Ukrgasvydobuvannya JSC has commissioned a new well with a flow rate of 107 thousand cubic meters of gas per day, the company reported on Facebook.

The appraisal and production well with a depth of 3715 meters was drilled by the Shebelynka drilling department at the old gas condensate field, which has been developed since 1978. Despite this, the field has significant residual reserves of more than 0.9 billion cubic meters of gas.

“This well has achieved a high flow rate due to the stimulation measures taken, including three stages of hydraulic fracturing. The well was completed using a coiled tubing unit,” said Serhiy Lagno, Head of UGV.

As reported, in 2023, Ukrgasvydobuvannya launched 86 new wells, 24 of which had an initial flow rate of more than 100 thousand cubic meters, and in January-May 2024, 36 new gas wells, 11 of which are highly productive.

In 2022, UGV produced 12.5 billion cubic meters of natural gas (commercial), which is 3% less than in 2021. In 2023, the company produced 13.224 bcm of commercial gas, which is 0.679 bcm more than in 2022.

“In January-June 2024, Ukrgasvydobuvannya increased natural gas (commercial) production by 8.8% compared to the same period in 2023 – up to 6.913 bcm.

NJSC Naftogaz of Ukraine owns 100% of Ukrgasvydobuvannya shares.

Ukrzaliznytsia JSC (UZ) will purchase 10 thousand tons of diesel fuel from state-owned Ukrnafta PJSC following the fourth tender for the purchase of diesel fuel through Prozorro Market, the company said in a telegram on Wednesday.

According to the release, Ukrnafta offered the best price of UAH 50.97 thousand per ton.

It is noted that Ukrzaliznytsia will sign a contract with the winner in the near future. It is specified that all diesel should be painted to prevent theft.

Earlier, UZ has already purchased 25 thousand tons of diesel fuel through Prozorro Market at prices of UAH 50.5 – 52.9 thousand per ton. The company notes that, taking into account the Platts indices at the time of the selection of the winners, this corresponds to the prices of direct contracts with European producers, including all related costs for delivery and customs clearance.

In particular, in June 2024, Ukrnafta was awarded contracts for the supply of 15 thousand tons. In July, the winner of the tender for 10 thousand tons was Sokar Ukraine Trading House LLC.

It is noted that both winners at the stage of their registration in the electronic catalog of the electronic procurement system were qualified by the Professional Procurement State Enterprise and guaranteed that their products were not of Russian, Belarusian or Iranian origin.

As reported, UZ used to buy diesel directly from European producers, but in April 2024, after amendments to a government decree, the company no longer has this option and can only buy diesel through Prozorro.

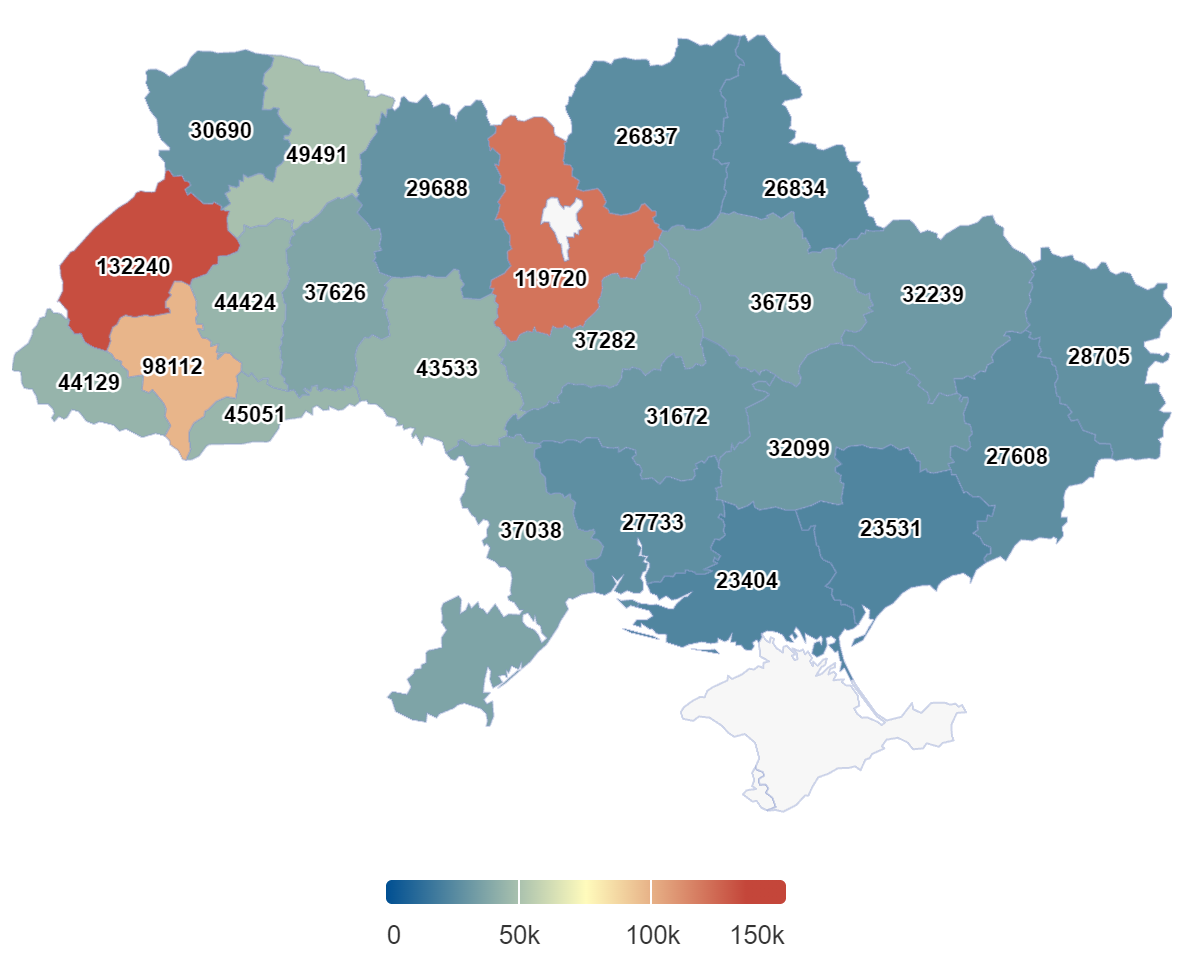

Average price per hectare of land in 2023, UAH

Source: Open4Business.com.ua

We understand that the issue of security in residential complexes, including social infrastructure, requires a comprehensive approach.

That is why in our projects we apply a three-level security system, namely: personal security (closed area, access control system, video surveillance and security), energy security (enhanced means of automation of engineering communications, use of alternative energy sources (if necessary), as well as design of geothermal pumps for apartment construction, which reduces heating consumption by at least 40% and energy consumption by about 35 kWh per square meter), and social security,” says the company. This, as the practice of already inhabited houses shows, removes a lot of domestic issues and cohabitation on the territory.

Social facilities are not isolated in time and space point developments (schools, kindergartens, development centers, community centers), but part of our living ecosystem. Therefore, they are fully designed according to our approaches and values: well-thought-out ergonomics of living space, high level of energy efficiency (achieved, for example, through double-glazed windows with a new generation of high-quality glass with magnetron sputtering, which allows sunlight to penetrate into the room while not letting the sun’s heat through, durable heat-resistant mineral wool from the global brand Rockwool, which provides an optimal internal microclimate without interfering with the natural diffusion of excess water vapor and demonstrating high thermal insulation properties), aesthetics and service of the highest level.

Currently, our portfolio of large social facilities includes kindergartens and schools at various stages of implementation, and we already know the operators – KMDS (Lucky Land residential complex) and an elementary school in the Park Lake City multifunctional cluster (British International School in Ukraine), a community center for neighbors in Park Lake City with a restaurant and several attraction areas, where everyone will find something for everyone. A bilingual kindergarten will also be located in Park Lake City. It will be a two-storey institution with an area of almost 3 thousand square meters, designed for 180 children aged 3 to 5 years.

In total, we will have 6 kindergartens in Lucky Land, so we have enough work to do. We plan to implement everything gradually with the construction of new houses in order to organically meet the demand of young parents for a high-quality, safe and comfortable space for their children to grow up.

Daria Bedia, Marketing Director at DIM

Ukrainian State Postal Service Enterprise (USPS) Ukrposhta (Kiev) is holding a tender for services of compulsory insurance of civil liability of owners of motor vehicles (OSAGO).

As reported in the system of electronic public procurement “Prozorro”, the expected cost of the service -2.064 million UAH.

Documents are accepted until August 24.

There are no registered cases of monkeypox in Ukraine, according to Deputy Health Minister and Chief Sanitary Doctor of Ukraine Ihor Kuzin.

“No such cases have been registered in Ukraine. In fact, they are estimated to be quite low, given the lack of transport and air traffic,” he said during a telethon on Wednesday.

Kuzin clarified that there was an appropriate response to monkeypox and relevant WHO recommendations even before Russia’s full-scale invasion of Ukraine.

“The emergency situation declared by the WHO at this time is related to the fact that a new subtype of the monkeypox virus has begun to circulate. This new subtype is now being detected in the vast majority of cases among those population groups that were not previously at risk,” he said.

The Deputy Minister noted that during the first wave of monkeypox, Ukraine received vaccines against the disease thanks to the EU.

Earlier, the Experts Club information and analytical center released a video with a detailed explanation of the origin of the disease and the prospects for its spread – https://youtu.be/YXYU6KcQTcQ?si=wEj2TQc3MPHGx0QY