In 2025, Ukraine imported 123,600 tons of potatoes, which is 2.4 times more than in 2024; the cost of purchasing them increased 2.5 times to $66.29 million, according to the State Customs Service.

Poland (37.1%), Egypt (13.56%), and the Netherlands (11.58%) became the leaders in potato supplies to Ukraine.

In January-December 2025, Ukraine imported 138,410 tons of potatoes, which is 5.3 times (+431.3%) more than in 2024, when 26,050 tons were imported into the country, according to the State Customs Service.

According to published statistics, in monetary terms, potato imports increased 4.9 times (+391.9%) to $74.82 million compared to $15.21 million a year earlier. The main imports came from Poland (38.2%), Egypt (14.1%), and the Netherlands (10.8%).

Potato exports from Ukraine during the same period amounted to 2.38 thousand tons, which is 11.2% less than in 2024 (2.68 thousand tons). At the same time, despite the physical reduction in export volumes, in monetary terms, the sale of Ukrainian potatoes abroad was more profitable and brought in 3.1% ($584 thousand) more revenue than in 2024 ($566 thousand). The main buyers were Moldova (60.2% of all exports), Azerbaijan (35.4%), and Georgia (1.2%).

As reported, Ukraine had a poor potato harvest in the 2024 season due to drought, extremely high temperatures, and a lack of seed material.

Deputy Minister of Economy, Environment, and Agriculture Taras Vysotsky noted in a podcast by the Center for Economic Strategies that the 2025 vegetable harvest in Ukraine is sufficient and even larger than last year, so no shortage is expected in this sector.

Commenting on Ukraine’s potato imports in 2024-2025, Mykola Furdyga, director of the Potato Institute, explained that this record volume of imports was caused by the unusual weather conditions in 2024. Therefore, the state was forced to import potatoes to meet domestic food needs. European countries were eager to supply Ukraine with their products due to their attractive prices. At the same time, potatoes from Egypt did not dominate the market but occupied their traditional niche in the off-season (February-March – IF-U). In addition, Ukraine traditionally imports seed potatoes from leading breeding companies in the European Union.

Furdyga noted that since the beginning of the war, there has been a trend in Ukraine toward reducing potato cultivation in households and expanding production areas for this crop in farms and even in agricultural holdings. He explained this trend by the departure of the population from villages abroad and mobilization.

In the first two months of the new marketing year (2025/2026 MY), which began on July 1, Ukraine exported 1.456 million tons of wheat, which is 28% less than in the same period last season (2.026 million tons), according to APK-Inform.

Egypt became the key importer of Ukrainian wheat, almost doubling its purchases to 699,000 tons and becoming the largest buyer.

At the same time, most other traditional importers reduced their volumes:

Supplies also decreased to:

As of early September, Ukraine had harvested 30.4 million tons of grain crops on an area of 7.2 million hectares, which is about 63% of the total crop.

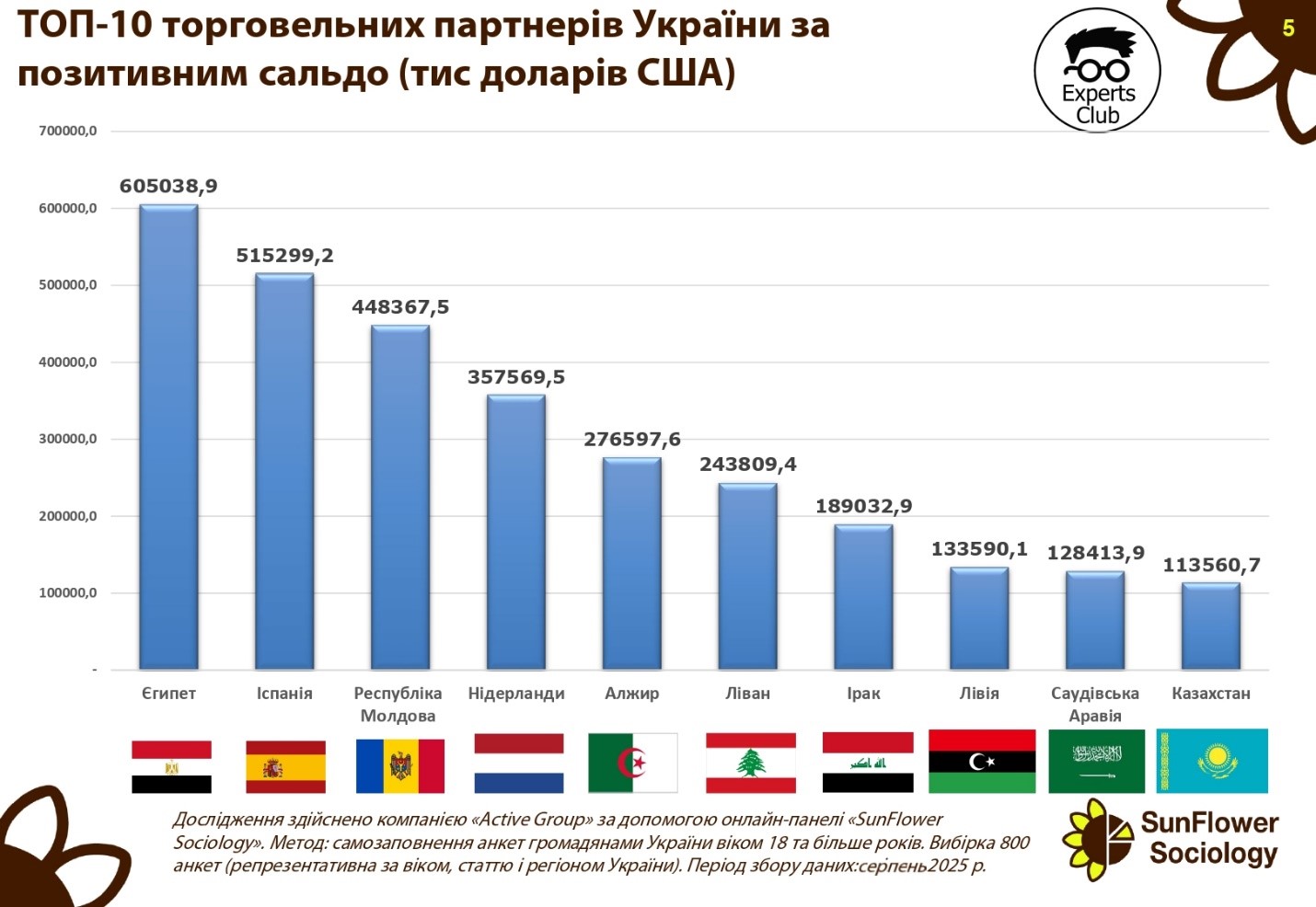

Earlier, the Experts Club information and analytical center presented a study of Ukraine’s main trading partners in the first half of 2025, where Egypt ranked first in terms of positive balance among all of Ukraine’s trading partners.

“Egypt is an extremely important and profitable trading partner for the country, along with a number of other Arab states. Partnerships with these countries provide the country with currency and somewhat correct the extremely negative trend of recent years with Ukraine’s constantly growing trade deficit,” emphasized Maxim Urakin, founder of Experts Club.

Ukraine maintains a significant positive trade balance with a number of key partners, which partially offsets the deficit in relations with China and EU countries.

The largest surplus in the first half of 2025 was recorded in trade with Egypt — $605.0 million. Spain ranks second with a balance of $515.3 million, followed by the Republic of Moldova — $448.4 million. Positive dynamics are also observed in relations with the Netherlands ($357.6 million), Algeria ($276.6 million), and Lebanon ($243.8 million).

Ukraine also has a high trade surplus with Iraq ($189.0 million), Libya ($133.6 million), Saudi Arabia ($128.4 million), and Kazakhstan ($113.6 million).

“The positive trade balance indicates that Ukraine is capable of competing effectively in international markets, especially in the agricultural sector and metallurgy. At the same time, it should be borne in mind that these markets are vulnerable to changes in the global economic situation, price fluctuations, and political factors,” emphasized Maksim Urakin, founder of Experts Club and economist.

According to him, maintaining a positive balance in relations with the countries of the Middle East and North Africa is a key element of Ukraine’s foreign trade strategy.

“Egypt, Spain, and the countries of the Arab world are stable importers of Ukrainian agricultural products. This is a strategic direction that needs to be developed further, as it creates a safety cushion for the economy against the backdrop of significant import costs,” Urakyn emphasized.

Analysts note that consolidating positions in the African and Middle Eastern markets could become a long-term factor in strengthening Ukraine’s foreign economic balance.

Agricultural exports, ALGERIA, ECONOMY, EGYPT, EXPERTS CLUB, FOREIGN TRADE, IRAQ, KAZAKHSTAN, LEBANON, LIBYA, MOLDOVA, NETHERLANDS, positive balance, SAUDI ARABIA, SPAIN, UKRAINE, МАКСИМ УРАКИН

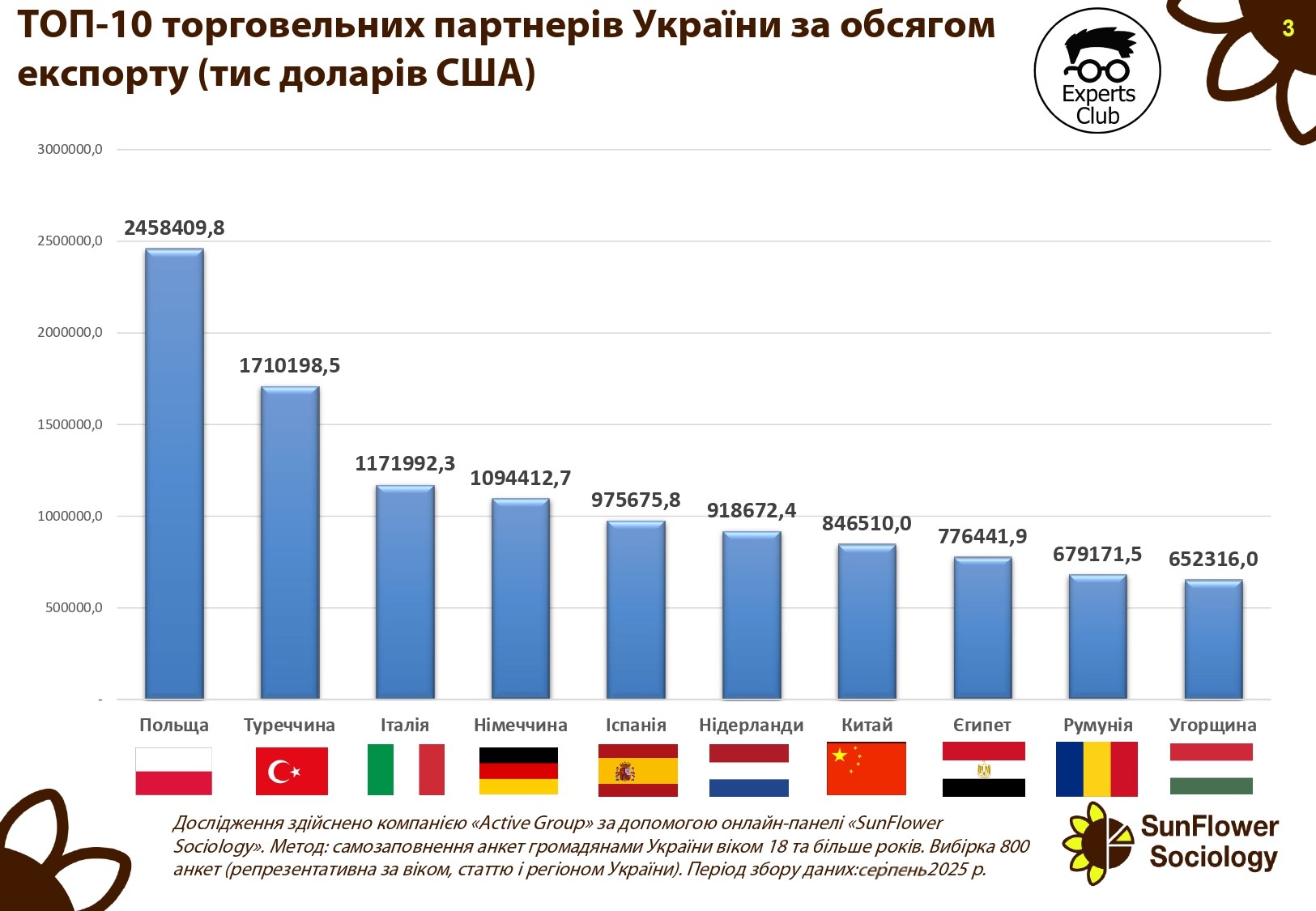

According to the results of the first half of 2025, Poland remains Ukraine’s main trading partner in terms of export volumes. According to research by Active Group and Experts Club, exports to Poland amounted to US$2.45 billion.

Turkey ranks second with USD 1.71 billion, and Italy ranks third with USD 1.17 billion. Other major partners include: Germany ($1.09 billion), Spain ($976 million), the Netherlands ($919 million), China ($847 million), Egypt ($776 million), Romania ($679 million), and Hungary ($652 million).

“The structure of Ukraine’s exports shows a clear focus on European Union countries. Poland, Italy, Germany, Spain, and the Netherlands together account for more than half of total exports. This indicates Ukraine’s strategic integration into the European economic space,” emphasized Maksim Urakin, founder of Experts Club and economist.

He also noted that Turkey remains a critically important partner for Ukrainian agricultural and metallurgical exports, while China and Egypt are key markets for agricultural products, particularly grains.

“The presence of trading partners such as Egypt and China diversifies Ukrainian exports,” Urakin added.

CHINA, ECONOMY, EGYPT, EXPERTS CLUB, EXPORTS, GERMANY, HUNGARY, ITALY, POLAND, ROMANIA, TRADE, TURKEY, UKRAINE, МАКСИМ УРАКИН

Egypt has signed an agreement with China’s Sailun Group to build a car tire plant in the Suez Canal Economic Zone (SCEZ) with a total investment of $1 billion, according to a cabinet statement. The construction of the plant will take three years. The first phase is scheduled for completion in 2026.

The plant will eventually produce 10 million tires a year, Reuters quoted the government as saying.

The EZSC is a complex of six ports and four industrial zones located along or near a strategic waterway. The Egyptian government has granted the zone special legal and tax incentives. Meanwhile, the country is investing heavily in infrastructure to attract investors to the EZSC.