Alfa-Bank (Kyiv) has improved our real GDP growth forecast for 2020 from 3% to 3.2% and expects economic growth to reach 3.8% in 2021, according to the bank’s macroeconomic forecast under the base case (most probable) posted on its website last week. According to the document, the economy would expand with moderate rates of 2.3-2.5% during the first three quarters of 2020. At the same time, the bank sees prospects for economic growth accelerating in the fourth quarter of 2020 to more than 4% due to expected thrust in bank lending, which would provide additional impetus for domestic demand.

“Low baseline effect would be another major reason behind economic growth acceleration at the end of 2020, as the last quarter of the previous year was associated with local slump in industrial and agricultural output,” the bank said in the forecast.

According to the bank’s analysts, low inflation would be one of the key features of 2020. According to the bank’s forecast, average annual growth in Consumer Price Index (CPI) would turn just 3.4% this year, after 7.9% in 2019.

“Only by the end of 2020, inflation would return to the target range set by the National Bank of Ukraine (4-6%), as a result of monetary easing and some recovery in producer prices,” the bank’s analysts said.

The bank’s experts share the recently updated central bank’s expectation of its prime rate at 7% by end 2020 from current 11%. However, they do not exclude that prolonged inflation below target range in 2020 would request for an even more accommodative monetary policy.

The Antimonopoly Committee of Ukraine has permitted ADM International Sarl, Bunge S.A., Cargill International S.A., Louis Dreyfus Company Suisse S.A. (all based in Switzerland) and Glencore Agriculture B.V. (the Netherlands) to create TechCo (Switzerland).

According to a Monday posting on the committee’s website, the creation of the company is aimed at uniting and transforming the process of the process of performing post-sales operations for the sale of agricultural products by gradually moving from manual document management to automatic through digitization.

“Given that the platform will be used only for the stage of performing after-sales operations at the international level by sea, outside Ukraine, the planned creation will not affect the level of competition in any Ukrainian market,” the committee said.

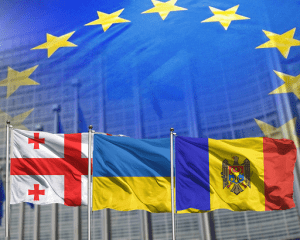

The foreign ministers of Ukraine, Georgia and Moldova have addressed the European Union together regarding the importance of support for the Eastern Partnership, according to the press service of the Foreign Ministry of Ukraine.

“On the margins of the Munich Security Conference the Ministers of Foreign Affairs of Ukraine, Georgia and Moldova have signed a joint letter to the Members of the European Commission regarding importance of relevant financial support for the Eastern Partnership in the next EU Multiannual Financial Framework for 2021-2027 that is currently being shaped by the EU institutions,” reads the statement.

The ministers called on the EU to take into account within its strategic budgetary planning for the next seven years the scale and ambitions of the reforms, which are being implemented and planned by Ukraine, Georgia and Moldova in the process of their European integration.

“The joint address of the Ministers is another sign of unity of Ukraine, Georgia and Moldova in their approaches to future development of the Eastern Partnership, based on the differentiation principle, as well as to the idea of enhanced dialogue in the EU+3 Associated Partners format,” reads the statement.

Ukrainian President Volodymyr Zelensky said he was certain he will visit the White House and meet United States President Donald Trump, and has invited him to Kyiv.

“I am sure it will happen. The last time I met U.S. Secretary of State Mike Pompeo, we talked about it, and said that I would very much want my visit to America to be something special for the two countries. With some very important result for the two countries. Something beneficial for the two countries,” Zelensky said during the 56th Munich Security Conference on Saturday, when asked if he had a specific date for the White House visit.

The president said he wanted to re-start the relations with the U.S. “with a clean slate.”

“After all this Santa Barbara…about the impeachment…I want to come and start our relations with a clean slate, so that we agree and sign some contracts, agree strategic things, investment things. Let’s prepare a package of such documents and meet. So now the ball on the U.S. president’s court, but we are always happy to see them all in Ukraine. So I am ready to invite, and I am inviting, President Trump to Kyiv.”

He also commented on the blocking of U.S. military aid.

“We needed that aid, we needed a tactical win in this story, without the souring of our relations with the U.S. So, tactically is how I am thinking about Ukraine. Always. And, honestly, I’ll tell you this: sometimes I reply not how I want to, but in the way necessary for Ukraine. So, my body, my brain, my eyes belong to the Ukrainian people,” Zelensky said.

President Volodymyr Zelensky called on Ukraine’s international partners and business representatives to become involved in the implementation of infrastructure and social projects in the Donetsk and Luhansk regions affected by the armed conflict. During his speech at the Ukrainian Lunch in Munich, the head of state said that a global fund had been created to restore the Donbas infrastructure in Ukraine.

“It combines two ‘windows’. The first is for international partners, organizations and foundations. The second is for the Ukrainian fund, which will attract funds from the private sector and individual donors,” the head of state said.

According to the president, the key priorities of the fund are large infrastructure projects, work with local business and its affordable crediting, care for the least protected groups of the population, overcoming the consequences of the war – with a focus on youth, women, children and veterans.

“For the first time such a fund is administered jointly by the World Bank, the Office of the President and the Government of Ukraine,” Zelensky stressed.

In addition, the head of state told about the plans to establish the Ministry of Reintegration and Restoration of Donbas.

“I urge our international partners to join and start fundraising for the reconstruction and reintegration of Donbas together with me,” the president summarized.