Ukraine International Airlines (UIA, Kyiv) has begun a process of the forced dismissal of 900 employees (35.2% of the company’s staff as of early 2020) due to the closure of air traffic because of anti-epidemic quarantine measures introduced by Ukraine, the company’s press service has said.

“Now the company’s management is taking all possible measures to reduce costs and generate income from single flights. Our goal is to preserve the company and key personnel, in particular flight crews. Unfortunately, a significant decrease in the airline’s activities resulted in a forced reduction of 900 UIA highly professional employees,” UIA President Yevhen Dykhne said.

The airline’s press service told Interfax-Ukraine that UIA has already begun the process of staff reduction in accordance with the law, which will require a minimum of two months.

Dykhne emphasized that in connection with the introduction of restrictive measures on regular passenger air transportation since March 17 of this year, UIA’s work was practically stopped.

The company also noted that the UIA long-haul fleet will also be reduced.

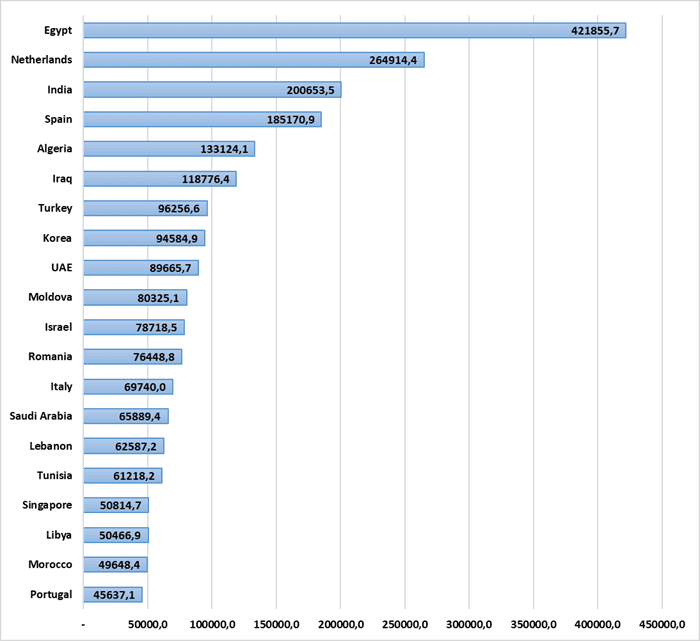

Top 20 countries Ukraine has posted the highest surplus of trade in goods in Jan-Feb 2020 (thsd Usd)

Rinat Akhmetov with a $2.8 billion fortune is No.1 in the top 100 wealthiest businessmen of Ukraine, the total fortune of whom exceeded $31 billion, and compared with the peak 2013 the fortune of Akhmetov plunged by almost 83%, Forbes has said on its website. According to the ranking of the Forbes Ukraine publication, which was published first since 2016, the owner of Interpipe Group Victor Pinchuk with a $1.4 billion fortune came in at No. 2 and the fifth president of Ukraine, leader of the European Solidarity party Petro Poroshenko ($1.4 billion) is No. 3.

Poroshenko returned to the list of U.S. dollar billionaires after a five year break: in 2014, U.S. Forbes estimated his fortune at $1.3 billion.

Eight people in the list have a fortune no less than $1 billion, including two, who are the co-owners of the Epicenter hypermarket chain – Oleksandr and Halyna Hereha. The list of the U.S. dollar billionaires is locked by former owner of PrivatBank Ihor Kolomoisky.

The top 100 richest businessmen of Ukraine with the minimum net worth needed to be part of the exclusive club of $95 million is locked by the co-owner of the Tavria V supermarket chain Borys Muzalev.

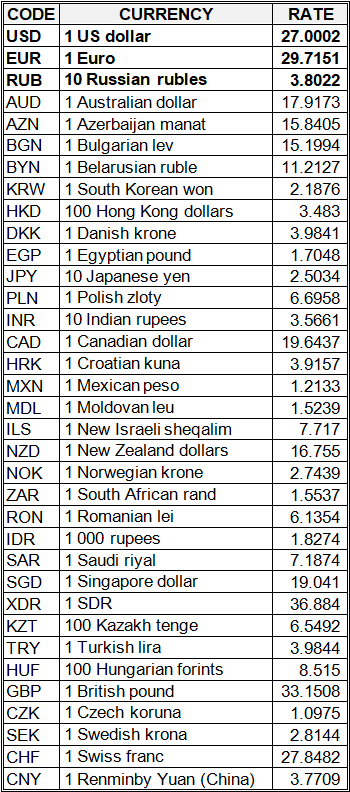

National bank of Ukraine’s official rates as of 28/05/20

Source: National Bank of Ukraine

Ukraine International Airlines (UIA, Kyiv) intends to operate medium-haul international point-to-point flights capable of demonstrating substantial passenger load without transit feeding, the airline said in a Thursday press release.

The airline said that the airline expects to resume operations by referencing the best case scenario provided that the entry/exit restrictions for both Ukrainian and foreign nationals are lifted effective June 15, 2020.

UIA predicted that Ukraine International’s passenger traffic will decrease by approximately 46%, i.e., down to 1.9 million passengers (of which 0.986 million have already been carried before the lockdown).

At stage one – through April 2021 – the carrier intends to operate medium-haul international point-to-point flights capable of demonstrating substantial passenger load without transit feeding. Ukraine international expects to resume domestic operations. At stage two, as soon as passenger traffic is regenerated, the airline will restore minimal international route network.

UIA said that long-haul operations may be resumed after critical feeding flights are re-introduced to the schedule – in or about April 2021.

“Right after Ukraine International resumes operations, the airline plans to operate 14 aircraft, gradually increasing the number up to 28. The long-haul fleet will be optimized with due allowance for the necessities of stage one. Later on, based on the traffic and market landscape (namely drop in demand for long-haul aircraft), the carrier will decide on extending its widebody fleet,” the airline said.

To perform efficiently on the post-pandemic market, Ukraine International introduces changes to its base product.

“The airline plans to facilitate its fare policy, cut down business class capacity, increase the sales share via the website, and offer customers full-cycle service on the website providing passengers with an opportunity to make changes in their bookings. The airline is committed to increasing fleet operation and cutting costs while preserving substantial transit potential,” UIA said.