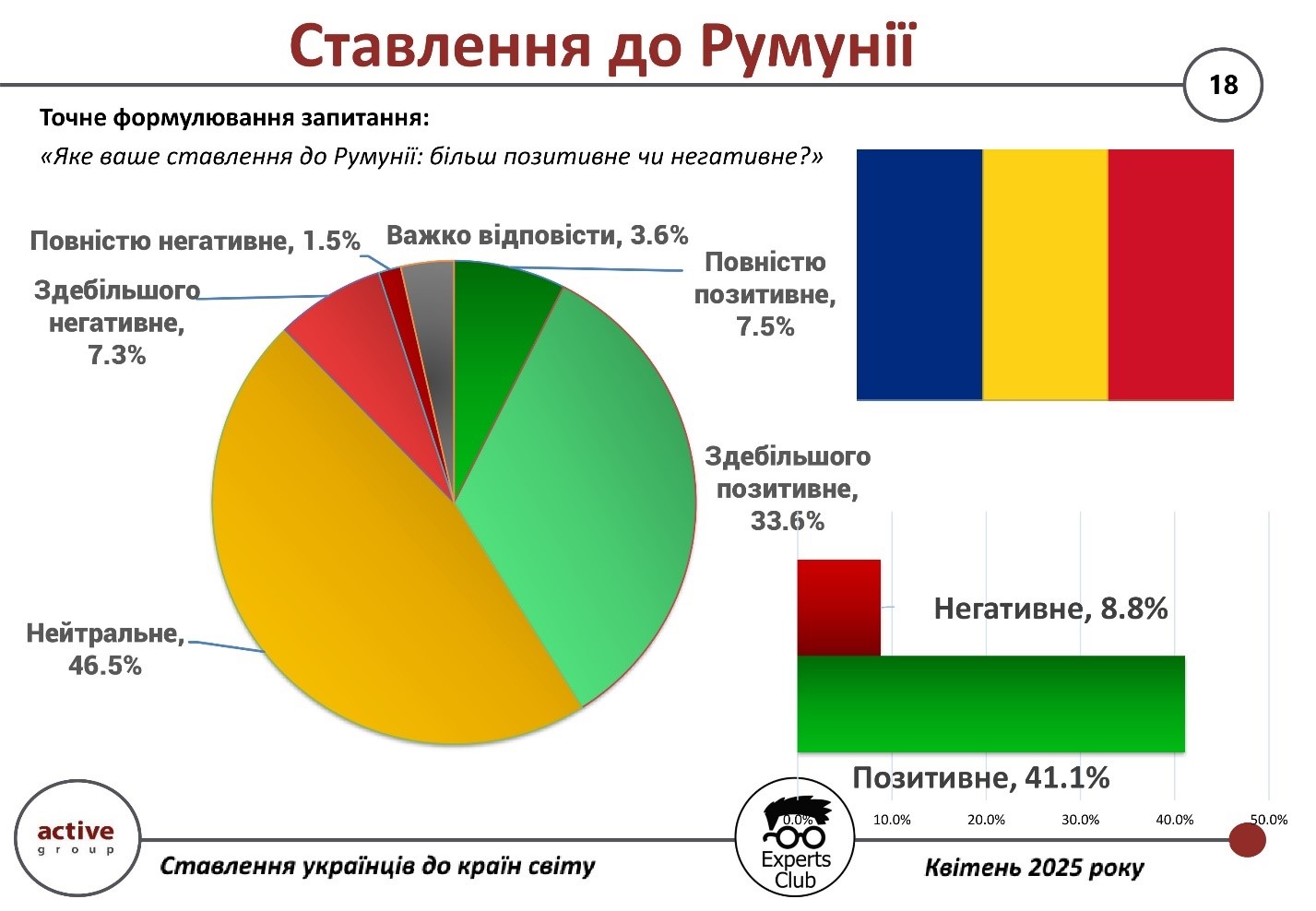

Romania, which is Ukraine’s neighbor and a member of the EU and NATO, is perceived by Ukrainian society as mostly neutral or moderately positive. This is evidenced by the results of a sociological survey conducted by Active Group in April 2025 in collaboration with the Experts Club think tank.

According to the survey, 41.1% of Ukrainians have a positive attitude toward Romania (33.6% mostly positive, 7.5% completely positive). On the other hand, 8.8% of respondents expressed a negative opinion (7.3% mostly negative, 1.5% completely negative). The largest share was held by those with a neutral position — 46.5%, while 3.6% of respondents were undecided.

“Neutrality towards Romania can be explained by both limited information about its support and the lack of high-profile initiatives that shape the image in the public consciousness. Nevertheless, there is almost no negativity,” commented Maksim Urakin, founder of Experts Club.

Thus, Romania has significant potential to deepen cooperation and improve its image in the eyes of Ukrainian society.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

Under the coordination of the Ministry of Energy of Ukraine, as part of a project to ensure uninterrupted power supply to critical railway infrastructure, JSC Ukrzaliznytsia (UZ) has received 23 backup power stations from donors in the Netherlands and Switzerland.

“Since the start of Russia’s full-scale aggression, Ukraine has received 211 humanitarian shipments from the Netherlands weighing a total of 2,905 tons, and 59 shipments from Switzerland weighing a total of 651 tons,” the ministry said on Thursday.

The Ministry of Energy did not specify the capacity of the power generators provided.

The equipment was provided to Ukraine by the Dutch Ministry of Economy and Climate and an unnamed donor from Switzerland.

As reported, in December 2024, the European Bank for Reconstruction and Development (EBRD) opened two credit lines for Ukrzaliznytsia: EUR 180 million for the purchase of gas piston units and EUR 300 million for the purchase of electric locomotives.

According to the plans, EUR 180 million will be allocated for the purchase and installation of equipment for decentralized small-scale gas generation with a total capacity of up to 270 MW. The facilities were planned to be located at Ukrzaliznytsia sites throughout Ukraine. The total cost of the project is EUR 248 million.

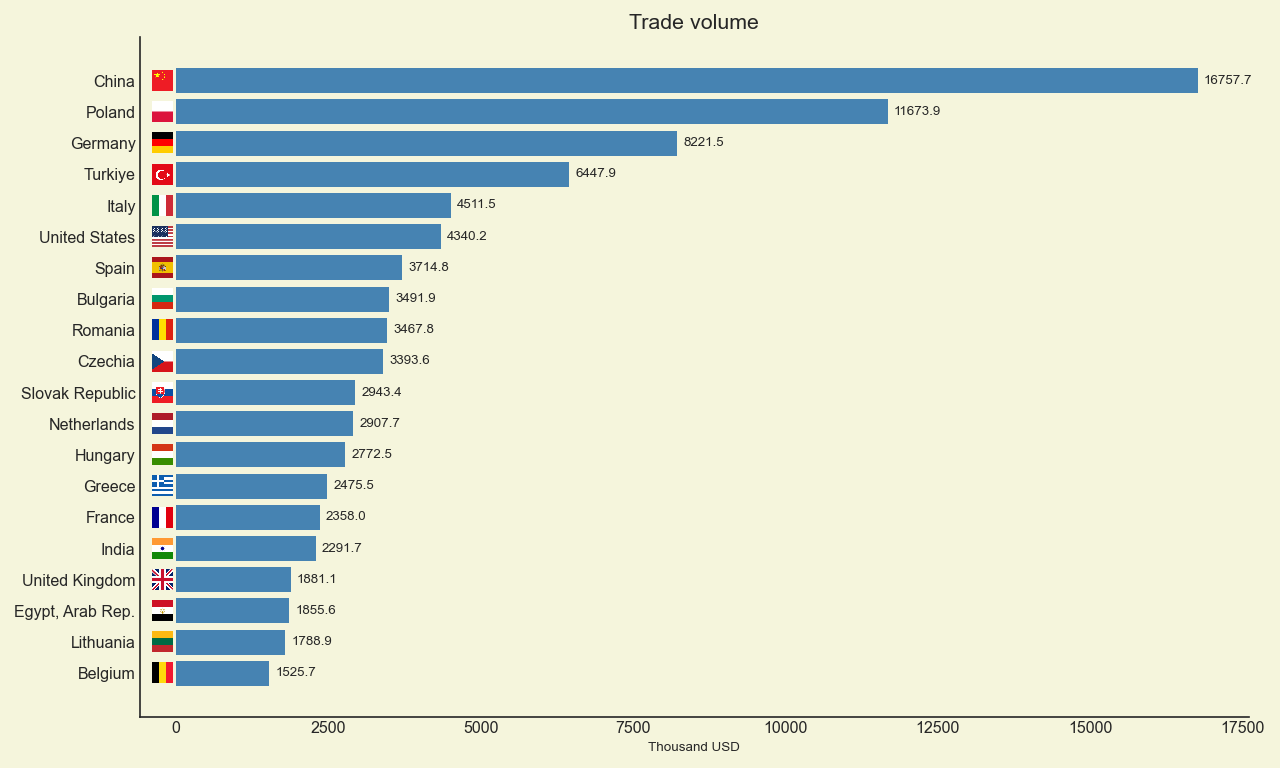

Geographic structure of Ukraine’s foreign trade (trade volume) in January-December 2024, mln. USD

Agrotrade will allocate more than 12,000 hectares for soybeans in the 2025 season. Sowing has already been completed in the Kharkiv region and is ongoing in the Sumy and Chernihiv regions, the company’s press service reported on Facebook.

“We plan to complete the main stage of soybean sowing by Monday. In some northern regions, work will continue throughout next week. Soybeans are one of the company’s staple crops, so we are working within a proven system: no changes in approaches, technologies, or crop structure,” said Oleksandr Ovsyanyk, director of the agro-industrial department at Agrotrade.

As reported, the production structure of the agricultural holding in 2025 will be as follows: winter wheat 25.2% of the sown area, corn 24.32%, soybeans 23.58%, sunflowers 17.84%, winter rapeseed 7.4%, mustard 1.02%, industrial hemp 0.56%, etc.

The Agrotrade Group is a vertically integrated holding company covering the entire agricultural cycle (production, processing, storage, and trade of agricultural products). It cultivates over 70,000 hectares of land in the Chernihiv, Sumy, Poltava, and Kharkiv regions. Its main crops are sunflower, corn, winter wheat, soybeans, and rapeseed. It has its own network of elevators with a total storage capacity of 570,000 tons.

The group also produces hybrid seeds of corn, sunflower, barley, and winter wheat. In 2014, a seed plant with a capacity of 20,000 tons of seeds per year was built on the basis of the Kolos seed farm (Kharkiv region). In 2018, Agrotrade launched its own brand, Agroseeds.

The founder of Agrotrade is Vsevolod Kozhemyako.

Veterans policy is one of Ukrnafta’s strategic priorities. The company is developing a systematic program to support veterans and military personnel with a view to the future.

On the sidelines of the Veterans Reintegration Conference, Serhii Koretskyi, Director of PJSC Ukrnafta, spoke about Ukrnafta’s practical experience in reintegrating defenders into the working environment.

“In total, the company has donated almost UAH 3 billion for the needs of the military. This includes weapons, armored vehicles, drones, pickups, and other equipment,” Serhiy Koretsky noted. ”Of Ukrnafta’s 20,000 employees, almost a thousand have been mobilized. Unfortunately, 43 of our colleagues have died. May their memory live on forever, and may we honor these heroes. More than 500 veterans have returned to work. In other words, the company has extensive experience in this area. It also has the capacity and a sincere desire to help. We must always remember that business must do everything possible to ensure that our defenders feel comfortable in their working environment. I would like to thank the European Bank for Reconstruction and Development, the Ministry of Veterans Affairs of Ukraine, the Ministry of Economy of Ukraine, and Korn Ferry for drawing attention to this important issue. I would also like to thank my colleagues who are creating a space adapted for veterans.

Ukrnafta’s main principle is to support veterans and military personnel at every stage. Salaries are paid on time. The company takes care of mobilized colleagues and their families by providing legal, psychological, and rehabilitation support. It helps its partner units. In fact, it acts as a patronage service.

Ukrnafta veterans are given the opportunity to retrain if necessary.

For veteran businesses, the company offers the opportunity to join the UKRNAFTA network, the largest single-brand network of gas stations in Ukraine.

Ukrnafta is Ukraine’s largest oil producer and operator of a national network of gas stations. In March 2024, the company took over the management of Glusco’s assets and now operates a total of 546 gas stations, 462 of which it owns and 84 of which it manages.

The company is implementing a comprehensive program to restore operations and upgrade the format of its network of gas stations. Since February 2023, it has been issuing its own fuel vouchers and NAFTAKarta cards, which are sold to legal entities and individuals through Ukrnafta-Postach LLC.

The largest shareholder of Ukrnafta is Naftogaz of Ukraine with a 50%+1 share.

In November 2022, the Supreme Commander-in-Chief of the Armed Forces of Ukraine decided to transfer the corporate rights of the company, which were owned by private owners and are currently managed by the Ministry of Defense, to the state.

Source: https://interfax.com.ua/news/press-release/1070512.html

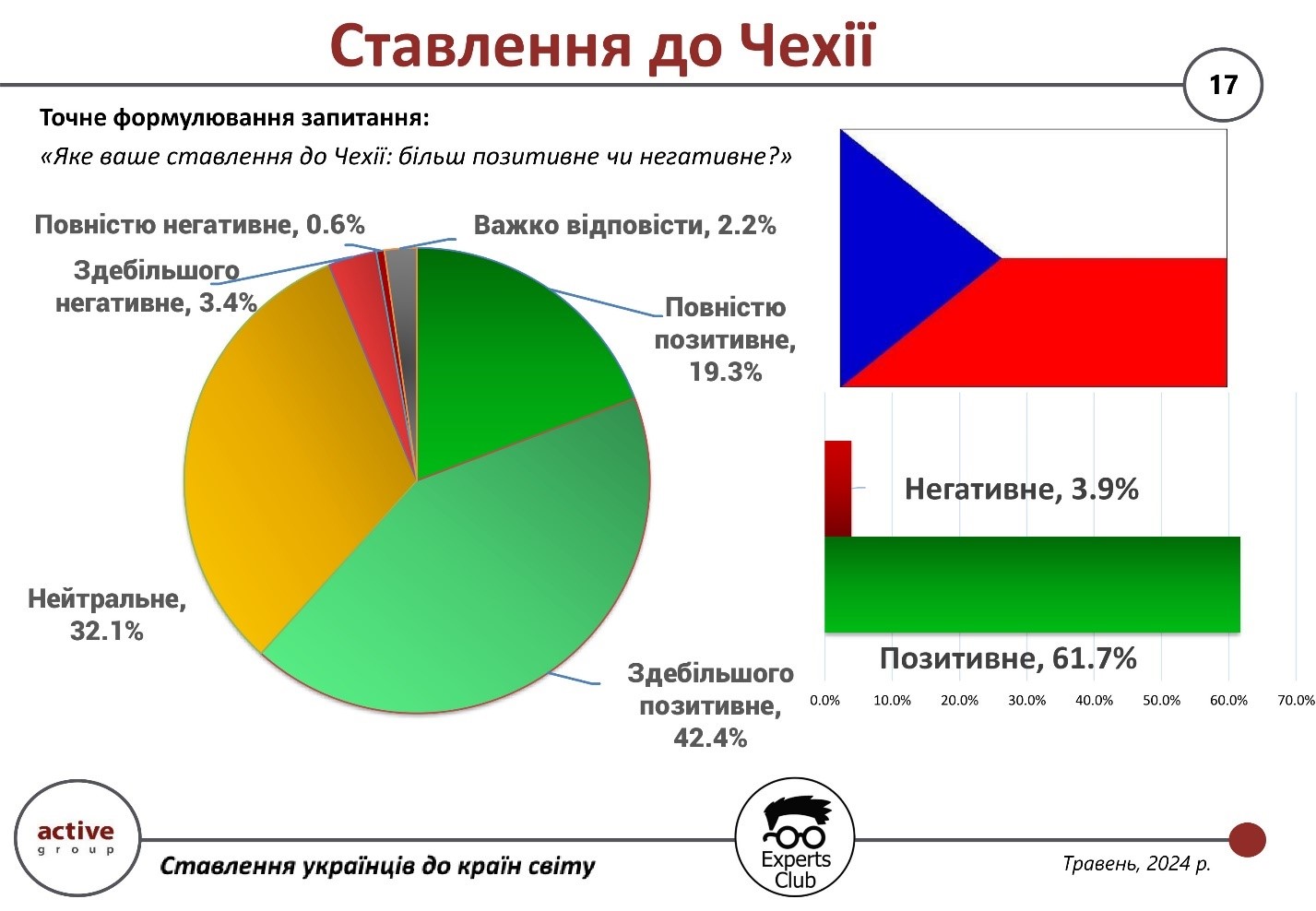

The Czech Republic maintains a positive image among Ukrainians, demonstrating a balance of support, sympathy, and stability in public perception. These data were obtained from a survey conducted by the sociological company Active Group in May 2024 in partnership with the analytical center Experts Club.

According to the survey, 61.7% of Ukrainians expressed a positive attitude toward the Czech Republic: 42.4% — mostly positive, and another 19.3% — completely positive. Only 3.9% of respondents had a negative attitude (3.4% mostly negative, 0.6% completely negative). 32.1% of those surveyed took a neutral position, and another 2.2% were unable to answer.

“The Czech Republic has consistently provided support to Ukraine in the political, humanitarian, and everyday spheres. At the same time, its image is not overly emotional or polarized, hence the significant share of neutral perceptions,” explained Oleksandr Pozniy, co-founder of Active Group.

This indicates a high level of trust on the part of Ukrainians, which could serve as a basis for further strengthening the strategic partnership.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN