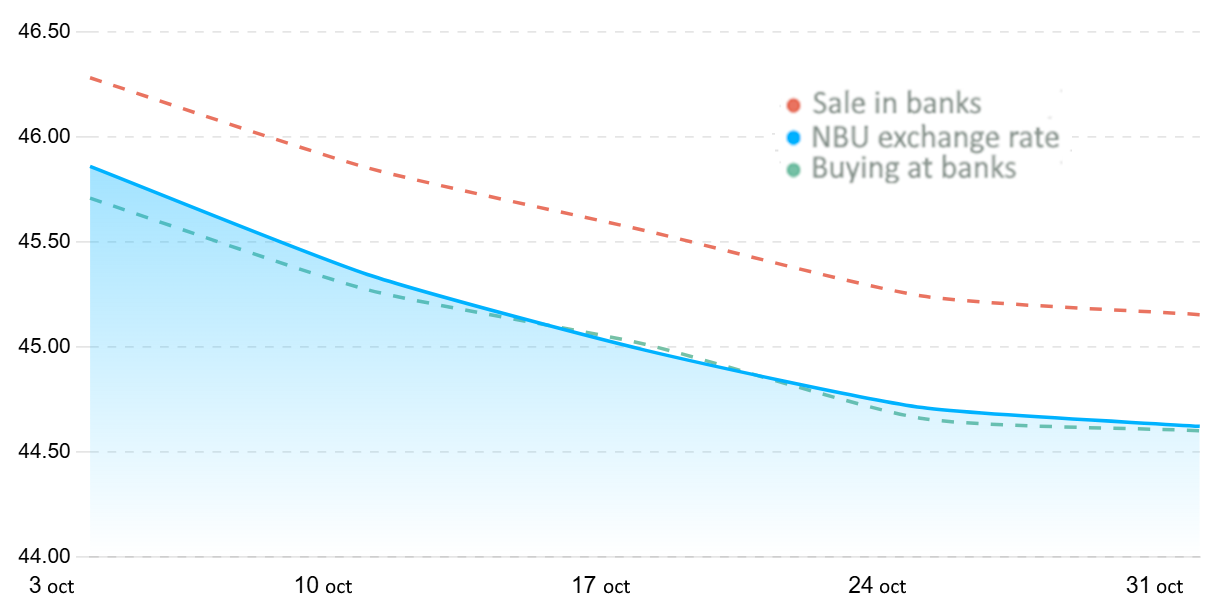

Quotes of interbank currency market of Ukraine (UAH for €1, in 01.10.2024-31.10.2024)

Source: Open4Business.com.ua

Elections in Ukraine should be held no earlier than six months after the end of martial law, said David Arakhamia, head of the Servant of the People parliamentary faction.

“Let me remind you once again that, first of all, elections are impossible during martial law. And secondly, within the framework of the Jean Monnet Dialogue, the leaders of all factions and groups have agreed that elections will be held no earlier than 6 months after the end of martial law,” he wrote in Telegram.

He also recommends that everyone once again read the text of this document with the conclusions adopted during the ninth Monet Dialogue (Jean Monnet Dialogues for Peace and Democracy), which he attached below the text of the statement.

The presidential, parliamentary and local elections in Ukraine are being prepared for simultaneous holding by the current authorities on October 26 this year, according to MP and leader of the European Solidarity party Petro Poroshenko, based on information from his own sources.

In an interview with Censor.net published on Sunday, answering the question of when, in his opinion, elections in Ukraine are possible, he said: “Write it down – October 26 this year.”

When asked how he came to this conclusion, the politician replied: “You know them, they are on Bankova Street (where the Office of the President of Ukraine is located). According to our sources in law enforcement. According to our sources in the printing plant “Ukraine”, which is currently processing as many ballots as necessary. According to our sources in the Central Election Commission, which is starting to make changes to the voter register According to our sources in the Ministry of Justice, which is opening its first office in Berlin. This is solely for the preparation of the elections.”

“So I think the elections will be held at the end of the year. What should they be tied to? According to the Constitution, parliamentary elections should be held at the end of the year. Although they should have been held two years ago. And at the end of October we have to have local elections. The government’s dream is to hold all elections simultaneously. But the Americans do not allow it,” Poroshenko said.

At the same time, he believes that representatives of the current government are afraid to leave it and “are now preparing everything to leave them without opponents and crawl back into power, destroying democracy, freedom, and transparency of elections.”

Poroshenko also said that he was categorically against holding elections in the near future.

He said that he had been in contact with Ukraine’s Ambassador to the United Kingdom of Great Britain and Northern Ireland, former Commander-in-Chief of the Armed Forces of Ukraine (2021-2024) Valeriy Zaluzhny, but had not discussed running for office with him.

“No, we did not talk about political issues, because I stand by my position – I am against elections. I believe that there may be a situation when there will be no place to go. I believe that the very existence of the state is now under threat,” the European Solidarity leader said.

Poroshenko denied the information that he had allegedly told representatives of partner countries that elections should be held in Ukraine as soon as possible. “It’s just incompetence, unprofessionalism (spreading such information). They do not understand that if I incite international partners, I am shooting myself in the foot. Do you know why? I have, but maybe 20-30 percent of them are secret meetings. If I say everywhere, including in interviews, that elections are suicide, and then I come and incite you to elections, no one will talk to me. This is a different policy, not the policy of 5-6 managers,” he said.

At the same time, the politician believes that the sanctions imposed against him by the National Security and Defense Council have actually launched the election campaign. “Today, the elections begin with sanctions, because in fact they have acted as a kind of flag for the start of the election campaign,” Poroshenko said.

President of Ukraine Volodymyr Zelenskyy believes that without security guarantees, the economic agreement with the United States on rare earth metals will not work.

“If we do not receive security guarantees from the United States, I believe that the economic agreement will not work. Everything must be honest,” Zelensky said in an interview with NBC News.

The President of Ukraine made it clear that any deal involving Ukrainian minerals must be accompanied by security guarantees from the United States.

“We looked at what America imports, what rare earth metals, what America imports for its industry. And when we took titanium as an example, we say that we have titanium in Ukraine, and this is accurate information. And it’s enough for the industry for 40 years,” he said.

“Help us protect it, and we will make money on it together,” Zelenskyy said.

For its part, the United States called Ukraine’s position short-sighted, the Associated Press reports.

White House National Security Council spokesman Brian Hughes said in a statement that “President Zelensky is short-sighted in his assessment of the great opportunity the Trump administration has provided to Ukraine.”

Hughes said that the minerals deal would allow U.S. taxpayers to “recoup” money sent to Kyiv while also helping to develop Ukraine’s economy.

Hughes added that the White House believes that “binding economic ties with the United States will be the best safeguard against future aggression and an integral part of a lasting peace.” He added: “The United States recognizes this, the Russians recognize this, and Ukrainians should recognize this,” AR writes.

Ukraine wants to attract American investors in strategic industries and get strong security guarantees, including from the United States, the head of the Presidential Office, Andriy Yermak, wrote in his Telegram channel on Sunday.

“The main message of President Vladimir Zelensky is that the situation in the world requires Europe’s strength and unity to be able to respond to any challenges. In addition, during meetings in Munich with U.S. Vice President J.D. Vance and other American officials, Ukraine received commitments of continued support and political will to achieve sustainable peace,” Yermak said.

He also noted that the president has made it clear that any plans prepared without Ukraine are unacceptable.

“Security guarantees must be strong, effective and real, and include the United States,” Yermak concluded.

Andriy Yermak, SECURITY GUARANTEES, STRATEGIC INDUSTRIES, US investorsi

Vitagro Group of Companies intends to reach the planned capacity of biomethane plant of 3 million cubic meters of biomethane per year in 2025 and in case of successful export is ready to build two more plants to increase production and export, the company’s development and investment director Sergiy Savchuk told Forbes Ukraina.

“We have several projects in the pipeline. Construction of one plant in Khmelnitsky region and another in Rivne region. However, we have not started construction yet, we have to evaluate the results of exports. If we are satisfied, we will quickly build new projects. The total capacity of the two new plants is about 8 million cubic meters of biomethane per year,” he said.

According to his information, the group of companies is considering the option of attracting foreign investors in capital.

He added that now 20 tons of cattle manure or 70-80 tons of slurry are used to produce 1000 cubic meters of biomethane at the plant in Khmelnitsky region.

Vitagro Group has its own cows and bulls – 5700 heads, pigs – 106 thousand heads, manure from which is the raw material for biomethane production. The plant has 20 employees, and 50 specialists were involved in the construction of the plant.

Savchuk suggested that EUR6 mln invested in the construction of the plant in Khmelnitsky region will pay off in five years, but everything will depend on the gas price. If the market continues to grow, EUR6 mln will be recouped faster. Now the cost of biomethane in the company is more than EUR500 per 1000 cubic meters. At the same time, the EU natural gas price is around EUR600 per 1,000 cubic meters as of mid-February 2025.

“Due to the high gas prices in the EU, biomethane is a premium market. We have seen the prospects. Another reason is risk diversification. Our own generation allows us to ensure the group’s energy independence, given the Russian Federation’s energy strikes,” emphasized the company’s development and investment director.

Preparing for the first export delivery of biomethane took the company’s team 5 months of work. Vitagro noted that the whole process of exporting biomethane was a challenge for them: from connecting to the grid, which took several months, injecting the biomethane, quality control to customs clearance and delivery to the border.