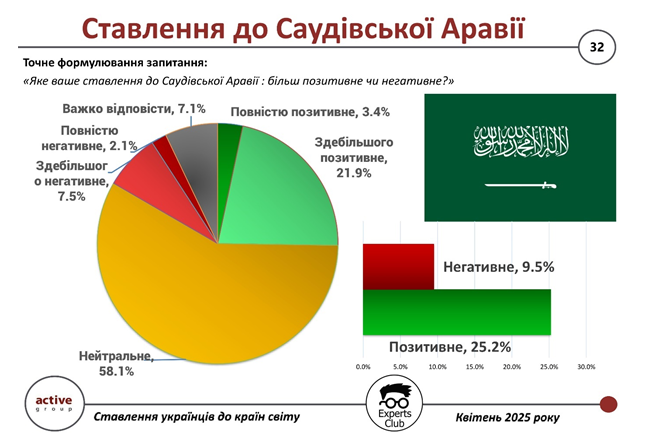

A survey conducted by Active Group and Experts Club shows that 58.1% of Ukrainians have a neutral attitude toward Saudi Arabia, while another 7.1% were unable to give a clear answer. This indicates a lack of deep emotional associations with this country in the mass consciousness.

At the same time, 25.2% of respondents have a generally positive attitude toward Saudi Arabia (21.9% — mostly positive, 3.4% — completely positive). A negative attitude was expressed by 9.5% of respondents (7.5% — mostly negative, 2.1% — completely negative).

“Saudi Arabia is associated with wealth, oil resources, and cutting-edge technological megaprojects. However, at the same time, cultural distance, limited rights, and a closed society create a mixed perception. The positive attitude is primarily due to the country’s active peacemaking position in the war,” comments Maxim Urakin, PhD in Economics and founder of the Experts Club information and analytical center.

The neutral and cautious attitude of Ukrainians towards Saudi Arabia shows that the country’s economic attractiveness does not always outweigh cultural stereotypes and a lack of deep contacts.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

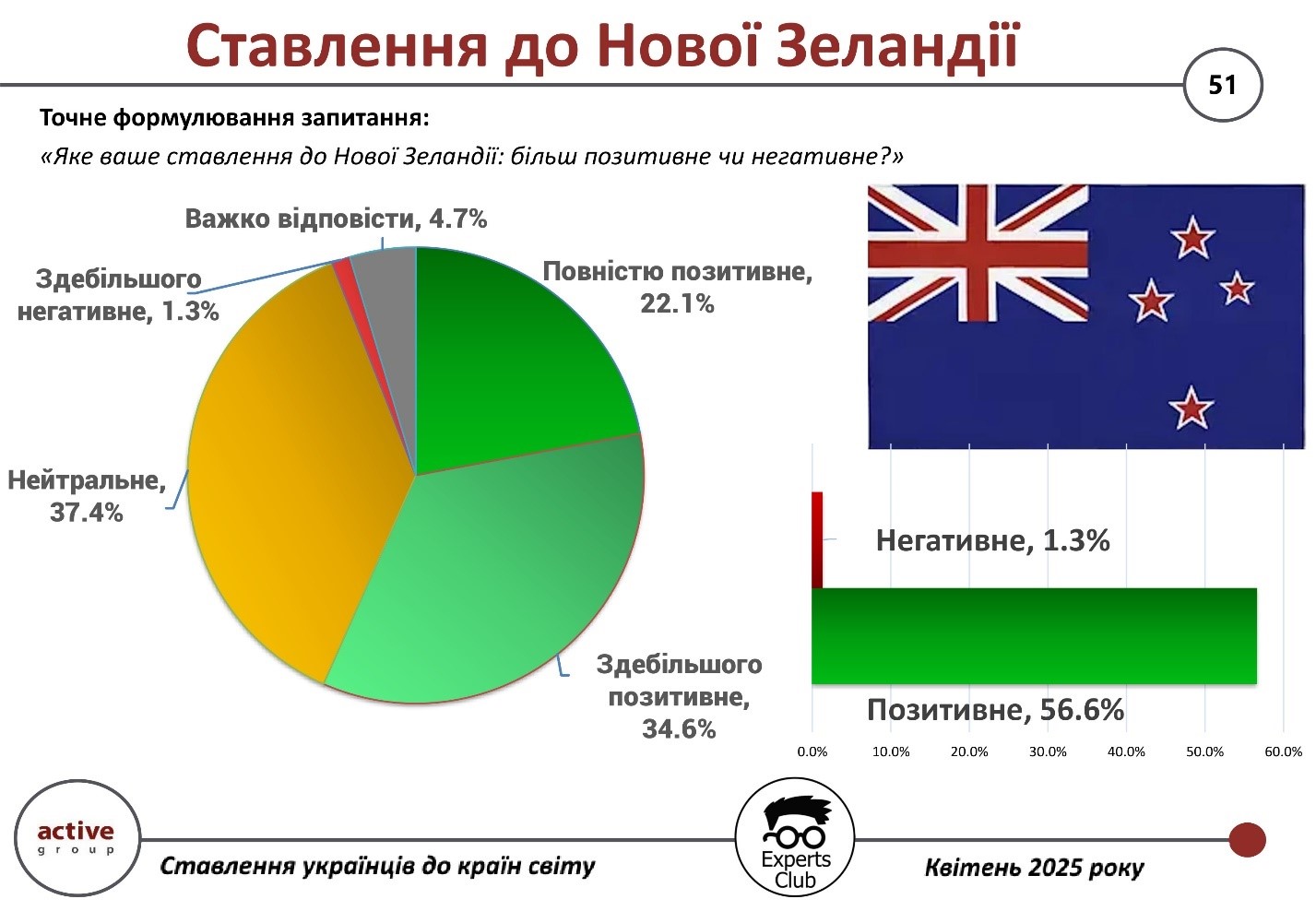

According to a survey conducted by Active Group and the Experts Club analytical center, 56.6% of Ukrainians have a positive attitude toward New Zealand. In particular, 34.6% of respondents said they had a “mostly positive” attitude toward the country, and another 22.1% said they had a “completely positive” attitude.

A neutral position was taken by 37.4% of respondents, which indicates limited knowledge about the country, but without prejudice. Only 1.3% of respondents expressed a negative attitude (1.3% mostly negative, 0% completely negative), and 4.7% were unable to decide on an answer.

“New Zealand is perceived by Ukrainians as one of the most peaceful, progressive, and naturally attractive countries in the world. Its environmental policy, the well-being of its citizens, and its positive image in world culture create a consistently high level of sympathy,” commented Maksim Urakin, candidate of economic sciences and founder of the Experts Club information and analytical center.

New Zealand has a strong positive image among Ukrainians, despite its geographical remoteness. Its support for international values and reputation as a peaceful, developed country form the basis for this friendly attitude.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

State-owned Oschadbank and Ukrgasbank, together with PUMB, issued a loan of UAH 2.8 billion to a defense industry enterprise in the fourth quarter of 2024 under the Program for Strengthening the State’s Defense Capabilities and Meeting the Urgent Needs of the Armed Forces of Ukraine, according to information on the website of the Ministry of Finance.

As clarified to the Interfax-Ukraine news agency by Oschadbank, the bank acted as the organizer of this consortium loan, which was the first loan to the domestic defense industry.

“As the coordinating bank for this agreement, Oschadbank has set itself the main task of creating a consortium not so much to diversify risks as to set a precedent for involving banks that do not have access to state secrets in the financing of defense industry enterprises,” commented Yuriy Katsion, deputy chairman of the board of Oschadbank, responsible for corporate business.

The shares of the participants in the consortium loan are not disclosed.

As reported, since the start of the full-scale war, Oschadbank has concluded loan agreements to support the defense industry worth over UAH 17.1 billion.

According to the Ministry of Finance, in 2024, the state-owned Oschadbank, Ukreximbank, Ukrgasbank, and PUMB provided 11 loans under state guarantees to defense industry enterprises under the above-mentioned program in the amount of UAH 21 billion. Excluding the consortium, Oschadbank issued six loans worth UAH 9.86 billion, and Ukreximbank issued four loans worth UAH 8.25 billion.

A year earlier, Oschadbank provided a loan worth UAH 6.09 billion under this program, and Ukreximbank provided a loan worth UAH 5.98 billion.

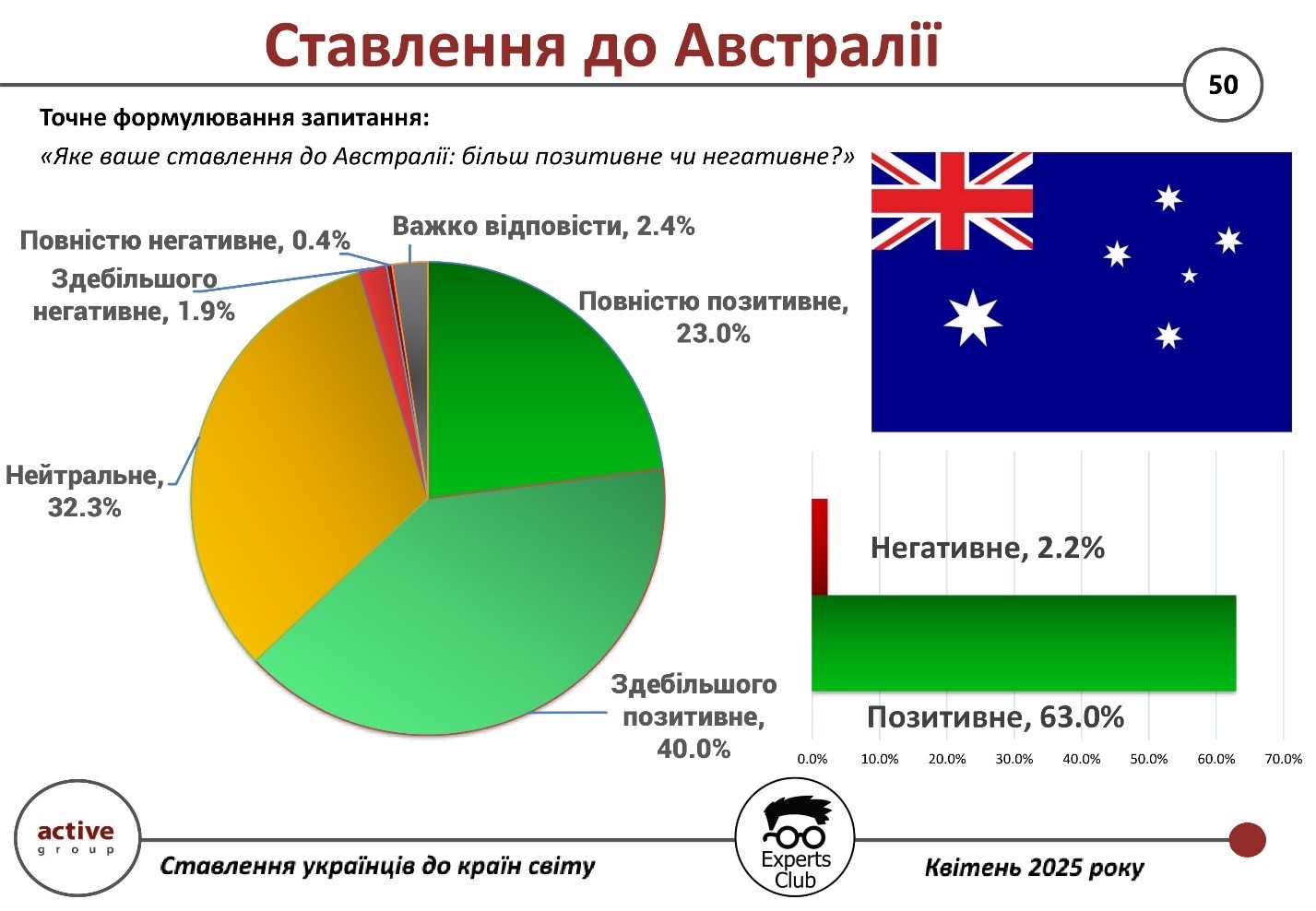

According to the results of a sociological survey conducted by Active Group and the information and analytical center Experts Club in April 2025, the majority of Ukrainians — 63% — have a positive attitude toward Australia. Of these, 40% chose the option “mostly positive,” and another 23% — “completely positive.”

A neutral position was taken by 32.3% of respondents, while only 2.2% of citizens have a negative perception of Australia (1.9% — mostly negative, 0.4% — completely negative). It was difficult to answer — 2.4%.

“Australia has long formed an image in the minds of Ukrainians as a democratic, safe, and distant but friendly country. Its participation in international initiatives, in particular its support for Ukraine in the war, has further strengthened its positive image,” says Oleksandr Pozniy, co-founder of Active Group.

Australia ranks among the top countries in terms of Ukrainians’ favorability ratings. Its distant geographical location does not prevent the formation of a stable positive image based on international support, shared values, and cultural openness.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

During a press conference on Saturday night, Putin proposed starting direct talks with Ukraine in Istanbul on May 15, according to Reuters.

Putin ignored the proposal by Ukraine and European leaders, supported by the US, for a 30-day ceasefire starting on Monday, May 12.

Instead, he said that a ceasefire could be discussed during direct talks.

“He said that Russia is offering direct talks with Ukraine in Istanbul in an attempt to ‘eliminate the root causes of the conflict’ and ‘achieve the restoration of long-term, lasting peace,’” Reuters quoted the Kremlin leader as saying.

As noted by the agency, Putin resorted to accusations against the Ukrainian authorities that are traditional for his rhetoric. In particular, he complained about the unsuccessful negotiations in Istanbul in 2022.

As reported, on Saturday, May 10, the leaders of France, Germany, Poland, the UK, and Ukraine, following a meeting in Kyiv, adopted a joint statement proposing that Russia cease fire completely and unconditionally from Monday, May 12, for at least 30 days. In the event of Russia’s refusal to accept the proposed ceasefire, they agreed to impose tougher sanctions on its banking and energy sectors, targeting fossil fuels, oil, and the shadow fleet. The joint statement also mentioned the 17th package of EU sanctions and continued work on the effective use of frozen Russian assets.