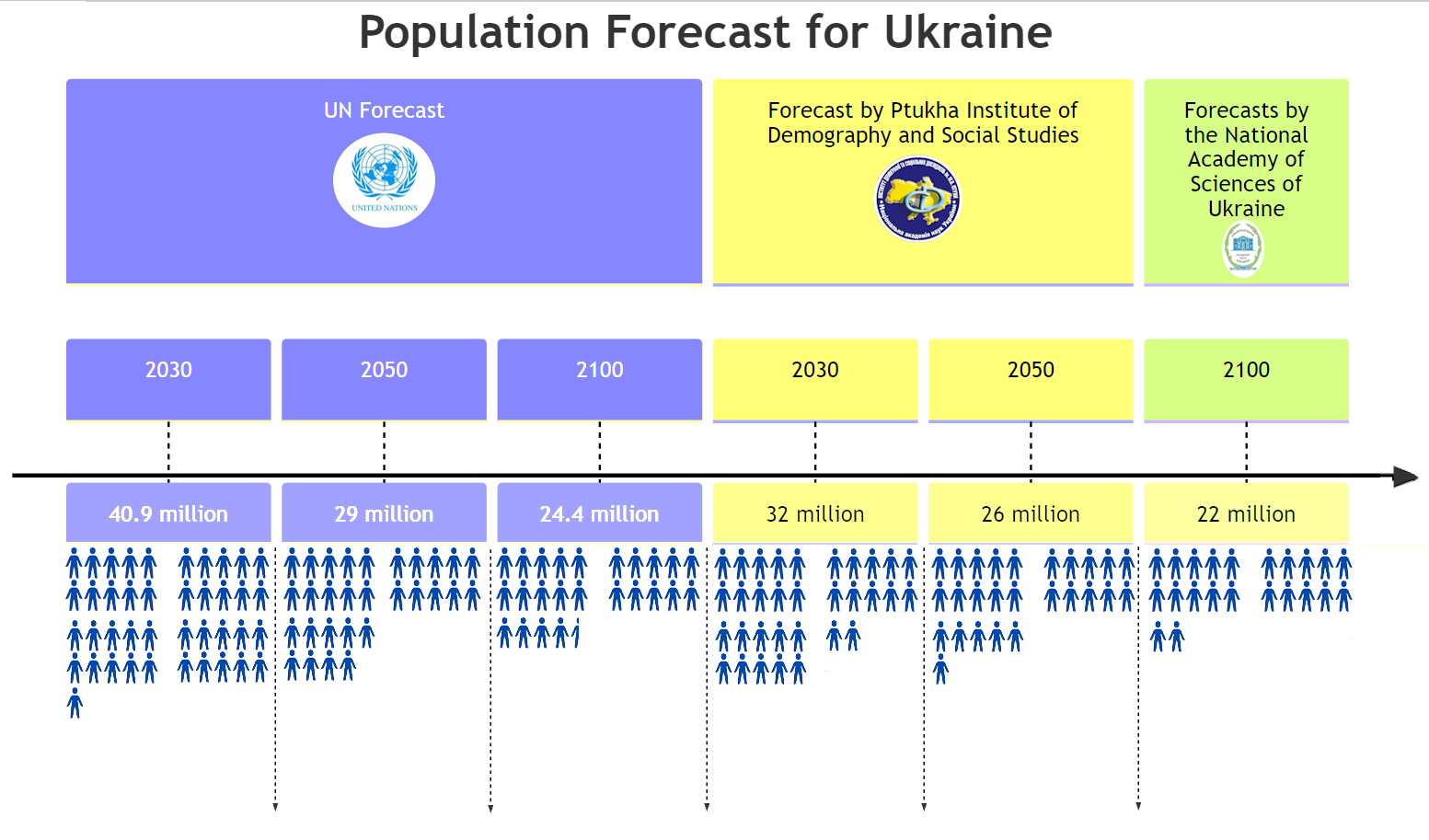

Population forecast for Ukraine in 2030-2100

Open4Business.com.ua

Ukrainian exports in January-September 2024 increased by 13.3% compared to the same period in 2023 to $30.7 billion, while imports increased by 9.9% to $51.2 billion, the State Customs Service reported.

“At the same time, taxable imports amounted to $42.5 billion, which is 83% of the total volume of imported goods. The tax burden per 1 kg of imports in January-September 2024 amounted to $0.5/kg, which is 8% more than in the same period in 2023,” the statistics are available on the website of the State Customs Service.

According to the published data, most of the goods were exported to Poland – for $3.6 billion, Spain – for $2.1 billion, and Germany – for $2.1 billion.

Goods were most often imported to Ukraine from China – for $10.3 billion, Poland – for $5 billion, and Germany – for $3.9 billion.

In January-September 2024, 65% of the total volume of goods imported were machinery, equipment and transport – worth $17.7 billion (UAH 125.7 billion, or 30% of customs revenues, was paid to the budget), chemical products – $8.8 billion (UAH 65.2 billion, or 15% of revenues), and fuel and energy products – $6.8 billion (UAH 111.7 billion, or 26% of customs revenues).

The top three most frequently exported goods from Ukraine are food products worth $17.9 billion, metals and metal products worth $3.4 billion, and machinery, equipment, and transport worth $2.5 billion.

As summarized by the State Customs Service, in the first nine months of 2024, UAH 217.9 million was paid to the budget during customs clearance of exports of goods subject to export duties.

“In January-September 2024, DTEK Energy invested over UAH 2.3 billion of its own funds in the repair and restoration of thermal power plants (TPPs).

According to the company’s press service, its goal is to restore as much capacity as possible that was damaged or destroyed as a result of numerous enemy attacks on the energy sector to ensure a more reliable heating season.

As reported earlier, DTEK Energy plans to invest about UAH 3.9 billion in the repair and restoration of TPPs in 2024, which is in line with last year’s investments.

Since the beginning of the full-scale Russian invasion, DTEK Energy’s TPPs have been attacked by the enemy more than 190 times. As a result of the attacks, 56 power engineers were injured and three were killed.

In March and June this year alone, the enemy carried out seven massive attacks on the company’s TPPs. The shelling destroyed or damaged about 90% of DTEK’s thermal generation capacity.

According to a study conducted by the sociological company Active Group in cooperation with the analytical center Experts Club, a significant number of Ukrainians have used medical laboratories over the past two years. In particular, private medical laboratories play an important role in the healthcare sector, as more and more people are turning to them for high-quality and fast medical services.

The top 10 most visited private medical laboratories in Ukraine are as follows:

1. Synevo – 39.5% of respondents said they had used the services of this laboratory. Synevo is the undisputed market leader, which can be explained by its wide network of laboratories across the country, modern equipment and high level of trust from the population. Synevo is known for its accessibility and a wide range of services that meet the needs of both ordinary citizens and medical professionals.

2. “Dila – 15.5% of respondents have visited this laboratory. “Dila also has a strong position in the market due to the high quality of its services, in particular the accuracy of analyzes and the speed of service. The laboratory is actively developing innovative diagnostic methods, which attracts consumers looking for modern medical solutions.

3. “Eskulab – 9.3% of Ukrainians choose this laboratory. “Eskulab has strengthened its position due to its regional coverage, especially in the western regions of Ukraine. An important factor in its popularity is the availability of services in remote locations, which makes the laboratory convenient for a large part of the population.

4. Invivo – 6.1% of respondents used the services of this laboratory. Invivo is known for its individual approach to each client, which contributes to its popularity among patients who value quality and comfort. An important aspect of success is a convenient system for obtaining results and high accuracy of analyzes.

5. “DniproLab – 4.8% of respondents chose this laboratory. Dneprolab has strong positions in the central and eastern regions of the country. The main factors that ensure its popularity are the promptness of results and affordable pricing.

6. “Median – 2.5% of visitors used the services of Median. This laboratory is known for the accuracy of its tests and the introduction of modern diagnostic methods. Despite its smaller scale compared to market leaders, Median offers high-quality services that attract patients who value professionalism.

7. “Medlab – 4.5% of respondents have used this laboratory. “Medlab provides quality service and modern facilities for patients, which makes it popular among those looking for reliable medical services at a reasonable price.

8. DNA Laboratory – 2.3% of respondents chose this laboratory. Its specialization in genetic research and diagnostics helps the laboratory to attract clients who need such specialized services.

9. “Unimed – 2.3% of visitors preferred Unimed. The laboratory attracts customers with its convenience and the ability to get results quickly and without queues. This provides a positive experience for patients who value comfort and time.

10. “New Diagnostics – 2% of respondents chose this laboratory. It specializes in accurate and fast tests, which makes it attractive to customers who need reliable diagnostics.

In general, the most visited laboratories are those that offer a wide range of services, modern equipment, and ensure high accuracy of results. At the same time, prices remain an important factor, as according to the survey, 69.8% of respondents said that the cost of services needs to be reduced, 31.8% – the accuracy of results, 15.2% – the speed of service, 12.5% – the conditions in the laboratory, 11.8% – the politeness of the staff. Competition between laboratories helps to improve the quality of service and reduce the cost of services, which has a positive impact on the overall healthcare market in Ukraine.

The survey was conducted in July by individual interviews. The survey involved 600 respondents.

According to Andriy Yeremenko, founder of Active Group research company, the increase in the number of private medical laboratories in Ukraine indicates a systematic increase in demand for their services. At the same time, competition between laboratories has a positive impact on the quality and cost of analysis.

He predicts that the market will continue to develop in the future, making it easier to open new laboratories and improve existing ones. This, in turn, will increase competition, which will further reduce prices and improve the quality of medical services.

For his part, Maksim Urakin, founder of the Experts Club information and analytical center, emphasized that the study confirms the trend of increasing demand for private medical laboratories among Ukrainians.

“The survey data indicate an increase in confidence in the private medical sector and its capabilities. At the same time, the high level of competition in the market encourages laboratories to innovate, improve diagnostic accuracy and customer service. This trend is a positive signal for all market participants, as improving the quality of medical services and making them accessible to more people contributes to the overall improvement of the health of the Ukrainian population,” the founder of Experts Club believes.

ACTIVE GROUP, Esculab, EXPERTS CLUB, LABORATORIES, SYNEVO, TESTS, URAKIN, Діла, Еременко

Three energy-modernized preschools in Rivne for a total of 410 children have started operating, the project was funded by the European Union under a EUR1.56 million grant, the press service of the project manager, the Nordic Environment Finance Corporation (NEFCO), reports.

The energy modernization was carried out for the buildings of the Rivne Special Child Educational and Rehabilitation Center, the Pahinets Center compensatory kindergarten and the 35th kindergarten, which are attended by a total of about 410 children, including IDPs and children with special needs.

“The European Union is pleased with the successful completion of the energy efficiency modernization project in Rivne, which has significantly improved the learning environment for local children, including IDPs and children with disabilities. This initiative reaffirms our unwavering commitment to helping vulnerable people in Ukraine, especially in these difficult times of war. The EU continues to support projects that strengthen the resilience and well-being of communities across Ukraine,” commented Josep Cornet, Head of the Reconstruction, Energy, Infrastructure and Environment Unit at the EU Delegation to Ukraine.

According to Viktor Shakirzyan, Secretary of Rivne City Council and Acting Mayor, these buildings had low energy efficiency and were in need of overhaul for a long time.

“Thanks to the modernization measures, we will be able to reduce costs from the community budget by reducing heat, electricity and water consumption. The work performed will also help reduce greenhouse gas emissions, which is part of our commitment to the NetZeroCities initiative to achieve climate neutrality by 2030,” he said.

The project “Reconstruction and Rehabilitation of Municipal Infrastructure in Rivne to Support the Urgent Needs of Internally Displaced Persons” was successfully implemented with the financial support of the European Union and implemented by the Nordic Environment Finance Corporation (NEFCO) under the NIP “EU Support for Urgent Housing Needs” program.

In total, the partnership between Rivne community and NEFCO has been going on for nine years, and four projects worth EUR 3 million 760 thousand have already been implemented. In particular, comprehensive thermal modernization of schools #26, #18 and #27, as well as kindergartens #14, #33 and #46, has been carried out to support the city’s transition to energy-efficient public buildings. Other measures implemented in educational institutions include the installation of eight new individual heating stations, replacement of kitchen equipment in 11 buildings, replacement of water tap nozzles in 13 buildings, and replacement of lighting fixtures with new LED lamps in 31 buildings.

NEFCO has also provided grant funding for the implementation of the project “Energy Efficiency of Public Buildings and Street Lighting in Rivne” under the Norway-Ukraine Energy Efficiency Initiative program. The grant funds will be used to insulate the facades of buildings, replace windows and entrance doors, and insulate roofs in pre-schools #7 and #57. Street lighting will also be modernized, including the replacement of lamps with energy-efficient ones, on the main and secondary streets of Rivne. The grant funds will also be used to install solar photovoltaic power plants on the roofs of three buildings of the Central City Hospital of the Rivne City Council, which need uninterrupted electricity supply.

Yom Kippur, the most important holiday of the Jewish calendar, will be celebrated by adherents of Judaism on Friday evening. It is believed that on this day, God decides what everyone’s fate will be in the coming year, hence the second name of the holiday – the Day of Judgment.

On Yom Kippur, one must observe a strict fast – refrain from eating and drinking water, refrain from washing, intimacy, lubricating the body with any means, and wearing leather shoes.

Unlike other fasts, Yom Kippur is observed even by pregnant and breastfeeding women, if their health is not in danger. In the event of a life-threatening situation, a person is exempted from fasting, but if his or her health allows it, he or she spends the day in prayer and repentance, just like all those who fast. Girls from the age of 12 and boys from the age of 13 also observe fasting, and younger children try to limit their sweets on this day. In addition, it is customary to give money to charity on the eve of the holiday.