Poultry meat exports from Ukraine in January 2026 amounted to 38.1 thousand tons, which is 6.1% more than in December 2025, according to the Ukrainian Poultry Farmers Union.

The industry association specified that in monetary terms, exports for the specified period decreased by 2.1% to $85.4 million.

“The growth in physical export volumes against the backdrop of a decrease in total revenue is a consequence of a decline in the export value of products due to a fall in world prices for poultry meat,” the Poultry Farmers Union noted.

The main buyers of Ukrainian products in January were the Netherlands (21.9%), the United Kingdom (11.8%), the UAE (9%), and Slovakia (8.2%). The share of EU countries in total exports was 37.3% (13.8 thousand tons). At the same time, in monetary terms, the European market provided almost half of the foreign exchange earnings – 48.7%.

As reported, in 2025, Ukraine reduced the physical volume of poultry meat exports by 1.8% compared to 2024, to 458.1 thousand tons, but foreign exchange earnings from its sale increased by 13.7%, reaching $1.15 billion. The main markets were the EU countries (in particular, the Netherlands and Slovakia), Saudi Arabia, and the United Kingdom.

Wheat prices in Ukraine will continue to rise until at least mid-March due to reduced supplies from the Black Sea region and limited supply from producers, according to the analytical cooperative “Pusk,” created within the framework of the All-Ukrainian Agrarian Council (VAR).

“Due to logistical constraints, the export volumes of one of Ukraine’s key competitors may fall by almost half. Accordingly, global importers will have to buy about 1–1.5 million tons of wheat from other suppliers, including Ukraine, Romania, and France,” analysts said.

According to experts, there is an imbalance in the domestic market: traders are actively contracting grain, while farmers are holding back sales. This leads to a weekly increase in wheat prices of $1–2 per ton. Weather risks and the threat of winter crop losses due to frost remain an additional factor supporting prices.

Currently, the conditional prices for food wheat (11.5% protein) on a CPT-port basis are $215–220 per ton. At the beginning of March, prices are expected to strengthen to $220–225 per ton.

Further price movements after mid-March will be determined by the condition of winter crops and the overall global market situation, Pusk concluded.

The catch of fish and other aquatic biological resources by Ukrainian fishing companies in 2025 amounted to 44.7 thousand tons, according to the State Agency for Land Reclamation and Fisheries (Derzhrybangentstvo).

“These figures confirm that the Ukrainian fishing industry remains capable of operating systematically both in national waters and in fishing areas of the World Ocean. Our task is to combine economic efficiency with unconditional adherence to the principles of sustainable use of biological resources,” said the agency’s head, Ihor Klymenok.

The largest catch was recorded in waters outside Ukraine’s jurisdiction—20.16 thousand tons. In particular, Ukrainian vessels caught 19.5 thousand tons of biological resources in the Antarctic region, of which more than 18.8 thousand tons were Antarctic krill. In addition, for the first time since 2006, a Ukrainian business entity resumed fishing in the northwestern part of the Atlantic Ocean (NAFO zone), where 637 tons were caught.

The aquaculture segment showed positive dynamics: the catch and sale of commercial products increased by 17.5% compared to 2024, to 10.78 thousand tons. Experts attribute this to the growing demand for domestic fish in the domestic market. At the same time, special commercial fish farms (SCFF) provided 2.26 thousand tons of biological resources.

In the fishery water bodies of Ukraine, industrial fishing was carried out by 126 entities, which in total caught almost 11.5 thousand tons. The main volume was provided by the Dnipro reservoirs (10.2 thousand tons), which exceeded the previous year’s figures by 3%.

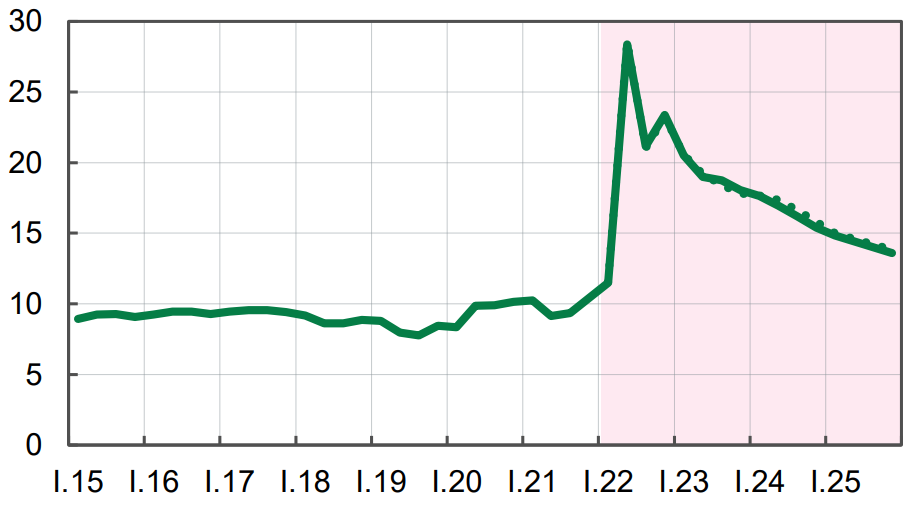

Forecast of unemployment rate in Ukraine according to methodology of International labor organization until 2025

Tax revenues from the tourism industry in 2025 amounted to UAH 4 billion 426.2 million, which is 50.6% more than in 2024, according to the annual report of the State Agency for Tourism Development of Ukraine (DART).

As SART Chairwoman Natalia Tabaka said during the presentation of the report, excluding companies under KVED 79.90 (booking services), tax revenues grew by 35.7% last year to UAH 3 billion 987.8 million.

According to SATA, the total number of taxpayers at the end of the year was 20,700, including 3,700 legal entities (+5.3%) and 16,900 individual entrepreneurs (+20.7%). The overall growth in the number of taxpayers in tourism in 2025 compared to 2024 was 17.6% (excluding KVED 79.90 – 7%).

According to the report, local budgets received UAH 359 million in tourism tax in 2025, which is 31.5% more than in 2024. The leaders in terms of revenue were Kyiv (UAH 70 million), Lviv region (UAH 63 million), as well as Ivano-Frankivsk (UAH 46 million), Zakarpattia (UAH 31.9 million), Cherkasy (UAH 28.5 million), and Odesa (UAH 20.3 million) regions.

It is noted that for 2025, DART was allocated funding from the state budget in the amount of UAH 22.8 million. At the end of the year, cash expenditures amounted to UAH 15.6 million, and returns to the budget amounted to UAH 7.1 million. The agency exceeded its plan in terms of international events (15 held, compared to 8 planned) and licenses issued (24 issued, compared to 15 planned).

Today, the news agency Interfax-Ukraine hosted a press conference titled “Fashion PRORYV” — a platform for cultural diplomacy and Ukraine’s international dialogue with the world.

“Ukrainian youth have proven that even in the darkest times they are capable of rising to moral and spiritual heights. And it is with them that a new era of Ukrainian fashion culture begins,” emphasized Golda Vynohradska, the competition organizer and president of the public union “Fashion PRORYV.”

According to her, “Fashion PRORYV” emerged as the fashion industry’s response to the war and since 2014 has evolved into an initiative that brings together vocational education, manufacturing, and international partners. At first, the project had a practical goal — the organizers designed and produced items needed for the front line — and later it grew into a competitive platform with partnerships, international shows, and presentations of Ukrainian participants’ works abroad.

Natalia Sasina, president of the Italian association Vita World (joining online), said that the Italian side is taking part in the “Fashion PRORYV for Freedom and Peace” event together with Fashion Globus Ukraine, engaging fashion schools and Italy’s professional community. She stressed that the initiative has not only an artistic but also a social dimension: “This is an event that speaks about the war — and at the same time about dignity, beauty, and the power of creativity. We want to show Ukraine not in the language of pity, but in the language of talent and resilience.”

A separate part of the discussion during the press conference focused on workforce training for the light industry and the role of vocational education in the country’s recovery. Kateryna Myroshnychenko, head of the All-Ukrainian Association of Vocational Education Workers, noted that stereotypes still persist in society about vocational education as “non-prestigious” and “secondary,” but the reality of war has completely disproved them.

“From the first days of the war, our students aged 15–17, sometimes even younger, worked to supply the front line: with sewn products, warm clothing, and institutions mastered new technologies and processes to respond to the needs of the time. Today vocational education is one of the powerful waves of support for the army and the economy,” she said.

At the same time, Myroshnychenko drew attention to the shrinking network of institutions that train personnel for the light industry and emphasized the need for a state policy to support the sector. According to her, a number of countries — in particular Turkey and China — show that an economic upturn often begins precisely with the development of light industry, investment in manufacturing, and workforce training.

In the context of international cooperation, participants of the press conference said that practical partnerships around the sector are capable of launching specific projects already in the short term. In particular, an example was cited of foreign companies’ interest in cooperation with Ukrainian institutions and production sites after the demonstration of competition works.

While discussing the interaction between business and the state, participants emphasized that a systemic breakthrough requires stable “education–business–state” models, as well as regular dialogue with sector employers. According to the speakers, successful pilot approaches to partnerships with employers in Ukraine had existed earlier, including in certain manufacturing sectors, and such practices should be scaled up.

Dmytro Kalach, a representative of Softorg, spoke about business participation in the development of vocational training, in particular through the creation of training laboratories at educational institutions, support for competitions, and involvement of companies as external partners in updating curricula and strengthening the practical component of training future specialists.

The press conference also included representatives of the organizers and partners, who noted that “Fashion PRORYV” is seen as a long-term platform combining cultural diplomacy, social responsibility, and the economic potential of the light industry — through support for talented youth, international collaborations, and promotion of Ukrainian manufacturing.

“Fashion PRORYV” is an initiative that brings together vocational education, the light industry, and international partnerships. Within the platform, competitive programs and presentations are held aimed at supporting young designers and promoting Ukraine through a modern cultural and production ecosystem.

As reported, the Column Hall of the Kyiv City State Administration hosted the ceremonial final of the 8th All-Ukrainian Professional Skills Competition “Fashion PRORYV for Freedom and Peace,” within which collections of sports and adaptive clothing were presented and the winners were awarded.

CULTURAL DIPLOMACY, FASHION PRORYV, LIGHT INDUSTRY, VOCATIONAL EDUCATION