In Dubrovnik, Ukrainian President Volodymyr Zelensky and Croatian Prime Minister Andrei Plenkovic met with Ukrainian children recuperating in Croatia, the press service of the head of state reported.

“Very pleased to be here today. Thanked the Prime Minister’s team for supporting our Ukrainian children, whose parents are heroes of our state, because they defend Ukraine. And there are, unfortunately, those who will remain in our hearts, in history, because they gave the most precious thing – life. We are very grateful to them. And none of us will never forget them,” – said Zelensky.

Currently, 90 Ukrainians are on vacation in the city of Split. All of them are children of soldiers of Kyiv region. Recuperation lasts 10 days and takes place within the framework of the program of the Embassy of Ukraine in Croatia for children of military men. The recreation is financed by the fund of the Honorary Consul of Ukraine in Croatia Ivica Piric. In total, more than 800 children have been able to undergo such recuperation since the beginning of the year.

“I am very glad that Croatia helps our Ukrainian children. Such assistance is very important. Such recreation allows us to support our children so that they smile. I can see it,” Zelensky noted.

Plenkovic added that the Ukrainian president’s visit to Croatia is related to the third summit “Ukraine – Southeast Europe”.

“We are here today to support Ukraine, your people and your president in the fight for your territorial integrity. We very much appreciate the heroism of your parents, with which they have been defending your state for two and a half years,” the Croatian Prime Minister said.

Zelenski and Plenkovic gave the children presents, and the children gave them flags with their signatures.

After the war is over and the energy supply situation improves, Nova Group will sell Nova Energy, a company created to develop generation, as a non-core business, said co-owner of Nova Group Volodymyr Popereshnyuk.

“…When the war is over… I will willingly sell this company to those for whom it is a passion, for whom it is the main business, the core business, because I believe that everyone should do their own thing,” Popereshnyuk said at the Energy of Business forum organized by Forbes.

He emphasized that Nova Energia is a non-core asset for NOVA Group, which the company is forced to deal with.

As of today, Nova Energia has already obtained most of the licenses, including the license to purchase fuel for refueling generators.

“Indeed, we opened Nova Energia not only because we need to produce electricity, but also because we need to refuel ourselves, because we had a fuel crisis that scared us, because we realized that if we don’t save ourselves, we may even stop, because fuel is critical for us… We have obtained a license for fuel to refuel our generators,” said Popereshnyuk.

He clarified that the market has long been subject to restrictions on the amount of one-time storage of fuel without a license.

According to him, Nova Energia already has about 4 thousand generators with a total capacity of 40 MW.

In addition, according to Popereshniuk, the company has ordered gas piston units and installed a number of solar power plants, and plans to install five more next year.

Minister for Foreign Affairs of Ukraine Andriy Sybiga met with Croatian Foreign Minister Gordan Grlic Radman in the framework of the Ukraine-South-Eastern Europe Summit, informed his Croatian counterpart about the situation on the battlefield and outlined Ukraine’s key defense needs.

“The Ukrainian Foreign Minister expressed his gratitude for the medical rehabilitation and recovery of Ukrainian defenders and their families in Croatia. This year alone, more than 800 children of Ukrainian servicemen have already been rehabilitated in Croatia. The ministers discussed the continuation and expansion of these programs,” the statement reads.

Sibiga also praised the solidarity of the Croatian side, in particular the leadership in assisting in the humanitarian demining of the territories liberated from occupation and the restoration of damaged energy infrastructure.

The Foreign Minister emphasized that Ukraine appreciates Croatia’s support for efforts to prevent the election of Russian representatives to the governing bodies of international organizations, including the Executive Council of the Organization for the Prohibition of Chemical Weapons. Sibiga also emphasized the importance of Croatia’s participation in the Ministerial Conference on the Human Dimension under the fourth point of Ukraine’s Peace Formula, “Release of all prisoners and deportees,” which is scheduled to take place in Canada in the near future.

In his turn, Grlić Radman emphasized Croatia’s readiness to continue to consistently support Ukraine in defending its sovereignty and territorial integrity.

The Croatian minister assured of the readiness of Zagreb to further assist Ukraine on its path to joining the EU and NATO.

The parties agreed that Croatia’s experience of joining the EU is important for Ukraine and discussed the provision of relevant expert support.

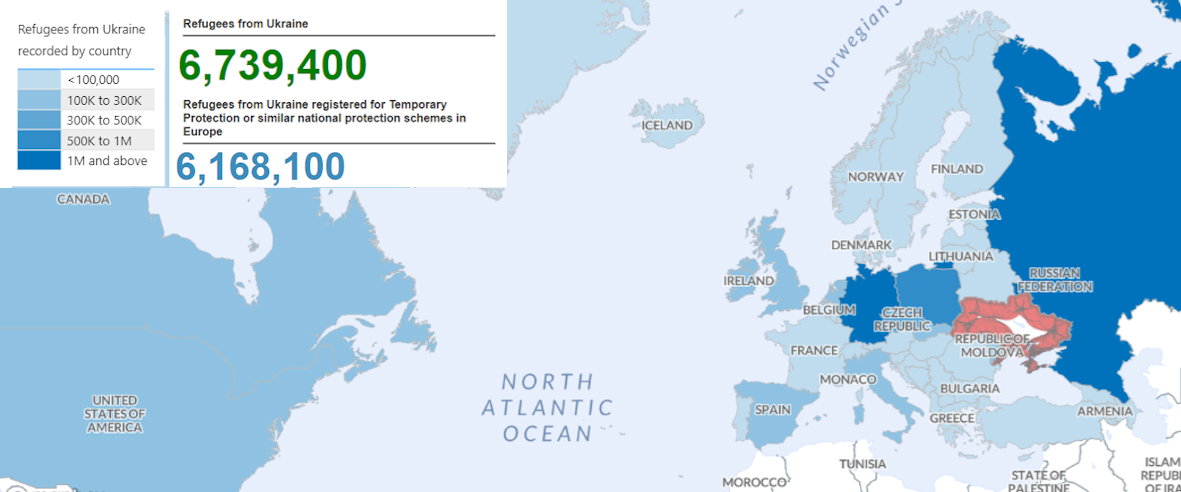

Number of refugees from Ukraine in selected countries as of 30.06.2024

Open4Business.com.ua

Turkey has allocated Ukraine the last package of 1 thousand licenses for transportation to / from third countries in accordance with the agreement reached at the end of 2023, said the Deputy Minister of development of communities, territories and infrastructure Sergiy Derkach.

“Plus 1 thousand permits from Turkey for transportation to/from third countries. Ukrainian carriers can continue to perform transportation to / from third countries with Turkey. The corresponding forms of permits are already in “Ukrtransbezpek” and are available for ordering,” Derkach wrote on Facebook on Wednesday.

According to him, the permits were issued in accordance with the agreement that was reached at the end of 2023, which will allow to close the need before the end of the year.”

“I will remind you that earlier this year, for the first time since 2018, we managed to agree with Turkey to increase the number of such permits by 40% – up to 3,500,” Derkach wrote, indicating that the market has already used 2,500 permits.

The Deputy Minister recalled that bilateral and transit traffic between Ukraine and Turkey do not require permits, as freight traffic between the countries is liberalized. “Visa-free” will be valid at least until the end of martial law.

Croatian Prime Minister Andrej Plenkovic, during the opening of the Ukraine-Southeast Europe summit in Dubrovnik, assured continued support for Ukraine, which is suffering from Russian aggression.

“Today I want to focus on three points. The first is Croatia’s continued assistance to Ukraine, the second is the relations of Southeast European countries with Ukraine, and the third is why Ukraine, which is suffering from Russian aggression, matters to the world and how we behave in the international community,” he said during his opening remarks at the Ukraine – Southeast Europe summit in Dubrovnik on Wednesday.

Prime Minister pointed out that the total amount of aid to Croatia since February 2022 amounted to about 300 million euros. In addition, Croatia has received about 30 thousand Ukrainian refugees, as well as Ukrainian wounded soldiers, who are being rehabilitated in centers for veterans and specialized hospitals.

“In this context, President Zelenski and I signed an agreement on long-term cooperation and support between Croatia and Ukraine, which lays the foundation for our relations for many years to come, and its content is in line with what we believe we can best contribute,” Plenkovic emphasized.

According to him, “it is a natural reflex of Croatia, as a country that in the past survived aggression and war with much less international assistance, to stand today next to a country that defends the same values of freedom, democracy and peace.”

“We believe this is the right thing to do, and I am proud that today we are all gathered to reaffirm our joint support for Ukraine,” Plenkovic said.

The prime minister noted that Ukraine supported Croatia in 1991, becoming one of the first countries to recognize Croatia internationally, its independence, and provided the country with military equipment and weapons.

“Today Croatia supports Ukraine with equal strength and assistance,” Plenkovic emphasized.