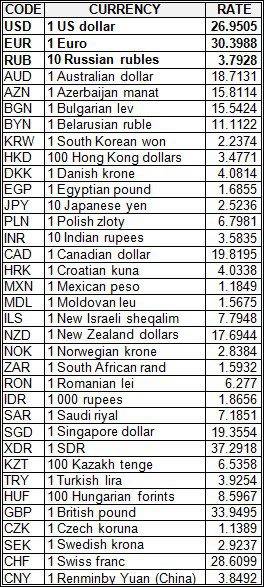

National bank of Ukraine’s official rates as of 13/07/20

Source: National Bank of Ukraine

Croatia has changed the entry alert for the citizens of a number of states including Ukraine. As Ambassador of Ukraine to the Republic of Croatia Vasyl Kyrylych wrote on Twitter, such decision was taken in late hours of July 10. “Late on July 10, Croatia took a decision on the obligation for third-country nationals, including Ukraine, who enter the Republic of Croatia to undergo 14-day self-isolation. If there is a test for COVID-19 done no later than 48 hours, self-isolation is not needed,” wrote the ambassador.

In turn, the Embassy of Croatia in Ukraine noted on Facebook that third-country nationals entering Croatia for personal urgent reasons (for example, have private property in Croatia) must undergo a mandatory 14-day self-isolation, but it can be reduced to seven days if a person at his own expense will passe a sample of material from a nose and a throat seven days after arriving in the country and will receive a negative PCR-test for SARS-CoV-2.

At the same time, persons entering Croatia for tourist purposes or for training can enter the country without a 14-day self-isolation, but upon presentation of a negative PCR-test for SARS-CoV 2. It is noted that the test should be done not later than 48 hours (counting from the time of taking sample to arrival at the border crossing).

As previously reported, Ukrainians could visit Croatia if a hotel reservation or a guest dwelling are confirmed.

The volume of non-cash payments in May grew to 55.5% of all operations from 50.3% in January 2020, and their number grew to 87% from 82.4%, the press service of the National Bank of Ukraine (NBU) reported on its Facebook page to Friday.

“During the quarantine, non-cash payments proved their safety and convenience. Therefore, the choice of Ukrainians in favor of cashless payments is obvious,” the press service of the central bank said.

At the regulator will publish statistics on the state of the card market on a monthly basis, due to the fact that since the beginning of the year, banks began to provide the regulator with statistical information with appropriate reporting intervals.

Trade in shares of foreign-registered companies doing business in Ukraine

On Tuesday, July 14, at 10.30, the press center of the Interfax-Ukraine News Agency will host a press conference on the subject: “Socio-Economic Consequences of the Crisis, Ukrainian Citizens’ Expectations before Municipal Elections” to present a sociology survey conducted by the companies Active Group and Expert Club. Participating will be Head of the Active Group sociology company Oleksandr Pozniy, Co-founder of the Expert Club, political scientist Danylo Bohatyriov, political expert Valentyn Haidai (8/5a Reitarska Street). The broadcast will be available on the YouTube channel of Interfax-Ukraine. Admission requires press accreditation on the spot.