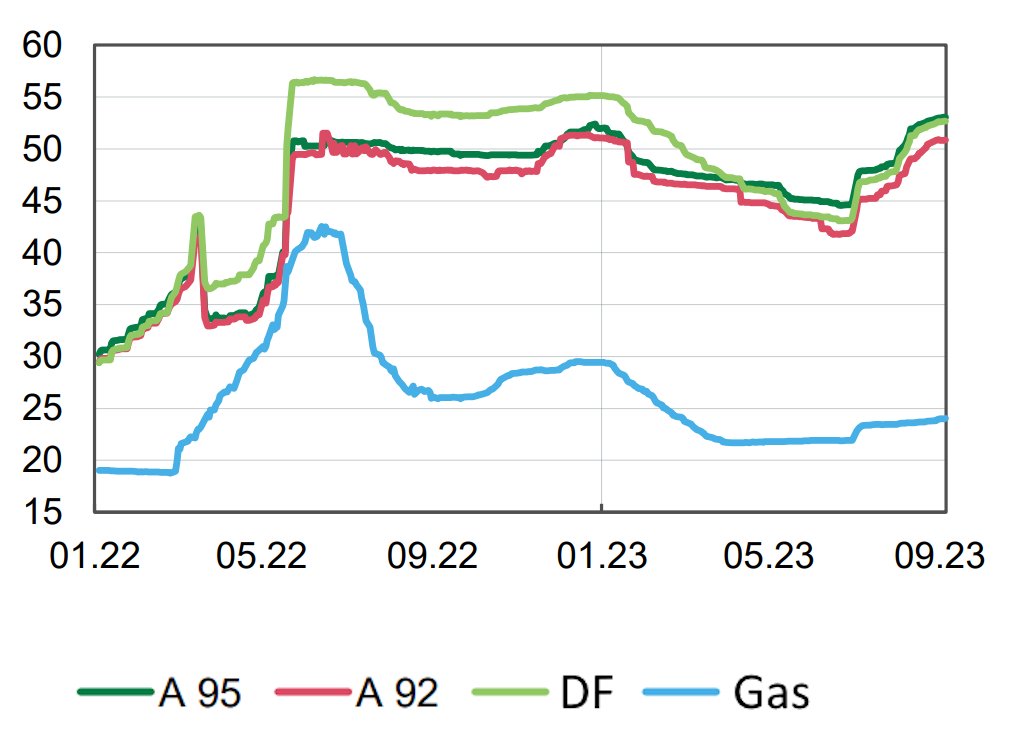

Fuel price developments for 2022-2023

Source: Open4Business.com.ua and experts.news

In January-June this year, Ukraine increased exports of carbon steel semi-finished products in physical terms by 61.6% year-on-year to 888,016 thousand tons.

According to statistics released by the State Customs Service (SCS) on Tuesday, exports of carbon steel semi-finished products increased by 47.3% to $439.909 million in monetary terms.

The main exports were made to Bulgaria (35.49% of supplies in monetary terms), Poland (11.74%) and Italy (8.56%).

In January-June 2024, Ukraine imported 5 tons of semi-finished products from Egypt for $5 thousand, while in January-June 2023, it imported 72 tons of semi-finished products from China for $133 thousand.

As reported, in 2023, Ukraine decreased exports of carbon steel semi-finished products in physical terms by 36.7% compared to 2022, to 1 million 203.454 thousand tons, while exports in monetary terms decreased by 48.9% to $608.516 million. The main exports were made to Bulgaria (36.66% of supplies in monetary terms), Poland (23.01%), and Italy (9.60%).

In addition, in 2023, Ukraine imported 96 tons of semi-finished products from China (98.26%) and Turkey (1.74%) for $172 thousand.

In the 2023-2024 marketing year (MY, July 2023 – June 2024), Agro-Region Agricultural Group refused to use freight forwarders, which allowed it to save 15% of the cost of railroad logistics, said Mykola Muravyov, Deputy Director of Logistics.

“Refusing to use freight forwarders and organizing rail transportation professionally on our own is a strategically sound decision. Of course, there are contracts on a “today-tomorrow” basis that are profitable to fulfill with freight forwarders when our own railcars are fully utilized, but these are isolated cases that we try to avoid,” the company’s press service quoted him as saying.

According to Muravyov, Agro-Region currently operates 100 railcars, of which 25 hopper cars were received by the company as part of the USAID Economic Support for Ukraine grant program.

At the peak of the 2023/2024 MY season, Agro-Region had up to 500 wagons under its operational control, as large volumes of corn harvest and uncertainty about whether the grain corridor and Black Sea logistics would work stably forced the company to make sales more concentrated in certain months to minimize risks, the deputy director explained.

He added that in the 2024/2025 season, the plan is more balanced and sales are planned in equal parts throughout the year, which significantly reduces the need for the number of wagons.

“The main indicator of the economic efficiency of railcar use is railcar turnover. It is important to organize the work so that the cars stand as little as possible and move as much as possible, i.e. make the maximum possible number of turns during the reporting period. The more turns a railcar makes, the more grain will be transported,” said the Deputy Director for Logistics.

Regarding railcar rental, he clarified that its cost is charged on a daily basis and does not depend on whether the railcar is idle or in constant motion.

Agro-Region is a group of agricultural companies that cultivate 40 thousand hectares of agricultural land in Chernihiv, Khmelnytsky, Kyiv and Zhytomyr regions. It has three elevators in Boryspil, Myropil and Zavorychi with a total storage capacity of about 160 thousand tons. The agricultural holding grows corn, wheat, rapeseed, soybeans, barley, sunflower and oats. In 2022, Agro-Region exported an average of 250-300 thousand tons of grain per year and is trying to increase its exports through its own and farmers’ grain.

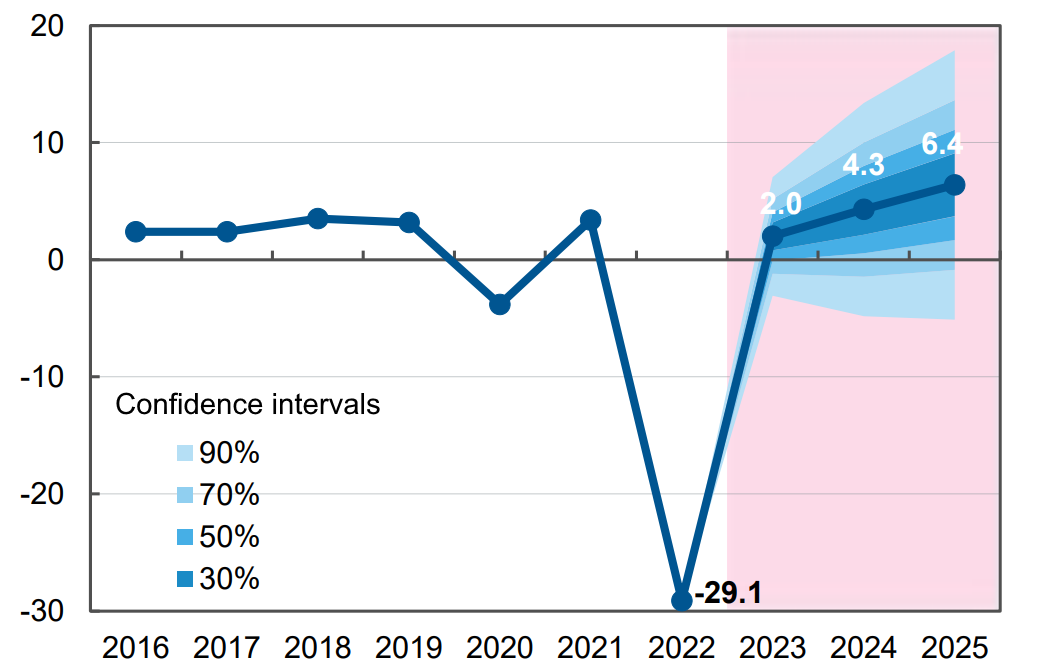

Forecast of dynamics of changes in ukrainian GDP in % for 2022-2025 in relation to previous period

Source: Open4Business.com.ua and experts.news

Hackers stole more than twice as much cryptocurrency in the first half of 2024 as they did a year earlier, according to a report by analytics firm TRM Labs.

The size of thefts in January-June amounted to $1.38 billion compared to $657 million in the same period last year.

As a year earlier, the bulk of the volume was stolen in a small number of attacks. Five hacks allowed hackers to steal 70% of the total semiannual volume.

The largest of these was the hack of Japanese crypto exchange DMM Bitcoin, in which attackers stole more than $300 million worth of bitcoins.

That said, there were no fundamental changes in the security of the cryptocurrency ecosystem that could have contributed to the increase in thefts, TRM notes. The number of attacks has also not changed significantly over the year.

However, the average value of cryptocurrencies rose in the first half of the year, which may have affected the dollar valuation of thefts.

Ukraine in January-June this year increased exports of semi-finished carbon steel products in physical terms by 61.6% compared to the same period last year – up to 888.016 thousand tons.

According to statistics released by the State Customs Service (SCS) on Tuesday, in monetary terms, exports of semi-finished carbon steel products increased by 47.3% to $439.909 million.

The main exports were to Bulgaria (35.49% of shipments in monetary terms), Poland (11.74%) and Italy (8.56%).

In January-June 2024 Ukraine imported from Egypt 5 tons of semi-finished products worth $5 thousand, while in January-June 2023 it imported from China 72 tons of semi-finished products worth $133 thousand.

As reported, Ukraine in 2023 reduced exports of semi-finished carbon steel products in physical terms by 36.7% compared to 2022 – to 1 million 203.454 thousand tons, exports in monetary terms decreased by 48.9% to $608.516 million. The main exports were to Bulgaria (36.66% of supplies in monetary terms), Poland (23.01%) and Italy (9.60%).

In addition, in 2023 Ukraine imported 96 tons of semi-finished steel products from China (98.26%) and Turkey (1.74%) for the amount of $172 thousand.