waste sorting line in Drohobych (Lviv region) at the expense of the state budget and the local budget.

Among the investment projects that are planned to be implemented at the expense of the state budget and international technical assistance are the modernization of the An-124-100 and An-225 aircraft families at Antonov State Enterprise, an air launch rocket and space complex, the Observatory International Scientific Center on the Pip Ivan mountain – a platform for the development of the Carpathian region.

In addition, it is planned to implement a project to prepare the production of an infrared homing head for guided air missiles, as well as to expand the Yahodyn international checkpoint – exclusively at the expense of the state budget.

Also, at the expense of the investor, local budgets and the state budget, it is planned to implement the construction of waste incinerators in Kramatorsk and Mariupol, the construction of the tourist and transport infrastructure of the Shatsk National Natural Park (plus international technical assistance funds), and to build the H2O Nova Kakhovka Olympic Sports Center.

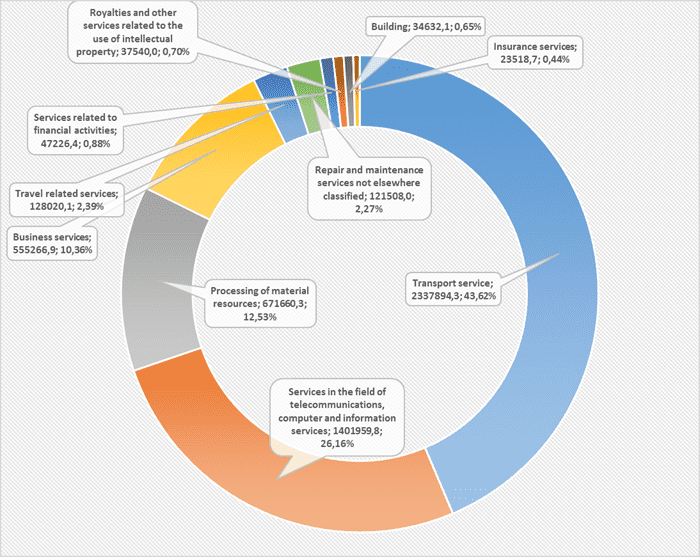

Structure of import of services in 1st halfyear of 2020 (graphically).

As of November 19, Ukrainian agricultural producers harvested 78.5 million tonnes of basic crops from an area of 23.4 million hectares, in particular, 60.3 million tonnes of grain and leguminous crops were harvested from an area of about 14.6 million hectares (95% forecast).

According to a report on the website of the Ministry for Development of Economy, Trade and Agriculture, 24.5 million tonnes of corn was harvested from an area of 4.7 million hectares (86%), 13 million tonnes of sunflower from 6.4 million hectares (100%), 2.7 million tonnes of soybeans from 1.3 million hectares (97%), 243,700 tonnes of millet from 150,300 hectares (100%) and 105,600 tonnes of buckwheat from 78,400 hectares (100%).

Some 8.1 million tonnes of sugar beet was dug from an area of 190,700 hectares (88%).

As reported, the Economy Ministry predicted the grain harvest in 2020 at 68 million tonnes. Of the early grains, the following have already been threshed: 25.1 million tonnes of wheat from an area of 6.6 million hectares; 7.8 million tonnes of barley from 2.4 million hectares; 516,200 tonnes of peas from 238,000 hectares; 2.56 million tonnes of rapeseed from 1.1 million hectares.