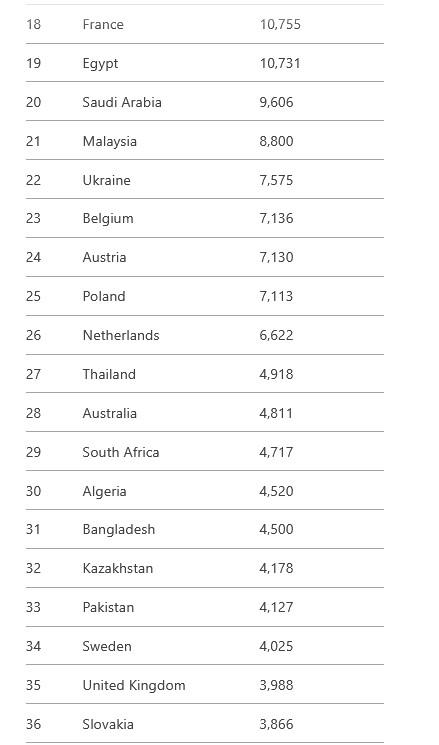

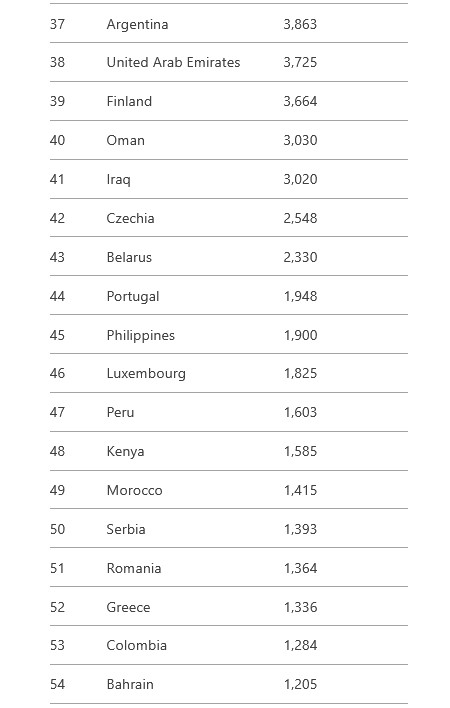

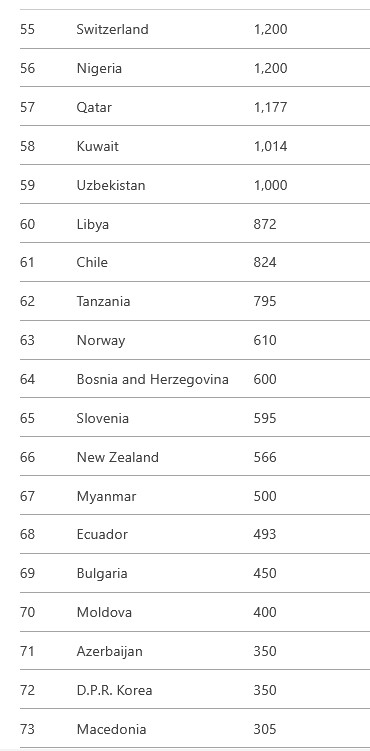

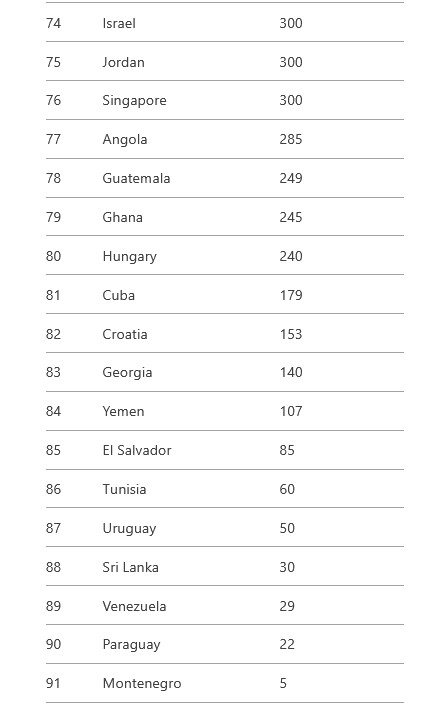

Experts club presents the 2024 ranking of all steel-producing countries in the world. The ranking is compiled by the World Steel Association (Worldsteel), which updates data for all steel-producing countries on a monthly basis. Below is the production data in million tons, with percentage of production in 2023 in parentheses.

Global steel production continued to perform strongly in 2024, despite fluctuations in demand and the impact of economic factors. China remained the undisputed market leader, producing 1,005.1 million tons of steel, accounting for more than half of the global total. India, which took second place, continues to increase production, reaching 149.6 million tons, while Japan rounds out the top three with 84 million tons, followed by the United States and Russia.

S&P has upgraded Serbia’s long-term sovereign rating from BB+ to BBB-, which removes its foreign currency bonds from junk status and puts them in the investment grade category, Bloomberg reports citing a statement from the agency.

The rating outlook is stable. Thus, the rating company now assesses Serbia’s creditworthiness on a par with Hungary and Romania and one notch below Mexico. The country’s speculative rating remains at Fitch Ratings and Moody’s Ratings.

“The rating upgrade reflects Serbia’s increasing resilience to shocks thanks to effective macroeconomic management, which we expect to continue in the coming years,” S&P said in a statement.

It emphasizes that robust domestic demand, accumulated reserves, and prudent fiscal and monetary policies, supported by cooperation with the IMF, allow Serbia to withstand economic difficulties and future potential shocks.

S&P changed its outlook on Serbia’s credit rating to positive in April 2024, and Fitch and Moody’s followed suit in August, raising the possibility that the country will soon receive an investment grade rating from the three global rating agencies, according to Bloomberg. Serbia became the first country in the Western Balkans to receive an investment grade rating and the only EU candidate country with such a rating. Yields on Serbia’s 2034 dollar-denominated bonds fell 70 basis points from their June peak to 5.63% as of Friday, October 4.

Since June, Serbia’s bonds have posted a 7% return, outperforming the Bloomberg EM Hard Currency Index, which was up 5.8%. Some investors, such as Morgan Stanley Investment Management, have long believed that Serbia deserves a rating upgrade, the agency notes.

Moldova’s incumbent President Maia Sandu is leading the ranking of potential candidates for the October 30 elections, according to an opinion poll presented at a press conference on Tuesday.

According to the poll, if the presidential election were held next Sunday, 30.3% of respondents would vote for Sandu, 13% for the head of the Socialist Party, Igor Dodon (who has already announced that he will not run); 6.5% – for the leader of Our Party Renato Usatîi; 5.6% – for the former bashkan of Gagauzia Iryna Vlah; 5.4% – for the mayor of Chisinau Ion Ceban, who, like Dodon, has stated that he does not intend to run.

Almost one in five respondents said they had not yet decided who they would vote for. If we take into account only the voters who have decided, 39.3% are ready to vote for Sandu, 16.9% for Dodon, and 8.5% for Usatîi.

Former prosecutor Alexandru Stoianoglo, whom the Socialist Party decided to nominate as an opposition candidate, gained 1% in the poll.

“Stoyanoglo recently announced his intention to run. He was not included in the list of presidential candidates, and this 1% is those who named Stoyanoglo on their own. It is possible that Stoyanoglo’s rating may be significantly higher now,” said Vasyl Kantarzhy, director of the CBS-Reserarch sociological company.

Speaking about the level of trust in politicians, he noted that when asked an open question about trust in politicians, 21.3% of respondents named Sandu, 7.2% – Dodon and 4.6% – fugitive oligarch Ilan Shor. They are followed by the head of the Our Party, Usatîi (3.3%), and the mayor of Chisinau, Ceban (3.2%).

At the same time, 38.2% of respondents said they did not trust any of the politicians.

The poll was conducted by CBS-Reserarch on behalf of the Institute for European Policy and Reform. The survey was conducted on June 28-July 18 with the participation of 1119 people. The margin of error is 2.9%.

Earlier, the Experts Club think tank and Maksim Urakin presented an analytical material on the most important elections in the world in 2024, a more detailed video analysis is available here – https://youtu.be/73DB0GbJy4M?si=eGb95W02MgF6KzXU

The Tchaikovsky National Music Academy of Ukraine has topped the nationwide ranking of artistic higher education institutions presented by the Institute of Sociological Research of the Kyiv National Economic University named after V. Hetman and the research company Active Group.

According to Oleksandr Poznyi, the coordinator of the project to create the rating, director of the Active Group research company, artistic higher education institutions are a very complex and important social institution that requires a specific methodology for studying.

“That’s why we combine the efforts of researchers, scholars and the best practices of the international community to improve our ranking of artistic higher education institutions,” he said at a press conference at Interfax-Ukraine on Tuesday.

Pozniy emphasized that the main mission of the rating is to evaluate artistic institutions, as the existing ratings are designed for classical universities and do not take into account the unique aspects of art education and the specifics of evaluating art institutions. This, in turn, affects the objectivity and significance of these rankings in the context of art education, resulting in the underrepresentation of artistic institutions in the rankings.

“This is an important step in creating a transparent and objective system for evaluating artistic educational institutions, which allows us to adequately assess their contribution to the cultural development of the country. The ranking is designed to reflect the uniqueness of each artistic institution. We have applied comprehensive criteria that include teaching, research, international activity and financial stability,” said Yulia Gorbova, Director of the Institute of Sociological Research at the Kyiv National Economic University named after V. Hetman.

According to her, the methodology of this year’s ranking was improved as part of the joint research work of Active Group, the Institute of Higher Education and the Institute of Sociological Research of the Kyiv National Economic University named after V. Hetman. The study searched, systematized, and analyzed international and local general and subject (industry) rankings, with a special focus on the rankings of art education institutions and/or educational programs.

Art higher education institutions were analyzed by 45 parameters grouped into six blocks: “Teaching and Learning”, “Science and Research”, “Impact of Higher Education Institutions on Society Development”, “Internationalization”, “Institutional Reputation”, and “Financial Sustainability”. The share of each group of indicators and the weight of each individual criterion was determined based on the analysis of international experience and adjusted based on the results of an expert survey of representatives of the field of art education.

The authors of the ranking also used multi-criteria approaches to evaluating the activities of higher education institutions based on the processing of data that can be obtained from open sources and whose validity can be verified.

The sources of data for the ranking of artistic HEIs were: EDEBO, NAQA, Rector’s Report, Report on Scientific Activities, Estimates, Financial Statements of HEIs, HEI Website, Scopus, Web of Science, OpenAlex, Ukrainian National H-index Ranking, Google Scholar, Transparent Ranking, QS, UniRank, services for measuring brand reputation on the Internet and social networks.

As a result, the all-Ukrainian ranking of art universities for the 2023-2024 academic year was as follows:

| Place in the ranking | Result | |

| Tchaikovsky National Music Academy of Ukraine | 1 | 68,6 |

| Kharkiv State Academy of Design and Arts | 2 | 47,7 |

| Kharkiv State Academy of Culture | 3 | 43,8 |

| Lviv National Academy of Arts | 4 | 43,5 |

| National Academy of Fine Arts and Architecture | 5 | 41,7 |

| Kharkiv National University of Arts named after I.P. Kotlyarevsky | 6 | 39,6 |

| Kyiv National University of Theater, Cinema and Television named after I.K. Karpenko-Kary | 7 | 38 |

| A.V. Nezhdanova Odesa National Music Academy | 8 | 32,2 |

| Mykola Lysenko Lviv National Music Academy | 9 | 32,1 |

| Mykhailo Boichuk Kyiv State Academy of Decorative and Applied Arts and Design | 10 | 27,2 |

| National Academy of Management Personnel of Culture and Arts | 11 | 27,1 |

| Transcarpathian Academy of Arts | 12 | 14,5 |

| Luhansk State Academy of Culture and Arts | 13 | 12,3 |

The researchers plan to continue this assessment of artistic institutions in order to track the dynamics of the development of Ukrainian art education institutions. The project team invites everyone to join the work on the development of the ranking, in particular, to improve the criteria for evaluating art institutions.

The international rating agency S&P Global Ratings has upgraded Turkey’s long-term foreign and local currency ratings to “B+” from “B”.

The ratings outlook is “positive,” according to a press release from S&P.

“We expect that following the municipal elections held in the country, the Turkish authorities will continue to fight inflation aggressively through tightening monetary policy and gradual fiscal consolidation,” the agency’s experts say.

S&P predicts a decline in Turkey’s current account deficit over the next two years, along with weakening inflation and slowing dollarization of the economy. At the same time, the agency’s analysts believe that the country’s inflation rate will remain double-digit until early 2028.

The Central Bank of Turkey is likely to keep the key interest rate at the current level of 50% until the end of 2024, according to S&P.

“We could upgrade Turkey’s rating again if the country’s balance of payments continues to improve, inflation slows, and domestic savings in Turkish lira increase, allowing the country to rebuild its foreign exchange reserves,” the agency said in a press release.

S&P may change the outlook on Turkey’s ratings to stable if pressure on the country’s financial stability or state budget increases, for example, if the lira’s depreciation fails to stop, or if the authorities abandon inflation control measures.

Earlier, Experts Club and Maksim Urakin released a detailed video analysis of how economic and political life is developing in Turkey, more detailed video analysis is available here – https://youtu.be/SUqOMFI5HbI?si=uEIZZOORj65VElUQ

You can subscribe to the Experts Club YouTube channel here – https://www.youtube.com/@ExpertsClub

Providing microcredits “Ukr Credit Finance” (TM “CreditKasa”) and “1 Safe Agency of necessary loans” (TM “MyCredit”) received the highest revenue among financial companies in 2023 – respectively UAH 3.12 billion and UAH 2.33 billion, the National Bank reported on its website.

The next three companies were formed by FC “E Groshi Kom”, “Miloan” and “Aventus Ukraine” (TM CreditPlus), whose revenue amounted from UAH 1.66 billion to UAH 1.46 billion.

According to the results of 2022, the leaders in terms of revenue were Finod LLC, engaged in currency exchange and deprived of all licenses by the National Bank in August 2023, and Novapey payment system, the data of which the National Bank stopped publishing after re-licensing of payment systems. The net income of these companies in 2022 amounted to respectively UAH 5.41 and 5.18 billion, while the places from third to fifth were taken by “Ukr Credit Finance”, “Aventus Ukraine” and “E Groshi com” with revenue from UAH 2.50 billion to UAH 1.27 billion.

According to the results of 2023, net income over UAH 1 billion was received by five more companies, of which only one is not from the microcredit market: the network of payment terminals FC “Kontraktovy Dom” (TM “Easypay”), which received UAH 1.38 billion.

Following with relatively close revenue figures – from UAH 1.33 billion to UAH 1.07 billion are Lineura Ukraine (TM “Credit7”), LLC “Maniveo Fast Financial Assistance” (Moneyveo), “Consumer Center” (TM “ShvidkoGroshi”) and “Advance Credit”, which demonstrated the highest growth dynamics by the previous year among the entire top ten – almost 37 times.

Among the leaders, the highest labor costs were incurred by “Consumer Center” – UAH 167.8 million, or 13.6% of revenue, while at “Avans Kredit” they amounted to UAH 29.3 million, or 1.8% of revenue.

According to the NBU data, in 2023 the profitability of companies improved dramatically: of the 40 largest representatives of the market, all, except for the State Mortgage Institution (SMI), ended the year with net profit, which totaled UAH 1.57 billion, while a year earlier there were 15 unprofitable companies.

The leader in net profit among financial companies for the past year was PJSC “Ukrfinzhytlo” – UAH 5.94 billion. It is followed by Ukr Credit Finance – UAH 202.7 million, the State Fund for Entrepreneurship Development, the operator of state support programs – UAH 177.7 million and Bizpozyka – UAH 177.1 million.

Slightly behind was Maniveo Fast Financial Aid, which earned UAH 167.7 mln, which allowed it to partially offset UAH 625.6 mln of the previous year’s net loss.

“Ukrfinzhytlo” also significantly outperformed all and in terms of assets – 60.89 billion UAH, owing the primacy in these two categories to its capitalization at the expense of government bonds.

Avior FC specializing in lending to agrarians is next – UAH 12.05 billion, whose revenue amounted to UAH 125.4 million last year.

The other eight companies in the top ten with assets from UAH 8.68 billion to UAH 3.55 billion had no revenue last year, while salary expenses and net profit were minimal.

© 2016-2025, Open4Business. All rights reserved.

All news and diagrams placed on this Web site is made for internal use. Its reproduction or distribution in any form are welcome in case of placing a direct hyperlink to a source. Reproduction or distribution of information which contains Interfax-Ukraine as a source is prohibited without the written permission from the Interfax-Ukraine news agency. Photoes placed on this site are taken from open sources only; rightholder are welcome to make demands to info@open4business.com.ua , in this case we are ready to put your copyright to a photo or replace it.