In the second quarter of 2024, Astarta Agro Holding sold 141.9 thousand tons of sugar, up 106% year-on-year, and increased sugar sales by 77% to 211.4 thousand tons over two quarters.

According to the company’s announcement on the Warsaw Stock Exchange, the average sugar price in the second quarter decreased by 13% compared to the same period last year and by 10% over six months.

Astarta’s corn sales in the second quarter increased by 109% to 123 thousand tons, up from 58.8 thousand tons a year earlier. In the first half of the year, corn sales increased by 18% to 337.9 thsd tonnes.

At the same time, sales of sunflower seeds decreased by 98% to 705 thsd tonnes, while their selling price increased by 20%. In the first half of the year, sunflower sales decreased by 67% to 20.066 thsd tonnes, while prices were 20% lower than last year.

Sales of soybean oil in the second quarter decreased by 24% to 44.788 thousand tons, while prices also fell by 10%. Sales in the first half of 2024 increased by 21% year-on-year to 27.142 thousand tons, but prices were 15% lower.

In addition, in the second quarter, Astarta reduced sales of soybean flour by 24% to 44,788 thousand tons, while prices were 10% lower than last year. In the first half of 2024, they were 10% lower compared to the same period last year.

The agricultural holding’s sales of milk in the second quarter increased by 4% to 29.42 thousand tons, while the price of the product increased by 20%. Sales in the first half of 2024 increased by 5% to 60,013 thousand tons, prices – by 21%.

In 2023, Astarta, the largest sugar producer in Ukraine, reduced its net profit by 5.0% to EUR 61.9 million, and its EBITDA decreased by 6.1% to EUR 145.77 million, while revenue increased by 21.3% to EUR 618.93 million.

Astarta CEO Viktor Ivanchik’s family currently owns 40.68% of the company. Fairfax Financial Holdings is also a major shareholder with 29.91%, and another 2.12% of shares belong to the company itself and were previously bought back as part of a buyback.

According to the National Bank of Ukraine, as of October 1, 2023, Credit Agricole Bank ranked 11th in terms of total assets (UAH 100.36 billion) among 63 operating banks in the country, with 141 branches. The bank is fully owned by French Credit Agricole SA.

KMZ Industries (Karlivka Machine-Building Plant, KMZ, Poltava region) has fulfilled another export contract for the comprehensive supply of equipment for the construction of an elevator complex in Romania, according to the plant’s website.

“We manufactured and shipped silos, transportation and gravity equipment to the customer in a timely manner,” the statement said.

The supplied equipment includes two conical silos with a diameter of 5.5 m and eight tiers with a capacity of 210 tons of wheat grain each, two elevators with a capacity of 50 tons per hour, an elevator tower, two chain conveyors with a capacity of 50 tons per hour, a conveyor gallery and a set of gravity equipment.

The press service notes that the facility is actively undergoing installation work and this season the silos will receive the first grain stored there before being sent for processing.

“The peculiarity of Romanian farmers is their desire to avoid earthworks as much as possible, so the acceptance of agricultural products at their elevator complexes is carried out using an above-ground silo and elevators without burial. In particular, at the request of the customer, all metal structures (elevator tower, gallery, supports) were also designed and manufactured by KMZ Industries,” Oleksandr Tkachenko, Head of Exports at KMZ Industries, was quoted as saying in the statement.

According to him, the logistics of shipping elevator equipment from Ukraine to Romania is well established, and there are no problems with it.

“The delivery time may still be affected by the lack of truck drivers authorized to cross the border and queues at border crossings, which makes transportation take more than a week.

Therefore, both Romanian customers and Ukrainian producers take these factors into account to avoid the risk of extending the construction time,” Tkachenko added.

As reported, KMZ Industries carried out the first comprehensive supply of a set of elevator equipment for a farm in Romania in 2020, as part of the contract concluded after winning the tender.

KMZ Industries is the largest manufacturer of elevator equipment in Ukraine and produces a full range of equipment, including silos, grain dryers, transport equipment and separators, as well as provides automation and installation services. According to the company, it has sold more than 5,000 facilities. In 2012, the company acquired the assets of Brice-Baker (UK), one of the leading suppliers of elevator equipment in Europe, and in April 2021 announced a merger with the elevator business of Variant Agro Bud LLC.

According to the Clarity Project, in 2023, KMZ reduced its net profit by 3.9 times compared to 2022, to UAH 15.8 million, with revenue falling by 20% to UAH 650.2 million.

The plant ended the first quarter of this year with a net profit of UAH 35.4 million, 3.9 times more than in January-March 2023, and revenue increased by 3.3% to UAH 71.7 million.

In January-June 2024, state-owned PrivatBank (Kyiv) earned UAH 30.6 billion in net profit, up 2.7%, or UAH 0.8 billion, compared to the same period last year, the financial institution said on Wednesday.

“At the same time, the bank’s financial result before tax amounted to UAH 40.7 billion, which is 11% more than in the first half of 2023,” the state bank said.

According to data published on Privat’s website, income tax for the six months amounted to UAH 10.1 billion, compared to UAH 6.9 billion for the same period in 2023, when the rate was 18%, compared to 25% this year.

The bank’s total assets for the first half of the year increased by 1.5% to UAH 692.5 billion.

It is noted that the net loan portfolio of individuals and legal entities of the bank exceeded UAH 102.7 billion, which is 34%, or UAH 26.2 billion, more than last year and 11.6% more than at the beginning of the year.

“Since the beginning of the year, we have been actively lending not only to individuals and micro, small and medium-sized businesses, but also developing loan programs for corporate clients and large businesses in all regions of the country. We pay special attention to enterprises in the frontline regions, as well as to financing households and businesses under alternative energy generation programs,” Gerhard Bösch, Chairman of the Board of PrivatBank, said in a release.

According to the press service, deposits and balances on customer accounts amounted to UAH 681.1 billion, up from UAH 550 billion at the beginning of the year, with growth of UAH 30 billion, or 8%, in hryvnia accounts.

As of the end of the first half of 2024, PrivatBank’s active customer base amounted to 18.3 million individuals and 880 thousand legal entities, which is 50 thousand and 5 thousand less than at the beginning of the year, respectively. The number of Privat24 users reached 13.5 million.

Privat’s network includes 1184 branches (1199 at the beginning of the year), 6854 ATMs (6880), 10,419 thousand terminals (10,473 thousand) and more than 308.6 thousand POS terminals, according to the release.

As reported, at the end of June, it became known that Boesch was dismissed from the post of PrivatBank’s CEO after three years of work. The Supervisory Board of the financial institution has already started the selection process for the vacant position.

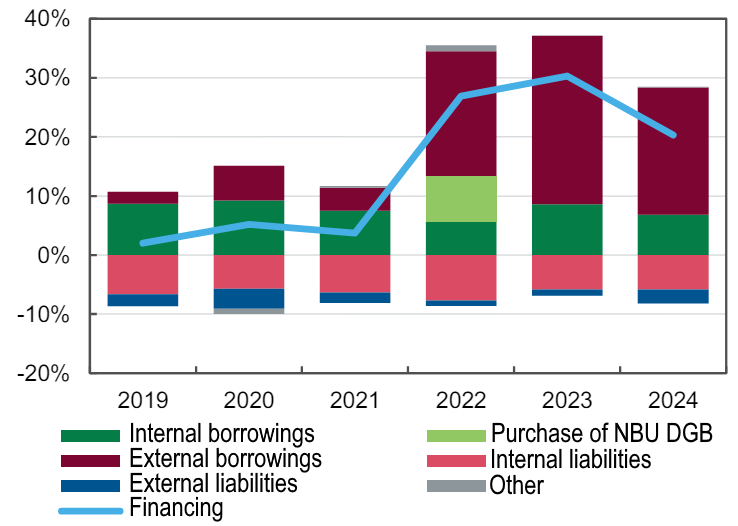

State budget financing, % of GDP

Source: Open4Business.com.ua and experts.news

The State Service of Geology and Subsoil of Ukraine has approved amendments to the special permit No. 4383 granted to Nadra Ukrayiny Holding Company LLC for the extraction of granite from the Koretske deposit (including the Southwestern part) in Rivne region.

According to NADRA.INFO with reference to the order of the State Service of Geology and Subsoil of 24.07.2024 No. 332 (download), changes to the special permit for subsoil use are made in connection with the alienation.

Nadra Ukrayiny Holding Company LLC is owned by Valentyna Khytyk (through the Czech Kristi Company S.R.O.) and Yuriy Bizhan (owner of 50% of the company since 2022). Since March 2024, the company has been headed by Yuriy Lytvynchuk (YouControl). The company has no other special permits for subsoil, except for the alienated one.

The ultimate beneficial owner of Second Granite Company LLC with a 40% stake is Viktor Melnyk. The head of the company is Yuriy Polishchuk (YouControl). According to the State Service of Geology and Mineral Resources, as of July 2024, Druha Granitna Kompaniya LLC holds two valid special permits (both acquired at auctions of the State Service of Geology and Mineral Resources): No. 5562 for the Negrebivske sand deposit in Zhytomyr region and No. 6522 for the Hvizdivske granite deposit in Rivne region.

According to the Public Audit of Subsoil Use, granites and gneiss-granites of the Koretske deposit are suitable for use as facing stone and raw materials for rubble and crushed stone.

As a reminder, the State Service of Geology and Subsoil revoked a special permit granted to Granitexpo LLC to mine granites from the Sarnovytske deposit in Zhytomyr region.

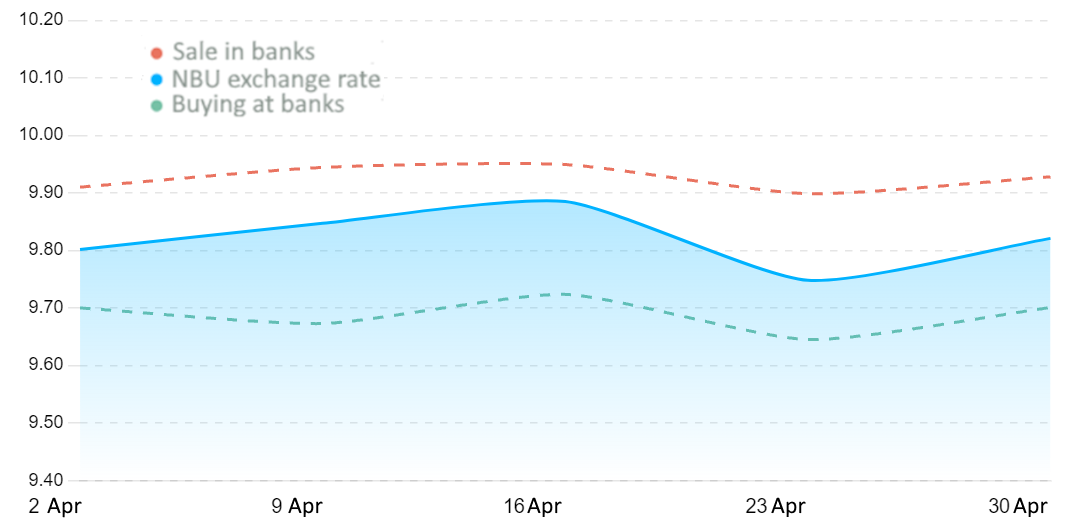

Quotes of interbank currency market of Ukraine (UAH for 1 pln, in 01.04.2024-30.04.2024)

Source: Open4Business.com.ua and experts.news