According to the results of 2025, Ukraine provided domestic exporters of animal and plant products with access to 22 new foreign markets, said Serhiy Tkachuk, head of the State Service for Food Safety and Consumer Protection, during a public report on Thursday.

According to him, this figure is a record for the period of full-scale war.

“Last year, we opened 22 new export markets. Currently, work is underway to open about 300 more. It does not stop there, because it is our priority to ensure that small, medium, and large Ukrainian businesses have the opportunity to export their products worldwide,” emphasized the head of the State Service.

According to the data presented, in 2025, the Chinese market opened up to Ukrainian peas, wild-caught seafood, and aquatic products. India and Canada allowed the import of Ukrainian apples. Canada also opened its market to table eggs.

“Each new certificate is the result of lengthy technical negotiations and audits. For example, opening up markets in countries such as Canada or China requires strict adherence to high safety standards,” added Tkachuk.

In addition, the Albanian market became accessible for table eggs, Argentina for sunflower seeds, and Kuwait for processed food products. Malaysia has opened access for milk, dairy, and egg products. Vietnam and Moldova have allowed the import of dairy products not intended for human consumption. The Chilean market has opened up for meat and bone meal and feather meal, and Turkey for canned animal feed.

Tkachuk noted that since 2022, Ukraine has managed to open a total of 75 new markets, despite logistical and political challenges.

“Even in the conditions of war, we continue to expand our geography. Currently, Ukraine has the right to export agricultural products to 386 trade destinations,” he specified.

The State Service of Ukraine for Food Safety and Consumer Protection is currently exploring opportunities to access markets in Asia, the EU, America, and the Middle East. In particular, work is underway to open the Canadian market for Ukrainian wheat, corn, soybeans, and rapeseed, as well as to expand the presence of plant products in China.

Ukraine exported 270,000 tons of sugar in the first half of the 2025-2026 marketing year (MY, September-February), according to the National Association of Sugar Producers of Ukraine “Ukrtsukor” on its Telegram channel.

The industry association specified that Lebanon was the main destination for Ukrainian exports during this period, accounting for 29% of the total. Syria (17%) and European Union countries (14%) were also among the top three consumers.

In addition, significant volumes of Ukrainian sugar were shipped to North Macedonia (6%) and Mauritania (5%).

As reported, Ukraine ended the 2025 sugar season with 1.72 million tons of sugar. Despite a 23% reduction in acreage (to 199,000 hectares), production fell by only 4% thanks to a record yield of 58 tons/hectare and high sugar content of raw materials (17.6%). Sugar yield was 15.17%.

According to Yana Kavushevskaya, head of the Ukrtsukor association, the industry remains export-oriented, but supply directions are being adapted to EU quota conditions. Export potential for 2026 is estimated at 700,000 tons, while domestic consumption is expected to reach 900,000 tons.

The leaders in production last season were Radekhiv Sugar (32% of the market), Astarta (21%), and UkrProminvest-Agro (15%).

According to the association’s forecasts, in 2026, the area under sugar beet cultivation may decrease to 170,000 hectares, which will lead to a decrease in sugar production to 1.3 million tons.

Ukraine needs to boost its presence in Sub-Saharan Africa and shift from exporting raw materials to investing in processing, as current supplies amount to only $280 million per year in a market worth $10 trillion, said Artem Gudkov, head of the Ukrainian-African Trade Mission, at the Forbes Agro conference in Kyiv on Thursday.

“The total volume of the African market is about $10 trillion in GDP in terms of purchasing power parity. For Ukraine, this is a huge potential and an opportunity to gain its subjectivity. However, as of now, the total volume of Ukrainian exports to Sub-Saharan Africa is only $280 million per year for 1.2 billion people. We supply less there than to neighboring Bulgaria,” he stressed.

Gudkov said that Russia is waging a food war against Ukraine on this continent and has introduced an “all or nothing” policy. According to him, if individual countries plan to purchase agricultural products from someone other than Russia, the aggressor threatens to stop supplies to the region altogether.

According to the head of the trade mission, Russia is already moving towards total control of logistics. In particular, the aggressor is negotiating with the Tanzanian government to build its own processing terminal in the port of Dar es Salaam, which will enable it to dictate the terms of wheat and corn supplies across the entire east coast of Africa.

Gudkov believes that the time of “simple imports” is over, so Ukrainian agribusiness needs to integrate into value-added chains directly in the region. African governments and businesses are increasingly interested in the transfer of Ukrainian technologies, not just the purchase of raw materials.

He recalled the European Global Gateway program, which provides EUR 150 billion to finance projects in Africa. According to Gudkov, Ukrainian businesses can become stakeholders in these funds by exporting equipment, elevators, and engineering solutions rather than raw materials.

The expert noted that Ukraine’s experience of working in wartime is unique for African countries, which also face security risks. The mission is already discussing the potential for implementing Ukrainian agricultural processing clusters on the continent.

“We have the opportunity to turn our economic front into an offensive as well. Russia is actively exporting food products. If we cannot influence oil, we can destroy their food ties through our own expansion,” the head of the mission concluded.

The Ukrainian-African trade mission promotes the entry of domestic enterprises into the markets of Sub-Saharan Africa, focusing on the export of processing technologies, agricultural machinery, and the creation of joint ventures.

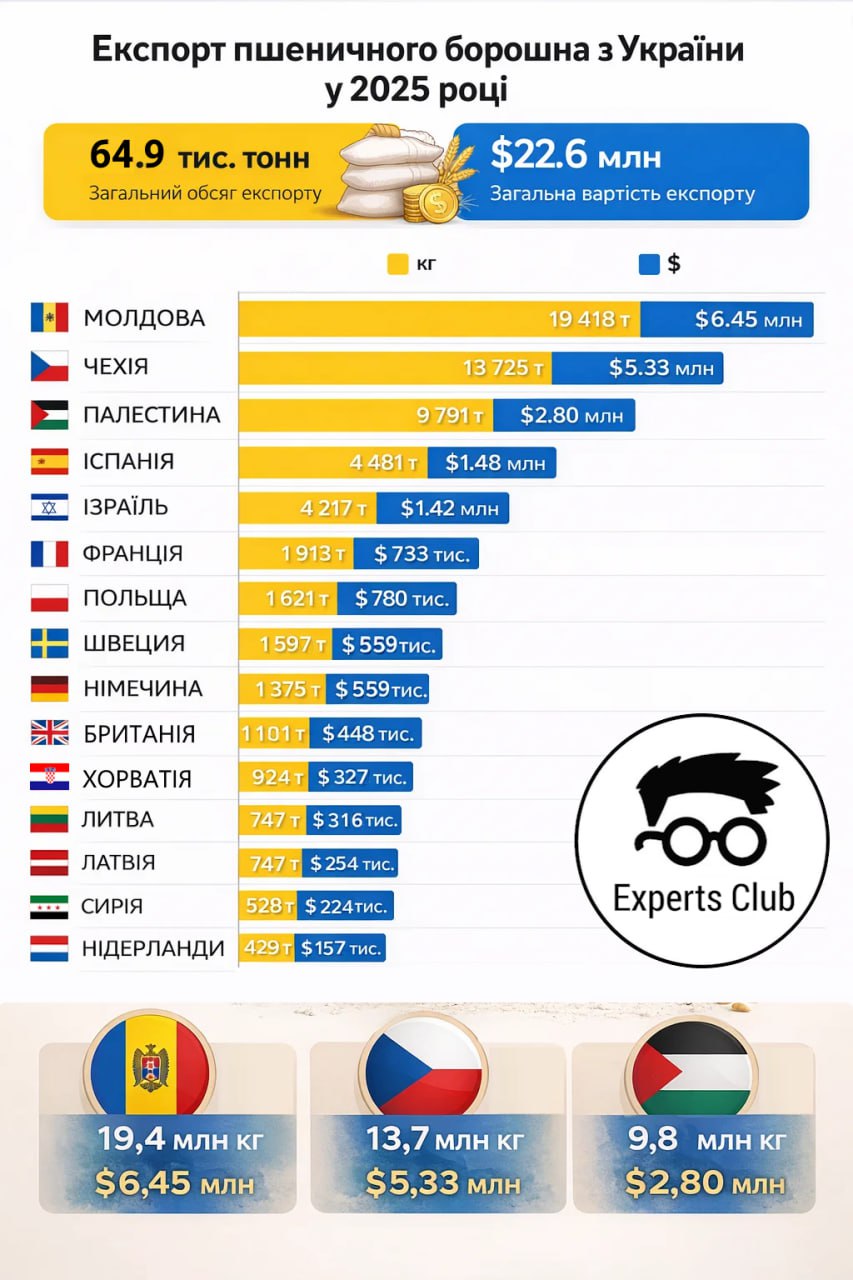

According to annual statistics from the Ukrainian Flour Millers Union and data from the Experts Club analytical center, in 2025 Ukraine exported 64.9 thousand tons of wheat flour to 25 countries worth $22.62 million. The average export price was about $348 per ton.

Exports remained highly concentrated: the five largest destinations accounted for almost 80% of the volume. The key markets were Moldova (19.4 thousand tons, about 30% of total exports), the Czech Republic (13.7 thousand tons, 21%), the Palestinian Territory (9.8 thousand tons, 15%), Spain (4.5 thousand tons), and Israel (4.2 thousand tons). Next in terms of volume were France (1.9 thousand tons), Poland (1.6 thousand tons), Sweden (1.6 thousand tons), Germany (1.4 thousand tons), and the United Kingdom (1.1 thousand tons).

The European segment stands out separately: deliveries to EU countries in 2025 amounted to 28.5 thousand tons (about 44% of the total volume) worth $10.74 million (47%). At the same time, the average export price to the EU was significantly higher – about $377 per tonne compared to $326 per tonne for non-European destinations.

The price range by destination was significant – from approximately $286 per tonne (Palestinian territories) to $538 per tonne (Georgia, small batches). Among the large markets, the highest price was recorded for deliveries to Poland – about $481 per ton, which may reflect higher requirements for specifications, packaging, and logistics.

The industry emphasizes that access to the European market and predictable trade rules are becoming key to export and investment planning, according to Rodion Rybchinsky, head of the Ukrainian Millers Union, commenting on the EU’s separate tariff quota for Ukrainian flour and investments by export-oriented enterprises in modernization.

The public association “Flour Millers of Ukraine” plans to create a “brokerage house” for the formation of large export consignments of flour and grain processing products, their marketing and promotion of products on world markets, the press service of the association reported following a meeting of the union’s Board of Directors.

“The goal of this project is to market and promote products on global markets, increase annual export volumes, and provide logistics. The main task is to process importers’ requests and form appropriate product batches, as there are requests for large batches that one company cannot fulfill on its own,” explained Rodion Rybchinsky, director of the association, whose words are quoted in the report.

He emphasized that by the end of 2025, the industry had achieved a strategic result: after lengthy negotiations involving Ukrainian Trade Representative Taras Kachka, the European Union decided to allocate a separate tariff quota for the export of Ukrainian flour in the amount of 30,000 tons.

Currently, the union, with the support of SIPPO, is conducting a comprehensive study of the quality of Ukrainian wheat and flour. Doctor of Technical Sciences Dmytro Zhigunov presented the results of the analysis of 14,000 wheat samples and 200 flour samples in terms of physical, chemical, functional, and technological indicators. According to Rybchynsky, these data will strengthen communication on global markets regarding the quality and safety of Ukrainian products.

Walnut exports from Ukraine in 2025 fell by 90% compared to the average annual figures for the previous five years, to $9.2 million, according to Gennady Yudin, president of the Ukrainian Nut Association.

“The export security regime introduced in December 2024 established additional control requirements and minimum export prices for shelled and unshelled nuts. This measure effectively halted exports through official channels: shipments of shelled nuts fell by 97% in 2025, and in-shell nuts by 76%,” he wrote on Facebook.

According to the expert, Ukraine is rapidly losing its global leadership in walnut exports, despite its harvest and strategic logistical position. In 2020-2024, Ukraine exported more than 160,000 tons of walnuts worth $461.4 million (an average of $92.2 million per year – IF-U), which accounted for one-third of the horticultural sector’s total foreign exchange earnings. However, in 2025, against the backdrop of record walnut imports to the EU (over EUR 1 billion), Ukraine’s share amounted to only EUR 6.8 million.

At the same time, Ukraine lost its position in the Georgian market, where it had previously been one of the three largest suppliers. In 2025, nut imports from Ukraine to this country practically ceased, while China ($7.9 million) and Uzbekistan ($4.2 million) became the main players.

The head of the association emphasized that while global demand is growing, in particular, consumption in the EU has increased by 75% over the decade, the Ukrainian industry is becoming unprofitable.

Yudin pointed out the need for immediate adjustment of regulatory legislation regarding the preparation of primary documentation for nuts harvested in households. Since more than 90% of the gross walnut harvest in Ukraine comes from private plots, forest belts, and field plantations, the lack of a transparent and simplified mechanism for legalizing such purchases creates “bottlenecks” for official exporters.

The Ukrainian Nut Association emphasized that without solving this problem, legal businesses lose profitability, which reduces the investment attractiveness of the industry and allows new players in the nut market to displace Ukraine from the global market.