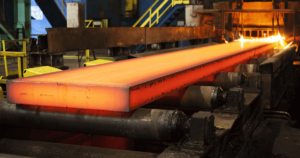

In January-September of this year, the Zaporizhstal metallurgical plant increased its rolled steel production by 14.1% compared to the same period last year, from 1.829 million tons to 2.0866 million tons.

According to the plant’s press release, steel production for the period amounted to 2 million 385.2 thousand tons (in January-September 2024 – 2 million 176.7 thousand tons), and 2 million 642.6 thousand tons of pig iron (2 million 297.5 thousand tons).

In September, Zaporizhstal produced 303.4 thousand tons of pig iron, 279.8 thousand tons of steel, and 247.3 thousand tons of rolled products, compared to 309 thousand tons of pig iron, 264 thousand tons of steel, and 231.2 thousand tons of rolled products in the previous month.

As reported, in 2024, Zaporizhstal increased its rolled steel output by 18.1% compared to 2023, to 2 million 426.7 thousand tons from 2 million 54.7 thousand tons, and steel output by 17.2%, to 2 million 890.8 thousand tons, and pig iron by 14.2%, to 3 million 106.3 thousand tons.

In 2023, Zaporizhstal increased its rolled steel production by 57.2% compared to 2022, to 2 million 54.7 thousand tons, steel by 65.4%, to 2 million 466.9 thousand tons, and pig iron by 35.3%, to 2 million 718.9 thousand tons.

Zaporizhstal is one of Ukraine’s largest industrial enterprises, whose products are in high demand among consumers both in the domestic market and in many countries around the world.

Zaporizhstal is a joint venture of the Metinvest Group, whose main shareholders are System Capital Management (71.24%) and Smart Steel Limited (23.76%). Metinvest Holding LLC is the managing company of the Metinvest Group.

The mining and metallurgical group Metinvest has allocated UAH 9.72 billion to support the state and its citizens, including UAH 5.2 billion for the army’s needs as part of Rinat Akhmetov’s Steel Front military initiative, according to the company’s CEO Yuriy Ryzhenkov.

“In the context of full-scale war, Metinvest has mobilized all its resources to preserve its workforce and protect the state. For more than three and a half years, our priority has been to help the army. After all, the future of the state, industry, Ukrainian cities, and families depends on the army’s defense capabilities. During this time, Metinvest has allocated UAH 5.2 billion to the needs of the defenders as part of Rinat Akhmetov’s Steel Front military initiative. In total, UAH 9.72 billion has been allocated to help Ukraine. We continue to work, believe in the country, and support its people on the path to victory,” said the CEO.

According to the company, despite their proximity to the front line and the threat of enemy shelling, the group’s enterprises in Zaporizhzhia, Kryvyi Rih, and Kamianske continue to operate at varying levels of capacity, taking into account security, energy, logistical, and economic factors.

The company noted that the main value of Metinvest remains the life and health of its employees. All of the company’s enterprises in Ukraine have bomb shelters equipped for long-term stays. The shelters have water, food, and medicine. Employees are trained to provide first aid and respond to emergencies related to military risks.

Despite losing operational control over its assets in Mariupol and Avdiivka and suspending the activities of the Pokrovsk Coal Group, Metinvest remains one of Ukraine’s largest exporters.

Even during the war, Metinvest is investing in major repairs and equipment upgrades. In particular, Kametstal is implementing a record program worth over UAH 2.5 billion this year.

Metinvest also continues to pursue a green transformation of its production. Together with its partners, the company has announced the construction of a modern metallurgical plant in Italy. It will consume Ukrainian iron ore and metallurgical raw materials, ensuring synergy between Ukraine and the EU.

The group is investing in energy independence. In July 2025, two new gas-fired power generators began operating at Northern GOK. In two months of operation, the units generated 1,040 MWh of electricity, which brought an economic effect of UAH 2.3 million. In total, four such units are planned to be installed at Northern GOK.

The company states that it remains one of the largest taxpayers in Ukraine: in 2024, the company transferred UAH 19.8 billion to budgets of all levels. In the first half of 2025, another UAH 9.3 billion was paid to the budget.

Metinvest is a vertically integrated group of mining and metallurgical enterprises. Its enterprises are located in Ukraine – in the Donetsk, Luhansk, Zaporizhzhia, and Dnipropetrovsk regions – as well as in the European Union, the United Kingdom, and the United States. The main shareholders of the holding company are SCM Group (71.24%) and Smart Holding (23.76%). Metinvest Holding LLC is the managing company of the Metinvest Group.

The Ukrainian cement market has stabilized after sharp fluctuations in 2021–2023, but production volumes remain almost half of what they were before the war. This is stated in an analysis by Experts Club, prepared in collaboration with the Ukrcement association.

In 2021, cement production reached 11 million tons, fell to 5.4 million tons in 2022, recovered to 7.43 million tons in 2023, and to 7.93 million tons in 2024. According to manufacturers’ estimates, the “ceiling” in 2025 will be around 8 million tons.

Consumption: 10.6 million tons in 2021, 4.5 million tons in 2022, 6.2 million tons in 2023, and 6.3 million tons in 2024. Thus, the market has stabilized at 6–6.5 million tons, which is about half of pre-war demand.

The structure of demand has changed: instead of residential and commercial construction, infrastructure and defense projects dominate — fortifications, shelters, urgent repairs of roads and bridges. Demand is additionally supported by state programs, including “єОселя.”

In 2025, experts expect stable “military” demand to continue, sensitive to budget financing and donor assistance.

Experts Club is a Ukrainian analytical center specializing in research on economics, energy, macroeconomics, infrastructure, and export-import relations.

A condensed version of the Experts Club’s cement market study is available at https://expertsclub.eu/rynok-czementu-ukrayiny-doslidzhennya-experts-club/

The Ukrcement Association brings together Ukraine’s leading cement producers.

In January-July 2025, Ukraine exported agricultural and food products worth $5.73 billion to the European Union, which is $891 million, or 13%, less than in the same period last year, according to an EU report.

At the same time, Ukraine managed to maintain its fourth place in the list of suppliers of agricultural products to the EU during this period. Ahead of it are Brazil ($9.1 billion), the United Kingdom ($7.8 billion), and the United States ($6.9 billion).

The ranking of the largest suppliers of agricultural products to the EU also includes China ($5.24 billion), Côte d’Ivoire ($5.05 billion), Turkey ($3.68 billion), Vietnam ($2.81 billion), Argentina ($2.57 billion), and Switzerland ($2.51 billion).

In total, agricultural imports to the EU in January-July 2025 are estimated at $96.8 billion (+16%).

Agricultural exports from the EU during the same period amounted to $118.7 billion (+2%). At the same time, $2.1 billion (+17%) worth of goods were supplied to Ukraine.

Thermal and waterproofing materials in Ukraine since the beginning of 2025 have gone up in price by 15-20%, the volume of demand remains stable, Sweetondale sales directorate head Alexander Manuylo told the Interfax-Ukraine agency.

“In 2025 in the segment of heat and waterproofing materials there were several price increases – in general by 15-20% depending on the product category. This is for the first time in four years of war and is mainly due to rising prices for energy resources, equipment and raw materials imported from outside Ukraine,” he said.

As for demand, according to the company, it generally remains stable, and in some sales channels it is even growing. For example, despite the active hostilities on the territory of Ukraine, the direction of industrial logistics complexes is rapidly developing. Thermal modernization of the old housing stock continues. Of the negative factors, the expert noted a tangible lack of funding for international reconstruction programs, in particular USAID, in 2025.

“For our part, we continue to complete state infrastructure projects and support the construction of fortification facilities. Unfortunately, there is a new category of facilities that were built during the war, but suffered significant damage and, accordingly, require renovation and restoration,” Manuilo added.

The structure of clients in 2025 has also changed: the market of new residential high-rise construction is no better. Prospects for the next year in the company have always been assessed by the number of new pits, but they state that in the presence of a significant number of permits for new construction now there are very few new pits.

The market is feeling the positive impact of government rebuilding programs, but their scale and speed of implementation do not match the needs at hand. “Businesses and citizens are now largely taking the initiative, whereas government support could be a more effective catalyst for recovery. Government support in our segment is mainly focused on the rehabilitation and thermo-modernization of social and educational institutions,” says Manuilo.

Thermal insulation materials (mineral wool and extruded polystyrene foam), on which the energy efficiency and comfort of projects directly depend, remain the most popular items. No less relevant is waterproofing, as more and more attention is paid to the reliable protection of buildings, including underground shelters.

Sweetondale is expanding its product line. In particular, 2025 has already introduced a new product – bitumen-polymer primer, and soon it is planned to launch a line of mastics, which will allow to comprehensively cover the needs of customers in the field of waterproofing solutions.

According to Manuilo, the company leads the Ukrainian market in all key product categories (up to 50%) and is working to expand exports. “The main priority for us has always been and remains the Ukrainian consumer: we are primarily focused on providing the domestic market with quality materials. At the same time we are increasing export volumes. Our products are already represented in Moldova, Romania, Poland, the Baltic States and Scandinavia. They are highly appreciated for their quality and compliance with international standards. This confirms the competitiveness of our materials not only in Ukraine, but also abroad,” he said.

According to Opendatabot, the authorized capital of Zavod “Sweetondale” LTD (“Zavod ”Sweetondale” LTD) is UAH 13.5 million, for 2024 the company received revenue of UAH 1.9 billion, which is 16.4% higher than the results of 2023, net profit amounted to UAH 314.2 million, which is 6% lower than the results of 2023.

Sweetondale was founded in 2012 by Gary Alan Stern. It initially specialized in industrial equipment engineering and leasing. Negotiations to acquire the plants owned by Russia’s Technonikol began in 2015 and were finalized in February 2018. Today, the company includes three plants for the production of roofing and thermal insulation materials: a plant for the production of mineral insulation in Cherkassy, a plant for the production of polymer insulation and a plant for the production of bitumen-polymer roll materials in Kamenskoye.

Ukrainians purchased more than 6,800 new passenger cars in September, which is 20% more than in September 2024 and 1% more than in August this year, UkrAvtoprom reported on its Telegram channel.

“For the first time, Chinese BYD took the lead in the market, exceeding its last year’s result by five times,” the message says.

According to the association, BYD’s sales in September amounted to 989 units (5.4 times more than in September last year).

The long-time sales leader, Toyota, took second place in the ranking with sales of 828 cars (-1%); Volkswagen came in third with 733 units (+118%).

Further down the ranking were Renault with 471 units (-13%); Skoda with 467 units (+5%); BMW with 366 units (-16%); Hyundai with 347 units (+47%); Zeekr with 248 units (+103%); Mazda with 244 units (+17%); and Honda with 216 units (+50%).

For the first time, the Volkswagen ID.Unyx electric car became the bestseller of the month.

UkrAvtoprom reports that 52,900 new passenger cars were registered in the country in January-September, which is 0.3% less than last year.

As reported, in 2024, initial registrations of new passenger cars in Ukraine, according to UkrAvtoprom, increased by 14% to 69,600 units.