Consumer prices in the euro area increased by 2.4% year-on-year in December, according to the latest data from the European Union’s statistical office. Thus, inflation accelerated from November’s 2.2% to its highest level since July. The final data coincided with both the preliminary estimate and analysts’ expectations.

Inflation in the service sector accelerated to 4% last month from 3.9% in November, while the rise in prices for food, alcohol, and tobacco products slowed to 2.6% from 2.7%. Industrial products went up by 0.5% (0.6%), and energy prices by 0.1% (down 2% in November).

The lowest inflation among the eurozone countries was recorded in Ireland (1%) and Italy (1.4%), and the highest in Croatia (4.5%).

In December, the growth in consumer prices excluding food and energy (CPI Core) amounted to 2.7% in annual terms, the same as in the previous month.

Consumer prices in the euro area in December rose by 0.4% compared to the previous month. In November, the figure fell by 0.3%.

Source: http://relocation.com.ua/infliatsiia-v-yevrozoni-v-hrudni-pryskory/

Inflation in Ukraine, which fell to 5.1% in 2023 after jumping to 26.6% a year earlier, rose to 12.0% in 2024, the State Statistics Service (Ukrstat) reported on Friday.

According to its data, consumer price growth in the country in December 2024 slowed to 1.4% from 1.9% in November, 1.8% in October and 1.5% in September.

The statistics agency recalled that in December 2023, consumer prices rose by 0.7%, so in annual terms, inflation in December 2024 increased to 12% from 11.2% in November, 9.7% in October, and 8.6% in September.

It is indicated that in December 2024, core inflation rose to 1.3% from 1.2% in November, returning to the level of October. Taking into account that in December 2023 it was zero, in annual terms, core inflation in 2024 rose to 10.7% from 4.9% in 2023, while in 2022 it was 22.6%.

At the end of October, the National Bank of Ukraine downgraded its inflation forecast for 2024 from 8.5% to 9.7%, and for 2025 from 6.6% to 6.9%.

The Ministry of Economy of Ukraine forecasted inflation at 9.5% in 2024 and expects it to be at the same level in 2025.

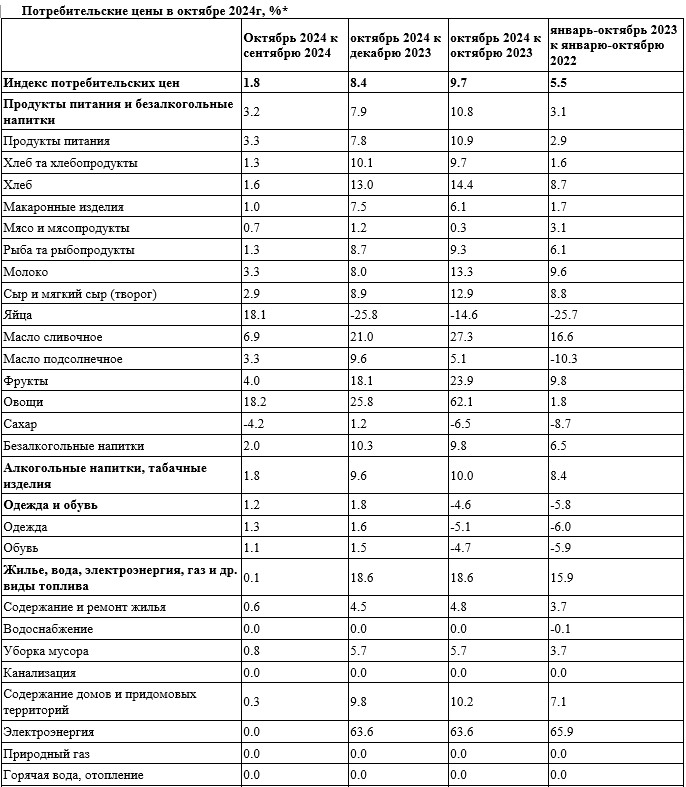

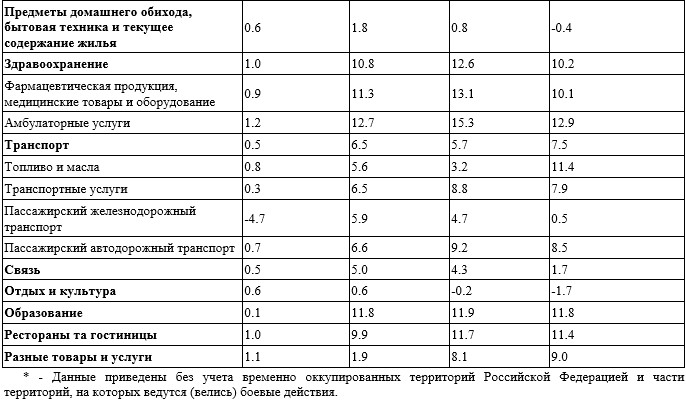

Consumer price growth in Ukraine accelerated to 1.8% in October 2024 from 1.5% in September, 0.6% in August, and zero in July, the State Statistics Service (Ukrstat) reported on Friday.

The statistics agency recalled that in October 2023, consumer prices rose by 0.8%, so year-on-year inflation in October 2024 rose to 9.7% from 8.6% in September, 7.5% in August and 5.4% in July.

It is indicated that in October-2024, core inflation decreased to 1.3% from 1.7% in September. Taking into account that in October-2023 it was equal to 0.4%, on an annualized basis, core inflation rose to 8.3% last month from 7.3% in September, 6.5% in August and 5.7% in July.

In the consumer market, prices for food and non-alcoholic beverages rose by 3.2% in October. Vegetables and eggs rose the most (by 18.2% and 18.1%). Prices for butter, fruit, milk and dairy products, sunflower oil, processed cereals, beef, soft drinks, bread, lard, fish and fish products increased by 6.9-1.3%. At the same time, sugar prices fell by 4.2%.

Prices for alcoholic beverages and tobacco products increased by 1.8%, driven by a 2.6% rise in the price of tobacco products.

The 1.0% increase in healthcare prices was primarily due to a 1.3% increase in prices for hospital services and a 1.2% increase in prices for outpatient services.

Transportation prices increased by 0.5%, mainly due to a 0.8% rise in fuel and oil prices and a 0.7% rise in road passenger transportation fares. At the same time, railroad passenger transportation fell by 4.7%.

As reported, inflation in Ukraine in 2023 fell to 5.1% after a jump in 2022 to 26.6% from 10.0% in 2021.

In late October, the National Bank of Ukraine downgraded its inflation forecast for 2024 from 8.5% to 9.7% and worsened it for 2025 from 6.6% to 6.9%. The NBU’s forecast envisages inflation falling to 6.9% at the end of 2025 and reaching the 5% target in 2026.

For more details, please see the website: https://expertsclub.eu/operatyvna-statystyka-pro-inflyacziyu-v-ukrayini/

Consumer prices in Turkey in September increased by 49.4% in annual terms, according to a report by the country’s statistical institute (Turkstat). The growth rate slowed from 52% in August and was the lowest since July 2023. The weakening of inflation was noted for the fourth consecutive month.

The consensus forecast of experts, cited by Trading Economics, assumed an even more significant slowdown in consumer price growth – to 48.3%.

The increase in the cost of food and non-alcoholic beverages in September slowed to 43.7% from 44.9% in August, transportation services to 26.6% from 29%, and utilities to 97.87% from 101.49%. Prices in hotels, cafes and restaurants increased by 65.41% (+67.7% a month earlier), alcohol and tobacco products went up by 52.35% (+60.94%), educational services by 93.59% (+120.81%), and medical services by 50.7% (+53.49%).

Consumer prices in Turkey in September increased by 2.5% compared to the previous month after rising by 3.2% in August.

Producer prices (PPI index) in the country last month increased by 33.09% in annual terms and by 1.37% in monthly terms, Turkstat reported. In August, they rose by 35.75% and 1.68%, respectively.

The Turkish Central Bank has kept its key interest rate at 50% since March this year, and tight monetary policy has helped to ease inflation. Back in June 2023, the rate was at 8.5%.

Trends in the global and Ukrainian economies can be tracked via the Experts Club information and analytical channel – https://www.youtube.com/@ExpertsClub

Inflation in Ukraine will drop to 9% or lower in 2023 from 26.6% last year, Prime Minister Denys Shmyhal said at the opening of the Kyiv International Economic Forum on Thursday.

“We have inflation of about 8-9% for the year. I am convinced that it will not be higher,” the Prime Minister said.

According to him, after a 29.1% decline, GDP growth this year was “3%+”.

“The (budget) deficit still remains 20% of GDP, but we have found a way to compensate for it: while last year we received $32 billion in grants and soft loans, this year we expect to receive $42 billion without military support and other humanitarian contributions,” Shmyhal said.

As reported with reference to the State Statistics Service, inflation in Ukraine in September fell to 7.1% in annual terms from 8.6% in August and 11.3% in July. Since the beginning of this year, inflation in the country has been 3.0%, with core inflation at 4.1%.

At the end of July, the National Bank of Ukraine again improved its inflation forecast for this year from 14.8% to 10.6%, but last week announced plans to further revise it downward.

In 2022, inflation is expected to rise to 26.6% from 10% in 2021, and core inflation to 22.6% from 7.9%.

Consumer prices in Ukraine rose by 0.5% in September 2023, after declining by 1.4% in August and 0.6% in July, the State Statistics Service (Ukrstat) reported on Monday.

At the same time, inflation was recorded at 1.9% in September-2022, so in annual terms in September-2023 it fell to 7.1% from 8.6% in August and 11.3% in July.

In September, the State Statistics Service recorded core inflation at 0.9% after two months of being at zero.

Given that core inflation stood at 2.4% in September 2022, it also fell to 8.4% year-on-year in September 2023 from 10.0% in August and 12.3% in July.

Since the beginning of this year, inflation in the country has been 3.0%, with core inflation at 4.1%, the State Statistics Service said.

In the consumer market in September, prices for food and non-alcoholic beverages decreased by 0.5%. Vegetables fell the most (by 9.7%). Prices for fruits, processed cereals, rice, sunflower oil, fish, and fish products fell by 5.1-0.4%. At the same time, eggs went up by 12.3%, and prices for butter, sugar, meat and meat products, lard, bread, and milk rose by 1.3-0.5%.

Prices for alcoholic beverages and tobacco products increased by 0.7%, which was due to a 1.4% rise in the price of tobacco products.

Clothing and footwear went up by 7.8%, with footwear rising by 8.2% and clothing by 7.6%.

Transportation prices increased by 2.2%, mainly due to a 4.9% rise in fuel and oil prices. At the same time, railroad passenger transportation fell by 3.2%.

Education services went up by 9.9%, namely secondary education by 13.9%, higher education by 11.5%, and preschool education by 5.4%.

As reported, at the end of July, the National Bank of Ukraine again improved its inflation forecast for this year from 14.8% to 10.6%, but last week announced plans to further revise it downward.

In 2022, inflation is expected to rise to 26.6% from 10% in 2021, and core inflation to 22.6% from 7.9%.