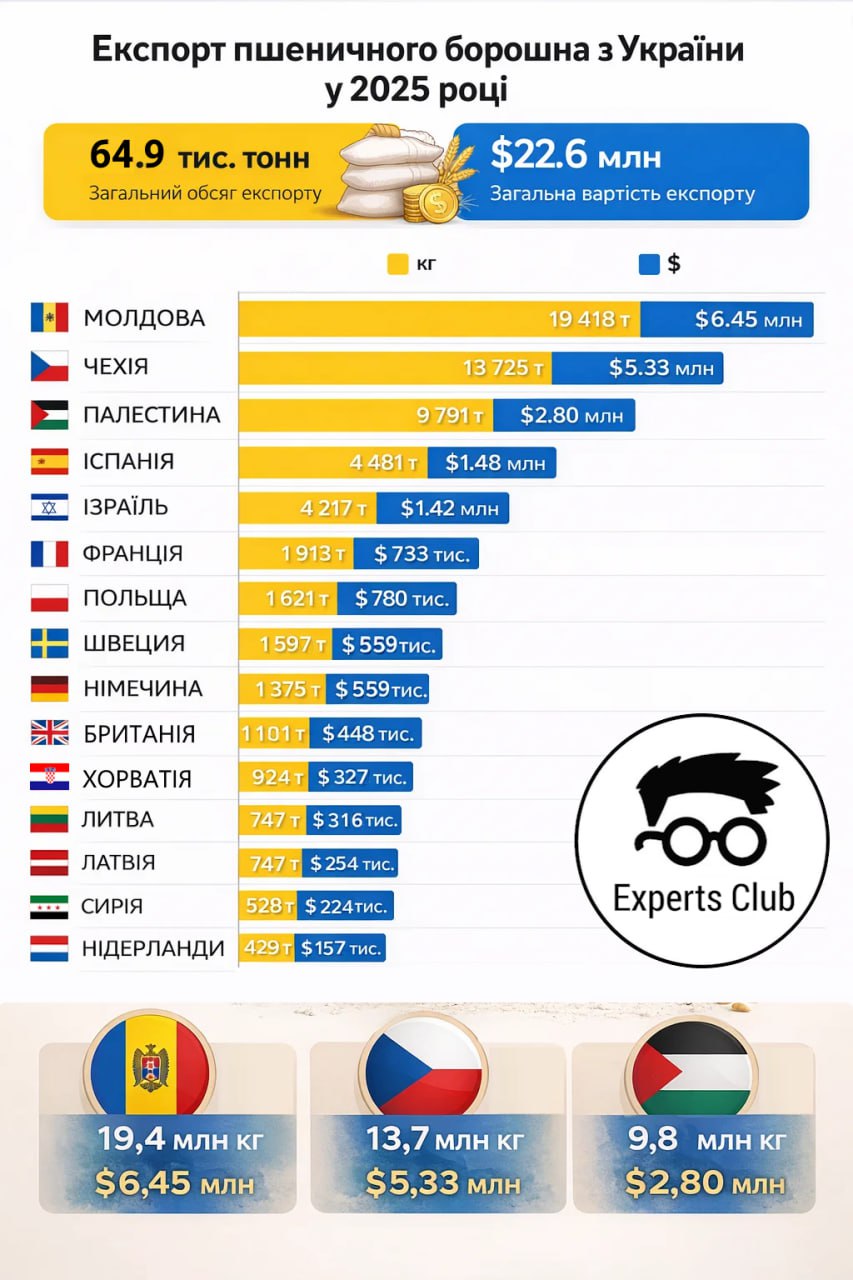

According to annual statistics from the Ukrainian Flour Millers Union and data from the Experts Club analytical center, in 2025 Ukraine exported 64.9 thousand tons of wheat flour to 25 countries worth $22.62 million. The average export price was about $348 per ton.

Exports remained highly concentrated: the five largest destinations accounted for almost 80% of the volume. The key markets were Moldova (19.4 thousand tons, about 30% of total exports), the Czech Republic (13.7 thousand tons, 21%), the Palestinian Territory (9.8 thousand tons, 15%), Spain (4.5 thousand tons), and Israel (4.2 thousand tons). Next in terms of volume were France (1.9 thousand tons), Poland (1.6 thousand tons), Sweden (1.6 thousand tons), Germany (1.4 thousand tons), and the United Kingdom (1.1 thousand tons).

The European segment stands out separately: deliveries to EU countries in 2025 amounted to 28.5 thousand tons (about 44% of the total volume) worth $10.74 million (47%). At the same time, the average export price to the EU was significantly higher – about $377 per tonne compared to $326 per tonne for non-European destinations.

The price range by destination was significant – from approximately $286 per tonne (Palestinian territories) to $538 per tonne (Georgia, small batches). Among the large markets, the highest price was recorded for deliveries to Poland – about $481 per ton, which may reflect higher requirements for specifications, packaging, and logistics.

The industry emphasizes that access to the European market and predictable trade rules are becoming key to export and investment planning, according to Rodion Rybchinsky, head of the Ukrainian Millers Union, commenting on the EU’s separate tariff quota for Ukrainian flour and investments by export-oriented enterprises in modernization.

The public association “Flour Millers of Ukraine” plans to create a “brokerage house” for the formation of large export consignments of flour and grain processing products, their marketing and promotion of products on world markets, the press service of the association reported following a meeting of the union’s Board of Directors.

“The goal of this project is to market and promote products on global markets, increase annual export volumes, and provide logistics. The main task is to process importers’ requests and form appropriate product batches, as there are requests for large batches that one company cannot fulfill on its own,” explained Rodion Rybchinsky, director of the association, whose words are quoted in the report.

He emphasized that by the end of 2025, the industry had achieved a strategic result: after lengthy negotiations involving Ukrainian Trade Representative Taras Kachka, the European Union decided to allocate a separate tariff quota for the export of Ukrainian flour in the amount of 30,000 tons.

Currently, the union, with the support of SIPPO, is conducting a comprehensive study of the quality of Ukrainian wheat and flour. Doctor of Technical Sciences Dmytro Zhigunov presented the results of the analysis of 14,000 wheat samples and 200 flour samples in terms of physical, chemical, functional, and technological indicators. According to Rybchynsky, these data will strengthen communication on global markets regarding the quality and safety of Ukrainian products.

Walnut exports from Ukraine in 2025 fell by 90% compared to the average annual figures for the previous five years, to $9.2 million, according to Gennady Yudin, president of the Ukrainian Nut Association.

“The export security regime introduced in December 2024 established additional control requirements and minimum export prices for shelled and unshelled nuts. This measure effectively halted exports through official channels: shipments of shelled nuts fell by 97% in 2025, and in-shell nuts by 76%,” he wrote on Facebook.

According to the expert, Ukraine is rapidly losing its global leadership in walnut exports, despite its harvest and strategic logistical position. In 2020-2024, Ukraine exported more than 160,000 tons of walnuts worth $461.4 million (an average of $92.2 million per year – IF-U), which accounted for one-third of the horticultural sector’s total foreign exchange earnings. However, in 2025, against the backdrop of record walnut imports to the EU (over EUR 1 billion), Ukraine’s share amounted to only EUR 6.8 million.

At the same time, Ukraine lost its position in the Georgian market, where it had previously been one of the three largest suppliers. In 2025, nut imports from Ukraine to this country practically ceased, while China ($7.9 million) and Uzbekistan ($4.2 million) became the main players.

The head of the association emphasized that while global demand is growing, in particular, consumption in the EU has increased by 75% over the decade, the Ukrainian industry is becoming unprofitable.

Yudin pointed out the need for immediate adjustment of regulatory legislation regarding the preparation of primary documentation for nuts harvested in households. Since more than 90% of the gross walnut harvest in Ukraine comes from private plots, forest belts, and field plantations, the lack of a transparent and simplified mechanism for legalizing such purchases creates “bottlenecks” for official exporters.

The Ukrainian Nut Association emphasized that without solving this problem, legal businesses lose profitability, which reduces the investment attractiveness of the industry and allows new players in the nut market to displace Ukraine from the global market.

Wheat exports from Ukraine in the 2025-2026 marketing year (MY, July-June) are expected to reach 17.6 million tons, which is 11.5% more than in the previous season, according to the Ukrainian Agribusiness Club (UAC).

The association estimates the gross harvest for the current season at 23.1 million tons, which is 2.9% more than in 2024/2025 MY.

According to analysts, the increase in production was made possible by the expansion of cultivated areas to 5.1 million hectares (by 4.8%), which offset the decline in average yield to 4.5 tons/hectare due to unfavorable weather conditions. At the same time, the current harvest is still 6.2% below the average for the last five years.

The UACB predicts that the increase in harvest will allow for an increase in shipments after a drop in exports in the previous season to 15.8 million tons. Experts cite the stable operation of Ukraine’s own sea route as the main factor in the recovery.

At the same time, domestic demand in Ukraine continues to decline due to the temporary occupation of territories and population migration. Total wheat consumption in 2025/2026 MY is forecast at 6.2 million tons, of which 3.7 million tons will be used for food, 1.5 million tons for feed, and 825,000 tons for seeds.

“The Ukrainian wheat market is demonstrating adaptability. Despite demographic challenges and weather conditions, farmers are managing to increase their acreage. Domestic needs are fully met, and the successful operation of export routes allows for the restoration of positive supply dynamics and guarantees Ukraine’s stable presence in key markets in Europe, Africa, and Asia,” the UCAAB concluded.

The Export Credit Agency (ECA) supported exports worth UAH 5.21 billion in January 2026, according to the agency’s website.

The largest amounts of support in cooperation with partner banks were provided by Raiffeisen Bank (UAH 4.61 billion in supported exports), PrivatBank (UAH 281.83 million), and Oschadbank (UAH 143.47 million).

The largest volume of supported exports was provided by enterprises in the Khmelnytskyi region (UAH 4.61 billion), Chernihiv region — UAH 281.83 million, Zaporizhzhia region — UAH 130.84 million, and Odesa region — UAH 119.81 million.

The main importers of Ukrainian products in January were: Germany (UAH 589.11 million), Bulgaria, Denmark, Hungary, the Netherlands, Poland, Spain, and Sweden (UAH 576.48 million each), Moldova (UAH 281.83 million), France (UAH 130.84 million), and Slovakia (UAH 49.79 million).

In terms of sectoral structure, the largest share was accounted for by furniture and related products, ferrous metal products, paper and cardboard products, food products, as well as ships and floating vessels.

The Export Credit Agency of Ukraine (ECA) is a state institution that supports non-commodity exports by insuring the risks of enterprises and banks. The agency insures foreign economic contracts, export credits, bank guarantees, and investment credits against military risks.

Ukraine may export military goods and services worth several billion dollars as early as 2026 after allowing the export of such products during the war, and is considering introducing a tax on these exports, Reuters reports, citing Deputy Secretary of the National Security and Defense Council (NSDC) of Ukraine David Aloian.

“When asked about this year’s export potential, Aloyan (Deputy Secretary of the NSDC David Aloyan – IF-U) replied: ”Taking into account finished products, spare parts, components, and services that can be provided, this amounts to several billion dollars.” Overall, he said, the potential is “significantly higher” than pre-war exports,” Reuters reported on Friday.

According to Aloyan, in February, the state commission responsible for issuing relevant licenses during wartime approved most of the 40 applications from defense sector manufacturers to export material assets and services.

It is noted that Ukraine stopped exporting weapons after Russia’s invasion in February 2022 and relies heavily on weapons supplies from partners to defend itself against Russian troops. At the same time, Kyiv has invested resources in developing its defense industry, particularly drones and missiles. Leveraging its vast combat experience, Ukraine has experienced a boom in defense technology in recent years.

However, Aloian, who is a member of the commission that authorizes exports, did not exaggerate the significance of the immediate export boom: Ukraine’s own military needs must come first, as Russian troops advance in the east of the country and airstrikes hit towns and villages far from the front line.

According to Aloian, Ukraine’s partners have expressed interest in acquiring its advanced defense technologies. He named Germany, the United Kingdom, the United States, the countries of Northern Europe, three Middle Eastern countries, and at least one Asian country among those most eager to do so. “One of the Middle Eastern countries, which has a long history of arms trade with Ukraine, is exploring opportunities in the field of drones and heavy equipment,” Aloyan said, declining to name the country.

According to Aloyan, priority will be given to exports to countries that are Kyiv’s biggest supporters in the war. Ukraine also seeks to prioritize joint ventures and other forms of cooperation with other countries to attract financial resources, create new supply chains for weapons to the front lines, and gain access to new technologies. “This is more important than simply exporting ready-to-use products,” Aloyan added.

“Ukraine is also considering the possibility of introducing export duties for defense manufacturers,” he said. Although a final decision has not yet been made, he believes that this measure would justify the state’s decision to resume exports, as Kyiv could use the revenue for its own underfunded military needs.

“None of the applications approved by the commission involve the export of ready-to-use weapons,” Aloyan said, “and most are aimed at reimporting weapons to Ukraine for use on the front lines. But some of them are related to equipment for the Ukrainian-American FrankenSAM program, which develops anti-aircraft missile systems by combining Soviet systems belonging to Ukraine with Western missiles.”