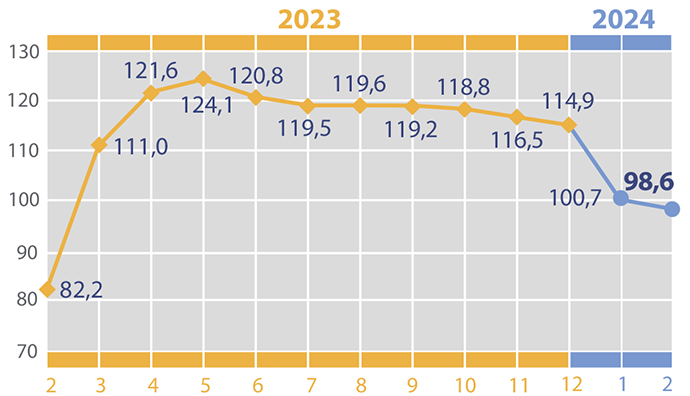

Import changes in % to previous period in 2023-2024

Source: Open4Business.com.ua and experts.news

Novus Ukraine LLC, which operates the Novus hyper- and supermarket chain, is suspending the Novus.online delivery service on June 18 and redirecting all orders to Zakaz.ua, the company’s press service reports.

“Covid-19 was the impetus for the birth of a new project – the Novus.online delivery service. We have achieved considerable success, and there is much to be proud of. However, today’s realities have made their own adjustments – now it is important for us to focus on the development of the network in order to continue to ensure the smooth operation of stores and invest in critical areas. That is why Novus.online will suspend operations from June 18 and redirect all orders to our partner Zakaz.ua,” the company said on Facebook.

Novus Ukraine LLC was established in 2008, the same year the first Novus supermarket in the country was opened. As of June 2024, the chain in Ukraine has more than 80 Novus and 17 Mi Markets.

The Novus supermarket chain is developed by BT Invest (Lithuania), a company established in 2008 by former Sandora shareholders Raimondas Tumenas and the late Igor Bezzub.

According to Opendatabot, as of July 2021, the owner of Novus Ukraine with a 100% stake in the authorized capital was Consul Trade House CJSC (Vilnius, Lithuania). The ultimate beneficiaries are Marina Poznyakova, Agne Ruzgienė, and Raimondas Tumenas.

According to the company’s financial results, in 2023, its revenue increased by 47% to UAH 23.6 billion, while its net loss decreased by 87% to UAH 310.7 million.

Oil prices are declining slightly on Tuesday after a 2 percent rise in the previous session amid a general increase in risk appetite in global markets.

The cost of August futures for Brent on the London ICE Futures exchange, as of 7:20 a.m., is $84.12 per barrel, which is $0.13 (0.15%) lower than at the close of the previous trading. On Monday, these contracts rose by $1.63 (2%) to $84.25 per barrel.

Futures for WTI for July in electronic trading on the New York Mercantile Exchange (NYMEX) fell by $0.16 (0.2%) to $80.17 per barrel. At the end of the previous session, the value of these contracts increased by $1.88 (2.4%) to $80.33 per barrel.

“Since mid-June, oil prices have been steadily rising on the back of US data,” said Fawad Razakzada, StoneX analyst. – “Last week’s market rise can be considered a delayed reaction to the OPEC+ decision to extend the current restrictions on oil production.

“Investors are also expecting fuel demand to increase with the start of the automotive season, which will push oil inventories lower in the coming weeks,” Razakzada said, as quoted by Market Watch.

Petro Bahriy, Chairman of the Association of Manufacturers of Medicines of Ukraine (AMPU), doubts that the two largest pharmaceutical distributors, BaDM LLC and Optima-Pharm, LTD JV, will have any competitors.

“Today, the vast majority of drug manufacturers work with these two operators. I do not think that another distribution company can appear in a country at war, because distribution means, first of all, warehouses, trained personnel and a fleet of special vehicles. These are very expensive things,” he said in an interview with Interfax-Ukraine.

At the same time, Bagriy believes that “it is unlikely that anyone will be interested in this new business, especially in times of war.”

The Myasniy Rai chain of stores, known for its high-quality meat products, announces the sale of its assets and trademark. The offer opens up new opportunities for investors and entrepreneurs seeking to develop their business in the retail sector.

The Myasniy Rai chain was founded in 2017 and quickly gained the trust of customers due to its high quality products and focus on local suppliers. The first store was opened on Shevchenko Boulevard, after which the chain was constantly expanding, opening new outlets. During 2018-2022, 8 stores were opened. The total investment in business development and support amounted to more than $700,000. Now Myasnyi Rai includes three stores, a production shop, a coffee shop and an online store providing a wide range of products for customers.

Key assets:

Advantages and prospects

The Myasnyi Rai chain offers a unique opportunity for investors to enter the food market with a ready-made, well-established business.

Main advantages:

This offer for sale is an ideal option for entrepreneurs who want to invest in a stable and profitable business with broad development prospects. For more information, please call +380 67 230 00 17.

BUSINESS, BUY_BUSINESS, INVESTMENTS, MEAT, MEAT_PARADISE, TRADE

KAN Development will invest about $80 mln in the construction of two schools in Kiev. construction two schools designed for more than 2,000 pupils in total, Igor Nikonov, founder of the KAN Development development company, told Interfax-Ukraine news agency.

“We fulfill our social obligations to the residents of the Republic Residential Complex. Here will be the largest educational institution in our A+ network. The building of 25 thousand square meters will house Respublika STEAM І-ІІІІ school and A+STEAM kindergarten. We will strive to launch it already by September 1, 2026,” Nikonov said during the official start of the construction of the construction work on Monday.

The building, designed by archimatika, will be located on a 3.3-hectare plot of land and will consist of four separate educational blocks: kindergarten, elementary, middle and high school – united by a large 80×18-meter column-free central atrium with an amphitheater in the center.

According to Nikonov, the investment in launching the school (construction and equipment) is estimated at about $40 million.

In parallel, work is underway on another school, on McCain St., a project that went to KAN Development six months ago. “Historically, there were commitments by another company to build an American school there, but due to the war this project was stopped. We have now finalized its concept. There will be IT direction, from the first grade to 12,” Nikonov said.

Architectural workshop “A. Pashenko” is working on the project. The area of the building is about 26 thousand square meters. m. The school is also designed for about 1 thousand pupils. The volume of investments is $40 million.

“On the basis of this school we want to make a small university. For this purpose we have already allocated the premises, about 3 thousand square meters. m. Our goal is to provide in our A+ network continuous quality education up to 23 years of age, from kindergarten to getting a profession,” Nikonov said.

This school, too, is scheduled to open on September 1, 2026, but Nikonov said Respublika STEAM is a priority. “We’re all dependent on financial issues. We definitely have funds reserved for schools, but the STEAM school is more important because it is our commitment to the residents of the LCD,” he said.

He added that great attention is paid to ensuring safety: all 11 institutions of the A+ network will be provided with shelters. In schools under construction they are included in the projects, in existing schools they are adapted, if the existing solutions allow, or separate ones are built. In particular, two new shelters are being built for existing schools – for the elementary school in “Republic” and for the school in “Comfort Town”. The budget of each of the projects is UAH 70 mln.

KAN Development was established in 2001. The company’s portfolio includes Ocean Plaza, Respublika Park, Tetris Hall, Central Park, Comfort Town, Faina Town, Respublika, IQ Business Center and 101 Tower. For more than 20 years on the market, KAN Development has developed more than 3 million square meters of residential, retail and commercial real estate. The company is also actively developing its own network of “A+” educational institutions.