Last year, Ukraine’s vehicle fleet was replenished with more than 110,200 zero-emission vehicles (passenger and commercial), which is twice as many as in 2024, according to Ukravtoprom’s Telegram channel.

Of this number, passenger car registrations increased 2.1 times to 107,470 units, and commercial vehicle registrations also increased more than 2.1 times to 2,773 units. Five electric buses were also registered (1.5 times more).

At the same time, the share of new vehicles in BEV registrations increased slightly and amounted to 21% compared to 20% in 2024.

The top five most popular new electric vehicles on the market in 2025 were led by the Volkswagen ID.Unyx with 3,162 units; followed by the BYD Song Plus EV – 2,948 units, BYD Leopard 3 – 1,623 units, ZEEKR 7X – 1,558 units, and BYD Sea Lion 07 – 1,337 units.

Among imported used electric vehicles, the most popular were the TESLA Model Y – 10,683 units; TESLA Model 3 – 9,348 units; NISSAN Leaf – 7,559 units; KIA Niro – 5,154 units; and HYUNDAI Kona Electric – 4,145 units.

According to the association, in December 2025, more than 32,800 electric vehicles (new and used) were added to the Ukrainian car fleet, which is 8.6 times more than a year earlier, including 32,134 passenger cars (8.8 times more) and 699 commercial vehicles (4.6 times more).

As reported, the surge in demand for electric vehicles in the last months of 2025 was due to information about the cancellation of VAT exemptions on customs clearance from 1 January 2026.

In particular, the share of electric vehicles in the new passenger car market grew from 14.5% to 28.3% over the year.

The spot price of gold set a new record during trading on Monday.

As of 8:22 a.m. Kyiv time, it stood at $4,574.77 per ounce, up 1.5% from the previous session’s close. Earlier in trading, the spot price of gold rose to $4,599.87 per ounce, a record high.

Gold futures on the Comex exchange added 1.9% to $4,586.5 per ounce.

Other precious metals are also rising in price. The spot price of silver rose 5.5%, platinum 3.5% and palladium 3.2%.

Demand for precious metals is being driven by heightened geopolitical risks and concerns about the independence of the US Federal Reserve (Fed), which have been exacerbated by news that the US Department of Justice is preparing criminal charges against Fed Chairman Jerome Powell.

According to Powell, the charges are related to his statements during a speech to the Senate Banking Committee in June last year on the long-term project to renovate the Fed’s headquarters.

‘These unprecedented actions should be viewed in the broader context of threats and ongoing pressure from the US administration,’ Powell said.

In addition, the United States continues to monitor the protests in Iran and is considering various options for action, US President Donald Trump said.

When asked how Washington would respond if Iran attacked American military bases, the president said, ‘We will strike them with a magnitude they have never experienced before.’

Trump also repeated his threats to take control of Greenland.

Passenger traffic across the Ukrainian border in the first week after New Year’s, from January 3 to 9, jumped by about 27% to 598,000, according to data from the State Border Service.

According to them, the number of border crossings for departure increased to 258,000 (for comparison, data for January 7 is not included due to the lack of statistics from the State Border Service for December 30) from 223,000 a week earlier, while the increase in entries was even more significant – to 271,000 from 184,000.

The number of vehicles that passed through checkpoints this week also increased to 95,000 from 77,000 a week earlier, and the flow of vehicles with humanitarian cargo – to 342 from 268.

According to the State Border Service, as of 6:00 p.m. on Saturday, most of the cars and buses waiting to leave Ukraine at the Krakivets checkpoint were 45 and 8, respectively. The queue at the Ustyluh checkpoint consisted of 25 cars, at the Uhryniv checkpoint – 15 cars, and at the Shehyni checkpoint – 12 buses.

Twenty-five cars and seven buses were waiting to cross the border with Slovakia at the Uzhhorod checkpoint, and five cars were waiting at the Maly Berezny checkpoint.

At the border with Hungary, there was only a small queue of five cars at the Tisa checkpoint, while unusually long queues were recorded at the Porubne and Dyakove checkpoints on the border with Romania – 50 and 35 cars, respectively, as well as at the Mamalyga checkpoint on the border with Moldova – 35 cars.

The total number of border crossings this week is equal to last year’s figures. At that time, 302,000 people left Ukraine and 292,000 entered, while this week the figures were 295,000 and 303,000, respectively, although the flow of cars was higher last year – 117,000 versus 109,000, which is probably due to weather conditions.

Last year, a 16.9% increase in passenger traffic was recorded during this week, but the following week saw a 13.3% decrease.

As reported, from May 10, 2022, the outflow of refugees from Ukraine, which began with the start of the war, was replaced by an influx that lasted until September 23, 2022, and amounted to 409,000 people. However, since the end of September, possibly influenced by news of mobilization in Russia and “pseudo-referendums” in the occupied territories, followed by massive shelling of energy infrastructure, the number of those leaving exceeded the number of those entering. In total, from the end of September 2022 to the first anniversary of the full-scale war, it reached 223,000 people.

In the second year of the full-scale war, the number of border crossings to leave Ukraine, according to the State Border Service, exceeded the number of crossings to enter by 25,000, in the third year by 187,000, and since the beginning of the fourth year by 195,000.

As noted in early March 2023 by Serhiy Sobolev, who was then Deputy Minister of Economy, the return of every 100,000 Ukrainians home results in a 0.5% increase in GDP.

In its July inflation report, the National Bank worsened its migration forecast: while in April it expected a net inflow of 0.2 million people to Ukraine in 2026, it now forecasts a net outflow of 0.2 million, which corresponds to the estimate of the net outflow this year. “Net return will only begin in 2027 (about 0.1 million people, compared to 0.5 million in the previous forecast),” the NBU added and confirmed this forecast at the end of October. In absolute terms, the National Bank estimates the number of migrants currently remaining abroad at about 5.8 million.

According to updated UNHCR data, the number of Ukrainian refugees in Europe as of December 11, 2025, was estimated at 5.311 million (as of November 14 – 5.331 million), and globally at 5.860 million (5.850 million).

In Ukraine itself, according to the latest UN data for July this year, there are 3.340 million internally displaced persons (IDPs), compared to 3.757 million in April.

Ukraine’s top-ranked player Elina Svitolina won the WTA 250 ASB Classic in Auckland, New Zealand, beating China’s Wang Xinyu 6-3, 7-6(6).

Svitolina won her 19th WTA singles title. According to the organizers, the total balance of the Ukrainian in the finals of WTA tournaments is 19 wins and 4 losses.

Svitolina is ranked 13th in the WTA rankings.

The UK intends to transfer advanced weapons to Ukraine in the form of powerful Nightfall long-range ballistic missiles capable of hitting Russian targets at a distance of over 300 miles, according to the Daily Mail.

“Nightfall missiles are equipped with warheads weighing about 200 kg, can be launched in series, and have a range that allows them to reach Moscow, among other targets. The UK Ministry of Defense is currently looking for British companies to develop, build, and supply the first three test missiles as part of a £9 million contract,” the report says.

The announcement of the Nightfall project coincided with the defense minister’s announcement of the UK’s plans to spend GBP 200 million.

As reported, The Independent, citing British Defense Minister John Gilli, said that the United Kingdom of Great Britain and Northern Ireland would spend GBP 200 million to prepare British troops for deployment in Ukraine in the event of a ceasefire with Russia.

Which companies go bankrupt most often in Ukraine?

780 companies began bankruptcy proceedings in 2025, according to data from the Supreme Court of Ukraine. This is about 10% of the total number of business closures. The turnover of the largest bankrupt companies ranges from UAH 3.4 to 7.7 billion. Most often, limited liability companies go bankrupt. Last year, companies engaged in wholesale trade and agriculture became insolvent. Kyiv leads in terms of the number of bankrupt businesses.

780 companies began bankruptcy proceedings in 2025. This is only 10% of the total number of business closures. Most companies in Ukraine go through the process of voluntary closure — this is 60% of cases. A total of 8,191 companies undergoing procedures related to the termination or change of business operations were recorded in Ukraine last year.

Most often, LLCs go bankrupt — 84% of cases in 2025.

Only in 48 cases do bankrupts try to stay afloat: to restore solvency and continue working through a reorganisation procedure. However, this is less than 1% of cases.

Currently, owners are increasingly opting for preventive restructuring: 8 cases in 6 companies were opened in 2025. These are cases where a business begins restructuring before it becomes insolvent, trying to avoid bankruptcy.

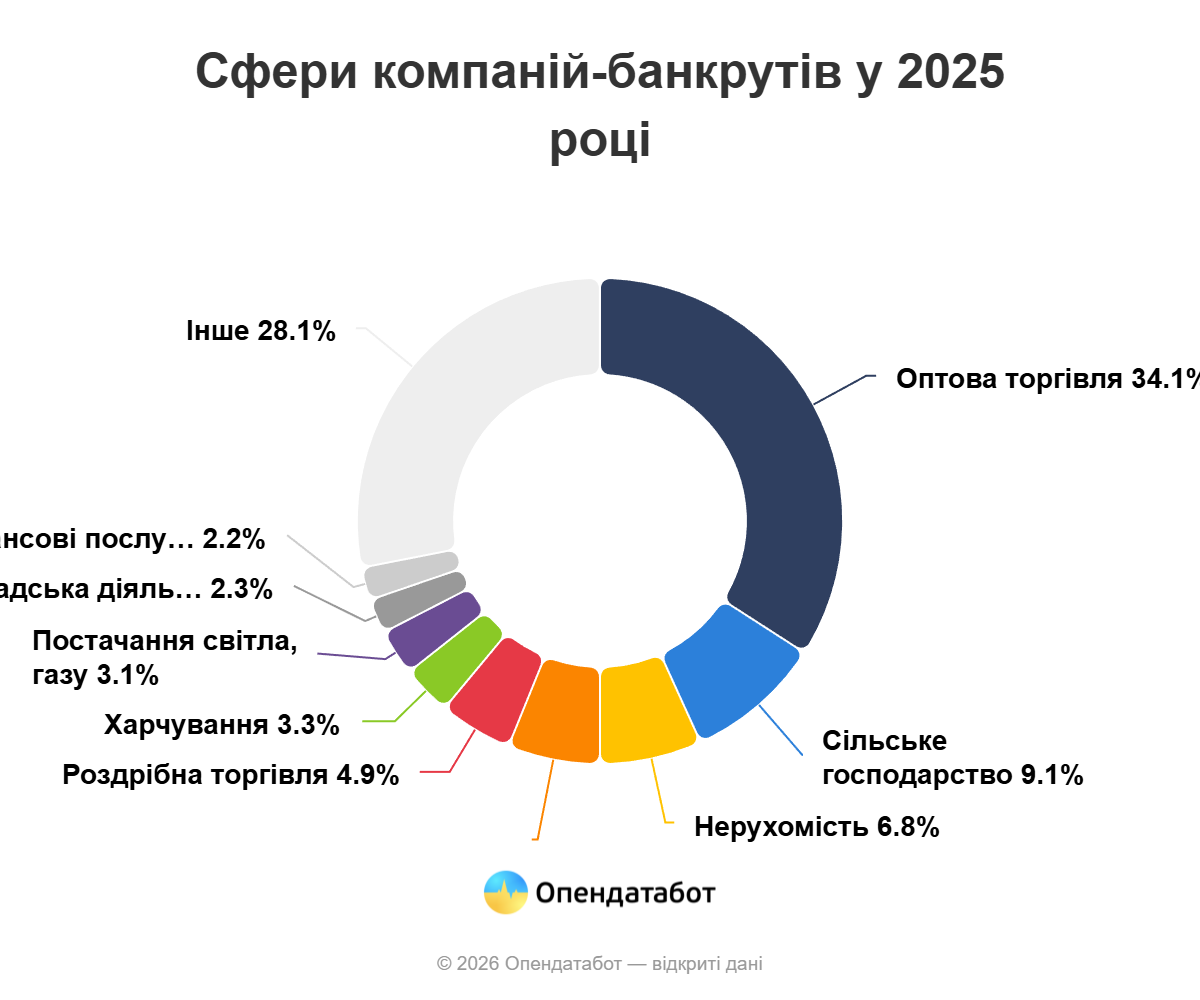

Most often, wholesale companies go bankrupt: 266 enterprises. In second place is agriculture: 71 companies. Next are real estate operations — 53 companies, construction — 48 companies, and retail trade — 38 companies.

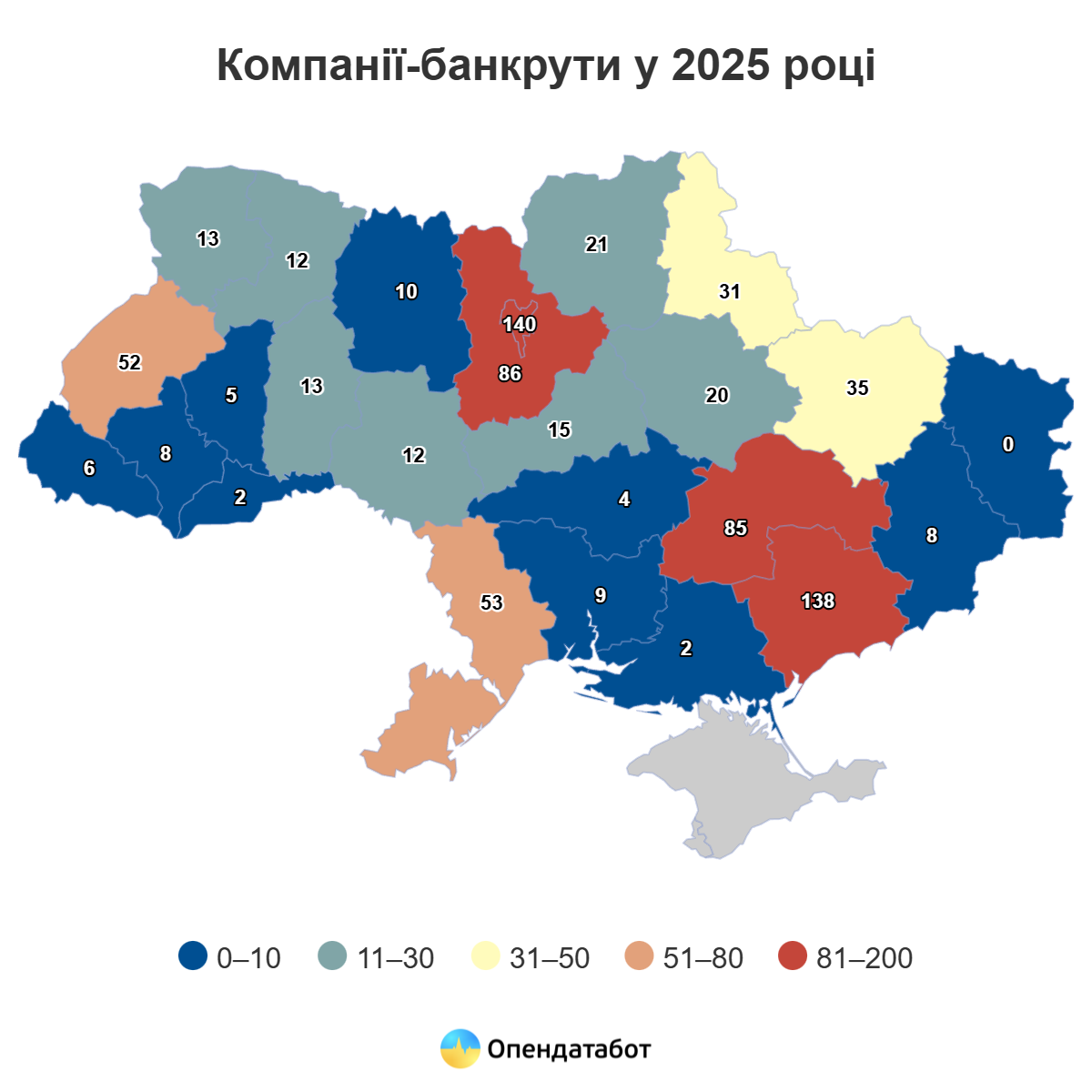

Most bankruptcy proceedings against businesses are opened in Kyiv — 140 companies (18%). Almost as many are in the frontline Zaporizhzhia region — 138 companies (17.7%). Next are Kyiv region — 86 companies (11%), Dnipropetrovsk region — 85 (10.9%) and Odesa region — 53 companies (6.8%).

The top 10 companies against which bankruptcy proceedings have been initiated include enterprises that until recently had revenues ranging from 3.4 to 7.7 billion hryvnia. The largest case concerns DEGS HOLDING, which was engaged in gas trading and had revenues of over 7.7 billion hryvnia in 2024. Next are PRIDE SOLUTIONS UKRAINE with revenues of UAH 6.08 billion and OPT-SYSTEMS with UAH 5.46 billion.