The international financial service NovaPay (TM NovaPay) issued UAH 1.7 billion in loans in 2024, the company’s press service reports.

“2024 was a period of active development of the lending business for NovaPay. During this time, the company launched new loan products – installment plans and loans for business, and the total amount of loans issued amounted to UAH 1.7 billion,” the press service of NovaPay said on Tuesday.

In particular, the amount of loans issued last year to small and medium-sized businesses amounted to UAH 281.4 million. Since the launch of the installment service in July 2024, 97 thousand loans for UAH 600 million have been issued. The average installment check amounted to UAH 6.2 thousand, the press service said.

Last year, 123 thousand transactions for UAH 746 million were executed as part of the Parcel on Credit service. The average check amounted to UAH 6 thousand.

“In 2025, NovaPay will expand lending opportunities by launching new loan products for Ukrainians and businesses, the company assured.

Earlier it was reported that the number of customers using the mobile application of the international financial service NovaPay (TM NovaPay) has reached half a million since its launch on December 13, 2023,

NovaPay was founded in 2001 as an international financial service that is part of the Nova group and provides online and offline financial services at Nova Poshta offices. The company provides online and offline payment services in more than 3.6 thousand Nova Poshta outlets across Ukraine. According to the National Bank of Ukraine, the company accounts for about 35% of the total volume of domestic money transfers.

In 2023, NovaPay was the first non-bank financial institution in Ukraine to receive an extended NBU license, which allowed it to open accounts and issue cards, and was the first non-bank to launch its own financial application with a wide range of financial services at the end of last year.

The Verkhovna Rada has recognized the results of education received by Ukrainian citizens abroad, MP Yaroslav Zheleznyak (Voice faction) said on Telegram. According to him, the relevant law No. 12375 was generally supported by 282 MPs at the plenary session of the Verkhovna Rada on Wednesday.

The MPs amended Article 6 of the law “On Complete General Secondary Education”.

The law formalizes the right of Ukrainian citizens to recognize the results of their formal and/or non-formal education in educational entities located abroad (except for the state recognized by the Verkhovna Rada as an aggressor or occupying state).

Pro-Russian presidential candidate Călin Georgescu was detained on Wednesday.

“Călin Georgescu was going to submit his new candidacy for the presidency. About 30 minutes ago, the system stopped him on the road and took him to a hearing at the prosecutor’s office! Where is democracy, where are the partners who are supposed to defend democracy?” – reads a message from his communications team posted on Georgescu’s personal Facebook page on Wednesday.

Earlier in the day, he reported massive searches of his supporters, calling the current government a “communist-bolshevik system,” and called on everyone to gather for a protest on Victory Square in Bucharest on Saturday, March 1.

As reported, Georgescu became the leader of the first round of elections held in the country on November 24, with 22.94% of voters supporting him. The second place with 19.18% of the vote went to the leader of the liberal progressive party “Union for the Salvation of Romania” Elena Lasconi. However, one of the presidential candidates, Cristian Terges, who is supported by the Romanian National Conservative Party, claimed election fraud. The Romanian Constitutional Court unanimously decided to recount all valid and invalid ballots, and on December 6, unanimously decided to cancel the results of the first round of the presidential election two days before the second round. The election was canceled against the backdrop of declassified information from the intelligence services indicating Russian interference in the election.

Later, the ruling coalition in Romania decided on the date of the new presidential elections, which will be held on May 4 and May 18.

Georgescu called Ukraine a “fictitious state” and said that its territories would be divided by neighboring countries. According to him, if elected, he will not allow the continuation of Ukrainian grain exports through Romania and further military aid to Kyiv. He also claimed that Bucharest is not obliged to comply with NATO’s defense spending commitments and questioned the effectiveness of the use of EU funds that have contributed to economic growth and infrastructure development in Romania. Earlier, the Experts Club and Active Group released a video analysis of the most important elections in the world in 2025, for more details, see the video review – https://youtu.be/u1NMbFCCRx0?si=-rc6YHH7EA1pnr7w

Representatives of VEON, the parent company of Kyivstar, the largest Ukrainian mobile operator, who visited Ukraine, confirmed their intention to invest $1 billion in the country in 2023-2027 and to indirectly list Kyivstar on the Nasdaq Stock Exchange (USA).

“Ogi Fabela, Chairman of the Board and Founder of VEON, and Kaan Terzioglu, CEO of VEON, met with the Kyivstar team to commemorate the third anniversary of the war and reaffirm the company’s commitment to invest in the recovery and reconstruction of Ukraine… The delegation emphasized the importance of immediate investment in the country’s recovery and stressed the plans to invest $1 billion in Ukraine over 2023-2027,” the press service of Kyivstar reported. “We are very pleased to announce that the government of Ukraine has decided to invest $1 billion in Ukraine.

According to the press service, representatives of VEON’s top management, together with Kyivstar CEO Oleksandr Komarov, took part in a special meeting of the Yalta European Strategy (YES) held in Kyiv on February 24. During the meetings with government representatives, including Mykhailo Fedorov, Vice Prime Minister for Innovation, Education, Science and Technology and Minister of Digital Transformation, and Oleksiy Chernyshov, Vice Prime Minister and Minister of National Unity, the participants were informed about the work to support the country’s critical communications and digital services sector. The parties discussed the progress of Kyivstar’s indirect listing on the Nasdaq Stock Market LLC.

Fedorov said after the meeting that he discussed possible joint AI projects and the implementation of innovative solutions in the mobile communications sector with Fabela, Terzioglu, and Komarov.

“I met with VEON top management and Kyivstar CEO… In the midst of the war, the company takes a proactive stance and does everything possible to keep Ukrainians connected. Our team is now actively working on the development of artificial intelligence in Ukraine. At a meeting with Auggie Fabella, co-founder and chairman of VEON, VEON CEO Kaan Terzioglu and Kyivstar CEO Oleksandr Komarov focused on possible joint projects with artificial intelligence and the introduction of innovative solutions in the field of mobile communications,” he wrote on Facebook.

In addition, the minister announced the launch of new major projects by Kyivstar, in particular, to provide connectivity to the country’s main highways.

“VEON is deeply committed to Ukraine’s future and the important role that the private sector and international investment must play in rebuilding the country. We are honored to be in Ukraine at this historically important time and to discuss our investment plans that will contribute to the development of Ukraine’s future,” the VEON press service quoted Fabela as saying following his visit to Ukraine.

He emphasized that VEON, together with Kyivstar, will continue to support Ukraine by investing in its digital infrastructure, expanding investment opportunities for the Ukrainian economy and introducing game-changing technologies. In particular, it will continue to develop Starlink’s Direct to Cell satellite communications service.

VEON, headquartered in Dubai, provides digital services to nearly 160 million customers, operating in six countries with more than 7% of the world’s population. VEON’s shares are listed on the Nasdaq Stock Market.

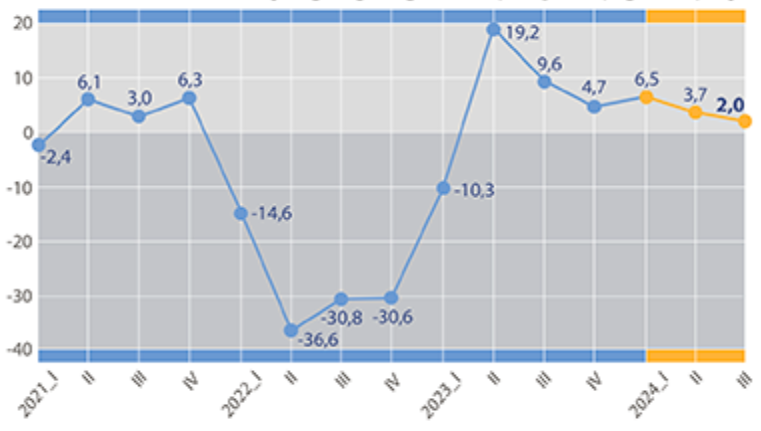

Real GDP percentage changes over previous period in 2014-2024

Source: Open4Business.com.ua

The total exports of grains and oilseeds from Ukraine in July-January of 2024/25 marketing year (MY) (July 2024-June 2025) are estimated at $11 billion, up 13.4% compared to $9.7 billion in the same period last year, the Ukrainian Grain Association (UGA) reported on Facebook.

According to the report, corn exports are leading in the group of grains, which in July-January of 2024/25 MY is estimated at $2.412 bln against $2.098 bln in the same period of the previous MY, wheat – $2.084 bln ($1.488 bln), barley – $350 mln ($212 mln).

At the same time, in the oilseeds segment, the shipments of soybeans and rapeseed increased to $909 mln ($718 mln) and $1.452 bln ($1.145 bln), respectively, while the exports of sunflower seeds decreased to $22 mln ($57 mln).

In the current season, Ukraine reduced exports of sunflower oil to $2.701 billion ($2.777 billion) and sunflower meal to $682 million ($774 million). Shipments of other vegetable oils decreased to $393 million ($438 million).