Moody’s Investors Service on November 22 changed the outlook on the Government of Ukraine’s ratings to positive from stable. At the same time, Ukraine’s long-term issuer and senior unsecured ratings have been affirmed at Caa1.

“The affirmation of Ukraine’s Caa1 ratings reflects its – while showing signs of improvement – significant external vulnerability,” Moody’s said.

The sizeable external debt repayments due over the coming years would – in the absence of a new International Monetary Fund (IMF) programme – require continued market access. At the same time, the risk of a new flare-up in geopolitical tensions continues to constrain upward movement in the credit rating at this time.

The key drivers for the change in the outlook to positive are: the rebuilding of Ukraine’s foreign exchange reserves is reducing external vulnerability in the context of large external repayments; and the improvement of Ukraine’s macroeconomic stability and the prospect for renewed reform momentum is strengthening the country’s economic resilience.

Concurrently, Moody’s has affirmed the Ca rating on the $3 billion eurobond that Ukraine sold in December 2013. The sole subscriber of the notes was the Russian government. The bond is under dispute due to the international armed conflict between the two governments.

Finally, Ukraine’s long-term foreign currency bond and deposit ceilings remain unchanged at B3 and Caa2 respectively, while the short-term foreign currency ceilings for bonds and deposits remain Not Prime (NP). The country ceilings for local currency bonds and deposits are also unchanged at B3.

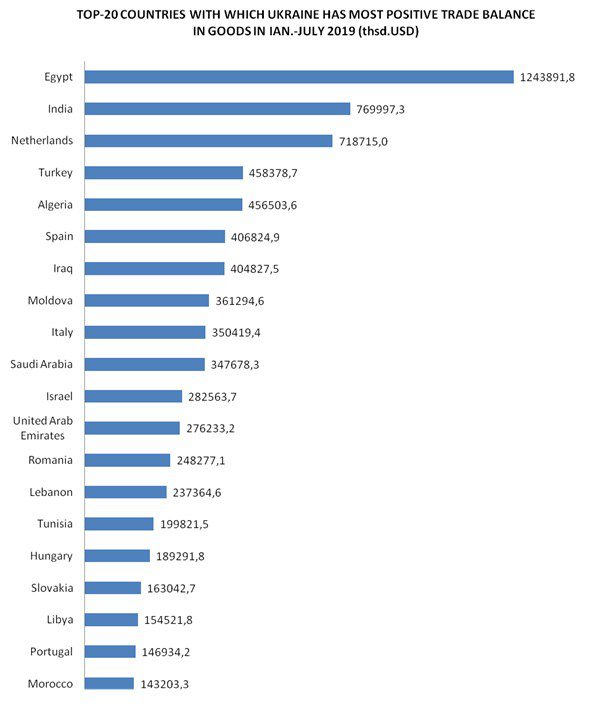

Top-20 countries with which Ukraine has most positive trade balance in goods in Jan-July 2019 (thsd.USD)