According to the Serbian Economist, Bulgaria has started accepting applications for a long-term stay permit on the basis of “digital nomad” – the relevant changes to the by-laws came into force on December 20, 2025.

As Bulgarian Telegraphic Agency reported, the introduction of the procedure for issuing such a permit is intended to create a clear procedure for foreigners who want to live in the country and work remotely without a relationship with a local employer, as well as to bring economic benefits by attracting specialists in innovation, high technology and creative industries.

Upon initial application or renewal of the permit, the applicant must, inter alia, prove an average annual income of at least 50 minimum monthly salaries for the previous calendar year and provide documents proving remote employment – an employment contract with the employer or contract(s) for remote services and recommendations from the customer(s), and the work or services must not be provided to persons and companies in Bulgaria.

Bulgarian legislation defines three categories of “digital nomads”: employees of an employer outside the EU/EEA/Switzerland; owners/shareholders (with a share of more than 25%) or management of companies registered outside the EU/EEA/Switzerland; and persons who have provided remote services for at least one year prior to the application, provided there is no employment on the Bulgarian market. The permit is valid for one year, renewable for another year; the procedure usually involves obtaining a D visa and subsequent regularization in Bulgaria.

https://t.me/relocationrs/1988

Sales of new buses in Ukraine in 2025 will grow by 13-15% compared to 2024 – to 940-950 units, according to Vadym Shkarupin, director of the Etalon Auto trading house.

“Although the year is not over yet, and we, like other companies, are still working, according to open data (excluding closed purchases), about 940-950 buses will be sold, compared to 831 buses last year,” he said at a press conference in Kyiv on Monday.

According to his data, Ataman buses manufactured by the Cherkasy Bus plant are in first place in sales this year with 370 units (market share of 39%), followed by ZAZ buses from the Zaporizhzhia Automobile Plant (UKRAVTO Group) with 240 units (24%), and third place goes to Etalon buses manufactured by the Chernihiv Automobile Plant, with 130 units (14%).

Next in the ranking are Bogdan buses (manufactured by BAS Motor in Lutsk) with 100 units (11%), and fifth place is taken by imported Isuzu buses (50 units or 6% of the market).

Another 50 buses are from other manufacturers: Turkish Temsa, Otocar, and two Elektron buses.

The largest number of buses sold were in the small class – 720 units (77%), 160 units (17%) were sold in the medium class, and 60 units (6.5%) in the large class.

Almost all buses sold were diesel-powered, with two electric buses sold.

“In terms of structure, 88-90% of sales were made using budget funds: for example, of the 940 buses sold, 720 were school buses. No more than 12% were sold to retailers, but this cannot even be called retail, because these were purchases made by companies for their own needs, to transport personnel. We had orders from Ukrnafta, from the Khmelnytskyi Nuclear Power Plant, and other manufacturers are also working in this direction. Meanwhile, retail is at a standstill today, there are no purchases,” Shkarupin said.

At the same time, he noted that Ukrainian companies have work thanks to the School Bus program.

Global investment in data centers, including M&A deals, reached a record $61 billion in the first 11 months of 2025, compared to $60.8 billion for the whole of 2024, CNBC reports, citing data from S&P Global. This was achieved with fewer transactions – 104 compared to 129 for the whole of last year. Most of the deals took place in the US, followed by the Asia-Pacific region (APAC).

Investments grew amid a “global construction boom,” S&P notes. In addition, the surge in debt financing contributed to the upturn.

According to the agency, debt issuance in the data center market in January-November amounted to $182 billion, compared to $92 billion for the whole of 2024. This included Google (owned by Alphabet Inc.) raising $29 billion, Amazon.com Inc. raising $15 billion, and Meta raising about $31 billion.

The trend toward increased borrowing has sparked investor concerns. Oracle Corp. shares fell 5% on Wednesday after media reports that Blue Owl had refused to invest in its Michigan data center amid Oracle’s growing debt. Oracle denied these reports, but after they appeared, investors began selling Broadcom, Nvidia, and Advanced Micro Devices shares, and the Nasdaq Composite fell by a maximum of about 1.81% in a month. A week earlier, Oracle shares fell 12% after the publication of reports showing an unexpected increase in its capital expenditures.

In November, investors also actively sold shares in technology companies, fearing an AI bubble.

Yuri Struta, an analyst at S&P Global Market Intelligence for the technology, media, and telecommunications (TMT) sectors, said his team believes market concerns about AI and Oracle are temporary.

According to experts, these fears are unlikely to have a significant impact on the construction of data center capacity and M&A in this market.

At the same time, the construction of new data centers may be temporarily limited by a shortage of energy sources, making existing centers more valuable, Struta says.

“In Europe, data center capacity is expected to be built more slowly than in other regions, but it is unclear whether this will lead to a surge in M&A activity amid a shortage of assets,” he said. Overall, the analyst expects such activity in the data center market to intensify in 2026.

“I wouldn’t be surprised if the already high valuations get even higher,” he told CNBC, noting that his team expects demand for AI applications to continue growing at a rapid pace next year.

Revolut, a neobank that officially announced the start of its operations in Ukraine in February this year, warned Ukrainian customers on Monday that it will be forced to close their accounts on February 22, 2026.

“In accordance with local regulations, we regret to inform you that we will no longer be able to provide our services to residents of Ukraine,” according to messages sent by the bank to users and reviewed by Interfax-Ukraine.

It is noted that for two months, it will still be possible to use accounts as usual, but after February 22 next year, it will only be possible to withdraw the balance from the account via an external bank transfer. In addition to withdrawing all balances, customers are advised to download account statements, as they may be needed for records or for other financial institutions in the future.

“Although we are currently unable to provide services to residents of Ukraine, we remain committed to making them available in the future and will communicate any changes if the situation changes,” the messages note.

As reported, on February 11, 2025, after a month and a half of beta testing, British fintech Revolut officially entered the Ukrainian market on the basis of a license issued by the European Central Bank to Revolut Bank UAB (Lithuania). At the same time, two weeks later, the National Bank of Ukraine (NBU) noted the need for the fintech to obtain a license to operate in Ukraine, which Revolut planned to obtain later.

In April, NBU Deputy Head Dmytro Oliynyk stated that the National Bank was interested in Revolut’s entry into the Ukrainian market, but within the framework of legislative and regulatory requirements, and was therefore in dialogue with it about obtaining a banking license. In an interview with NV Business, he said that, according to the regulator’s estimates, Ukrainians had opened up to 100,000 accounts with Revolut.

Monobank, the largest Ukrainian neobank and the second largest in terms of retail card customers in Ukraine, opposed Revolut’s entry into the Ukrainian market without obtaining a license.

Revolut was founded in 2015 in the UK and is headquartered in London.

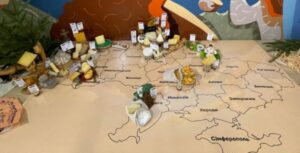

The first cheese map of Ukraine was presented in Kyiv as a unique analytical tool that systematically reflects the current state of Ukrainian cheese production, as well as a printed guide to recognized domestic cheeses for 2021-2025, according to Deputy Minister of Economy, Environment, and Agriculture Taras Vysotsky.

“The map features 65 cheeses from different regions of Ukraine that have been recognized at national and international competitions. This is not just a visualization—it is a record of the development of the Ukrainian cheese industry in recent years,” he wrote on Facebook.

According to him, the cheese map demonstrates the regional diversity of Ukrainian cheeses, confirms the competitive quality of domestic producers, forms a holistic image of Ukraine as a cheese-producing country on the international arena, and becomes a benchmark for retail, HoReCa, media, and consumers.

“Ukrainian cheeses are now recognized at international competitions – this is already a trend, not just isolated successes. Our producers demonstrate quality that competes at the global level. It is important that projects such as the cheese map help to systematically shape Ukraine’s image as a cheese-producing country,” the deputy minister emphasized.

He also thanked the ProCheese and Ardis Group teams and partners for their work, which strengthens the agri-food sector and adds another important element to Ukraine’s brand.