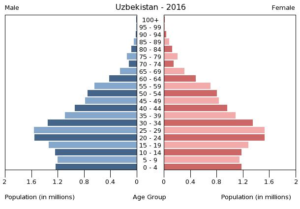

According to the National Statistical Committee, as of January 1, 2025, the number of permanent residents of the Republic of Uzbekistan amounted to 37.5 million people.

The permanent population of the Republic of Uzbekistan by years (as of January 1):

– 1920 – 4.4 million people

– 1930 – 4.9 million people

– 1940 – 6.6 million people

– 1950 – 6.2 million people

– 1960 – 8.4 million people

– 1970 – 11.8 million people

– 1980 – 15.8 million people

– 1990 – 20.2 million people

– 2000 – 24.5 million people

– 2010 – 28.0 million people

– 2020 – 33.9 million people

– 2025 – 37.5 million people

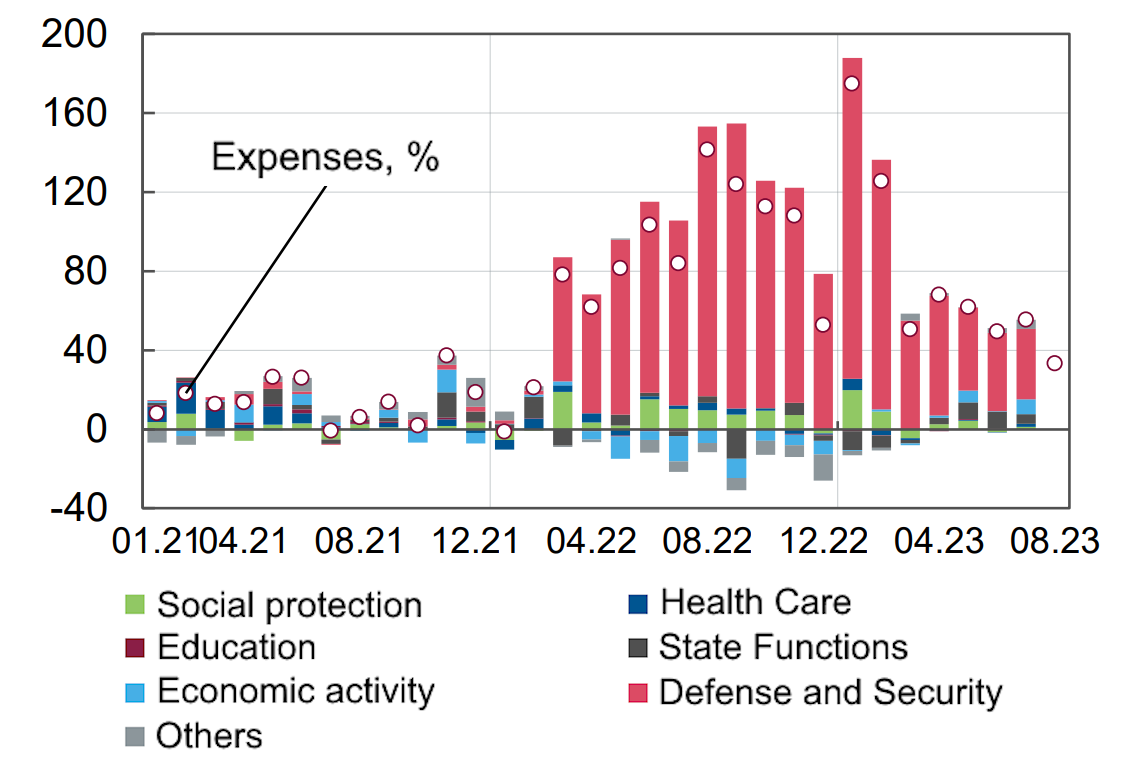

Changes in consolidated budget expenditures in 2021-2023 (%)

Source: Open4Business.com.ua

The revenue of the ten largest retailers in Ukraine amounted to UAH 529.2 billion in 2024, with ATB, Silpo and Aurora leading the way, according to the Opendatabot index.

In total, the ten largest companies in the retail segment accounted for almost 12.4% of all-Ukrainian revenue last year.

According to the project, the three leaders in terms of revenue in 2024 were ATB-Market with UAH 208.9 billion (+15.3% y-o-y), Silpo-Food with UAH 93 billion (+9.8%), and Vydyvna Pupka with UAH 38 billion (Aurora, +40.6%).

The top ten retail operators also included Fora (UAH 35 billion, +18.5%), Rozetka (UAH 29.7 billion, +16.8%), Novus (UAH 29 billion, +23%), Metro (UAH 28.7 billion, +12.5%), Rush (EVA stores and online store EVA. UA stores and EVA.

The Opendatabot index is an analytical tool published annually that allows to assess the real state and geography of Ukrainian business. The index is based on data from state registers, Opendatabot, financial statements of companies, information on relations with Russia, sanctions lists and other analytical tools.

As reported, in 2023, ATB, Silpo and Fora were the leaders of the Opendatabot index in the retail category, while in 2022, Epicenter and Metro pushed Fora aside.

Druzhkovka Metalware Plant (DZMI, Donetsk region) reduced its net profit by 34.8% year-on-year to UAH 15.671 million in 2024.

According to the company’s announcement that it will hold a remote general meeting of shareholders on April 18, the company’s supervisory board will consider the report for 2024 and adopt a decision.

In addition, the agenda includes the approval of the results of the financial and economic activities of the SFRD for 2024, determination of the procedure for distributing profits based on the results of work in 2024, and a decision on the payment of dividends.

According to the draft resolutions available to Interfax-Ukraine, it is planned to approve the amount of net profit based on the results of the plant’s operations for 2024 in the amount of UAH 15.671 million and to decide on the payment of dividends for 2024 in the amount of UAH 0.23 per share. Dividends will be paid directly to shareholders. The balance of net profit is to be left without distribution.

In addition, the shareholders at the meeting should determine the main areas of activity for 2025, decide on the preliminary consent to enter into significant transactions.

DZMI’s net profit amounted to UAH 15.671 million in 2024, UAH 24.049 million in 2023, and UAH 33.832 million in 2022.

Druzhkovka Metal Products Plant specializes in the production of hardware products: bolts, nuts, rivets for general engineering, fasteners for the upper structure of railway tracks, high-strength fasteners for building and bridge structures. In May 2022, the company issued an order to terminate employment contracts due to Russia’s military aggression and the inability to carry out production and business activities. Later, the company changed its legal address from Druzhkivka, Donetsk region, to Dnipro, Dnipro region.

According to the NDU, as of the fourth quarter of 2024, an individual Oleksiy Spyridonov owned 14.9949% of the company’s shares, Olena Mishchenko-Solona (resident of Spain) – 13.0304%, Iryna Mishchenko – 24.5167%, Serhiy Popkov – 5.8611%, Anton Malikov – 9.75%, Olena Malikova – 8.25%, Valeriy and Dmytro Malikov – 9.774% each.

The authorized capital of the company is UAH 3.323 million, the nominal value of 1 share is UAH 0.05.

The total area of residential buildings for which a notice of commencement of construction work (new construction) was registered in 2024 decreased by 7.2% compared to 2023, to 3.9 million square meters, the State Statistics Service (Ukrstat) reported.

According to the statistics agency, in January-December 2024, the total area of new construction of apartment buildings decreased by 8.6% year-on-year to 3 million 684.2 thousand square meters, while the area of single-family houses increased by 19.4% to 196.5 thousand square meters. The total area of new construction of collective housing also increased by 3.2 times, to 22.6 thousand square meters, which is the highest figure since 2019.

The number of apartments declared at the start of construction increased by 3.7% to 69.3 thousand, while the number of declared apartments in apartment buildings decreased by 11.4% compared to 2023 and amounted to 40.9 thousand square meters.

Lviv region became the leader in terms of new housing construction in 2024, with 793.2 thousand square meters, which is 8.9% less than in the previous year.

In Kyiv in 2024, the total area of new housing construction increased by 12% by 2023 to 335.6 thousand square meters, in the Kyiv region – by 3.3% to 636.3 thousand square meters.

The State Statistics Service also recorded high figures in Zakarpattia region (+44.6%, up to 370.2 thousand sq m), Ivano-Frankivsk region (minus 27%, up to 342.6 thousand sq m), Vinnytsia region (+36.7%, up to 315.1 thousand sq m). In other regions of Ukraine, the volume of new construction last year amounted to less than 200 thousand square meters.

The State Statistics Service reminds that the figures exclude the territories temporarily occupied by the Russian Federation and part of the territories where military operations are ongoing (or have been ongoing). As reported, the total area of new housing construction in 2023 amounted to 4.2 million square meters, in 2022 – 6.67 million square meters, in 2021 – 12.7 million square meters.

In 2025, the State Archival Service of Ukraine plans to implement a project to build an underground storage facility of one thousand square meters, said its head Anatolii Khromov.

“This is one of the biggest problems because almost all state archives are overcrowded. We usually solve the issue in such a way that even here in Kyiv we convert all free space for the storage of documents. All basements and cellars are dried, repaired and equipped for storage, thus finding new areas for relocated collections,” Khromov said in an exclusive interview withInterfax-Ukraine, answering the question of how acute the issue of overcrowding in archival storage is today.

At the same time, he said, the government has approved a strategy for protecting national identity, which deals with archives during the war. One of the points is about improving the material and technical base, that is, creating new areas for storage, including the construction of modern underground storage facilities.

Khromov said that in the near future it is planned to implement the project of the underground storage facility of the State Archival Service.

“As of today, we have updated the estimate documentation and conducted an expert examination, and there are assurances from the Ministry of Justice that they will help us find funds either in the budget plan or through donors to build it this year or at least put it into operation early next year. But, you know, the problem is not only money, it is a huge problem to find a contractor who can do professional work and who has a staff of non-mobilized workers,” he added.

In addition, he noted that, in addition to the ambition to complete the underground storage facility project, the plans are to complete the long-frozen construction of huge storage facilities that have not been built for more than 10 years.

“An underground storage facility of about a thousand square meters with all the equipment will cost about UAH 140 million. For two high-rise storage facilities, which are tens of thousands of square meters, together with the reconstruction of the existing premises where we were located, the amount was about $100 million before the war. The sums are quite large, but we are thinking of a phased implementation, because it is impossible to both build and find such a resource at the same time in the conditions of war, when the priorities of the state and society are obviously to support the defense sector,” added the head of the Ukrderzharkhiv.

In turn, Deputy Minister of Justice Viktoriia Vasylchuk emphasized that if the underground storage project is successful, it will significantly increase the protection of documents in the event of shelling or fire.

As reported, in 2022, Khromov said that Ukraine was the only post-Soviet country that had not built a new central archives complex.

In February 2025, he said that it was unrealistic to build underground storage facilities for the entire National Archive Fond for 100 million files.