According to the daily monitoring data of EastFruit project, this week the potato market in Ukraine has seen a decrease in trading activity. Contrary to the hopes of farmers that this product will once again increase in price on the eve of New Year vacations, the selling prices for potatoes in Ukraine, on the contrary, began to decline. Wholesale companies, in turn, see no reason to raise prices and increase the volume of purchases of this product, as the demand for this product has significantly decreased.

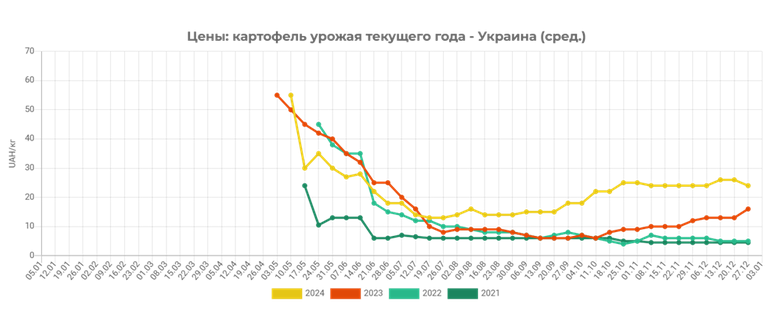

Thus, today marketable potatoes are on sale in the range of 18-28 UAH/kg ($0.43-0.67/kg), depending on the quality, variety and volume of offered batches of products, which is on average 12% cheaper than at the end of the last working week.

The reason for a slight decrease in prices in this segment was not only weakening demand for potatoes, but also stable supplies of these products from foreign markets. At the same time, most key market players note mediocre quality characteristics of imported potatoes, which, in turn, affected the pace of sales of local products as well.

Nevertheless, in general, Ukrainian farmers do not complain about the selling prices for potatoes this season, because this product has risen in price by an average of 41% compared to last year. The reason for such a significant price difference experts call the decline in potato yields in Ukraine due to unfavorable weather conditions in the summer months. Many farmers also note a gradual deterioration in the quality of products stored in storage.

You can get more detailed information about the development of the market of potatoes and other horticultural products in Ukraine by subscribing to the analytical weekly EastFruit Ukraine Weekly Pro. Detailed product information is available here.

Zezman Holding (Odesa) completed the construction of 15.2 thousand square meters of housing in 2024 and will continue to implement the previously announced residential estates in Uzhhorod and Odesa next year.

“This year, we have taken a bold and strategically important step by expanding our presence from the southern region to the west of Ukraine. We presented two large-scale projects: Lizrome in Uzhhorod, the first residential community in the region that meets the principles of sustainable development, and Gross Liebental cottage community in Odesa agglomeration, designed with a focus on energy autonomy, security and flexibility of housing solutions,” Boris Goldenstein, founder and CEO of Zezman Holding, toldInterfax-Ukraine.

By the end of 2024, the developer completed the construction of two buildings with 357 apartments in the Artville residential complex in Odesa, with a total area of 15.2 thousand square meters. The construction of nine buildings for 1 thousand apartments with a total area of 43.5 thousand square meters is also underway.

According to the company, about 40% of sales are made under the eOselya program, which indicates a high demand for mortgage programs.

“At the same time, we are seeing an increase in demand for ready-made housing, in particular, for renovated apartments that meet the principles of ready to use. This reflects the changing priorities of consumers who are looking for comfort and convenience without spending time and money on repairs,” Zezman Holding said.

Founded in 2013, Zezman Holding has commissioned 13 houses, with another 28 residential buildings at various stages of construction.

Metinvest Mining and Metallurgical Group mastered the production of 20 new products in 2024, including six new products at its joint venture, Zaporizhstal, which launched six new products.

According to the group’s press release on Friday, in the face of Russia’s full-scale invasion of Ukraine, which has been going on for almost three years, Metinvest remains the country’s economic and industrial backbone. Over the decade of war, the group has managed to launch 422 new products.

This year, most new products were launched in the long products segment (12), cold-rolled coils and sheets (four), hot-rolled coils and sheets (two), and galvanized coils and semi-finished products (one each).

Kametstal and Zaporizhstal accounted for the bulk of new products. One new product was launched by Unisteel, the Group’s galvanized steel producer.

All new long products were launched at Kametstal. Thus, the plant has mastered the production of rebar for reinforced concrete structures: two new sizes and a new strength class according to the Ukrainian national standard DSTU 3760, as well as rebar according to Polish standards.

In addition, the company has launched the production of six types of wire rod made of different steel grades and in various sizes in accordance with Ukrainian, international, European and American standards. The products are used in construction, civil engineering and metal products manufacturing.

In addition, the company has mastered the production of reinforced steel profiles for supporting mine workings such as SVP33 according to Ukrainian standards. These special interchangeable products are used in the manufacture of arch support for domestic mining and metals mines. The company also started production of round rolled products made of St3ps steel with a diameter of 27 mm in accordance with Ukrainian standards, which are used in construction and civil engineering.

Zaporizhstal is the leader in new products in the cold-rolled coil and plate segment: the plant has launched four products. These include S250GD coils made in accordance with Ukrainian and European standards, which are used for further galvanizing and other coatings, and then for the manufacture of lightweight steel thin-walled structures.

The company has also mastered the production of S215G rolled steel, which is suitable for the manufacture of unwelded and welded steel profiles, sheets, main, auxiliary and decorative structural elements. It is manufactured in accordance with the German standard DIN 1623-2.

In addition, the new product is a 2.5 mm thick DC01 coil that meets European standards EN 10130 and EN 10131. The steel is ideal for use in applications where precise product geometry and ease of forming are important, while maintaining sufficient mechanical strength.

The company has started production of 2.1-2.5 mm thick plates cut from hot-rolled coils in a wide range of grades, a versatile material for the production of various structural elements and technical products subject to cold forming.

All cold-rolled products are intended for the construction industry, machine building and metal products segment.

In the hot-rolled coils and sheets segment, Zaporizhstal launched production of two types of rolled products: coils and sheets of S355JR/S355J2 grades with a thickness of 2.75-2.79 mm according to European standards, as well as a newly designed sheet with a size of 5.0×1500×6000 mm made of 09G2/09G2S steel according to Ukrainian technical standards. These products are in demand in the construction and machine-building industries. In particular, the first of these products is used in the production of electric-welded pipes and profiles, and the second is used to manufacture structural elements for freight and passenger railcars.

In the galvanized coils and semi-finished products segment, Unisteel has mastered the production of S250GD-S280GD rolled products from Zaporizhstal coils – these steel grades are used in construction, namely in structures that require a combination of strength and corrosion resistance.

For its part, Kametstal has launched the production of continuously cast square billets that meet higher quality standards both in terms of chemical composition and physical structure after crystallization. These semi-finished products are used to make long and structural shapes for critical applications.

“Metinvest is a vertically integrated group of steel and mining companies. The Group’s enterprises are located primarily in Donetsk, Luhansk, Zaporizhzhia and Dnipropetrovs’k regions. The main shareholders of the holding are SCM Group (71.24%) and Smart Holding (23.76%), which jointly manage it. Metinvest Holding LLC is the management company of Metinvest Group.

State-owned Oschadbank (Kyiv) has entered into a 5-year loan agreement with the Lviv City Council for UAH 840 million, of which UAH 718 million will be used to complete the construction of a waste processing plant.

According to the bank’s press release, the rest of the funds will be used to implement four more projects: the construction of an alternative bridge on Kovcha Street, the arrangement of two centers for veterans, and the reconstruction of the power supply system of the Pivnichna shopping center (CHP-2).

“Despite the fact that Oschadbank’s share in financing municipalities is more than 60% of the market, this loan agreement is the first in our cooperation with the Lviv City Council during a full-scale war. As a conscious bank that adheres to ESG principles, we are pleased to participate in the implementation of such an important environmental project for one of the most European cities in the country,” said Yuriy Katsiyon, Deputy Chairman of the Board of the state-owned bank in charge of corporate business, as quoted in a press release on Friday.

In turn, the Lviv City Council’s website states that the volume of construction work at the facility has reached 70%.

According to the release, once launched, the municipal waste recycling facility will be able to process more than 250 thousand tons of waste per year using mechanical and biological methods. This volume is expected to fully meet the city’s solid waste disposal needs.

The Oschad press service added that the Lviv Waste Recycling Plant construction project is also being implemented with the financial support of the European Bank for Reconstruction and Development (EBRD) and the Eastern European Energy Efficiency and Environment Partnership (E5P). The waste processing plant covers an area of 9.66 hectares.

The Lviv City Council website specifies that UAH 46.2 million of the total amount of approved funding will be used to build an alternative bridge on Omelyana Kovcha Street, and the remaining UAH 75.8 million will be used to equip two centers for veterans and reconstruct the power supply system of the Pivnichna shopping center (CHP-2).

According to the National Bank of Ukraine (NBU), as of November 1, 2024, Oschadbank ranked 2nd (UAH 340.77 billion) among 62 banks in the country in terms of total assets. The financial institution earned UAH 12.78 billion in net profit for 10 months of this year, compared to UAH 14.58 billion in the same period last year.

France has one of the most complex and multi-level taxation systems in place, covering both legal entities and individual entrepreneurs. Let us consider the main taxes applicable to these categories of taxpayers.

Taxes for legal entities

1) Corporate income tax (Impôt sur les Sociétés, IS):

Its standard rate is 25% on company profits. A reduced rate of 15% is possible and applies to the first 38,120 euros of profit for small and medium-sized enterprises with an annual turnover of less than 7.63 million euros.

Some companies can choose between being taxed under the income tax system (Impôt sur le Revenu, IR) or the corporate tax system (IS), depending on their legal form and capital structure.

2) Value added tax (Taxe sur la Valeur Ajoutée, TVA), its rates are also diversified. The standard rate is 20%, and the reduced rates are: 10%, 5.5% and 2.1% are applied to certain goods and services.

3) There is also a tax called the territorial economic contribution (Contribution Économique Territoriale, CET). It consists of two components – a tax on the value of commercial real estate (Cotisation Foncière des Entreprises, CFE) and a contribution to the value added of business (Cotisation sur la Valeur Ajoutée des Entreprises, CVAE). The rates depend on the location and turnover of the company; the maximum CVAE rate is 1.5% for companies with a turnover of more than EUR 50 million.

4) There is also a so-called vehicle tax (Taxe sur les Véhicules de Sociétés, TVS). It is levied on companies that use cars for commercial or business purposes. The rates depend on the type of vehicle, its age, and CO₂ emissions.

Taxes for individual entrepreneurs (IEs) are also quite complicated.

1) Income tax (Impôt sur le Revenu, IR) with a progressive scale from 0% to 45%, depending on annual income. The income of individual entrepreneurs is taxed on the same scale as the income of individuals. There are various taxation regimes for individual entrepreneurs, such as “micro-entrepreneur” with a simplified accounting and taxation system.

2) Social contributions – individual entrepreneurs are required to pay social and health insurance contributions, the amount of which depends on the type of activity and income level.

3) Value added tax (TVA). Individual entrepreneurs are required to register as VAT payers if their annual turnover exceeds certain thresholds, for example, for trade in goods it is 91,900 euros, and for the provision of services – 36,800 euros.

Like almost any other country in the world, there is a real estate tax (Taxe Foncière). It is levied on property owners, regardless of their residency status. The rates are determined by local authorities and depend on the cadastral value of the property.

There is also still a tax on residence (Taxe d’Habitation), which is levied on persons living in real estate as of January 1 of the reporting year. This tax is being gradually abolished for most households; the full transition is expected to be completed in the coming years.

The luxury tax or Impôt sur la Fortune Immobilière (IFI) is levied on individuals whose real estate in France is valued at more than EUR 1.3 million. There is a progressive scale from 0.5% to 1.5% of the property value.

The French tax system is characterized by a high degree of progressivity and diversity of taxes, which requires careful planning and accounting when doing business. It is recommended to consult with professional tax advisors to ensure compliance with current legal requirements and optimize the tax burden.

http://relocation.com.ua/osoblyvosti-podatkovoi-systemy-frantsii-na-kinets-2024-roku-styslyj-analiz/

Since the beginning of this week, the demand for milling wheat has increased in the ports of Greater Odesa and Danube, APK-Inform news agency reported.

“The purchase prices for this crop were supported by the increased demand of importers to cover the positions under the previously concluded agreements, while the restrained supply also supported the prices. At the same time, the currency factor contributed to the increase in hryvnia wheat prices,” the analysts explained.

According to them, in the ports of Greater Odesa, the purchase prices for milling wheat increased by $1-2 per ton and as of December 26, 2024, were in the range of $208-215 per ton on CPT-port terms. At the same time, in the Danube ports, the increase in demand prices averaged $2 per ton and was recorded in the range of $209-215 per ton on CPT-port terms compared to the end of last week.

Hryvnia prices (CPT-port basis) increased by 50-150 UAH/ton and are mainly in the range of 9.9-10.3 thousand UAH/ton.

“The minimum and close to them prices were mainly declarative in nature and were close to the prices of feed wheat,” summarized APK-Inform.