Ukraine ranked 9th among the countries whose citizens most often came to Georgia in 2025 – 136,826 visits (an increase of 15.4% to 2024), follows from the data of the National Tourism Administration of Georgia.

In total, Georgia recorded 6,856,809 international visits in 2025 (plus 6.2% to 2024). The leader was Russia with 1,579,764 visits, or about 23% of the total (plus 11.1%).

Turkey, Armenia, Israel, Azerbaijan, Kazakhstan, Belarus, India and China were also in the top 10 source countries of tourist flow (international visits).

Georgia from January 1, 2026 introduces a mandatory requirement of medical insurance for all foreign citizens crossing the border of the country. This is reported by the National Tourism Administration of Georgia and local media with reference to the updated Law on Tourism.

From this date, foreign tourists must have a medical and accident insurance policy in Georgian or English upon entry. The document must be valid from the moment of crossing the border and cover the entire period of stay in Georgia.

According to explanations of insurance companies and tour operators, the minimum parameters of coverage include payment for emergency outpatient services for at least 5 thousand dollars and inpatient treatment for at least 30 thousand dollars, including risks of accidents, injuries, sudden illnesses, medical evacuation and repatriation. A number of materials also mention the benchmark of the minimum sum insured at the level of GEL 30 thousand equivalent, but in the market for non-residents the benchmark of USD 30 thousand is used as a basic benchmark.

In case of absence of a valid policy, a fine of 300 GEL (about $110) is envisaged, and the border guard at its discretion can either offer to issue insurance on the spot or refuse entry. The new rules apply to all foreign citizens, regardless of citizenship and mode of entry, Georgian and international media emphasize.

Tour operators note that the greatest practical significance of the innovation will be for independent travelers who book flights and accommodation without package tours.

The Georgian authorities are carrying out a large-scale reform of migration legislation, which provides for tighter control over the legality of foreigners’ residence, the creation of a database of violators and the introduction of mandatory work permits from 1 March 2026.

Since 1 October 2025, the relevant ministry has been keeping a special register of foreigners who are or have previously been in the country illegally. State authorities have been given the right to request extended biometric data (including fingerprints and palm prints) and to carry out checks in private premises – residential buildings and workplaces – if there is a suspicion of a violation of the residence regime.

Complaints about the refusal to issue a residence permit or a decision on deportation will not automatically suspend the execution of such decisions. The new monitoring procedures apply to the main categories of residence permits – for work, business, study and property ownership.

A separate type of residence permit is being introduced for IT specialists: applicants must have at least two years of documented relevant experience and an annual income of at least $25,000. Such residence permits are issued for three years with the possibility of extension up to 12 years.

From 1 March 2026, foreigners will generally require a valid work permit to work in the country. Experts recommend that foreign citizens and employers prepare a package of documents in advance – employment contracts, proof of income, certificates of no criminal record – and strictly comply with the conditions of already issued residence permits, as violations can lead to additional checks, fines, deportation and refusals to extend status.

According to data from the National Statistics Office of Georgia (Geostat), in 2024, foreigners made up about 6.6% of the country’s population, or about 250,000 people, while in 2014 there were only about 22,000 (0.6% of the population). Research by ISET-PI and other think tanks shows that in 2015–2024, the largest net immigration inflows came from citizens of Russia (about 97,000 people), Ukraine (about 27,000) and Azerbaijan (about 14,000), with significant groups also coming from Turkey, India and Belarus.

Analysts note that further tightening of the migration regime could lead to a partial outflow of relocants and their families to other jurisdictions with more predictable rules – primarily to EU countries with active programmes for IT and start-ups (Portugal, Spain, Germany, the Czech Republic), as well as to destinations already popular with people from Russia, Ukraine and Belarus: Serbia, Montenegro, Armenia, Kazakhstan and the UAE. According to consultants, the key factors when choosing a country for relocation are the transparency of residence permit and work permit procedures, the availability of housing and political stability.

Investments in the development of Georgia’s transport and logistics infrastructure for 2026-2031 will amount to $7 billion, the country’s Economy Minister Mariam Kvrivishvili said, speaking in Tashkent at the second forum of investors in the Trans-Caspian Transport Corridor.

“To fully realize the transport and logistics potential of Central Asia, the Caspian region, the South Caucasus and the Black Sea, coordinated financing is crucial. In this regard, Georgia has committed to invest $7 billion in key transportation and logistics infrastructure by 2032,” Kvrivishvili said, quoted by the press service of the Economy Ministry.

According to her, the realization of these plans will require more active participation of the private sector in addition to the permanent participation of international financial institutions.

The Minister said that the priorities in the field of transport and logistics of Georgia in 2026 will be the complete renewal of railroad rolling stock and freight fleet, completion of the Baku-Tbilisi-Kars (BTC) railroad, as well as the introduction of unified digital services for both the public and private sectors in order to reduce the transit time in the country by 30%.

She also announced the signing of an agreement on the Caspian Sea-Black Sea international transportation route between Turkmenistan, Azerbaijan, Georgia and Romania this December. “This initiative will create a new multimodal route from the Caspian region to the European Union, increasing transport connectivity, diversifying access routes and strengthening sustainability,” the minister said.

In addition, Kvrivishvili reiterated plans to build a deep-water port in Anaklia. “Once launched, Anaklia port will be able to handle up to 600,000 TEUs in the first phase by 2029 and at least 1 million TEUs in the second phase by 2035, which will allow Georgia to become the main hub for Central Asian cargo in the Black Sea region,” the minister said.

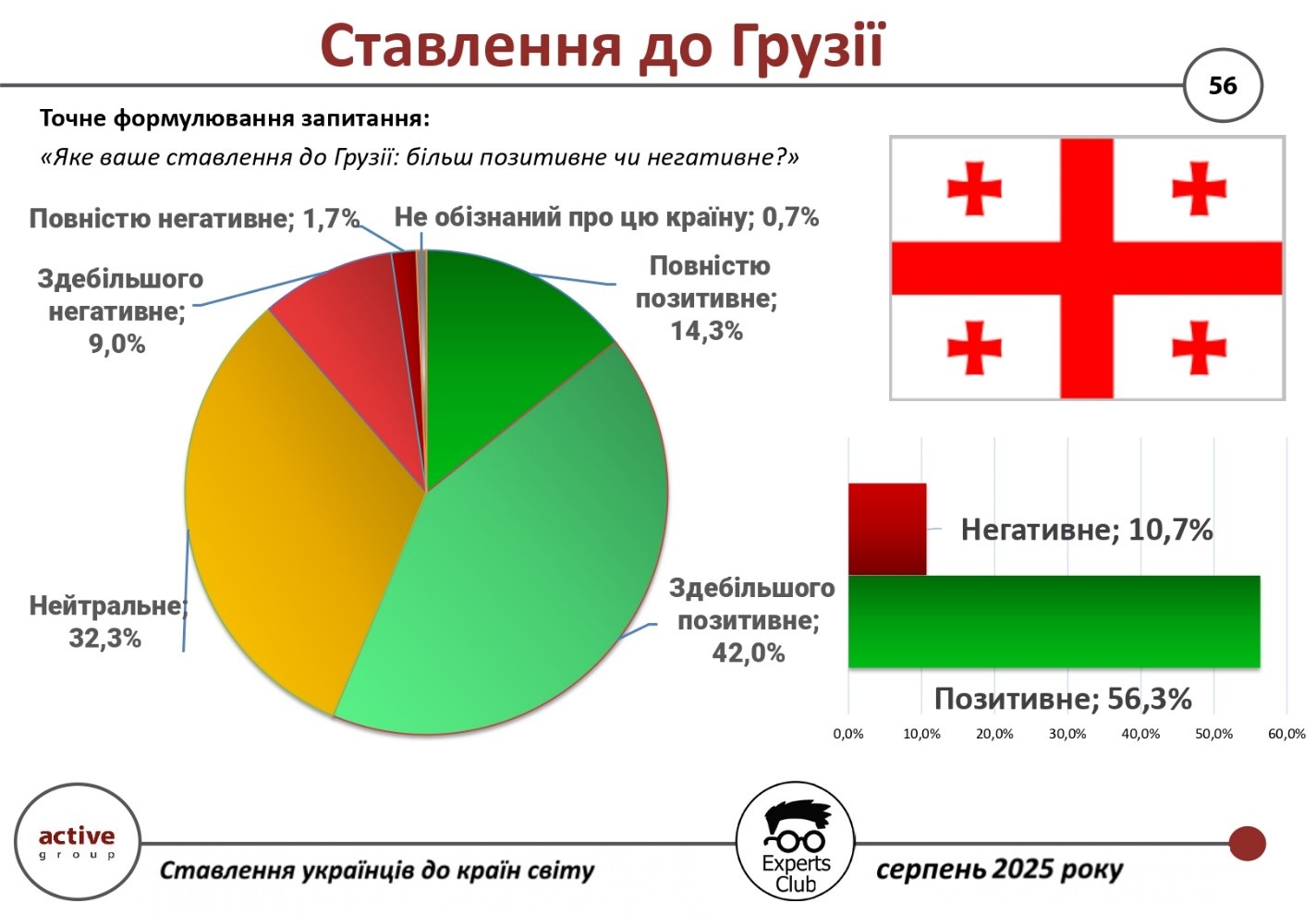

Most Ukrainians have a positive opinion of Georgia, according to the results of a survey conducted by Active Group in collaboration with the analytical center Experts Club.

According to the study, 56.3% of Ukrainians expressed a positive attitude towards Georgia: among them, 14.3% are completely positive, and 42.0% are mostly positive.

At the same time, 10.7% of respondents have a negative attitude (1.7% completely negative and 9.0% mostly negative). A third of respondents (32.3%) remain neutral, while another 0.7% admitted that they are not sufficiently knowledgeable about the country.

At the end of 2024, Ukraine’s trade turnover with Georgia amounted to $1,828.2 million. Exports of Ukrainian goods to Georgia reached $1,360.8 million, while imports amounted to $467.4 million. Thus, Ukraine had a positive bilateral trade balance of $893.4 million.

According to economist and founder of Experts Club Maksim Urakin, the positive balance with Georgia reflects a sustained interest in mutual cooperation:

“Georgia traditionally remains an important trading partner for Ukraine in the Caucasus. The high level of positive attitudes among Ukrainians toward this country is a favorable foundation for the further development of economic and cultural relations,” the expert emphasized.

Thus, Georgia is among the group of countries that Ukrainians view mostly positively, and strong economic ties and shared historical proximity create the basis for further deepening the partnership.

The full video can be viewed at: https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here: https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, EXPERTS CLUB, GEORGIA, Pozniy, SOCIOLOGY, TRADE, UKRAINE, URAKIN

From March 1, 2026, a new system will come into force in Georgia: foreign workers and self-employed persons will need an official work permit.

Previously, the country did not have a full-fledged work permit regime and in most cases allowed foreigners to work without a separate permit, according to industry sources.

According to the business press, there will be a transition period for foreigners already employed in Georgia: they must obtain a permit before January 1, 2027; fines will be imposed on both the employee and the employer for violations (with increased penalties for repeat offenses).

The aim of the reform is to bring order to the labor market, put an end to work on tourist visas, and bring regulation closer to international practice. Additionally, it is reported that the details of the procedure (categories, exceptions, lists of documents) will be specified in subordinate government acts.

In 2024, 135,800 immigrants entered Georgia (–34% y/y), while 121,400 emigrants left the country; 48.2% of immigrants are Georgian citizens, the rest are foreigners. Among foreign citizens, the top countries were Russia, Ukraine, Turkey, India, and Azerbaijan.

Officially, in 2022, 62,300 Russians were registered as immigrants (i.e., they remained to live in the country). In 2023, there were 52,600 Russian citizens among immigrants.

According to media reports and think tanks, in 2025, there will be about 100,000 Russians living in the country (estimates vary widely, taking into account the outflow in 2023). At the same time, only about 20% of them have “tax resident”/official resident status, according to the National Bank of Georgia.

According to the UN, since the start of the full-scale war, approximately 245,000 Ukrainians have passed through Georgia; about 26,600 currently reside in the country (estimate for spring 2025).

Among the largest sources of migration in 2023 are Turkey (≈8,600 immigrants), India (≈8,400), and Belarus (≈3,600); Ukraine provided ≈7,500 immigrants in 2023. These figures show the annual inflow, not the “stock” of permanent residents.

The labor market reform complements earlier changes in migration regulation (e.g., an increase in the minimum property value for a “residence permit by purchase” from $100,000 to $150,000 as of March 1, 2026).

Experts expect that the unification of employment rules will increase the transparency of hiring foreigners and reduce informal employment, but will increase the administrative burden on businesses during the adaptation period.

https://t.me/relocationrs/1390