Global stainless steel production in 2023 increased by 4.6% compared to 2022 to 58.444 million tonnes, while production declined in all major regions except China, according to a press release from the World Stainless Association (formerly the International Stainless Steel Forum (ISSF)).

According to the information, in Europe last year, stainless steel production decreased by 6.2% to 5.902 million tons by 2022, and in the United States – by 9.6% to 1.824 million tons.

In Asia (excluding China and South Korea), stainless steel production decreased by 7.2% to 6.880 million tons, while in China it increased by 12.6% to 36.676 million tons.

Other regions (Brazil, Russia, South Africa, South Korea and Indonesia) recorded a 5.2% decline in production to 7.163 million tons.

As reported, global stainless steel production in 2022 decreased by 5.2% to 55.255 million tons. At the same time, in Europe in 2022, production decreased by 12.4% to 6.294 million tons, and in the United States – by 14.8% to 2.017 million tons. In Asia (excluding China and South Korea), stainless steel production decreased by 4.9% to 7.411 million tons, while in China it fell by 2% to 31.975 million tons.

Other regions recorded a 9.1% decline in production to 7.557 million tons.

International agricultural research company Corteva Agriscience and state-owned Oschadbank (Kyiv) are expanding their partnership lending program to Ukrainian agricultural producers to enable them to purchase the company’s crop protection products on favorable terms, the company’s press service said.

According to the press release, under the terms of this lending program, farmers can purchase sunflower, corn and winter rape seeds of premium genetics of the Pioneer® brand at reduced rates.

Farmers wishing to purchase Corteva plant protection products in the amount of UAH 200 thousand or more can take out a loan with an interest rate of 0.01% per annum in UAH, depending on the repayment schedule, loan term and availability of collateral. There is no loan disbursement fee. The maximum loan term is 12 months. To apply, farmers should contact Corteva representatives in their region.

Borrowers under this program will provide Oschadbank with a simplified list of documents and can expect priority consideration of their application, as well as a shorter time for making a loan decision.

“Launched in February, Corteva’s program of lending at reduced rates for the purchase of Pioneer seeds in partnership with Oschadbank was well received by farmers, so we are pleased to welcome the willingness of our partners to expand the program to give farmers better access to Corteva’s advanced crop protection products,” explained Elena Dunina, Financial Head of Corteva Agriculture in Ukraine, Central Asia and the Caucasus.

“The agricultural sector suffered significant losses during the war. The State Bank considers it its mission to support agrarians and provide them with the most extensive package of opportunities. (…) Thanks to the simple and flexible terms of the Corteva partnership program, agricultural producers can get a loan at reduced rates, replenish working capital and optimize costs,” said Natalia Butkova-Vitvitska, Oschadbank Board Member in charge of micro, small and medium-sized businesses.

Corteva Agriculture is a global agricultural company. It offers comprehensive solutions to maximize yields and profitability. It has more than 150 research facilities and more than 65 active ingredients in its portfolio.

The company’s presence in Ukraine includes the headquarters in Kyiv, a research center in Liubartsi village (Kyiv region) and a seed production complex in Stasi village (Poltava region).

In April 2022, the company decided to leave the Russian market due to the full-scale war against Ukraine waged by Russia.

According to the National Bank of Ukraine (NBU), as of February 1 this year, Oschadbank ranked second in terms of total assets (UAH 369.56 billion) among 63 banks operating in the country.

agricultural producer, CORTEVA AGRISCIENCE, LENDING, OSCHADBANK

The Polish Agricultural and Food Products Quality Inspectorate (IJHARS) in Rzeszów has issued a decision to ban two batches of sponge cakes with a total weight of 10.55 thousand tons imported from Ukraine from circulation on the Polish market.

According to the inspection’s post on Monday on the social network X, the decision was made due to incorrect labeling.

The decision was immediately implemented.

As reported, on April 9 in Rzeszow, the IJHARS issued a decision to ban the circulation on the Polish market of three batches of lambs weighing 5.34 thousand tons imported from Ukraine.

A few days earlier in Lublin, three batches of ice cream with a total weight of 8.48 tons imported from Ukraine were withdrawn from the Polish market due to defrosting.

In early April, the Polish Trade Inspectorate announced the largest fine in its history of PLN 1.5 million (about $380 thousand) imposed on an importing company for importing 11.5 thousand tons of technical rapeseed and feed wheat from Ukraine as counterfeit products for further use as food. In addition, it was decided to ban the import of 57.66 tons of tomato paste from Ukraine due to the presence of mold.

In March, IJHARS Chief Inspector Przemysław Rzodkiewicz said that over the past year, 1.4% of the consignments from Ukraine inspected by the commission at the border were rejected.

The survey, conducted by Active Group in cooperation with the Experts Club think tank, revealed citizens’ attitudes to various aspects of social and economic life in Ukraine, including the initiative to refund part of the cost of Ukrainian goods, the government’s influence on business, the level of trust in law enforcement, financial stability of citizens, and forecasts for the hryvnia exchange rate.

A significant proportion of respondents (44%) have heard of the initiative to refund the cost of purchasing Ukrainian goods, with opinions divided on its impact on living standards. Most respondents believe that the government will increase taxes to finance this initiative.

According to Andriy Yeremenko, founder of the sociological research company Active Group, this raises concerns among the population, as most are not ready for an increase in the fiscal burden.

The study also revealed a deep distrust of government institutions (57% of citizens) and law enforcement agencies (62%) in the context of relations with business, in particular due to the lack of transparency and efficiency of their work. The majority of respondents believe that the state hinders rather than helps business to develop, and this trend has increased compared to previous months.

A significant number of Ukrainians (up to 60%) are experiencing financial difficulties, including increased debt and lack of savings for a rainy day. Respondents also expressed concern about the future of the hryvnia exchange rate, with the majority (55%) expecting it to fall.

In the context of utility bills, the vast majority (67%) of respondents believe that the level of tariffs is too high, which further emphasizes the general dissatisfaction with the financial situation and government policy in this area.

According to Oleksandr Poznyi, Director of Active Group, these results demonstrate the serious challenges faced by Ukrainian society in the context of the war and the current economic situation.

Earlier, Maksym Urakin, the founder of the Experts Club think tank, noted that in 2024 Ukraine’s public debt may exceed GDP for the first time, which poses significant risks to economic stability in the country.

For more details, please see the video at the link:

https://www.youtube.com/watch?v=8hkvHhyzGLQ

You can subscribe to the Experts Club channel here:

ACTIVE_GROUP, ANDRIY_EREMENKO, ECONOMY, EXPERTS_CLUB, OLEXANDR_POZNYI, POLITICS, SOCIOLOGY, TAXES, URAKIN

ArcelorMittal Kryvyi Rih’s Kryvyi Rih Mining and Metallurgical Plant (AMKR, Dnipro region) has completed an extended overhaul of blast furnace No. 6, which lasted 296 days and took place in difficult military conditions.

According to the company, the overhaul will increase the reliability of the furnace equipment, reduce operating costs, save energy, and help reduce the industrial environmental footprint.

The furnace has been repaired and is awaiting an order to put it into operation. The relevant documents are currently being processed. This is the first time that the sixth blast furnace has been repaired in the second category since 2015, when this metallurgical unit was reconstructed and environmental protection measures were implemented. In the period from 2015 to 2023, the blast furnace underwent only a few third-category repairs due to the replacement of the backfill apparatus and minor maintenance work.

It is specified that the main stages of this repair were the removal of residual charge materials and spent refractory lining, replacement of the charging apparatus, design lining of the blast furnace shaft, which used about 980 tons of refractory bricks, restoration of the furnace, and replacement of the cooling plates of the furnace shaft cooling system. More than half of the refrigeration plates – 364 pieces – have been renewed; these plates, as well as most of the other spare parts, were manufactured by LMZ specialists. The furnace shaft was lined by the specialists of Steel Service PE. Repair work was also carried out by contractors and repair departments of our enterprise.

“Restoration work was also carried out on the blast furnace hearth. The hearth is the lower part of the blast furnace where the smelting products – liquid iron and slag – are accumulated and where the devices for their release are located. When the blast furnace is in operation, the horn is exposed to high temperatures and considerable pressure, so it is important that it can withstand a heavy load – it must be strong and stable. During the repair, it was reliably restored with imported refractory materials,” explains Sergey Losyuk, Deputy Head of BF No. 1 for Mechanical Equipment.

In addition, BF No. 6 repaired the hydraulic equipment in the casting yard, the charge feeding system, and the blast furnace top. At the same time, the first category of air heater No. 2 was repaired. This will allow the blast furnace to maintain the required thermal conditions with maximum coke savings during operation.

A significant amount of work was done to repair the electrical equipment and automation of BF-6. The blast furnace’s aspiration units have been repaired to capture harmful emissions and help improve the environment.

“Military conditions affected the progress of the work. We had to solve logistical issues of delivering new materials and equipment. As for air raid alerts, we have all learned to work as safely as possible under the sirens. Nevertheless, we have accomplished everything we planned,” said Vladislav Polishchuk, head of DC No. 1.

Earlier, Mauro Longobardo, the company’s CEO, announced his intention to launch another blast furnace in April, and the plant will operate two blast furnaces, at about 50% of its pre-war capacity.

“ArcelorMittal Kryvyi Rih is the largest rolled steel producer in Ukraine. It specializes in long products, including rebar and wire rod.

ArcelorMittal owns the largest mining and metallurgical plant in Ukraine, ArcelorMittal Kryvyi Rih, and a number of small companies, including ArcelorMittal Berislav.

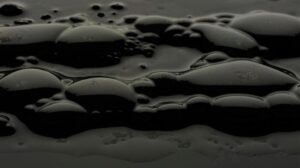

Oil prices resumed their rise on Friday amid a new wave of fears about a possible Iranian attack on Israel.

Earlier, the United States and its allies warned of a high probability of an Iranian attack on government and military targets in Israel in response to the strike on the Iranian embassy in Syria.

The Wall Street Journal reported on Thursday, citing informed sources, that the attack will take place in the next 24-48 hours.

The cost of June futures for Brent on the London ICE Futures exchange as of 8:05 a.m. is $90.22 per barrel, which is $0.48 (0.53%) higher than at the close of the previous trading. On Thursday, these contracts fell by $0.74 (0.8%) to $89.74 per barrel.

Futures for WTI for May in electronic trading on the New York Mercantile Exchange (NYMEX) have risen in price by this time by $0.61 (0.72%) to $85.63 per barrel. As a result of previous trading, the value of these contracts fell by $1.19 (1.4%) to $85.02 per barrel.

“The threat of Iranian intervention is likely to support the upward trend in oil prices,” said Charu Chanana, an analyst at Saxo Bank Capital Markets in Singapore. – “However, the upward trend in the market will be jeopardized if the escalation of geopolitical risks is avoided.

Traders’ attention on Friday is also focused on the International Energy Agency’s (IEA) monthly review of the oil market.