DTEK has signed a memorandum of understanding and business cooperation with the Croatian energy company HEP (Hrvatska elektroprivreda d.d.).

According to the company’s press release, the document signed in Split provides for cooperation in the field of energy trade, the implementation of joint projects in foreign markets, including investment in energy assets.

The first step in the framework of DTEK’s cooperation with HEP is the test supply of electricity by subsidiary of DTEK Hungary Power Trade in the amount of up to 2,500 MWh in October this year. Next year, the volume of trade may increase to 1.3 million MWh.

According to DTEK Director General Maksym Tymchenko, access to foreign markets and international partnership are one of the vectors of the company’s long-term strategy.

“Today we are already cooperating with more than 20 European companies in the field of energy trading, which confirms the status of DTEK as a reliable international partner. The signing of the memorandum of cooperation with HEP, the leader of the energy sector in Croatia, is another step in expanding our presence in European energy markets. We are considering it as another step towards the rapprochement of Ukrainian and European energy systems, which is the key to strengthening Ukraine’s energy security,” he said.

“Our partnership will make a significant contribution to the achievement of Croatia’s strategic goals, such as diversifying energy supplies and enhancing Croatia’s energy security and stability. In the field of renewable energy, both DTEK and HEP have made significant progress over the past few years. In the field of “green” energy we see great opportunities for intensive cooperation,” chairman of the board at HEP Frane Barbaric said.

Deputy Governor of the National Bank of Ukraine (NBU) Dmytro Sologub has said that grain harvest in Ukraine this year could reach 80 milion tonnes compared with 70.1 million tonnes in 2018. “This year, grain crops harvest in Ukraine could hit a record of 80 million tonnes, and this is not a coincidence, not a factor of favorable weather conditions, but rather an increase in the effectiveness of the agricultural sector, which has invested a lot in updating machinery and technologies in recent years,” the NBU said in a message on its Facebook page citing the deputy NBU governor.

In addition, according to Sologub, 80 million tonnes of grain is not the limit, and land reform can contribute to a significant increase in crop yields in the coming years.

As reported with reference to the Ministry of Agricultural Policy and Food, this year the harvest in Ukraine may reach 71.1 million tonnes (of which wheat – 27.8 million tonnes) compared to 70.1 million tonnes in 2018.

Agricultural companies operating on the Ukrainian market for over three years would be able to buy farmland which they lease as of the date of the opening of the market, October 1, 2029, Head of the Verkhovna Rada committee for agricultural policy and land relations Mykola Solsky (the Servant of the People parliamentary faction) has said.

“There are more than 1,300 enterprises that have been operating in Ukraine for years, investing in Ukrainian land, infrastructure, creating jobs, and belong, including to foreigners. For this category of legal entities, only those that have been engaged in agricultural business for at least three years in Ukraine, and only for the amount of land that they cultivate at the time the law comes into force, which they have in the contracts,” he said at a briefing in the Verkhovna Rada on Friday.

In the near future, the land committee intends to consider 11 land bills that are registered in the Rada, Solsky said.

According to him, the Ministry of Economic Development, Trade and Agriculture is currently considering the introduction of a limit on government support in the framework of budget support for 2020, estimated at UAH 4.4 billion, at the level of UAH 5 million per person or a group of affiliated persons.

Deputy Minister of Economy, Trade and Agriculture Taras Vysotsky, in turn, noted the need to include all the information about state-owned land in the register of the State Service for Geodesy, Cartography and Cadastre by August 1, 2020.

“By the end of the year, we will enter information on 1 million hectares of state-owned land, and before August we will have to add another 0.5 million hectares. We are in line with the schedule,” Vysotsky said.

He said that it is planned to hold 18 regional forums devoted to the land market.

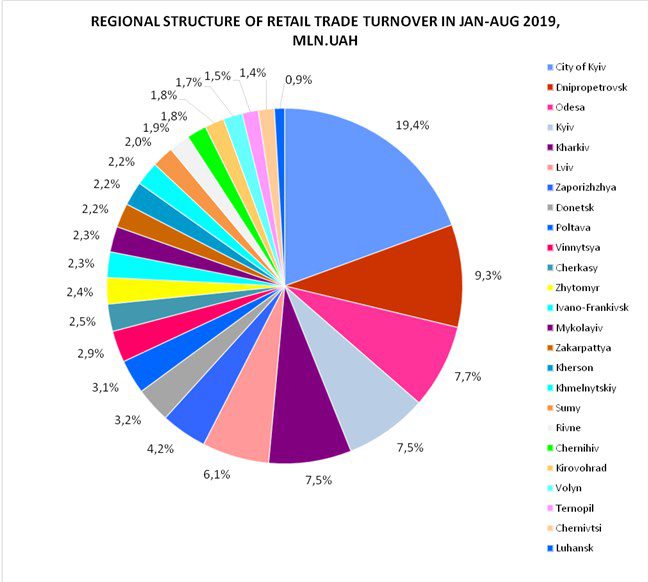

Regional structure of retail trade turnover in Ukraine in Jan–Aug, 2019

NJSC Naftogaz Ukrainy and its member companies paid UAH 83.7 billion in taxes and dividends to the national budget in January-September 2019, the company’s press service said.

Budget payments from the group accounted for about 15% of total budget revenue for the nine months of 2019, the company’s press service said.

As reported, in 2018 Naftogaz and its affiliated companies paid UAH 137.8 billion in taxes and dividends to the state budget in 2018, which was 27.2% more than in 2017. In particular, dividends were paid in the amount of UAH 29.5 billion, oil and gas production royalties totaled UAH 28.5 billion, VAT payments stood at UAH 37.4 billion, payments of corporate profit tax were UAH 23.9 billion.

Naftogaz brings together the country’s biggest oil and gas producers. It holds a monopoly on the transit of natural gas and its storage in underground facilities and on the transportation of crude oil by pipeline throughout Ukraine.

Permanent Representative of Ukraine to the European Union Mykola Tochytsky has discussed at a meeting with Special Envoy of the Ministry of Foreign Affairs of Lithuania Ričardas Degutis the organizational aspects of the preparation of the International Ukraine Reform Conference, as well as current issues of Ukraine-EU cooperation.

“On October 10, Ukraine’s representative to the EU Mykola Tochytsky met with Special Envoy of the Ministry of Foreign Affairs of Lithuania Ričardas Degutis, who is preparing the International Ukraine Reform Conference, which is scheduled to be held in Vilnius in 2020,” the press service of the Ukrainian mission in the European Union said.

Degutis emphasized the priority of the Conference, which is considered in Vilnius as part of the overall strategy to support the reform process in Ukraine.

In turn, Tochytsky thanked Degutis for the consistent support of Lithuania to Ukraine both at the bilateral level and within the EU, especially in the context of confronting Russian aggression and introducing systemic reforms in the state.