Changes made by the Ministry of Energy to the charter of NEC Ukrenergo with a provision on a qualified majority of votes for the appointment of the chairman of the board, has provoked a sharp reaction from the company’s creditor, the European Bank for Reconstruction and Development, threatening the loss of access to a €141 million loan and grant, as well as early repayment of the €533 million already received, according to Maksym Khlapuk, a member of the Verkhovna Rada’s energy committee (Holos).

“The Ministry of Energy has pushed Ukrenergo into a real, not technical, default. The amendments to the company’s charter, which the Ministry of Energy introduced to strengthen its influence over it, have already hit the financial stability of the critical energy infrastructure operator. Yesterday, the EBRD, referring to the Ministry of Energy’s order on amendments to the charter, emphasized its right to suspend the disbursement of loan funds and demand early repayment of the loan already provided,” Khlapuk wrote on his Facebook page on Saturday, publishing an excerpt from the EBRD’s letter to Ukrenergo and the Ministry of Finance of Ukraine dated June 6.

It points to the company’s failure to notify the bank in a timely manner of any changes to the charter and to provide an opportunity to comment on them.

Referring to the terms of the loan agreements, the bank emphasizes its right to suspend disbursements and send appropriate notices of early repayment of loans in connection with changes to the charter.

“This situation threatens Ukrenergo not only with the loss of access to further EBRD financing in the amount of EUR 141 million (EUR 77 million of unutilized loan balance and EUR 64 million of expected grant), but also with the need for early repayment of funds already received in the amount of EUR 533 million,” emphasized a member of the Rada’s energy committee.

He also notes that the restructuring of Ukrenergo’s debt obligations to holders of green sustainable development bonds, for which the company planned to raise $430 million on international capital markets under the DFC guarantee, is now under threat.

“This debt management operation should have been completed in early July, but its success directly depends on the support of international financial institutions. And, according to my information, the DFC has currently suspended any actions related to the restructuring of green bonds,” Khlapuk emphasized.

As reported, on May 19, the Ministry of Energy amended the charters of LLC “OGTSU” and “Ukrenergo” with a provision on a qualified majority of votes of the Supervisory Board for the appointment of managers instead of a simple majority. This means that four out of five members of the supervisory board (three of whom are independent) must vote for the head of OGTSU, and five out of seven (four of whom are independent) must vote for the head of Ukrenergo.

As commented to EnergoReform by the head of the Association for Energy Efficiency and Energy Saving, former head of the Department for State-Owned Enterprises and Corporate Rights of the State Property Fund of Ukraine, Oleksandr Vizir, the Ministry of Energy, as a shareholder of Ukrenergo had the right to amend the company’s charter, and the provision on a qualified majority of votes is completely legal from a legal point of view. However, he drew attention to the way in which this was done. “For example, as far as I know, the amendments to the charter were not agreed with the supervisory board of Ukrenergo, nor with the company’s creditors, which is a condition of loan agreements in most cases,” Vizir explained in a comment. Vizir expressed his conviction that this would also delay the appointment of the chairman of Ukrenergo’s board, which should have taken place long ago, since the members of the supervisory board – representatives of the state and the Ministry of Energy, as the appointing body – can now effectively block the candidacy of independent representatives.

“According to my information, the independent members of the supervisory board and the shareholder have very different views on who should head Ukrenergo. And in fact, changes to the charter regarding the voting structure for appointing the head in the midst of the competition give grounds for concluding that the shareholder cannot agree with the candidates selected by the supervisory board,” Vizir believes.

In his opinion, the Ministry of Energy also had no right to submit the charter for registration or authorize anyone to do so; the charter should have been registered by the head of the company, Oleksiy Brecht, as acting chairman of the board, or by a person with a power of attorney from Ukrenergo.

According to Energorforma, the supervisory board of Ukrenergo was scheduled to meet on June 4, but was unable to elect a chairman of the board.

EnergoReforma’s interlocutors familiar with the situation also pointed out that the Ministry of Energy did not consult with the Energy Community Secretariat on changes to the statutes of Ukrenergo and OGTSU certified by it, which also caused its negative reaction. They noted that the issue of changes to the statutes of the operators is already known to European institutions and creditors, who have asked the Ministry of Energy for explanations, and assumed that a position will be expressed soon. In their opinion, the Ministry of Energy needs to communicate this issue very carefully with all stakeholders and provide very convincing arguments “or abandon the proposed changes in order to save the situation.”

For his part, Ukrainian Energy Minister Herman Galushchenko, during Question Time in the Verkhovna Rada on June 6, explained that the purpose of the changes to the statutes of OGTSU and Ukrenergo was to strengthen the position of company executives vis-à-vis the NR.

“I believe that these changes are actually aimed at something else: to ensure the maximum independence of the supervisory board and to ensure that the relevant managers and members of the management boards can work in order to protect them from dismissal or other decisions by a majority vote,” he said.

The new supervisory board of Ukrenergo, formed at the end of 2024, includes Yuriy Boyko, Anatoliy Guley, and Oleksiy Nikitin as representatives of the state, as well as independent members Patrick Greichen, Luigi De Francisci, Jan Montell, and Eppe Kofod, who heads the NR.

NR Ukrenergo announced a competition for the position of chairman of the board on February 5, 2025, with applications accepted until March 14 inclusive.

A shortlist of three candidates for the position of chairman of the board was formed in mid-April. It included the acting head of the company, Oleksiy Brecht, its chief dispatcher and member of the board, Vitaliy Zaychenko, and another representative of the company, Ivan Yurik, who deals with Eurobond issues.

In connection with the submission by OGTSU CEO Dmitry Lippa of a statement on the early termination of his powers, the company will be temporarily headed by a member of the management board, operations director Vladislav Medvedev, until the completion of the competitive selection process. The deadline for accepting applications from candidates for the position of the next head of OGTSU was March 31.

Kernel, one of Ukraine’s largest agricultural holdings, exported 1.6 million tons of grain in the third quarter of fiscal year 2025 (FY, third quarter – January-March 2025), down 15% from a year earlier.

According to the quarterly report on the company’s website, the decline in exports was due to limited domestic supply caused by a poor harvest in 2024 and lower stocks.

“Nevertheless, Kernel maintained its strong market position, accounting for 12% of Ukraine’s total grain and oilseed exports in the first nine months, with total volumes reaching 4.4 million tons,” the report said.

According to the agricultural holding, the export terminal’s throughput capacity in the third quarter of fiscal year 2025 was 2.5 million tons, up 2% from the previous year, including 1.8 million tons of grain, 0.3 million tons of edible oil, and 0.4 million tons of vegetable meal.

Total throughput for the nine months of fiscal year 2025 increased by 65% compared to the previous year to 7.3 million tons, thanks to smooth export operations and a low base of comparison with fiscal year 2024, when exports were interrupted at the beginning of the season.

Grain receipts at elevators in the third quarter of fiscal year 2025 amounted to 91 thousand tons, reflecting typical seasonal dynamics. This brought the total receipts for the nine months of fiscal year 2025 to 2.7 million tons, down 2% from the previous year.

Of this volume, the agricultural holding’s own segment provided 1.5 million tons, with the remainder purchased from third parties.

The infrastructure and trade segment recorded EBITDA of $62 million for January-March 2025, representing a decrease of 46% year-on-year and 21% quarter-on-quarter. Of this total, the trading business provided $26 million, unchanged from the previous year, while Kernel’s grain and edible oil export value chain in Ukraine generated $36 million, down 59% year-on-year.

Before the war, Kernel was the world’s leading producer of sunflower oil (about 7% of global production) and its exporter (about 12%). It is one of the largest producers and sellers of bottled oil in Ukraine. In addition, it is engaged in the cultivation and sale of agricultural products.

In the first nine months of 2025, Kernel increased its net profit by 7% to $218 million, with revenue growing by 19% to $3.092 billion, and its EBITDA increased by 4% to $398 million.

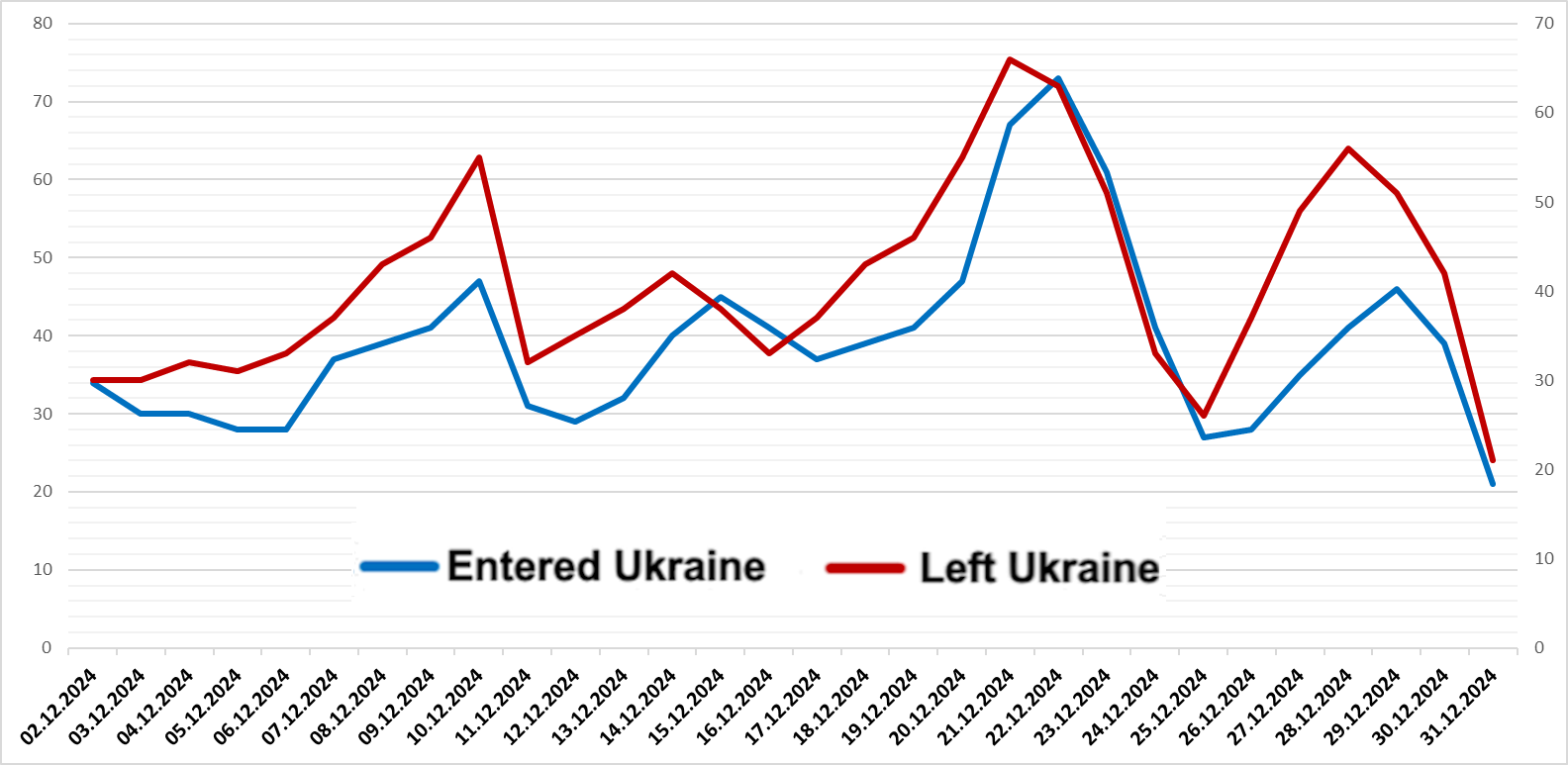

Passenger flow through western border of Ukraine in September 2024, thousand

Canadian Minister of Finance and National Revenue François-Philippe Champagne announced that Canada will extend the Order exempting Ukrainian goods from duties until June 9, 2026, according to the Canadian government’s website

“Canada remains unwavering in its support for Ukraine as it fights to defend its sovereignty, territorial integrity, and democracy. The conflict, initiated by Russia with the support of Belarus, continues to seriously affect Ukraine’s economy, including its ability to export goods to global markets,” the Canadian Ministry of Finance said in a press release. The document recalls that last month in Banff, Alberta, G7 finance ministers and central bank governors unanimously reaffirmed their unwavering support for Ukraine.

“Canada continues to support Ukraine’s economy by extending duty-free access for Ukrainian goods to Canada for one year,” the statement said.

Since the issuance of the Order exempting goods from Ukraine from duties on June 9, 2022, Canada has imported more than $35 million worth of these goods, with $8.5 million in customs payments waived. It is expected that approximately $1.2 million in customs duties will be refunded between June 10, 2025, and June 9, 2026.

The order exempting Ukrainian goods from customs duties came into force on June 9, 2022, for an initial period of one year, after which it was extended annually. The order temporarily suspends customs duties on imports of Ukrainian goods.

The DIM.RIA marketplace for verified real estate analyzed

the situation on the primary, secondary, and rental housing markets in Ukraine in May

2025. The report presents the dynamics of prices, supply, and demand compared

to April 2025 and May last year.

Primary market

Supply

In May, the share of operating sales departments for new buildings

remained unchanged at 77%. During the month, four new buildings

(5 sections) were commissioned during the month: two in the Lviv region, one in the Kyiv region, and one in the Zakarpattia region.

The highest share of completed projects among all new buildings was recorded in the Rivne

(62%), Zaporizhzhia (56%), and Odesa (54%) regions.

Prices

Prices in the primary market in most regions are showing

growth. The highest price increases were recorded in the Chernihiv (+8%),

Zhytomyr (+8%), and Kyiv (+6%) regions. Only Kirovohrad showed

a decrease, averaging 5%. Kyiv remains the most expensive city, with an average

price of $1,409/m². The cheapest new buildings are in the frontline regions: Zaporizhzhia,

Sumy, and Mykolaiv.

Demand

The most noticeable growth in interest in new buildings

was observed in the Ternopil region (+22% compared to April). At the same time,

a significant decrease in demand was recorded in the Sumy (-25%) and Dnipropetrovsk

(-17%) regions.

Secondary market

Supply

The largest number of advertisements for the sale of secondary housing in

in May came from the Volyn, Rivne, and Mykolaiv regions.

Prices

According to the DIM.RIA marketplace, during May, the average

cost of one-room apartments continued to grow in most regions of Ukraine.

The largest increase was recorded in the Kherson region (+16%), although it remains

the cheapest for this type of housing.

The most expensive housing is in the capital: the cost of a one-room

apartment in Kyiv reaches $92,400. In terms of districts, Pechersky remains

the most expensive (almost $132,000), and Desniansky is the most affordable ($45,000).

Demand

In May, users were most actively searching for secondary

real estate in the Khmelnytskyi, Odesa, and Volyn regions.

The ratio of the number of purchase listings to the number of

responses to them in May in Kyiv was 1:3, with only the Odesa region having a lower ratio —

1:2. In the Vinnytsia region, it was 1:18, in the Ternopil region — 1:16, and

in the Mykolaiv region — 1:15.

Rental market

Supply

According to DIM.RIA analysts, the rental market was

unstable in May. The largest number of new listings appeared in the Chernivtsi (+35%) and

Zakarpattia (+29%) regions. In contrast, in Kirovohrad, the number of

offers decreased by 40%. In Kyiv, the decline was 22% compared to April.

Prices

Kyiv remains the most expensive city for rent:

the average cost in May was 18,200 UAH, which is 4% more than in

April. The most expensive apartments are in the Pecherskyi district — 26,300 UAH, and the cheapest are

in the Desnianskyi district (10,900 UAH).

In most regions, rental prices changed by

a few percent, with the exceptions of Zakarpattia and Ternopil regions (an increase of

11%), Cherkasy (-11%) and Chernihiv (-15%).

Demand

In May, users were actively looking for rental housing:

according to data from the DIM.RIA analytical center, interest was observed in almost

in all regions of Ukraine. The ratio of rental ads to

responses in May in Kyiv was 1:6, while in most

regions these figures differed several times over.

The full analytical

report and high-quality images are available at the link!

On June 10, at 6 p.m., the large exhibition hall of the Lavra Art Gallery in Kyiv will host the opening of the first group exhibition of contemporary surrealism and symbolism in Kyiv.

More than 20 young Ukrainian artists will take part in the project “A Look Through Reality.” This interdisciplinary art event will combine painting, sculpture, audiovisual art, live music performance, and breaking art performance. The project was created in collaboration between the Lavra Gallery and the Plemya.Art formation.

The art event invites visitors to delve into the world of human consciousness and its interaction with reality. The exhibition explores how each person perceives the world around them through their own “prism” of life experiences, emotions, memories, and dreams.

Moments of our lives — upbringing, travel, interaction with society, loss, art, literature, and even short conversations — shape the light we radiate outward and strive to show this inner glow through a combination of different art forms. The dialogue between the conscious and the subconscious through symbolism and surrealism allows us to explore the inner states, emotions, memories, and dreams that shape our perception of the world.

The artists participating in the project use surrealism and symbolism to reflect the boundaries of the interaction between the inner world of a person and external reality. The works include elements of social criticism, the study of symbols and archetypes, their meaning and role in shaping the perception and understanding of the world. Painting, sculpture, audiovisual art, and music come together to create an interactive and multi-layered artistic environment. The interaction between the inner world of a person and external reality will be revealed through the works of artists and interactive performances.

The main goal of the event is to support young Ukrainian artists who create art in wartime. It also aims to raise funds for the rehabilitation of war victims in collaboration with the Legacy of War Foundation for the modern U+System center.