Avangard Agroholding LLC, parent company of Ukraine’s largest producer of poultry eggs, has reduced its net loss by 18.6 times in 2021 compared to 2020 to UAH 28.5 million.

According to the company’s report in the information disclosure system of the National Commission on Securities and Stock Market (NSCSM) on Monday, the company’s assets decreased last year by 19% to 20.71 billion UAH, while the unallocated loss decreased by 0.2% to 10.5 billion UAH.

According to the NKTSBFR, the net loss per common registered share of Avangard last year amounted to 0.00056 UAH.

According to the statement, on December 29, the annual shareholders’ meeting will be held on December 29, where shareholders are going to decide on offsetting the net loss incurred in 2021 at the expense of future profits.

As reported, Avangard said in March 2022 that it has incurred a loss of 1.5 billion hryvnias since the beginning of the Russian military invasion of Ukraine. Russian aggression led to the shutdown of a number of key poultry farms of the group, and chickens were left without food and died at the Chornobaivska poultry farm (Belozerska village, Kherson Region).

“Ukrlandfarming is one of the largest agricultural holdings in Eurasia. It grows crops, raises cattle, and distributes equipment, fertilizers and seeds. Its member Avangard is Ukraine’s largest producer of eggs and egg products.

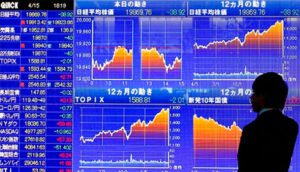

U.S. index futures and various commodities prices are down on Monday amid a general decline in investors’ risk appetite amid information about the ongoing protests in China against anti-covid restrictions.

“We knew we were going to be nervous this morning about the COVID-19 situation in China, but the protests took the market by surprise,” said SPI Asset Management managing partner Stephen Innes, quoted by MarketWatch.

December futures for the Standard & Poor’s 500 Index were down 0.6% by 9:17 a.m. Ksk, the Dow Jones was down 0.4% and the Nasdaq 100 was down 0.7%.

January Brent crude futures on London’s ICE Futures exchange fell 3.1% to $81 a barrel by 9:17 a.m. Ksk. January WTI futures fell 3% to $73.98 per barrel in electronic trading on the New York Mercantile Exchange (NYMEX), which was the lowest level since late last year.

Oil fell 5.4% on the Shanghai exchange.

Base metals in London and Shanghai also fell on Monday. Iron ore prices on the Dalian Commodity Exchange fell 2%.

Protests were held in cities across the country, including the capital Beijing, as well as Shanghai, Xinjiang and Wuhan, which was originally the epicenter of the COVID-19 spread, Bloomberg reported.

That contributes to a stronger U.S. dollar, which reduces the attractiveness of investments in raw materials, and also raises the possibility of even more significant tightening of restrictions by Chinese authorities, the agency said. It may have a negative impact on economic activity in China, which is the world’s largest consumer of many raw materials.

China’s oil demand could fall to an average of 15.11 million bpd in the fourth quarter, down from 15.82 million bpd for the same period in 2021, Kpler oil analyst Gregory Leckner predicted.

The Insurance Business Association together with the League of Insurance Organizations of Ukraine and the Kharkiv Union of Insurers supported the draft law “On introducing changes to certain legislative acts of Ukraine on reforming the sphere of urban planning” (No 5655) with the recommendation to adopt it at the second reading and in whole by the Supreme Council.

The relevant opinion of professional associations of insurers promulgated in an open letter, the association noted in a post on Facebook on Monday.

“The current text of the bill provides for liability insurance of authorized persons for urban planning control. Considering the international insurance and reinsurance practice, we consider it advisable to further extend such practice to performers of certain types of architectural and construction works, who take part in the creation of construction objects, namely architects, design engineers, engineers for technical supervision and the like”, – notes the General Director of the Association “Insurance Business” Vyacheslav Chernyakhovsky, whose words are contained in the message.

As reported, the bill number 5655 provides for the activities of the examination of design documentation for the construction expert organization and implementation of urban planning control at the prior conclusion of the contract of professional liability insurance, without the presence of which the activities of the expert organization and authorized person for urban planning control is impossible.

Georgia in January-October 2022 increased wine exports by 6% compared to the same period last year to $200.8 million, the National Statistics Service said.

According to published reports, during the 10 months $12.3 million was exported to Poland, $10.5 million to China, $9.14 million to Ukraine, $8.15 million to Kazakhstan, $4.7 million to Belarus, $4.46 million to USA, $3.8 million to Latvia, $2.9 million to Germany, $1.8 million to Lithuania. 64% of all exports were delivered to Russia, making up $128.9 million.

Georgia exported $234 million (107 million bottles) worth of wine in 2021, which is a historical record for the country. The National Wine Agency believes that this year’s supplies to foreign markets could be no less. The agency says one of the achievements of the industry is the increased supply of Georgian products to such a famous country as France. That country for the 10 months of 2022 purchased Georgian wine at almost $ 985 thousand. This result looks modest compared with the volume of supplies to traditional markets for Georgia, but it is twice as much as the record number of shipments to France in 2018.

Asian stock markets are declining in trading on Monday.

Investors were negatively influenced by protests in China against the “zero tolerance” policy on COVID-19, reports MarketWatch.

Demonstrations against restrictive measures imposed by the authorities of the country because of the coronavirus infection took place on Sunday night in a number of Chinese cities, reports AP. In Shanghai in particular, about 300 people gathered for a midnight protest. Police used pepper spray to disperse the crowd.

On Friday, the People’s Bank of China (PBOC) announced a 0.25 percentage point reduction in reserve requirements for banks starting Dec. 5, which is expected to free up liquidity totaling 500 billion yuan ($70 billion) in the financial system.

The reserve requirement ratio for large banks will drop to 11 percent, the lowest since mid-2007. It will average 7.8 percent in the country’s banking sector.

“The purpose of lowering the reserve requirement ratio is to maintain sufficient liquidity in the financial system and support the real economy,” the NBK said in a statement.

China’s Shanghai Composite index was down 1.4 percent by 7:31 a.m. Ksk. Hong Kong’s Hang Seng was down 2.4% by that time, while earlier in trading it had fallen as much as 4%.

Shares of developers Country Garden Holdings Co. (-5.8%) and Longfor Group Holdings Ltd. (-5%), insurers Pung An Insurance (-5%) and China Life Insurance Co. (-3.9%), retailer JD.com Inc. (-4.7%), and banks China Merchants Bank Co. (-4.3%) and Hang Seng Bank Ltd. (-4%) showed the most noticeable decline on Hong Kong Stock Exchange.

At the same time, the owner of the restaurant chain Haidilao International Holding Ltd. (+4.6%), breweries China Resources Beer (Holdings) Co. (+2.1%) and Budweiser Brewing Co. APAC (+1.5%).

Japan’s Nikkei 225 was down 0.5% by 7:26 a.m. Ksk.

Among the index components the leaders in value decline are shares of CyberAgent Inc. (-7.6%), metal producers Nippon Steel Corp. (-3.5%), JFE Holdings (-2.8%) and Sumitomo Metal Mining Co. (-2.8%).

Moreover, the securities of such big companies as SoftBank Group (-0.6%), Toyota Motor (-0.9%) and Nintendo (-0.8%) are also declining.

South Korea’s Kospi index was down 1.1% by 7:25 a.m. Ksk.

One of the world’s biggest chip and electronics maker Samsung Electronics Co. was down 1.6% while Hyundai Motor rose 1.5%.

Australian S&P/ASX 200 index lost 0.4% over the day.

Share prices of the world’s largest mining companies BHP and Rio Tinto declined by 0.7% and 1.4% respectively.

Retail sales in Australia in October unexpectedly declined 0.2% from the previous month, according to preliminary data. This came as a surprise to analysts, who had forecast an average increase of 0.5%, Trading Economics reported.

The decline was the first since December 2021.