Bankers hope for a quick appointment of a new head of the National Bank of Ukraine (NBU) to replace Kirill Shevchenko, who announced his resignation on October 4, and expect the regulator to maintain a consistent course even after the new appointment.

This is evidenced by the bankers’ comments provided to the Interfax-Ukraine agency on Wednesday.

“I don’t think that any radical changes in the strategy of the National Bank should be expected in the conditions of war. The entire system of governing the country in the current situation is more or less subordinated to a single common goal. Under these conditions, one can hardly speak of full-fledged freedom of decision-making by individual In other words, I do not expect any “revolution”,” Ivan Svitek, head of the board of Unex Bank, said.

He believes that it is better not to delay the appointment of a new head, as this is important for the banking system and its stability, as well as for foreign partners and creditors.

“As a banker, shareholder and head of the bank, I, of course, would like to see a person from the system at the head of the NBU. He has fresh experience in a commercial bank, who understands all the complexities and problems of the system. I am sure that in addition to strategic state tasks, the regulator should remain a “friend “the market he regulates,” Switek said.

The banker added that the new head of the NBU, who has fresh practical experience in a commercial bank, is better able to provide banks, especially during the war, not only with instructions and requirements, but also with support.

“It is necessary to appoint a new head of the NBU as soon as possible, especially given the military situation in the country. But this is not a question, we will find out his name in the near future,” said Vladimir Mudry, head of OTP Bank.

According to him, if one of the members of the Shevchenko team becomes the new head, this will mean a certain continuity of the NBU policy and a greater degree of predictability of further decisions and tools to influence the market.

“Otherwise, in my opinion, it should be a macroeconomist, not only with experience in managing a commercial bank, but also with broader expertise, possibly in international organizations, government agencies, capable of bringing a new vector of development to the National Bank’s policy,” he added. banker.

Volodymyr the Wise stressed that in any case, the main thing today is the unity of all authorities, therefore the first task of the new head of the NBU is his soonest entry into the system of managing the country’s economy and financial market.

As reported, People’s Deputy Yaroslav Zheleznyak, First Deputy of the Parliamentary Committee on Finance, Tax and Customs Policy and People’s Deputy Oleksandr Dubilet claim that Andriy Pyshny will become the new head of the National Bank.

Previously, Pyshny was named as a possible candidate for the post of head of the NBU even before the start of the war, when the topic of a possible change in the head of the central bank arose several times. At the same time, the ex-head of Oschadbank was ready to compete for the post of head of Ukreximbank, but due to the war, the corresponding competition was canceled. In May of this year, Pyshny became an adviser to the head of the board of Oschadbank, and is also a member of the Yermak-McFaul sanctions group.

The current head of the National Bank of Ukraine, Kirill Shevchenko, announced his resignation on October 4 for health reasons.

The Rada appointed him to this post for a seven-year term on July 16, 2020, and before that he was the head of the board of the state-owned Ukrgasbank.

Earlier, on July 1, 2020, the head of the NBU, Yakov Smoliy, resigned due to political pressure. He has worked in this position since March 2018, and before that, since May 2017, he was acting. head of the NBU.

The National Bank of Ukraine (NBU) has increased from UAH 50,000 to UAH 100,000 (equivalent) the monthly limit on the purchase of non-cash foreign currency by citizens with subsequent placement on an irrevocable deposit for at least three months.

“Such changes will further reorient the demand of the population from foreign cash to non-cash, because transactions for the sale of non-cash currency by banks are carried out at a rate closer to the official than for the sale of cash, more convenient and safer,” the NBU website said on Friday.

As reported, with the outbreak of war on February 24, the National Bank banned the sale of non-cash currency to citizens, and on July 21 partially allowed it – up to UAH 50,000 per month on an irrevocable deposit of three months.

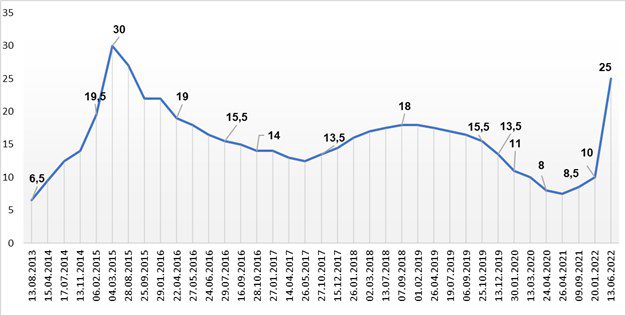

Dynamics of changes in discount rate of NBU

NBU

Net sales of dollars by the National Bank of Ukraine rose to $510.7 million last week compared to $475.0 million a week earlier and $231.4 million two weeks earlier.

According to the information of the National Bank on its website, from August 12 to September 16, it purchased $17.5 million, which is 2.5 times more than the previous week, but sold $528.2 million compared to $482 million a week earlier.

This week, on the cash market, the hryvnia again weakened by about 50 kopecks, and its rate came close to the level of UAH 42/$1, while the official rate of UAH 36.57/$1 was fixed since July 21.

As reported, in August the volume of interventions of the National Bank in the market increased slightly – to $1.33 billion from $1.2 billion in July, but still remained much less than in June ($3.96 billion), May ($3.4 billion) and April ($2.2 billion).

Finance Minister Serhiy Marchenko said that in August the volume of foreign aid to Ukraine amounted to a record $4.6 billion since the beginning of the war, compared with $1.7 billion in July and $4.4 billion in June.

In general, from the beginning of the year to September 16 inclusive, the NBU purchased $3 billion 114.2 million and EUR111.0 million on the market, and sold $17 billion 862.8 million and EUR1 billion 789.1 million.

Including since the beginning of the war, the purchase of foreign currency has reached $2 billion 457.3 million and EUR111.0 million, and the sale – $14 billion 92.6 million and EUR1 billion 789.1 million.

The international reserves of Ukraine as of September 1, 2022, according to the NBU, amounted to $25.436 billion (in equivalent), which is 13.6% or $2.679 billion more than at the beginning of August. In July, the fall in reserves amounted to 1.6%, or $371.5 million, in June – 9.3%, or $2 billion 343.8 million.

The state-owned Ukrgasbank (Kyiv) repaid ahead of schedule UAH 1 billion of refinancing received from the National Bank of Ukraine (NBU) this year, the bank’s press service reported on Tuesday.

“On August 30, the state-owned Ukrgasbank made an early repayment of a refinancing loan in the amount of UAH 1 billion received from the NBU this year. The repayment was due to the positive dynamics of attracting funds from legal entities and individuals in August this year,” the report says.

JSB “Ukrgasbank” was founded in 1993. The state, represented by the Ministry of Finance, owns 94.94% of the shares of the financial institution.

According to the data of the National Bank of Ukraine, as of July 1, 2022, Ukrgasbank ranked 5th (UAH 139.671 billion) in terms of total assets among 68 banks operating in the country.

The profit of Ukrainian banks in January-July 2022 decreased by 10.8 times – to UAH 3.4 billion, the press service of the National Bank of Ukraine (NBU) reported on Tuesday.

According to the regulator, the income of banks for 7 months of this year increased by 26% against the figure for the same period last year – up to UAH 189.082 billion. Including commission income increased by 20.5% to UAH 112.374 billion.

At the same time, the result from the revaluation and from purchase and sale operations was positive and amounted to UAH 27.214 billion, while for the same period last year it was negative and amounted to UAH 409 billion.

At the same time, the expenses of the banking system in January-July 2022 increased by 1.68 times compared to this indicator in 2021 – up to UAH 185.675 billion, including deductions to reserves – by 12.3 times, up to UAH 73.56 billion . At the same time, fee and commission expenses increased by 1.87% to UAH 18.8 billion,

As reported, Ukrainian banks doubled their net profit in 2021 to UAH 77.5 billion compared to UAH 41.3 billion in 2020.