The Federation of Automobile Employers of Ukraine (FAU), citing data from Auto-Consulting, has published statistics on sales of new passenger cars.

According to the data, 33.773 thousand passenger cars were sold in Ukraine in January-June.

The first six places in the market remained unchanged compared to May: Toyota is in the lead with sales of 887 cars (4% more than in June 2024, but 20% less than in May 2025), Volkswagen is in second place, with sales more than doubling in June compared to June 2024 – up to 557 units, Renault is third with 547 cars (+32%).

The fourth place is taken by Skoda, which in June increased sales by 69% compared to June last year – 454 units, BYD has already steadily gained a foothold in fifth place thanks to the import of electric cars (453 units), and Huyndai was sixth (284 cars and an increase of 73% compared to June last year).

Zeekr has also increased its influence – now these Chinese electric cars are in seventh place in the Ukrainian market and are ahead of all premium brands in terms of sales.

“It was the import of electric vehicles from China that ensured Honda’s eighth place in June, and contributed to the popularity of many other cars,” according to Auto-Consulting.

The demand for German premium cars remains strong. BMW is the leader here (257 cars – 53% less than in June 2014), followed by Audi with 233 cars (+47%). Both German brands took 9th and 10th place in the Ukrainian market in June.

The FAU also cites Auto-Consulting statistics on sales of light commercial vehicles (LCVs), according to which in June they decreased by 9% compared to June 2024, amounting to 637 units, and for the first half of the year – by 4.6% compared to the same period last year, to 3,856 thousand units.

Thus, in the overall market of passenger cars and light commercial vehicles, the share of LCVs in June amounted to 9.3% (12.2% last year), and for the first half of the year – 10.2% (10.6%).

In this segment, Citroen had the best result in June, with sales up 62% by May 2025, but down 40% by June 2024, to 146 units. Renault was second with sales of 80 vehicles (57% less than in June 2024), and Peugeot took third place with 70 vehicles compared to 27 last year.

At the same time, in the first half of the year, Renault is the leader with a market share of 16.55% and sales of 638 cars (down 58% year-on-year), followed by Citroen – 522 units (-15%) and Ford – 458 units (+87%).

Sales of new passenger cars in Ukraine in June increased by 23% compared to the same month last year, reaching 6,217 units, according to the Federation of Employers in the Automotive Industry (FAU), citing data from Auto-Consulting.

“This allowed the car market to almost catch up with the results of the first half of 2024 (-0.95%) and offset the market decline at the beginning of the year and in the spring. The car market is finally on a positive track,” the FAU said in a statement on its website.

At the same time, compared to May of this year, sales in June fell by 9.3%.

According to the data, 33,773 passenger cars were sold in Ukraine in January-June.

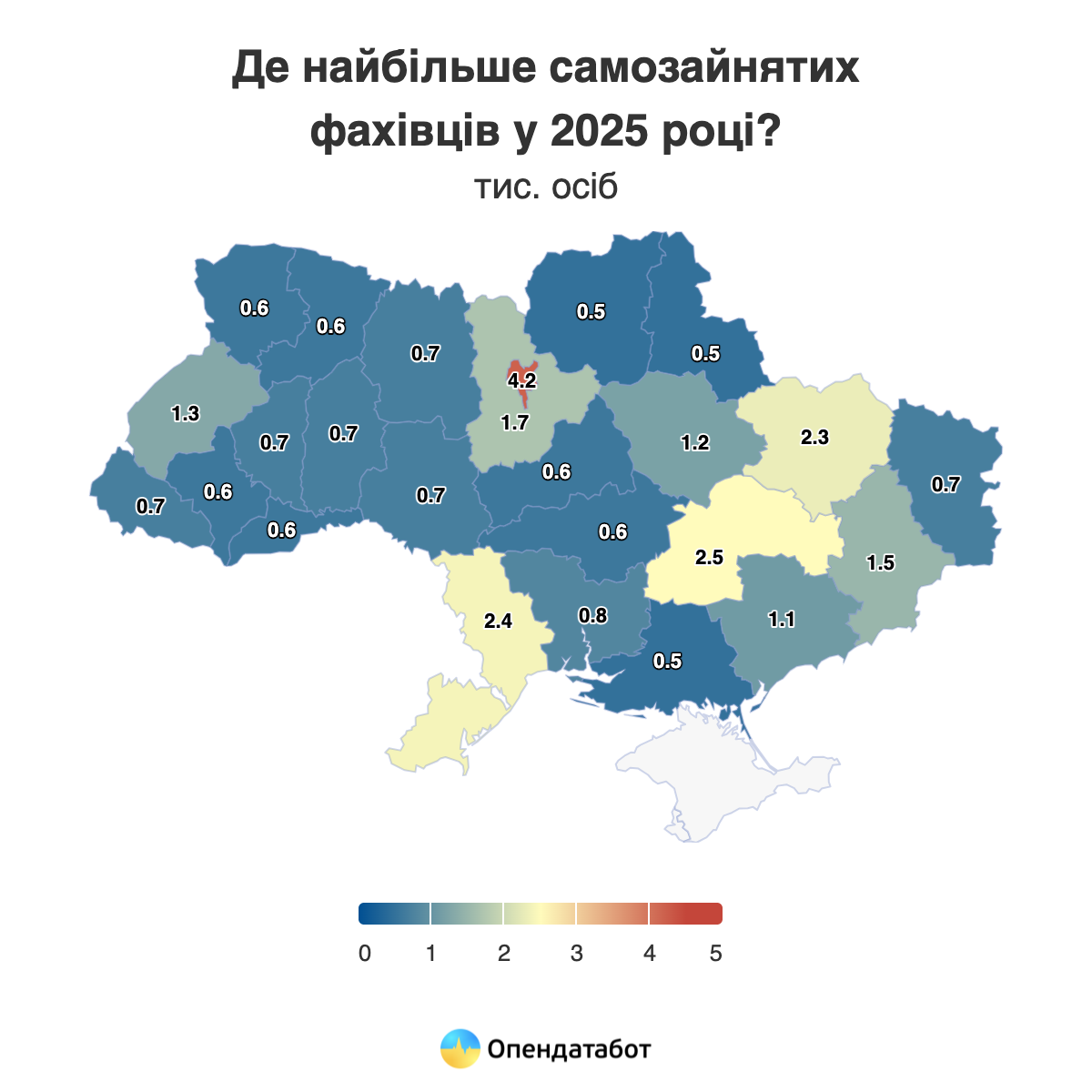

More than 28 thousand self-employed people are currently registered in Ukraine, according to the State Tax Service. This is a record figure for the last 5 years. The number of self-employed has increased by 1.1 thousand since the beginning of the full-scale reform. Over UAH 292 million of tax has already been paid by professionals engaged in independent professional activities in the first five months of 2025. The largest number of such professionals is in Kyiv, Dnipro and Odesa regions.

As of the beginning of June 2025, 28.3 thousand professionals engaged in independent professional activities – i.e. self-employed – were registered in Ukraine. These are lawyers, private teachers, translators, architects, notaries, psychologists, artists, scientists, doctors, and other professionals who do not have the status of a sole proprietor but work independently.

This is a record figure for the last five years. The peak number of such specialists was previously recorded in November 2021 – 27.9 thousand. However, in December, their number decreased by 700 people, after which the figure began to grow again, albeit with a pause in the first months of the full-scale invasion. Since the beginning of the full-scale invasion, the number of self-employed professionals has increased by 1,100, or about 4%.

It is worth noting that the Unified Register of Lawyers alone currently contains more than 71 thousand professionals. However, not all of them are registered as self-employed, but, for example, they can work in law firms or associations, or work as private individuals.

The largest number of such specialists works in Kyiv – 4.2 thousand people. This is followed by Dnipropetrovs’k region – 2.5 thousand and Odesa region – 2.4 thousand.

The self-employed paid UAH 292.29 million in taxes to the budget in the first five months of 2025. This is 33% more than in the same period last year. It is worth noting that the amount of taxes paid in Kherson, Volyn, and Kyiv regions almost doubled. In total, such specialists paid UAH 603.16 million in taxes in 2024. This is 1.6 times more than in 2023 and 1.2 times more than before the full-scale campaign.

The leaders in terms of taxes paid are Kyiv – UAH 140.5 million (23% of the total amount), Lviv region – UAH 49.8 million (8%), and Dnipropetrovs’k region – UAH 49.6 million (8%). However, while in Lviv region this amount was paid by 1.3 thousand people, in Dnipropetrovs’k region 2.5 thousand self-employed people paid almost the same amount.

On average, one self-employed person in Lviv region paid UAH 38 thousand in taxes in 2024. In Kyiv – UAH 33 thousand, in Vinnytsia region – UAH 31 thousand. The lowest average amounts were in Luhansk, Donetsk, and Kherson regions.

However, these calculations are conditional – it is impossible to give an accurate estimate, because it is not known how many of the people who are certified as self-employed actually work and earn income.

It is worth noting that independent professionals account for only 1.4% of all self-employed persons in Ukraine (together with sole proprietors). Their share of tax revenues is only 0.6% of the total amount paid by the self-employed.

Banks regularly check the self-employment status of their clients, which is important for assessing their financial profile, taxation, and regulatory compliance.

Opendatabot offers a service that allows you to check whether a person is an entrepreneur or self-employed, as well as to receive a corresponding statement.

Context

In April, the Cabinet of Ministers approved a draft law on the introduction of an international automatic exchange of information on income received through digital platforms. It provides for the taxation of self-employed people’s income received from activities on digital platforms such as Uklon, Bolt, OLX, Prom, Rozetka, etc.

https://opendatabot.ua/analytics/self-employed

The Ukrainian Association of Developers believes that the legal conflict regarding share contributions for construction projects started after January 1, 2021, must be resolved.

“It is necessary to eliminate the legislative conflict and clearly stipulate that for construction projects whose construction began before January 1, 2021, and which, as of that date, had not been accepted into operation, and agreements on the payment of share participation between developers and local authorities as of January 1, 2021, have not been concluded, the payment of share participation shall not be charged or made. This will be in line with the original intention of the legislator to eliminate the quasi-tax and stimulate the development of the construction industry,” commented Yevgeny Favorov, head of the association’s board, to Interfax-Ukraine.

He recalled that in 2019, the authorities officially recognized that equity participation had become a source of corruption, and therefore Law No. 132-IX was adopted to abolish it. This decision contributed to a reduction in housing prices and was intended to stimulate investment activity in the industry. However, in practice, the industry has encountered a situation where communities are demanding, including through the courts, the payment of share contributions for projects for which construction permits were obtained before that date but construction began later. In particular, the Department of Economy and Investment of the Kyiv City State Administration (KCSA) is the plaintiff in 152 court cases seeking to recover share contributions from construction customers. According to Interfax-Ukraine, as of March 1, 106 such cases were pending in courts of various instances for projects launched in 2020-2022 worth about UAH 1.59 billion.

According to experts from the Association of Developers, the cancellation of share participation revealed a legislative conflict that created this legal loophole in the regulation of relevant legal relations. This was directly acknowledged by the Supreme Court in its decision of July 20, 2022, in case No. 910/9548/21, which states: “Law No. 132-IX does not regulate issues of equity participation in cases where construction of a facility began after January 1, 2021.” At the same time, in providing its own interpretation of these legal relations, the court effectively departed from the essence and intent of the legislator, which was to completely eliminate equity participation as a quasi-tax on real estate.

On May 14, 2025, in case No. 320/44099/23, the Supreme Court finally confirmed that the changes to the procedure for attracting and using share contributions adopted by the Kyiv City Council in 2019-2020 are unlawful and invalid. In other words, with this decision, the court confirmed that the legal basis used by the city authorities since 2019 to calculate share participation, conclude relevant agreements, or issue financial claims is unlawful, i.e., illegal.

“In addition to the legally unfounded position of the city authorities, another important aspect should be noted. The city already receives billions of hryvnias from developers and home buyers in the form of engineering, transport, and social infrastructure facilities that have been built and transferred to municipal ownership,” Favorov emphasized.

According to the association’s estimates, in Kiev alone, eight projects by five of its member companies have already created engineering, transport, and social infrastructure worth more than 5.6 billion hryvnia. The total cost of all the infrastructure that the city’s developers have built over the years is estimated at tens of billions of hryvnia, the head of the association said.

Many of these assets are being transferred to the balance sheets of municipal enterprises, which not only receive them free of charge but also receive a stable income by charging residents for the maintenance of the built networks.

But what is happening now — attempts to retroactively charge additional contributions — only exacerbates the already difficult situation of the most acute housing crisis in the history of independent Ukraine, he noted.

According to experts from the Ukrainian Association of Developers, such practices cause housing prices to rise, as they create a double, unpredictable financial burden on companies, which are forced to include these costs in the price per square meter.

“These costs cannot be predicted within the business model, as national legislation explicitly prohibits equity participation. The country’s political leadership bears particular responsibility in this situation, having publicly promised voters that it would abolish equity participation and improve the investment climate. However, in practice, this turned out to be a declarative gesture that was only partially implemented in law. What we are seeing today directly contradicts the state’s stated goals of deregulation, support for the construction industry, and ensuring affordable housing,” Favorov emphasized.

According to the association’s experts, the situation can be remedied by eliminating the legislative conflict and clearly stipulating that for construction projects that were started before January 1, 2021, and which had not been commissioned by that date, and agreements on the payment of equity participation between developers and local authorities had not been concluded at that time, the payment of equity participation shall not be charged or made.

The Ukrainian Association of Developers was founded in 2023. The association’s members implement projects that account for 26% of the Ukrainian market and 93% of the capital’s market.

Lesy Ukrainy State Enterprise set another record and sold UAH 8.9 billion worth of unprocessed timber in April-June, according to the company’s CEO Yuriy Bolokhovets on his Facebook page.

“Lesy Ukrainy increased revenues to the state and local budgets by 40%! Tax payments in the first half of the year grew by more than UAH 1.7 billion compared to the same period in 2024,” he emphasized.

Bolochovets noted that the state-owned enterprise uses its after-tax profits to purchase new firefighting equipment (10 large fire trucks are planned in the near future), developing modern seed centers and infrastructure (forest roads, recreational areas, etc.), restoring forestry in de-occupied territories, and mechanizing harvesting (harvesters, forwarders, tractors, etc.).

He highly praised the effect of the six-month forward contracts, under which buyers selected all the timber, which made it possible to achieve 101% of the planned volume.

“Thanks to forward contracts, wood processors can reserve the volume of raw materials they need and fix the price. The company also benefits. The guarantee deposit, which is returned only after 97% of the contract has been fulfilled, motivates buyers to select the entire contracted volume of products. Next year, the share of forward contracts will be increased, with annual contracts planned,” he wrote.

In addition, Lesy Ukrainy has already shipped more than 95% of timber under quarterly contracts for the second quarter. Most of the non-fulfillments are the fault of buyers who either refuse to accept the goods or fail to pay on time.

The state-owned enterprise noted that it pursues a flexible policy on mutual settlements, realizing that producers may experience difficulties with working capital, as they do not immediately receive payment for the timber products they manufacture. However, the enterprise sometimes resorts to suspending deliveries until the buyer settles the debt, which to a certain extent affects the contract fulfillment rate.

“Overall, the situation on the timber market is still balanced. The rapid rise in the euro exchange rate has significantly strengthened the position of Ukrainian exporters, so the forecasts for the second half of the year are more than optimistic,” summarized the CEO of Lesy Ukrainy.

Greek retail chain Veropoulos, known in Serbia under the Super Vero brand, has announced that it will continue its expansion in the country with the launch of new locations starting in 2026. The company plans to strengthen its presence after more than 20 years of successful operations.

The company has been present in Serbia since 2001, with the first Super Vero store opening in 2002 in New Belgrade. As of 2017, total investment amounted to €48 million, with 500 employees and 15,000 m² of retail space.

In 2013, Veropoulos invested an additional €20 million in projects to build new stores: at that time, three supermarkets were in operation, a fourth was under construction, and a fifth was being prepared for launch. The total number of employees grew to 650.

Growth plans: 2026 and beyond

• Several new stores are expected to open in 2026, including the Jumbo format. The company is preparing sites in various districts of Belgrade and other cities.

• Super Vero specializes in Georgian and Greek products, household goods, and premium delicacies. Its product range includes fresh vegetables and fruits, seafood, olives, cheese, meat, groceries, and household goods.

Analytical information about Veropoulos

• Country of origin: Greece, parent company — Vero S.A., a family business since the 1970s.

• Investments in Serbia: €68-70 million over more than 20 years of operation.

• Staff: approximately 650 people (as of 2025).

• Store formats: Super Vero (supermarkets), Jumbo (hypermarkets with restaurants); floor space from 2,000 m².

• Product range: focus on high-quality products, a wide range of Greek, natural, and organic products. Fresh baked goods, seafood, and premium products are available.

• Brand strategy: positioned as a family brand that does not seek aggressive expansion but is committed to sustainable growth and development.

Source: https://t.me/relocationrs/1147