More than 160 thousand vehicles were imported to Ukraine in 5 months of 2024, according to the Ministry of Internal Affairs (MIA). Only 28% of imported cars in 2024 were new.

160,750 vehicles were imported to Ukraine in 5 months of 2024. This is 21% more than in the same period in 2023.

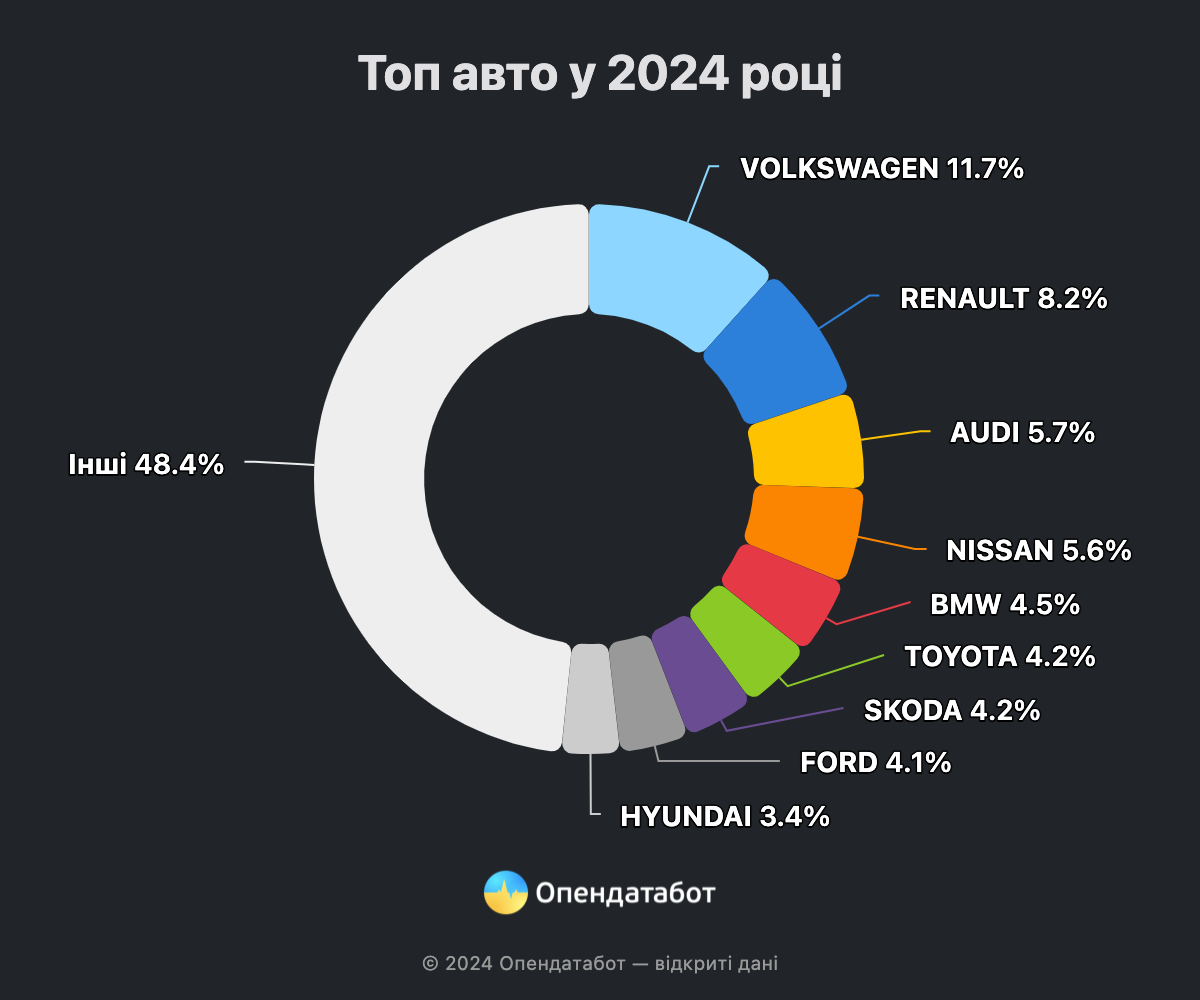

The most popular brand among all imported cars this year was VOLKSWAGEN – 18,771 cars or 11.7% of the total. RENAULT was in second place with 13,187 vehicles (8.2%), and AUDI took third place with 9,137 cars (5.7%). The most popular models among imported cars were SKODA OCTAVIA, VOLKSWAGEN GOLF and PASSAT.

Gasoline cars remain the most popular – almost every second imported car. Diesel cars accounted for 29% of cars imported this year. Electric cars accounted for 12.9%.

72% of all imported cars this year were used. Currently, the average age of imported cars is 10 years.

The largest number of newly imported cars was registered in Kyiv – 13.9%. Lviv (10.2%) and Odesa (7.5%) regions are also in the top 3.

https://opendatabot.ua/analytics/autoimport-2024-5

In 2022-2023, Metinvest Mining and Metallurgical Group invested UAH 23 billion in the modernization of Kametstal and Zaporizhstal steel plants and the green transformation of the enterprises.

Metinvest’s Chief Operating Officer (COO), Oleksandr Myronenko, said during the discussion “The largest wartime investors: a look into the future” at the Forbes Ukraine forum “Money for Victory” that the company’s priority areas for investment in 2024-2025 are employees, equipment and assistance to the Ukrainian Armed Forces.

“We have three key priorities. The first is our employees. The second is equipment and production sites. And the third is to support the Armed Forces. Especially in the cities where our enterprises are located. These are Zaporizhzhia and Pokrovsk, located 40 kilometers from the front line. We must support the units that defend these cities,” said Mr. Myronenko.

He added that the company’s employees are paid an increased bonus, which reaches 20-50% of their salary, and that starting May 1, salaries were increased by up to 20% depending on their specialty.

Metinvest’s COO noted that in 2024, the company plans to invest $320 million in capital and about $350 million in operating investments in equipment and work sites.

“These are investments aimed at maintaining our equipment: repairs of blast furnaces and sintering machines, maintenance of equipment at mining and processing plants and development of mine management in Pokrovsk,” explained the top manager.

According to him, the company is currently operating at 65%-70% of its capacity. “And we clearly understand that when the hostilities end and the infrastructure is fully restored, we will need to accelerate – at the expense of people and equipment,” he said.

Mironenko added that the company has already allocated more than UAH 6 billion for humanitarian and military support to Ukraine since the start of the full-scale war. And now Metinvest is allocating about UAH 200 million a month to build fortifications and support brigades from Dnipro to Donetsk.

“We have a clear strategy for the development of Ukrainian and foreign enterprises. Now it is very difficult to persuade banks to finance any projects in Ukraine. We estimate the full transition of Ukrainian enterprises to green metallurgy within 10 years after the end of the war at about $9 billion,” the COO said.

He also said that the company would not be able to implement such a project on its own and would need to attract external financing. Since this option is currently not possible, Metinvest is considering a joint project with Danieli to build a steel plant in Italy, with an estimated investment of about $2 billion.

“The Ukrainian economy will benefit from the implementation of such a project. We will be producing energy-efficient green steel at a very low cost because we have our own resource – iron ore in Kryvyi Rih. From this point of view, we believe that the Ukrainian-Italian joint venture will be much more efficient than a European-only production facility and will be able to compete with European producers,” said Mr. Myronenko.

Metinvest’s COO also noted that the company’s operations are currently being negatively affected by the mobilization of personnel, as one in six employees is serving in the Armed Forces. “This is a big challenge in relations with the government. And it has a bigger impact on our operations than any commercial disputes,” the top manager stated.

He also emphasized that Metinvest buys equipment, drones, electronic warfare devices, etc. for the Armed Forces of Ukraine. There are also two proprietary developments that the group has already codified and certified with the Ministry of Defense and will now begin official deliveries. These are corrugated steel shelters and mine trawls that are installed on tanks.

The SSO clarified that the shelters produced by Metinvest are half the price of those currently purchased by the country, and the situation with mine trawls is about the same.

“The second thing we do is to make anti-submarine shelters for equipment. For example, Abrams, which are now fighting in the Donetsk sector, will be completely covered with our anti-water nets, and this will enhance their protection. We are also developing and already installing such shelters on Soviet-made T-64 and T-72 tanks. And there are many other things we are doing to make our soldiers feel protected,” summarized Mr. Myronenko.

“Metinvest is a vertically integrated group of steel and mining companies. Its enterprises are located in Ukraine – in Donetsk, Luhansk, Zaporizhzhia and Dnipro regions, as well as in Europe.

The main shareholders of the holding are SCM Group (71.24%) and Smart Holding (23.76%), which jointly manage it. Metinvest Holding LLC is the management company of Metinvest Group.

METINVEST, MODERNIZE, steel plants, ZAPORIZHSTAL, Каметсталь

On Thursday, the European Union will hold elections to the European Parliament (EP), which will last until June 9.

The Netherlands will hold elections on June 6. Ireland – on June 7. Latvia, Malta, and Slovakia – on June 8. The Czech Republic will vote on two days: June 7 and 8, and Italy – June 8 and 9. The rest of the EU states are holding elections on June 9.

More than 370 million European citizens are eligible to vote in 27 EU countries to elect 720 members of the European Parliament.

These elections are held in one round and are intended to determine the national contingents of representatives – members of the European Parliament. Voting is conducted on full lists of candidates nominated by political parties or coalitions. Lists that do not receive 5% of the votes do not get into the EP.

The first estimates of the new composition of the European Parliament will be published on June 9 around 20:15-20:30 Brussels time (21:15-21:30 Kyiv time). The preliminary results are expected between 23:15 and 23:30 (00:15 and 00:30 CET, June 10).

The EP plenary session is scheduled for July 16-19 in Strasbourg. The elected MEPs will gather to structure political factions, elect the leadership of the European Parliament and distribute other organizational posts.

After that, the leaders of the EU countries and the European Parliament will elect the President of the European Commission (EC) and form the EC Executive Board – 27 European Commissioners.

In order to be elected as the head of the EC, a candidate must first receive the support of a qualified majority of the leaders of the 27 EU countries. After that, he or she must receive at least 361 votes from the 720 new members of the European Parliament.

The current head of the European Commission, Ursula von der Leyen, has already announced her desire to run for a second presidency. In early March, the center-right European People’s Party, which has the largest faction in the European Parliament, approved her candidacy for a second term as head of the European Commission during the Congress.

Earlier, Experts Club presented an analytical material on the most important elections in the world in 2024, more detailed video analysis is available here – https://youtu.be/73DB0GbJy4M?si=eGb95W02MgF6KzXU

You can subscribe to the Experts Club YouTube channel here – https://www.youtube.com/@ExpertsClub

According to preliminary estimates of the National Bank of Ukraine (NBU), Ukraine’s international reserves in May decreased by 7.9%, or $3.4 billion, to $39 billion 033.8 million.

“This dynamics is due to the NBU’s foreign exchange interventions to ensure exchange rate stability and the country’s debt payments in foreign currency, which were partially offset by proceeds from the placement of foreign currency domestic government bonds (foreign currency government bonds) and from international partners,” the NBU website explained on Thursday.

Earlier, the Experts Club think tank and Maxim Urakin released a video analysis of the macroeconomy in Ukraine and globally, more detailed video analysis is available here – https://youtu.be/P_-qI9k9Xjc?si=nIQFriaWTYRqdvkU

The National Bank clarified that in April, its net sales of foreign currency amounted to $3.08 billion, which is 30.7% more than in the previous month: The NBU sold $3.09 billion in the foreign exchange market and bought back $11.1 million in reserves.

“This is due to the growth in demand in the foreign exchange market, primarily against the backdrop of increased government spending due to the rhythmic flow of foreign aid in March-April,” the central bank explained the dynamics.

In addition, the current volume of reserves was affected by revenues in favor of the government and payments for servicing and repaying public debt.

In May, $143.1 million was transferred to the foreign currency accounts of the Cabinet of Ministers, while $412.3 million was allocated for the servicing and repayment of the public debt.

It is noted that Ukraine also paid $240.8 million to the International Monetary Fund (IMF).

The central bank added that the volume of reserves was positively affected by the revaluation of financial instruments, adding $216.1 million.

“The current volume of international reserves provides financing for 5.1 months of future imports,” the regulator said.

As reported, Ukraine’s international reserves in April decreased by 3.1%, or $1.4 billion, after reaching a historic high of $43 billion 762.7 million in late March due to record external receipts of more than $9 billion for the month.

On April 25, the NBU raised its reserve forecast for the end of this year to $43.4 billion from $40.4 billion and to $44.3 billion from $42.1 billion at the end of next year.

Earlier, Experts Club and Maksym Urakin released a video analysis on the macroeconomy of Ukraine and the world in 2024, more detailed video analysis is available here – https://youtu.be/P_-qI9k9Xjc?si=nIQFriaWTYRqdvkU

Sukha Balka mine (Kryvyi Rih, Dnipropetrovs’k region), part of Aleksandr Yaroslavsky’s DCH Group, commissioned a new longwall at Yubileynaya mine in early May.

According to the DCH Steel corporate newspaper, on Thursday, May 8, miners of the 17th section carried out the first explosion in block 34-36, located on the 1st floor of the Gnezdo 1-2 deposit at a horizon of -1420 m. Ore reserves in the block amount to 244 thousand tons.

“Thanks to the high quality of ore, the mine operated steadily in May and ensured stable operations in June,” the company said in a statement.

It also specifies that self-propelled equipment, namely a DERUI loading and delivery machine, was used to perform the cutting operations.

“The mine employees made every effort to deliver the block on time and with a good grade. Thanks to this, Yubileynaya Mine can confidently work on ore production in the near future,” said Vladimir Moiseichenko, head of the mine’s production department.

It is also reported that in the first quarter of 2024, the mine increased the payment of taxes and fees to the budgets of all levels by 45% to UAH 81 million compared to the same period last year. At the same time, the rent for the use of subsoil for mining increased significantly, by almost 2.5 times to UAH 42.5 million. The amount of the unified social tax remained at the level of the first quarter of 2023 and amounted to UAH 16.4 million.

Sukha Balka mine is one of the leading mining companies in Ukraine. It produces iron ore by underground mining. It includes Yubileynaya and Frunze mines.

DCH Group acquired the mine from Evraz Group in May 2017.

According to the third quarter of 2023, Yaroslavsky, who is designated as a non-resident of Ukraine (British citizen – IF-U), directly owns 77.4193% of the mine’s shares, while resident individual Artem Aleksandrov owns 20%.

The authorized capital of Sukha Balka PrJSC is UAH 41.869 million, with a share par value of UAH 0.05.

Ukrainian tech retailer Foxtrot reported a 35% increase in turnover in the first quarter of 2024 compared to the same period last year.

“The market of household appliances and electronics has recovered almost to pre-war levels. We see this in numbers and as the number of our customers grows (almost 220 thousand in three months), their needs and expectations from the company change. Therefore, our goal is to be close to them and offer the most profitable and convenient solutions while remaining a socially responsible business and employer, supporting our defenders and civilians,” Foxtrot CEO Oleksiy Zozulya was quoted as saying in the company’s release.

According to the company’s press service, this spring, the share of online sales increased by 20%, and Foxtrot.ua traffic grew by 21%.

In general, the largest growth is demonstrated by the categories of large (+51%), small (+44%) household appliances and TVs (+34%). According to the company’s analysts, this indicates a moderate increase in consumer sentiment, when most Ukrainians have adapted to wartime conditions and buy not only household essentials, but also coffee machines, washing machines, and TVs.

In the first quarter of 2024, Foxtrot opened four new stores in Chernihiv, Stryi (Stryi City shopping center), Odesa (Ostrov shopping center), Kryvyi Rih (Victory Plaza shopping center), and reopened a store in Dnipro in the Appolo shopping center after a missile attack.

In the first quarter of 2024, Foxtrot paid UAH 207 million in taxes and fees to the state budget. The amount of assistance to the Ukrainian Defense Forces increased by UAH 8.5 million. In addition to the current monthly deliveries of equipment to the defenders, in March the company initiated an additional purchase of 60 FPV drones for a total of UAH 1 million for three combat units of the Armed Forces of Ukraine. Currently, Foxtrot’s total contribution to the country’s defense capability is UAH 35 million.

“Foxtrot is one of Ukraine’s largest omnichannel retail chains in terms of the number of stores and sales of electronics and home appliances.

By the end of May, Foxtrot was represented by 124 stores in 67 cities of Ukraine, including the only major electronics retailer in Kherson, Kramatorsk, Sloviansk and Pokrovsk, which are located near the frontline. Currently, 100% of the stores are energy-independent, which makes it possible to operate uninterruptedly during power outages.

The Foxtrot brand is developed by the Foxtrot group of companies. The co-founders are Valery Makovetsky and Gennady Vykhodtsev.