A new unique opportunity for investors in one of the most famous and picturesque places in the capital – Landscape Alley. This place, which has a great historical and cultural value, is known not only for its landscapes, but also for the constant flow of tourists and locals. The only available commercial space is located here, which creates an exceptional opportunity to open and develop a successful business in the heart of Kyiv.

Characteristics of the property

The offer includes three combined apartments on the ground floor of the historic building, as well as additional space on the sixth floor. The total area of the premises allows to accommodate various types of commercial enterprises, such as a restaurant, boutique hotel or other projects focused on the tourist and local market. All premises have recently undergone major repairs with modernization of engineering systems and interior renovation, which allows the new owner to start their business promptly.

Advantages of the investment project

Landscape Alley is a park popular among tourists and locals, known for its historical significance and picturesque views. The daily flow of visitors creates favorable conditions for any commercial project.

The 185-square-meter premises, with the possibility of expanding to 225 square meters, have just undergone a major renovation with the replacement of all communications. The space is ready to be used for a variety of businesses – from a family restaurant to a boutique hotel or sports complex.

Due to its central location and constant flow of tourists, the property has high profitability and a wide range of business opportunities.

The transfer of the premises to non-residential use will be fully supported by the legal team, including the development of a design project and the execution of all necessary works. The price of the property includes the entire range of works, except for the final finishing works. This allows investors to start their business as soon as possible.

This unique commercial offer provides investors with transparent transaction terms and the most comfortable conditions for starting a business in a prestigious area of Kyiv.

Contact information for inquiries: Phone: (050) 340 66 44

Address: 16 Velyka Zhytomyrska St., Kyiv, Ukraine

Watch more in the video at the link: https://www.youtube.com/watch?v=PnI7rJzq5Og

Ukraine has exported 12.04 mln tonnes of grains and pulses since the beginning of 2024-2025 marketing year (MY, June-July) as of October 14, 2024, including 1.593 mln tonnes shipped in October, the press service of the Ministry of Agrarian Policy and Food reported, citing the data of the State Customs Service.

According to the report, as of the same date in 2023, the total shipments were estimated at 6.676 mln tonnes, including 7 thsd tonnes in October.

In terms of crops, since the beginning of the current season, Ukraine has exported 6.894 mln tonnes of wheat (796 thsd tonnes in October), 1.575 mln tonnes of barley (252 thsd tonnes), 10.5 thsd tonnes of rye (3.1 thsd tonnes), and 3.302 mln tonnes of corn (538 thsd tonnes).

The total exports of Ukrainian flour since the beginning of the season as of October 14 are estimated at 21.5 thsd tonnes (2.6 thsd tonnes in October), including 19.4 thsd tonnes of wheat (2.1 thsd tonnes).

Romania has expanded the list of goods imported from Ukraine that require a license to enter the country to include eggs and poultry meat, Euractiv.ro reported, citing information from the Romanian government. The publication reminded that Romanian poultry producers faced a “serious problem” due to the import of eggs and poultry meat from Ukraine, which are sold at prices significantly lower than the cost of production in Romania.

According to the Minister of Agriculture Florin Barbu, after discussions with representatives of the poultry industry, the government decided to add eggs and poultry meat to the list of products that can be imported from Ukraine only with a license. The list also includes cereals, seeds, flour and sugar.

“It is our duty to protect Romanian production,” Barbu said.

In addition, he reminded that Romania, as a member of the European Union, must comply with certain production requirements in the poultry sector, which is why Romanian poultry farmers have “30% higher costs than in Ukraine.”

Barbu also emphasized that there is no ban on imports of Ukrainian eggs and poultry meat.

“We have made this decision on licensing to ensure that when the food industry needs these products and Romania is not completely self-sufficient, only Romanian processors will be able to import them under license,” he added.

After the European Commission decided not to extend the ban on imports of Ukrainian grain to five neighboring EU countries (Bulgaria, Poland, Romania, Slovakia, and Hungary) in September 2023, Romania introduced import licenses for grains and oilseeds from Ukraine and Moldova. This measure, introduced in October last year, was extended.

According to this decision, only Romanian companies engaged in the production of oil and fat products, flour milling, animal feed production and livestock farming are entitled to import agricultural products from Ukraine and Moldova.

The Ministry of Agrarian Policy and Food, with the support of the Food and Agriculture Organization of the United Nations (FAO), intends to develop agrarian diplomacy, said Vitaliy Koval, Minister of Agrarian Policy and Food of Ukraine, after a meeting with Viorel Gutsu, head of the FAO Regional Office for Europe and Central Asia.

“The goal of agrarian diplomacy is to train specialists to promote Ukrainian agricultural products on international markets on the basis of specialized higher education institutions. We are talking about the so-called agrarian attaches at diplomatic and trade missions abroad,” the press service of the Ministry of Agrarian Policy quoted Vitaliy Koval as saying.

The Ukrainian minister added that the FAO team had confirmed its interest in implementing such a project.

The ministers also discussed the possibility of allocating grants for Ukrainian farmers to automate production processes and increase the volume of value-added products, providing livestock farmers with generators, switching to gas generators, attracting international experts to adapt the Ukrainian agricultural sector to European requirements, and climate programs for Ukraine.

As of October 11, farmers in all regions of Ukraine have harvested 62.2 million tons of new crops from 16.8 million hectares, up from 56.6 million tons from 15.8 million hectares a week earlier.

As reported by the Ministry of Agrarian Policy and Food on Friday, 40.2 million tons (37.3 million tons) of grains and legumes, 17 million tons (15.8 million tons) of oilseeds and 5 million tons (3.5 million tons) of sugar beet have already been harvested.

The Ministry specified that wheat harvesting was completed, with 22.3 million tons harvested from 4.9 million hectares at a yield of 42.4 c/ha, barley – 5.5 million tons from 1.4 million hectares at a yield of 39.2 c/ha, peas – 465.3 million tons from 212.2 thousand hectares at a yield of 21.9 c/ha.

Corn harvesting continues, with 10.6 million tons harvested (7.7 thousand tons a week earlier) from 1.9 million hectares (48% of the plan), buckwheat – 124.3 thousand tons (121.8 thousand tons) from 85.8 thousand hectares (96%), millet – 156.1 thousand tons (154.8 thousand tons) from 82.9 thousand hectares (89%).

Ukraine continues harvesting oilseeds. In particular, 3.5 mln tons of rapeseed (3.457 mln tons a week earlier) have been harvested from 1.3 mln hectares (100%), soybeans – 4.8 mln tons (4.277 mln tons) from 2.1 mln hectares (80%), sunflower – 8.8 mln tons (8 mln tons) from 4.3 mln hectares (87%).

At the same time, the leaders in grain harvesting are farmers in Odesa region, who threshed 4.2 mln ha, Poltava region – 3.5 mln tons, and Kirovograd region – 2.7 mln tons. In terms of yields, the leaders are farmers in Khmelnytsky region with 65.5 c/ha, Ternopil region – 63 c/ha, Cherkasy region – 60.5 c/ha, and Ivano-Frankivsk region – 60.2 c/ha.

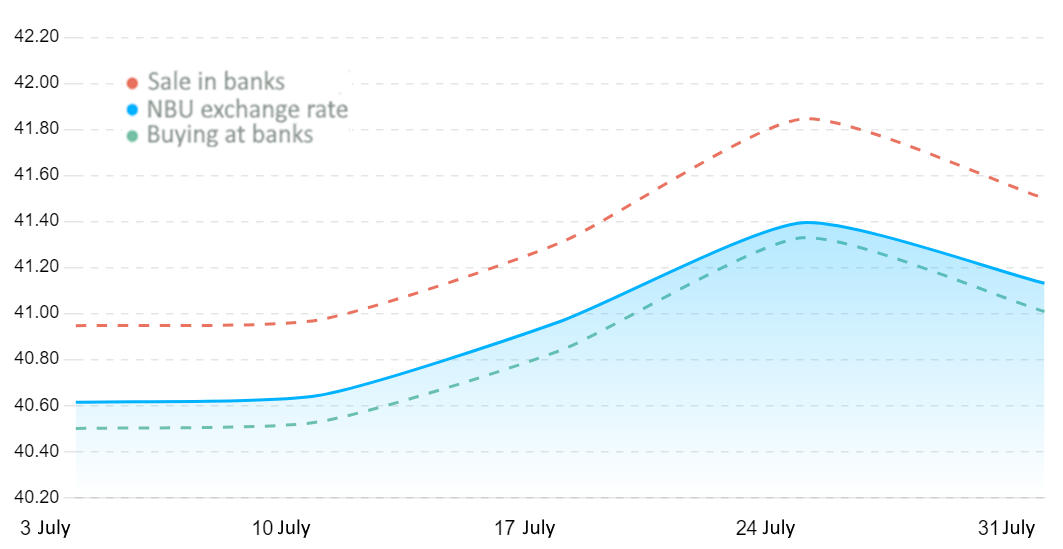

Quotes of interbank currency market of Ukraine (uah for $1, in 01.07.2024-30.07.2024)

Open4Business.com.ua