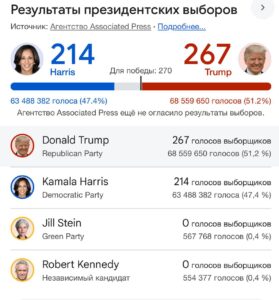

US Republican presidential candidate Donald Trump has declared himself the winner of the election, speaking to supporters and voters in Palm Beach, Florida.

“This is a political victory like our country has never seen before. I want to thank the American people for this honor of being elected your 47th president and your 45th president,” Trump said.

The Republican Party has won the US Senate elections, taking 51 seats out of 100, while the Democratic Party took 42 seats, the Associated Press reports.

“The Republicans have gained control of the US Senate, taking back the chamber for the first time in four years. This gives the GOP a large center of power in Washington and a leading role in approving the next president’s Cabinet, as well as any Supreme Court justice if a vacancy occurs,” the report said.

Seven other senatorial candidates have not yet been named.

Also, the Republican Party is leading in the House of Representatives elections and has already taken 187 seats out of 435, while the Democratic Party has 163 seats. Another 85 winners will be announced later.

Consumer prices in the euro area increased by 2% year-on-year in October, according to a report by the European Union’s statistical office, which presented preliminary data. Thus, inflation accelerated compared to September, when it was 1.7%.

The consensus forecast of analysts, as cited by Trading Economics, predicted an increase in consumer price growth in October to 1.9%.

According to preliminary data, the increase in the cost of services this month amounted to 3.9%, the same as in September, the growth in prices for food, alcohol and tobacco products accelerated to 2.9% from 2.4%. Industrial products went up by 0.5% in October (+0.4% in September), while energy prices fell by 4.6% (-6.1% in September).

Consumer prices excluding food and energy (CPI Core) increased by 2.7%, the same as a month earlier. Experts had expected a slowdown to 2.6%.

Consumer prices in the euro area in October rose by 0.3% compared to the previous month. In September, they declined by 0.1% in monthly terms.

Source: http://relocation.com.ua/spozhyvchi-tsiny-v-ievrozoni-v-zhovtni-zbilshylysia-na-2/

Unemployment in the euro area in September amounted to the lowest ever recorded at 6.3%, according to the European Union Statistical Office. The August figure was revised from 6.4% to 6.3%. According to Trading Economics, analysts had expected unemployment last month to be 6.4%.

In September 2023, unemployment in the euro area was at 6.6%.

The number of unemployed in the region last month increased by 13 thousand compared to August, to 10.884 million. Youth unemployment (population under 25) rose to 14.4% from a revised 14.3% a month earlier.

The lowest unemployment rate among the largest eurozone countries was recorded in Germany (3.5%, the same as a month earlier), and the highest in Spain (11.2%, down 0.1 percentage point). In France, the unemployment rate increased by 0.1 percentage points to 7.6% in September, while in Italy it remained unchanged at 6.1%. Overall, in the European Union, unemployment last month amounted to 5.9%, the same as in August.

Yavir-Invest LLC (Berdychiv, Yavoriv district, Lviv region), a member of the Kormil agro-industrial group that processes soybeans, is issuing its debut bonds.

According to the National Securities and Stock Market Commission (NSSMC), it registered the issue of A and B series bonds of Yavir-Invest at its meeting on Tuesday.

According to the regulator’s website, these are private issues, and there is no information on their parameters.

According to Kormil’s website, Yavir-Invest processes 100 thousand tons of soybeans annually, producing more than 80 thousand tons of high-protein Herbal Soya and 15 thousand tons of soybean oil.

Kormil Group was founded in 2006 as an importer of Agrolife Feed, which later set up its own production. It also includes the Agrolife Transservice poultry farm with a capacity of up to 5 million broilers per year, a plant for the production of premixes, concentrates and mixed fodder, and Danylo Halytskyi LLC, which grows agricultural products on 4,000 hectares. The group employs over 400 people.

According to YouControl, Yavir-Invest’s revenue in the first half of this year decreased by 2.3% to UAH 303.38 million, and net profit by 3.4% to UAH 4.18 million. As of the middle of this year, the company’s authorized capital amounted to UAH 2.01 million, and its equity capital was UAH 60.08 million.

The company’s beneficiary is Ihor Patsula from Yavoriv.

Ukrnafta plans to drill about 30 new wells in 2025, as well as carry out workovers, equipment upgrades and production stimulation.

This was announced by the company’s CEO Sergiy Koretsky at the conference Supplier Day for State-Owned Oil and Gas Enterprises: Plans for 2025.

“In 2025, we plan to increase production by about 30 new wells. The vast majority of them will be completed with the help of third-party contractors. We also plan about 120 workovers – about 34 with the help of third-party contractors, and 52 hydraulic fracturing operations – about 30 with external support,” he said.

According to the CEO, the company will focus on upgrading equipment and improving energy efficiency: modernizing compressor stations, installing booster compressor stations and modular equipment for hydrocarbon preparation and measurement.

“We are preparing to conduct 3D seismic surveys over about 1,250 square kilometers of area. We also plan to conduct industrial and geophysical studies, design and survey work. In 2025, we will focus on pipeline surveys: about 2.5 thousand kilometers will need to be inspected to prevent gusts and emergencies,” Koretskyi said.

The company also repairs and modernizes the filling stations of the largest mono-brand network in Ukraine. About 100 existing filling stations will be partially modernized this year. Shops and cafes will be added. Modernization of the existing filling stations and construction of new complexes is the goal for the next few years.

“All Ukrnafta’s plans are impossible without reliable partners. That is why I sincerely invite everyone to follow the updates on the company’s official resources and participate in open tenders in the Prozorro public procurement system,” said the Ukrnafta CEO.

“Ukrnafta is Ukraine’s largest oil producer and operator of the national network of filling stations. In March 2024, the company took over the management of Glusco’s assets and operates a total of 545 filling stations – 460 owned and 85 managed.

The company is implementing a comprehensive program to restore operations and update the format of its filling stations. Since February 2023, the company has been issuing its own fuel coupons and NAFTACard cards, which are sold to legal entities and individuals through Ukrnafta-Postach LLC.

Ukrnafta’s largest shareholder is Naftogaz of Ukraine with a 50%+1 share. In November 2022, the Supreme Commander-in-Chief of the Armed Forces of Ukraine decided to transfer to the state a share of corporate rights of the company, which belonged to private owners and is currently managed by the Ministry of Defense.