Ukrainian cheese makers are facing a decline in sales due to both the high price of Ukrainian cheese and rising imports, according to Infagro, an industry news and analysis agency.

“In March, cheese imports increased by more than 40%, and in April this figure may increase by another 15-20%. That is, the share of European cheeses again accounts for about a third of total cheese sales in Ukraine,” the analysts said.

They emphasized that the share of imports in Ukraine’s domestic market is still lower than before the war, but this should force producers to take measures to stay in their own market.

“Due to the devaluation of the hryvnia, cheese exports are becoming even more profitable. At the same time, exports of cheese products, for example, to Kazakhstan, are falling rapidly. Ukrainian cheese products have already been practically pushed out of the Kazakh market by Russian producers. If exports of cheese products to Kazakhstan stop, production will have to be significantly reduced,” Infagro predicts.

The Ministry of Education and Science of Ukraine has approved the distribution of 18.8 billion UAH of state budget expenditures among 134 state-owned higher education institutions, which fall under the management of the Ministry of Education.

According to the press service of the ministry, the amount of allocated state funds for each university is determined taking into account 5 main criteria that an educational institution must meet.

In particular, the main criterion of distribution is the contingent of applicants who study at the expense of the budget, as well as we are talking about such indicators as: scientific activity – the number of funds that the university has earned from the provision of scientific and technical, consulting services or received in the form of grants for scientific research; internationalization – place in international rankings or participation in European projects Erasmus+; employment – the percentage of employed graduates; regional coefficient – to support the educational institutions of the largest number of graduates in the country.

Thus, the most funds will go to: National Technical University Kyiv Polytechnic Institute named after Sikorsky (UAH 1,530.9 mln.), National University Lviv Polytechnic (UAH 980.1 mln.), National University of Bioresources and Nature Management (UAH 620 mln. ), Lviv Frank National University (UAH 568.4 million), National Aviation University (UAH 498.8 million), National Technical University “Kharkiv Polytechnic Institute” (UAH 496.6 million), Kharkiv National University named after Karazin (UAH 412 million).

“The MES is developing methodological recommendations on the use of the reserve, the amount of which amounts to UAH 504 million. It is envisaged that part of this reserve will be directed to solve problems related to the functioning of displaced educational institutions”, – stated in the message.

Bank-partner of the state program on affordable lending SKY Bank accredited for participation in the program “eOselia” housing complexes of DIM company, houses No. 4 and No. 6 in LCD LUCKY LAND and house No. 3 of LCD “Metropolis” in Kiev, reported in the press service of the developer.

“SKY BANK JSC welcomes the beginning of cooperation with the leading developer of the capital’s real estate market and continues to implement the strategic mission of the state preferential mortgage lending program “eOselia”, making it affordable for citizens to buy housing at the construction stage,” – quoted in the release Director of Retail Business, member of the Board of SKY BANK JSC Vladimir Chernenky.

Managing partner of DIM companies Alexander Nasikovsky said that DIM regularly receive requests from clients about the possibility of buying an apartment under the state program “eOsel”.

“Everyone should have a house – we are sure of it. Since the beginning of the year we have commissioned more than 1,000 apartments and are actively working on developing comfortable conditions for the purchase of housing for our clients, including working with the state program of affordable housing loans,” said Nasikovsky.

Lucky Land (Berkovetskaya Street, 6) is a residential complex of comfort class, designed as a multifunctional district with developed infrastructure. It assumes 23 buildings 13-14 floors high, 5183 apartments in total, with guest parking for 2,5 thousand and underground parking for 356 cars. Under the program “єOsela” available for mortgage one, two- and three-bedroom apartments with the area from 41 sq.m. in the house № 3, which has already received a certificate of readiness, and houses № 4, № 6, which are scheduled for commissioning in the third and fourth quarters of this year.

You can also buy an apartment under the “eOsel” program in building No. 3 of the Residential Complex “Metropolis” (ak.Zabolotnogo, 1), its planned date of commissioning in the third quarter.

Also available on “eOsela” apartments in the completed housing estate “New Autograph” (Kn. Roman Mstislavicha (Generala Zhmachenko), 26).

As reported, the program of affordable mortgage lending “eOsela” has worked in Ukraine since October 2022. For a preferential mortgage at 3% per annum for up to 20 years with a down payment of 20% of the cost of housing can be claimed by contract servicemen of the AFU, employees of the security sector and defense, medical workers, teachers, researchers.

From August 1, 2023, war veterans, combatants, internally displaced persons (IDPs) and citizens who do not have their own housing larger than the standard area can apply for participation in the “eOsela” program at 7%.

Eight partner banks are integrated into this program: Oschadbank, PrivatBank, Ukrgasbank, Globus Bank, Sky Bank, Ukreximbank, SENS and Bank Credit Dnipro. You can apply for participation in the program in the mobile application “Diya”.

As of April 30, the volume of loans issued under “eOsel” reached UAH 14.9 billion, loans were issued for 9613 families. At the same time, 2.9% of apartments were purchased on the primary market, 71.7% – on the secondary market, 25.4% – from developers.

DIM Group was founded in 2014 and consists of six companies covering all stages of construction. To date, it has commissioned 12 houses in six residential complexes with a total residential area of more than 218 thousand sq. m. Six residential complexes of “comfort +” and “business class” category are under construction: “New Autograph”, “Metropolis”, Park Lake City, Lucky Land, A136 Highlight Tower, Olegiv Podil.

At the end of 2023, they accounted for 18.6 percent of the total 181,370 foreigners in the state, as reported by the State Statistics Office in Halle on Thursday. Based on data from the Central Register of Foreigners. The second and third largest groups are people from Syria (15.9 percent) and Poland (7.8 percent). The number of foreigners in Saxony-Anhalt increased by 12,150 people from the end of 2022 to the end of 2023.

https://www.zeit.de/news/2024-05/02/ukrainer-sind-groesste-auslaendische-bevoelkerungsgruppe

PrJSC Ukrainian Financial Housing Company (Ukrfinzhytlo) plans to increase the share of loans for the purchase of property rights to housing under construction to 20-30% in 2024 and to 80% or more by 2028, according to the company’s strategic goals set out in its annual financial report for 2023.

According to the report on Ukrfinzhytl’s website, the financial plan for 2024 envisages a 16.5% increase in the volume of revenues from the company’s business activities compared to the 2023 target. By the end of 2024, it is planned to form a loan portfolio (the balance of debt under eHouse program agreements and financial leasing agreements) in the amount of UAH 29.9 billion (about 20 thousand loans).

In addition, in the second half of 2024, the state budget provides for additional capitalization of Ukrfinzhytl in the amount of UAH 20 billion, the document says. The company’s capital investments for 2024 are planned in the amount of UAH 44.3 million at the expense of its own funds.

Ukrfinzhytel’s strategic goals for 2024-2028 include providing housing for 50 thousand families, developing subprograms with central and local authorities, developing and launching a transparent housing construction financing scheme to protect investors’ rights, ensuring the de-shadowing of the rental housing market, etc.

According to the results of the last year, 6325 mortgage loans totaling UAH 9.5 billion were issued during the operation of the eHouse program and by the end of 2023. 83.6% or 5289 loans were issued to privileged categories of citizens at 3% per annum, 16.4% or 1036 loans to other categories at 7%. The leader was Oschadbank, which lent 43% of the program’s clients, and most of the apartments under the program were purchased in Kyiv, Kyiv, Rivne, Volyn and Chernihiv regions, the document says.

Earlier, Yevhen Metzger, Chairman of the Board of Ukrfinzhytl, announced the company’s plans to gradually leave the secondary real estate market and focus on the primary market.

As reported, the affordable mortgage lending program eHouse was launched in Ukraine in October 2022. Contract servicemen of the Armed Forces of Ukraine, employees of the security and defense sector, healthcare workers, teachers, and researchers can apply for a preferential mortgage at 3% per annum for up to 20 years with a down payment of 20% of the cost of housing.

Starting from August 1, 2023, war veterans, combatants, internally displaced persons (IDPs) and citizens who do not have their own housing larger than the standard area can apply for the eHouse program at a 7% discount.

Eight partner banks are integrated into this program: Oschadbank, PrivatBank, Ukrgasbank, Globus Bank, Sky Bank, Ukreximbank, SENS and Bank Credit Dnipro. You can apply for participation in the program in the Diia mobile application.

As of April 30, the volume of loans issued under eHousing reached UAH 14.9 billion, with loans issued to 9,613 families. At the same time, 2.9% of apartments were purchased on the primary market, 71.7% on the secondary market, and 25.4% from developers.

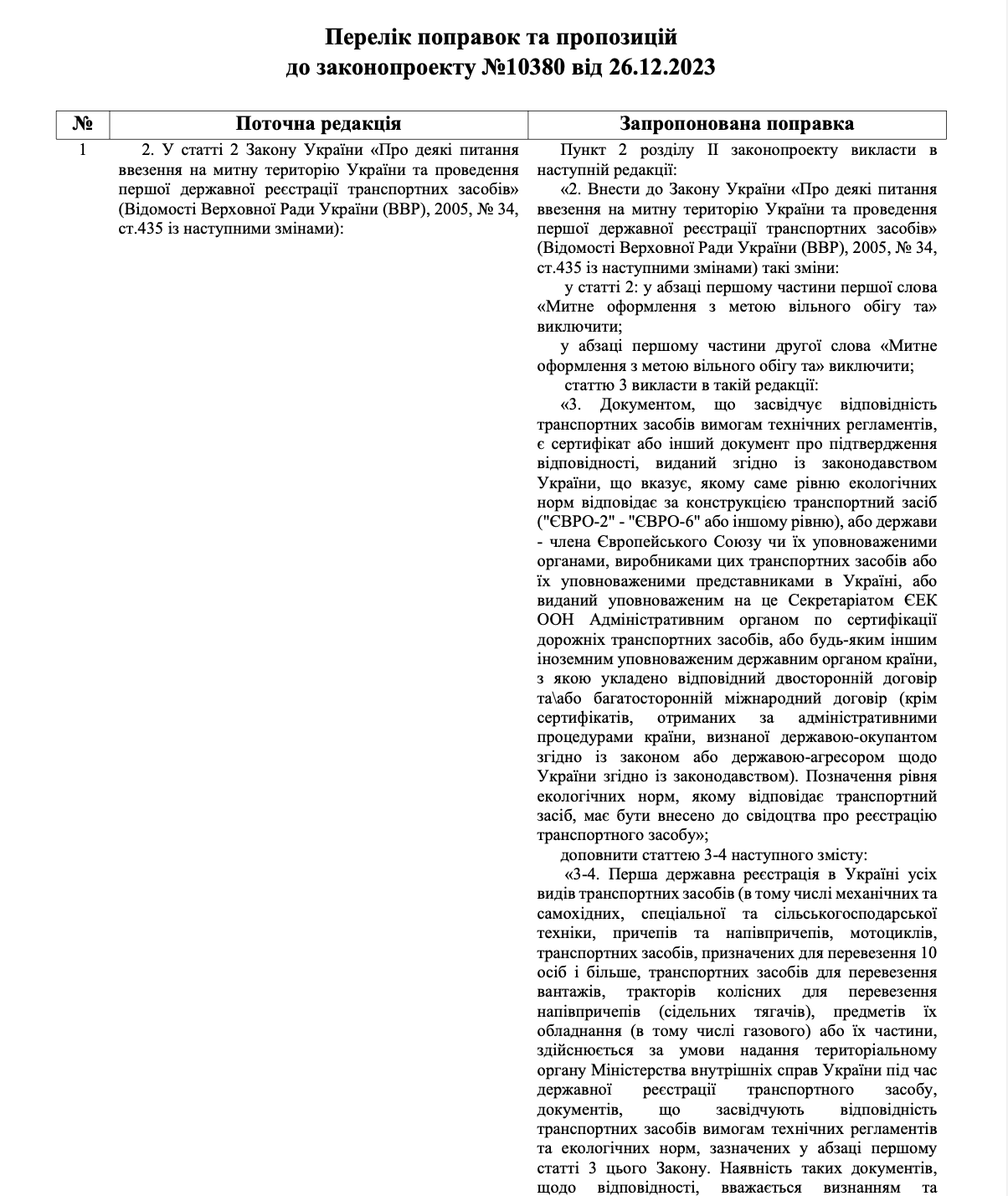

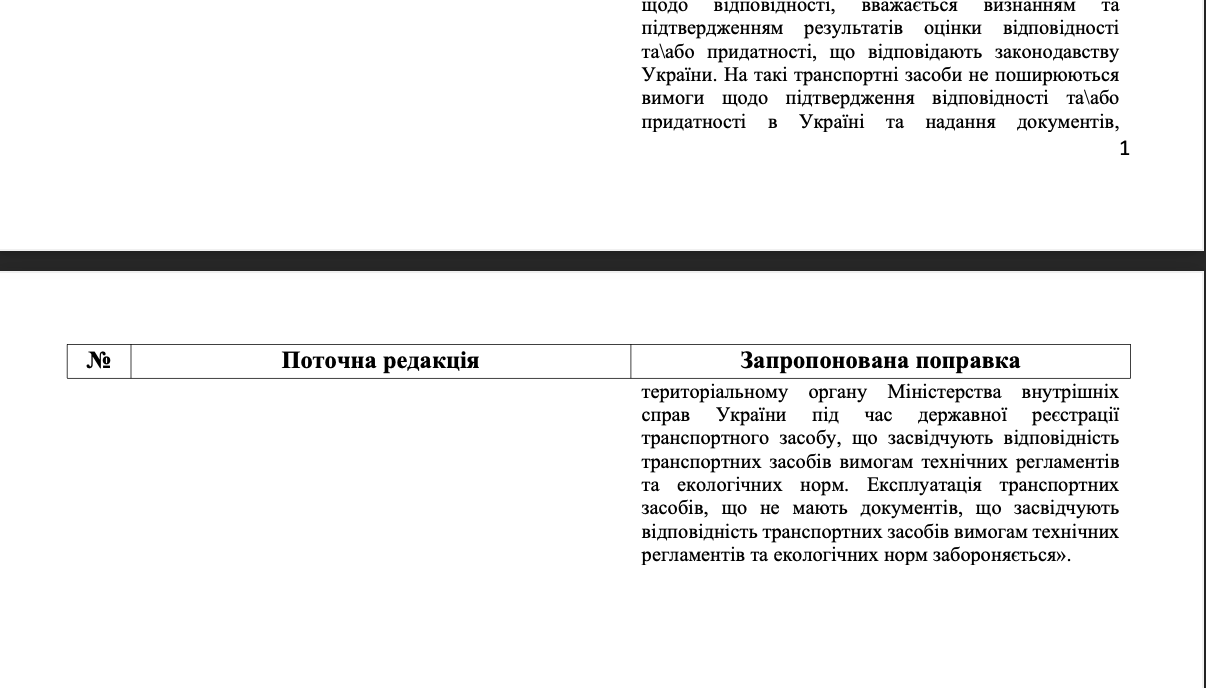

MP Marian Zablotskyi proposes to add to the draft law on customs clearance of cars through Diia a permit for mass importation of junk cars into Ukraine without any technical condition checks.

People’s Deputy Marian Zablotskyi is trying to allow the import of junk cars to Ukraine without any checks, which are banned from the EU and the US due to their poor technical condition and danger to drivers and passengers. As it became known, Zablotskyi proposes to add the relevant amendments to the draft law 10380 on customs clearance of cars through Diia, which was adopted as a basis. As a reminder, the idea of the MP’s colleagues in the faction and the Ministry of Digital Transformation was to simplify the procedure for customs clearance of cars, not to cancel technical condition checks.

Earlier, the MP’s attempts to introduce uncontrolled import of cars by introducing draft laws 9460 and 9210 were stopped in time in the committees on economic policy and law enforcement, and the Government concluded that such ideas of Marian Zablotskyi would harm Ukraine’s European integration, economy and road safety.

In particular, the Ministry of Economy, in its opinion on Draft Law 9460, emphasized that its adoption would negatively affect Ukraine’s fulfillment of its obligations under the Association Agreement, as the introduction of unilateral recognition of conformity assessment results conducted in EU member states would offset the results achieved in the negotiation process on the conclusion of the Agreement on “industrial visa-free regime” in the first priority sectors of industrial products – machinery. As for the consequences for citizens and businesses, the Ministry of Economy stated them very simply: higher car prices. The Ministry also noted that registering a vehicle in countries where minimum safety requirements apply cannot be equated with assessing compliance with the requirements in force in Ukraine. That is, draft law 9460 could have led to an increase in road accidents.

However, Zablotskyi is again trying to push the same proposals – this time to draft law 10380.

As you know, in the EU and the US, the main reasons for deregistering and selling a car are that it has high mileage or has been involved in an accident. Often, due to the high mileage, these cars have their engines replaced, catalytic converters and particulate filters removed due to their failure before they even get to Ukraine. Thus, a car that was once registered in the EU or the US and a car that later entered Ukraine are completely different cars in terms of safety and environmental parameters.

Thus, if Zablotskyi’s amendments are adopted, vehicles that do not meet the requirements of the technical regulations will be imported into Ukraine en masse, and without undergoing a certification procedure or any inspection of the technical condition of the vehicle, they will be registered and allowed to participate in road traffic, which will lead to an increase in the number of accidents on Ukrainian roads, as the technical condition will not be controlled.