The National Bank of Ukraine, which previously included certain terms of “significant improvement in the security situation” in its basic macroeconomic forecast scenario, has abandoned this approach and instead published an alternative scenario in its April inflation report, the main difference of which is slower economic growth in 2025 with a larger budget deficit, weaker hryvnia and reduced international reserves.

“The alternative scenario is based on the assumption of higher security risks and, accordingly, a slower return of the economy to normal conditions over the forecast horizon. Under this scenario, Ukraine’s economy will recover more slowly in 2025 compared to the baseline scenario. However, the inflation trajectory will differ slightly,” the NBU said in the report.

As reported, in the first inflation reports for July and October 2022 after the pause caused by the Russian invasion, the NBU, in addition to the baseline, provided an alternative scenario with a longer period of war, but later abandoned it, although the IMF continued to provide such a scenario.

In the renewed alternative scenario in the April inflation report this year, GDP growth in 2025, in particular, will accelerate to only 3.3% from 3% this year, while the baseline scenario envisages economic growth of 5.3% next year.

At the same time, in 2026, the baseline scenario envisages a slowdown to 4.5%, while the alternative scenario envisages an acceleration to 5.6%.

According to the NBU, the economic recovery in the alternative scenario will be more fragile, even with more significant budget deficits. “Increased imbalances in the labor market amid a worse migration situation than in the baseline scenario will restrain consumer and business activity, and increase pressure on business labor costs. The recovery of industrial production from the damage and losses caused under this scenario will be slower, as will the recovery of sown areas,” the NBU said.

He added that the energy deficit will also have a negative impact on economic activity, which, however, is assumed to remain unchanged compared to the baseline scenario – about 5% in 2024-2025.

“Ensuring macro-financial stability will require somewhat higher volumes of international assistance and, at the same time, significantly higher spending of the NBU reserves to maintain a controlled situation in the foreign exchange market and moderate inflation,” the NBU emphasized.

According to the document, the main factor supporting the economy will be the continued maintenance of a softer fiscal policy than in the baseline scenario. The budget deficit, excluding grants in revenues, will amount to 18% of GDP in 2025 (13.5% of GDP in the baseline) and 12% of GDP in 2026 (7.5% of GDP in the baseline). The government will continue to spend heavily on infrastructure, social welfare, defense, and security. Their impact on the budget deficit will be partially offset by additional measures to mobilize budget revenues at 3.5% of GDP, the NBU added.

According to its forecasts, large budget deficits in 2025-2026 will be financed by both additional domestic and external borrowings. In particular, the alternative scenario envisages international assistance of $28.7 billion in 2025 and $18.5 billion in 2026, compared to $25.1 billion and $12.6 billion in the baseline scenario, respectively. “As a result, this will make it possible not to resort to monetary financing of the budget,” the NBU said.

According to the alternative scenario, budget deficits will lead to an increase in public and publicly guaranteed debt, which will approach 100% of GDP at the end of the forecast period.

The NBU added that the inflation trajectory will be similar to the baseline scenario, but it will require more significant spending of international reserves: consumer inflation will temporarily accelerate to 8.6% at the end of 2024, followed by a decline to 5.5% at the end of 2025, compared to 8.2% and 6.0% in the baseline scenario, respectively.

To cover the larger structural deficit in the foreign exchange market, the NBU will spend more of its international reserves. Therefore, despite the higher external financial assistance, the reserves will remain almost unchanged in 2024 and will decrease over 2025-2026 to $33 billion, while in the baseline scenario they will amount to $39.3 billion at the end of 2026.

“At the same time, such volumes of reserves will allow us to continue to gradually ease currency restrictions,” the NBU said.

As reported, Ukraine’s GDP, according to the State Statistics Service, grew by 5.3% in 2023 after a 28.8% decline in 2022.

Earlier, Experts Club and Maxim Urakin released a video analysis of how the GDP of the world’s countries has changed in recent years, more detailed video analysis is available here – https://youtu.be/w5fF_GYyrIc?si=BsZmIUERHSBJrO_3

You can subscribe to the Experts Club YouTube channel here – https://www.youtube.com/@ExpertsClub

The Business Activity Expectations Index (BAEI), calculated by the National Bank of Ukraine (NBU), rose to 45 in February from 37.5 in January (index values from 0 to 100) and continued to remain below the neutral level (50), according to a survey of enterprises published by the NBU on Wednesday.

“In February 2023, the BAEI was 45.0, up from 37.5 in January 2023. In February, companies significantly softened their negative expectations for their economic performance. Economic activity is gradually reviving across all sectors, apart from the construction sector,” the central bank said, commenting on the results of the index.

As the National Bank said, the revival of companies is being held back the most by power shortages, higher production costs because of purchases of uninterruptible power supplies and fuel, and depressed consumer demand.

The NBU said that companies markedly improved their views about their trade turnover, purchases of goods for sale, and inventories/stocks of goods for sale.

In addition, respondents remained downbeat about their total staff numbers, the DI being 43.2, down from 44.5 in January.

At the same time, expectations of both growth in purchase prices and the cost of contractors’ services, as well as prices/tariffs for own products/services, softened.

The National Bank said that the gradual revival of power supply and purchases of uninterruptible power supplies softened the pessimistic expectations of industrial companies in February, as the sector’s DI moved to 47.2, up from 40.6 in January 2023.

“Respondents declared intentions to step up production (for the first time since October 2022), while also expecting an increase in the number of new export orders for products (for the first time since February 2022), the DIs being 50.7 and 50.4 respectively, up from 34.0 and 39.6 in January. While remaining negative, respondents’ expectations for the number of new orders for products improved noticeably, the DI being 48.6, up from 38.0 in January,” the NBU said, describing the situation in the industry.

Respondents markedly improved their views about their trade turnover and the amount of goods purchased for sale, the DIs being 47.4 and 46.8 respectively, compared to 21.6 and 23.7 in January.

“Respondents expected a decrease in their inventories/stocks of goods for sale, the DI being 51.1, down from 61.9 in January. Companies reported weaker intentions to cut their trade margins, the DI being 46.3, up from 39.2 in January. Respondents slightly softened their expectations of a rise in purchase prices, the DI being 30.0, up from 24.7 in January. At the same time, companies expected the price of goods purchased for sale to rise at a faster pace, the DI being 61.1, up from 54.6 in January,” the NBU added.

Services companies continued to report a gloomy economic outlook, the DI being 43.2 in February, up from 37.2 in January. Respondents significantly softened their negative expectations for the amount of services provided, the number of new orders, and the amount of services that are being provided, the DIs being 43.8, 42.6 and 46.9 respectively, compared to 35.2, 34.4 and 38.8 in January.

“With less strong expectations of a rise in purchase prices, companies reported weaker intentions to raise their selling prices, the DIs being 23.8 and 58.6 respectively, compared to 18.4 and 60.4 in January,” the regulator said.

Construction companies reported the most guarded views about their economic performance on the back of seasonal factor, consumers’ weak purchasing power and power shortages, the DI being 33.5 in February, down from 34.5 in January. Companies worsened their negative expectations of the amount of construction work done, the DI being 28.6, down from 30.0 in January. At the same time, respondents expected a drop in the number of new orders and in purchases of raw materials and supplies, the DIs being 28.6 and 31.0 respectively, compared to 27.5 and 25.0 in January.

A Ukrainian delegation headed by First Deputy Prime Minister, Economy Minister Yulia Svyrydenko is on an official visit to Paris, it is planned to pay special attention in the talks to joint infrastructure projects, as well as the participation of French companies in the Big Construction program and the creation Ukrainian national air carrier.

“During the one-day stay of the delegation, the First Deputy Prime Minister of Ukraine will meet with Minister of Economy, Finance and Recovery of France Bruno Le Maire. In addition, a number of meetings are planned with French partners, in particular, leading French companies Airbus, Alstom and Bouygues,” the Economy Ministry said on its wesite on Wednesday.

The visit takes place in order to implement the agreements between the leaders of Ukraine and France and in the context of the planned visit of French President Emmanuel Macron to Ukraine, the ministry said.

Svyrydenko said on Facebook that among the issues of French-Ukrainian cooperation are the attraction of financial guarantees or a direct loan from the French government, the development of promising nuclear energy projects: cooperation between the Ukrainian Energoatom and EDF is essential, as well as consultations on holding the World Exhibition EXPO in Ukraine 2030.

In addition, within the signed memorandum of understanding, the parties will touch upon the issues of cooperation between the national air carrier and Airbus, under the signed intergovernmental agreement on the supply of 130 locomotives manufactured by Alstom for Ukrzaliznytsia, the organization of the conversion of Airbus passenger aircraft into cargo aircraft on the basis of SOE Antonov (Kyiv).

Minister of Foreign Affairs of Ukraine Dmytro Kuleba held a telephone conversation with Minister of Foreign Affairs of the Islamic Republic of Pakistan Shah Mehmood Qureshi, the parties agreed to hold the first ever meeting of the joint economic commission.

“The heads of Ukrainian and Pakistani diplomacy agreed to hold the first political consultations of the foreign ministries and the first ever meeting of the Joint Ukrainian-Pakistani Commission on Economic Cooperation,” the press service of the Ukrainian Foreign Ministry said on its website.

Kuleba also said that it was Ukrainian traders who exported the critically needed volume of grain, which compensated for two-thirds of the deficit during last year’s food crisis in Pakistan. Thus, the minister said that Ukraine is ready to increase export volumes, in particular, together with Pakistan, to develop trade with other countries in the region.

“The ministers expressed a common desire to significantly increase the number of Pakistani students coming to study in Ukraine. The parties exchanged invitations to make visits,” the ministry said in the statement.

DMYTRO KULEBA, ECONOMIC, ECONOMIC COMMISSION, MINISTER OF FOREIGN AFFAIRS, PAKISTAN

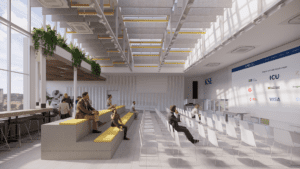

ICU Group will allocate $1 million for the development of Kyiv School of Economics (KSE) as part of the continuation of the program to support education in Ukraine, ICU said in a release.

“In 2016, we were one of the first in Ukrainian business who believed in the mission of KSE and the real desire of the management to realize it. The school is intended to become an intellectual basis for a strong and innovative economy of Ukraine, and it is important for us to direct funds to create such a basis. We have been doing this for five years, and we see a clear result of the efforts of the school – the number of students has grown 10 times, and the list of curricula covers almost all trends in the development of modern economic thought,” the founder of ICU and co-chairman of the board of directors of KSE, Makar Paseniuk, said.

President of Kyiv School of Economics Tymofiy Mylovanov noted the systematic cooperation between the KSE and ICU.

“ICU is one of the first strategic partners of Kyiv School of Economics. KSE and ICU are primarily partners who together generated the most daring ideas and implemented them together: setting a new quality bar for themselves and for others. Ukrainian Financial Forum 2018 and 2019, Ukraine Economy Week are our common and favorite projects aimed at improving the quality of economic and business discussions,” he said.

ICU is one of the founders and sponsors of the Center for Journalism at KSE, where Ukrainian media journalists receive necessary knowledge in the field of economics and finance. Now KSE is opening two modern English-language bachelor’s programs: “Economics and Big-Data” and “IT and Business Analysis.” This became possible, among other things, thanks to the partnership and financial support of ICU.

“I am sure that such a significant investment in the development of education in Ukraine will become a bright precedent for domestic businesses – the flagships of the Ukrainian economy,” he added.

ICU Group is an independent financial group, founded in 2006 by specialists from ING, providing brokerage services, asset and private equity management services, as well as venture capital investments. The group specializes in the markets of Central and Eastern Europe.