The Cabinet of Ministers of Ukraine has decided that documents produced or certified on the territory of foreign states are accepted on the territory of Ukraine without an apostille if such a practice existed as of February 24, 2022 in accordance with international treaties of Ukraine.

“This step was necessary, because in December last year, in relations with Russia and Belarus, the international Convention on Legal Assistance and Legal Relations in Civil, Family and Criminal Matters was terminated. As a result, citizens of Ukraine who have documents issued on the territory of these two states should have affixed an apostille on them. That is, they would have to go to the territory of the aggressor state for this, which is unacceptable,” the press service of the Ministry of Reintegration of the Temporarily Occupied Territories said in a statement.

Thus, by the decision of the government, it was decided that during the martial law in Ukraine and six months after it, documents that were accepted without an apostille before February 24, 2022 continue to be accepted without an apostille.

Ukraine exported in January “grain corridor” by 25% less agricultural products than in December due to deliberate actions of Russian inspectors to delay ships in the Bosphorus, the Administration of Sea Ports of Ukraine (AMPU) reported on Sunday.

According to the agency, in January the ports of “Big Odessa” processed 77 ships and sent 3 million tons of agricultural products to Africa, Asia and Europe, while in December the figure was 97 ships and 3.7 million tons of agricultural products, respectively.

At the same time, the Ministry of Infrastructure of Ukraine noted that the critically low rate of ships’ departure from the ports (2.5 ships per day) continues to remain. For comparison, in October this indicator was 5.7.

“In January, the ports worked only at 30-40% of capacity due to a shortage of the fleet to load. Three ships a day at the proposed nine are inspected in the Bosphorus and receive permission to move to Ukrainian ports for food,” – added in the ministry.

According to the ministry, the SKC plans to conduct 10 inspections a day, but Russian inspectors successfully complete only half of them.

“In January, 204 inspections were conducted, of which 173 were successful, another 31 inspections were not completed because Russian inspectors ended their workday prematurely and unilaterally at 3 p.m. 30 minutes (work time is regulated till 5:30 pm) or due to claims of documents not having been checked by the SKZ,” added in the Ministry of Infrastructure.

In addition, the registration of vessels for participation in the initiative is also delayed. With more than 80 ships declared, the representatives of the aggressor country register 2-3 ships a day without any explanation. As of February 4, 120 vessels are waiting for inspection in Turkish territorial waters (98 – entering the ports for loading, 22 – with the agricultural products for the exit). The vast majority of them are waiting several weeks.

In total, for six months of operation of the “grain corridor” ports of Greater Odessa has sent 691 ships with 19.7 million tons of foodstuffs: the port of Chernomorsk – 285 ships-7.3 million tons, port “Odessa” – 215 ships-5.2 million tons and port “Pivdenny” – 191 ships with 6.6 million tons of food.

“The world received 19.7 million tons of food, and should receive more than 30 million tons, subject to the stable functioning of the corridor,” the department added.

As reported, in Istanbul on July 22 with the participation of the UN, Ukraine, Turkey and Russia signed two documents on the creation of a corridor for 120 days for the export of grain from the three Ukrainian ports – “Chernomorsk”, “Odessa” and “Pivdenniy”. After the end of its validity period, the agreement was extended for another 120 days, starting from November 19, 2022.

The European Commission will propose to the EU member states to extend the suspension of all customs duties and trade protection measures on imports from Ukraine for a year, the head of the European Commission, Ursula von der Leyen, has said.

“Last year, we abolished all duties and quotas for goods from Ukraine. It was a great success… Today I can announce that we will propose to prolong this trade agreement for the next year,” – said von der Leyen during a press conference with Ukrainian Prime Minister Denis Schmigal.

In the next video YouTube-channel of the analytical center “Club of experts” the prospects of trade and economic relations between Ukraine and Egypt were considered.

As the founder of the Club of Experts Maxim Urakin emphasized, before the war Egypt was the most favorable trade partner for Ukraine, the trade surplus with which amounted to almost 2 billion U.S. dollars. Grain and metallurgical products were the main Ukrainian goods at the Egyptian market.

At the same time, in the first months of the war, the Russian blockade of maritime communications in the Black Sea limited Ukrainian exports to Africa and, above all, to Egypt. The grain agreement improved the situation, but only with regard to agricultural exports. In order not to lose the Egyptian market, the Ukrainian companies have to adapt to the current situation now in order not to make additional efforts after the war.

According to the President of the Ukrainian Exporters Club Eugenia Litvinova, the Ukrainian producers should pay attention to the Egyptian market of dairy products in the first place. In this case, it is necessary to take into account the separation of Egyptian groups of goods for wholesale and retail trade while creating favorable conditions for imports. Also, according to her, the demand in Egypt is for canned and dried fruits, confectionery, chocolate, oils, fats, mineral water, as well as crockery, various cutlery, baths, showers, sinks, building materials and other goods for the retail trade.

“I want to draw attention to the fact that all Ukrainian exporters who want to trade with Egypt, must be registered in the general administration to control exports and imports. After that it is possible to establish logistics through rail and road ways, taking into account the temporary inaccessibility of the port of Odessa”, – she explained.

Besides, Yevgeniya Litvinova noticed that since March of the last year, Egypt obliged Ukraine to use the letter of credit for many groups of goods that leads to rise in price of transactions from 0,2 to 0,5%. This factor, according to the expert, will also directly affect trade and its final results.

“If we talk about advice to our small and medium-sized businesses when entering the Egyptian market, first you need to understand what exports are, if you have not previously been involved in this process. Then you should analyze in which cases it is profitable to open a Ukrainian enterprise in Egypt to work, and in which cases you do not always need to do it and not always profitable. Finally, the third tip – go through the registration. At least look at how to pass authorization, registration through a single window in Egypt. I draw your attention to the fact that your brand should be registered at least in Ukraine before you start to pass this registration in Egypt, “- summed up Eugenia.

In turn, the head of the Egyptian diaspora in Ukraine, Dr. Atia Walid noticed that in recent years Egyptian-Ukrainian trade relations have been intensively developed and our country has been invited to participate in major infrastructure projects, which are now being implemented by the Egyptian authorities.

“Back in 2021 Egypt discussed with the Ukrainian government investment in the special economic zone of the Suez Canal. That is, the Egyptian economic policy is primarily aimed at encouraging investment in the country’s economy. Egypt, of course, is interested in cooperation with Ukrainian companies from the point of view of opening joint ventures on its territory, which can well be realized today, despite the war. I think it is quite realistic for Ukrainian companies to open branches there, if they are interested in the sales market. Egypt is ready to facilitate this,” stressed the representative of Egypt.

In his opinion, our suppliers should work more actively both with the Egyptian embassy in Kiev and the Ukrainian embassy in Cairo. This will facilitate the passage of bureaucratic procedures and reduce the likelihood of becoming victims of fraud.

“Ukrainian businessmen should check with the Egyptian embassy or the Chamber of Commerce the authenticity of the documents of those organizations with which they cooperate. And only after that, conclude a contract according to all international rules. You should not believe the promises and pretty eyes, and do not forget the basics of doing business in the field of export-import. I wish all businessmen in Egypt and in Ukraine only success,” said Dr. Atia Walid.

See more details in the video:

You can subscribe to the Club of Experts channel by following the link:

ATIA_VALID, BUSINESS, CLUB_EXPERTS, CLUB_EXPORTERS, EGYPT, EXPORT, GOODS, IMPORT, LITVINOVA, TRADE, UKRAINE, URAKIN

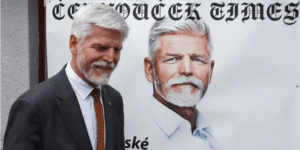

Ukrainian President Vladimir Zelensky congratulated Petr Pavel on his victory in the Czech presidential election and invited him to visit Ukraine.

“Congratulated Petr Pavel on his victory in the Czech presidential election. Thanked him and the Czech people for their unwavering support. Invited him to visit Ukraine,” Zelensky wrote in his Telegram channel on Sunday.

Earlier it was reported that the former chairman of the NATO Military Committee Petr Pavel on Saturday won the second round of the presidential elections in the Czech Republic. After all ballots were counted, he received more than 58.3 percent of the vote. The inauguration is scheduled for March 9.

Japan International Cooperation Agency (JICA) resumes work in Ukraine and will focus on reconstruction issues, Prime Minister Denis Shmygal said.

“The Japan International Cooperation Agency (JICA) resumes work in Ukraine and will focus on reconstruction issues. Good news for the 31st anniversary of the establishment of diplomatic relations between Ukraine and Japan,” Shmygal wrote in his Telegram channel.

The prime minister also said that he discussed with the Japanese ambassador Kuninori Matsuda further support for Ukraine in various areas.

“Priority: energy, housing reconstruction, humanitarian demining and support for small and medium-sized businesses in Ukraine. Touched on the situation at the Zaporizhzhia NPP. Called on Japanese partners to promote sanctions against the Russian nuclear industry”, – he added.