On October 17, on the eve of the Day of Restoration of Independence of the Republic of Azerbaijan, many honored guests gathered in the space of the National Library of Ukraine for Children to celebrate the Day of Culture of Azerbaijan: Distinguished Ambassadors Extraordinary and Plenipotentiary of foreign countries, readers and people’s artists of Ukraine. The event was supported by the Ministry of Culture and Strategic Communications of Ukraine.

The Republic of Azerbaijan is an incredible country with well-established traditions and a unique culture, where wonderful people live. The rich cultural heritage of Azerbaijan combines elements of the East and the West. This country has given the world not only outstanding scientists and artists, but also preserved unique cultural heritage that has been passed down from generation to generation.

Ukraine and Azerbaijan have strong political, diplomatic, and economic ties.

The National Library of Ukraine expresses its sincere gratitude to His Excellency Mr. Seymur Mardaliyev, Ambassador Extraordinary and Plenipotentiary of Azerbaijan to Ukraine, for the close, friendly cooperation with the National Library of Ukraine for Children.

This year, the Embassy of Azerbaijan became a partner in organizing and conducting the III All-Ukrainian Environmental Children’s Drawing Contest “The Future of the Planet is in Our Hands”, and helped to involve the State Oil Company of the Republic of Azerbaijan SOCAR Energy in Ukraine in the co-organizers of the contest. Representatives of the Embassy and the oil company worked in the jury, participated in the press conference and awarding ceremony of the winners and prize-winners, and provided gifts for the children.

Thanks to Mr. Ambassador, new wonderful children’s books were added to the library’s collection.

Seymour Mardaliev and Alla Gordienko delivered their speeches on stage and assured the audience of a fruitful and strong partnership and friendship.

Part of the culture of every nation is its poetic word. As part of the national project “Ukraine Reads to Children”, Consul of the Embassy of the Republic of Azerbaijan in Ukraine Galibbay Agadashov and Assistant and Translator of the Ambassador Olena Nazarenko read the poem “The Bee” by the famous Azerbaijani children’s poet and prose writer Abdullah Shahig in Azerbaijani and Ukrainian.

As part of the celebration, students of the Irpin Humanitarian Lyceum “Linguist” named after Zarifa Aliyeva, headed by the deputy directors of the lyceum, visited the NBU for children for the first time. This educational institution also enjoys a true friendship with the Embassy of Azerbaijan.

On the second floor of the library, adults and children visited the book exhibition “Cultural Values of the Azerbaijani People”, decorated with household items. The exhibition will be on display at the National Library of Ukraine for Children for 10 days.

The Embassy of Azerbaijan in Ukraine treated all the guests of the holiday with delicious Azerbaijani delicacies.

In January-September 2024, Ukraine imported 526.545 thousand tons of salt worth $69.844 million, which is 65.6% and 6.64% more than in the same period last year, respectively.

According to statistics released by the State Customs Service (SCS), Egypt became the largest supplier of salt to Ukraine, accounting for 55.41% of total imports worth $38.7 million in January-September 2024.

Turkey and Romania accounted for 15.7% and 15.6% of supplies, for which these countries earned $10.96 million and $10.81 million, respectively.

A year earlier, Ukraine’s top three salt importers were Turkey with a 30.9% share, Egypt and Romania with 21.6% and 20.9%, respectively. Their revenues from salt sales amounted to $20.3 million, $14.11 million and $13.697 million, respectively.

In January-September 2024, Ukraine reduced its salt exports to a record low of 21 tons, for which it earned $21 thousand. Its buyers were Romania, which purchased 17 tons (80.9%), Moldova and Spain purchased a ton each, which was 4.8% for each country.

A year earlier, salt exports amounted to 38 tons, for which Ukraine earned $155 thousand. Exports of this product were supported by Romania, which bought 35 tons (94.6%), and Moldova – a ton (2.7%).

As reported, in pre-war 2021, Ukraine exported 710.04 thousand tons of salt for $28.32 million, while in 2022 it fell fivefold in physical terms to 142.038 thousand tons, and revenue fell even more, to $3.82 million. In 2021, the main buyers of Ukrainian salt were Poland (39.1%), Hungary (27.4%), and Romania (7.3%). In 2021, Ukraine imported 142.81 thousand tons of salt worth $12.92 million.

After the occupation of the country’s largest salt producer, Artemsol, by Russian troops, Ukrainian salt exports amounted to only 149 tons for $32 thousand in the first half of 2023.

More than half of the bankrupts are Ukrainians aged 25 to 45

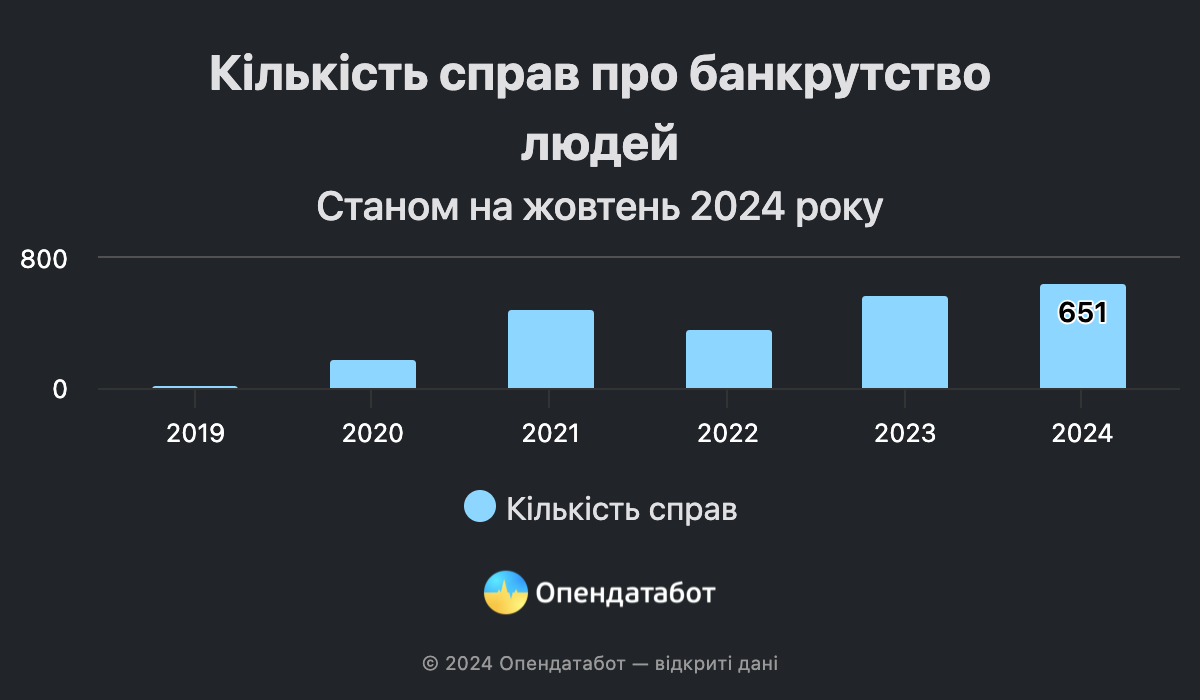

651 bankruptcy cases are currently open, according to the Supreme Court of Ukraine. The number of cases has almost doubled in the last 4 months of this year. The largest number of bankrupts is in Kyiv and its region and in Dnipropetrovs’k region. 64% of bankrupts are people aged 25 to 45.

651 bankruptcy cases have been opened in Ukraine this year. The number of cases has almost doubled since the beginning of summer.

So far, more bankruptcy cases have been opened against Ukrainians than in the whole of last year: 575 such cases were considered then.

Most often, people aged 25 to 45 apply to be declared insolvent – 64.1% of bankrupts. Another 28.7% are over 45 years old.

51% of bankrupts are women, and another 48% are men.

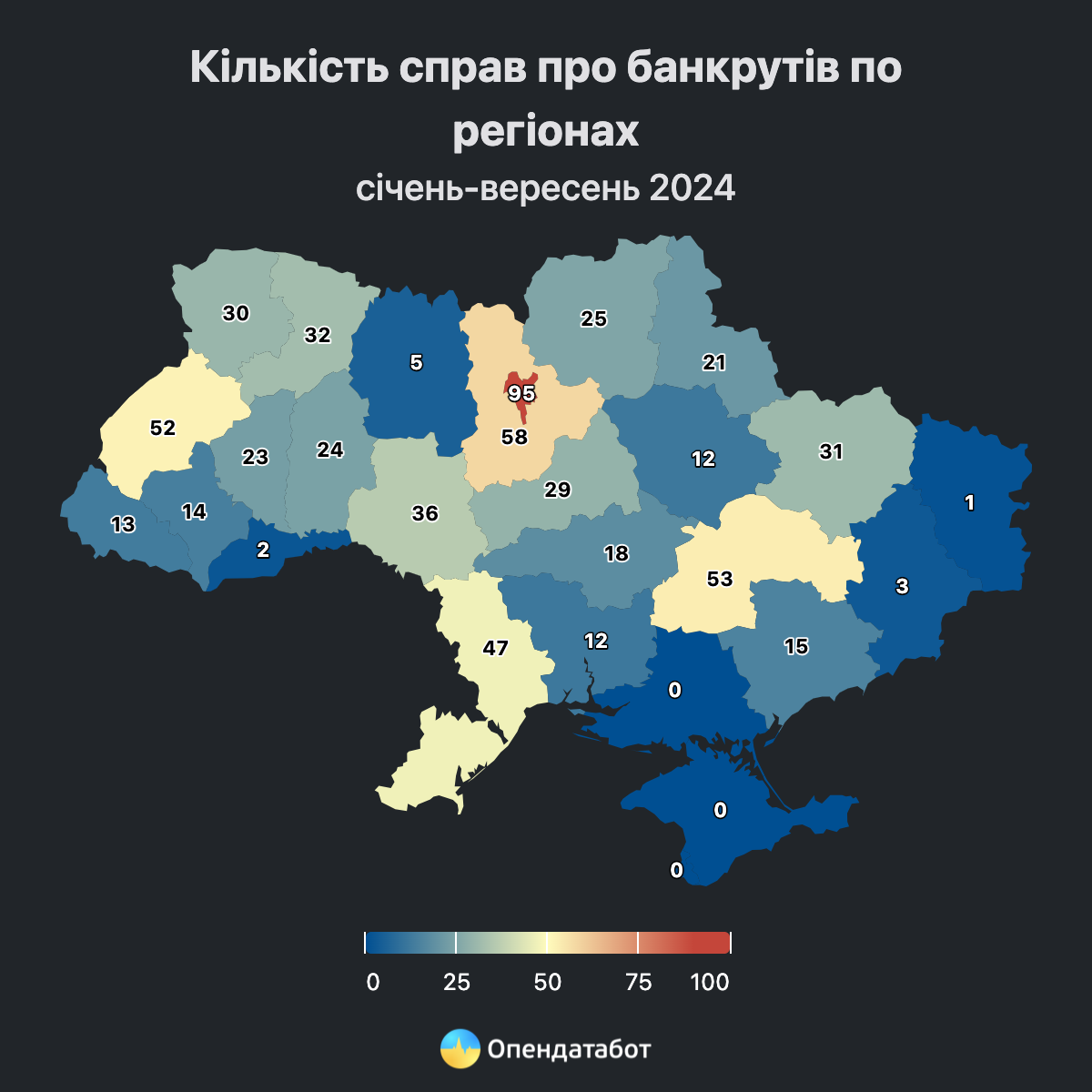

Most bankrupts are in the capital: 95 cases or 15% of the total number. Kyiv region follows with 58 or 9%. Dnipropetrovs’k region closes the top with 53 cases, which is 8% of the total.

Denys Lykhopiok, Insolvency Receiver, believes that the current dynamics is most likely a “pent-up demand” rather than a rapid growth caused by any one factor.

“It should be understood that at the beginning of the full-scale war, people did not have time to deal with debts – they were prioritizing survival.

At the same time, there was a moratorium on the collection of most debts in enforcement proceedings for more than a year. Even after the moratorium was lifted, private and public bailiffs reminded debtors of their obligations. This may have been the driving force that prompted people to seek a solution to their debts through insolvency proceedings.

In addition, Ukraine is already developing a positive judicial practice in bankruptcy matters,” comments Denys Lykhopiok, attorney at law, insolvency officer, member of the Qualification Commission of Insolvency Officers, and bankruptcy specialist.

Context.

The Verkhovna Rada allowed citizens to become bankrupt back in October 2018. The procedure became fully operational in 2019. Since then, a person in a difficult financial situation can initiate bankruptcy and, after going through the entire procedure, get rid of debts.

https://opendatabot.ua/analytics/people-bankrupts-2024-10

Kyivpastrans municipal enterprise intends to purchase five fully low-floor three-section self-propelled tramcars with a length of 25.5-28 m by December 31, 2025, for an expected amount of UAH 493 million 071.4 thousand.

According to Prozorro, the relevant tender was announced on October 18, with bids accepted until October 28.

The technical conditions stipulate that the trams should be produced no earlier than 2024, have at least 60 seats and at least one seat for a wheelchair passenger, and have USB ports for charging gadgets in the cabin.

In addition, the vehicle must have an autonomous range of at least 1 thousand meters on a horizontal straight line. The warranty period is 24 months from the date of commissioning.

The terms provide for 100% cash on delivery within five working days from the date the buyer signs the invoice for the actually delivered batch of goods.

According to the AllTransUA portal, two models of trams already in operation in Kyiv – manufactured by Polish Pesa and Ukrainian Tatra-Pivden – meet the criterion of the length of the cars stipulated by the technical specifications, while the car manufactured by Lviv-based Electron does not meet the requirements (the length of the three-section Electron tram is 19.5 m – IF-U).

The new Ambassador of Japan to Ukraine, Masashi Nakagome, has arrived in Ukraine, the Japanese Embassy has reported.

“We are pleased to welcome the new Ambassador of Japan to Ukraine, Masashi Nakagome! With many years of experience in diplomacy and international relations, he is ready to continue strengthening the ties between Japan and Ukraine. We are looking forward to starting a new chapter in relations between Japan and Ukraine!” reads the message on the page of the Embassy of Japan in Ukraine on the social network X.

As reported, in October 2024, Ambassador Extraordinary and Plenipotentiary of Japan to Ukraine Matsuda Kuninori completed his diplomatic mission in Ukraine. He had served as Ambassador to Ukraine since October 2021.