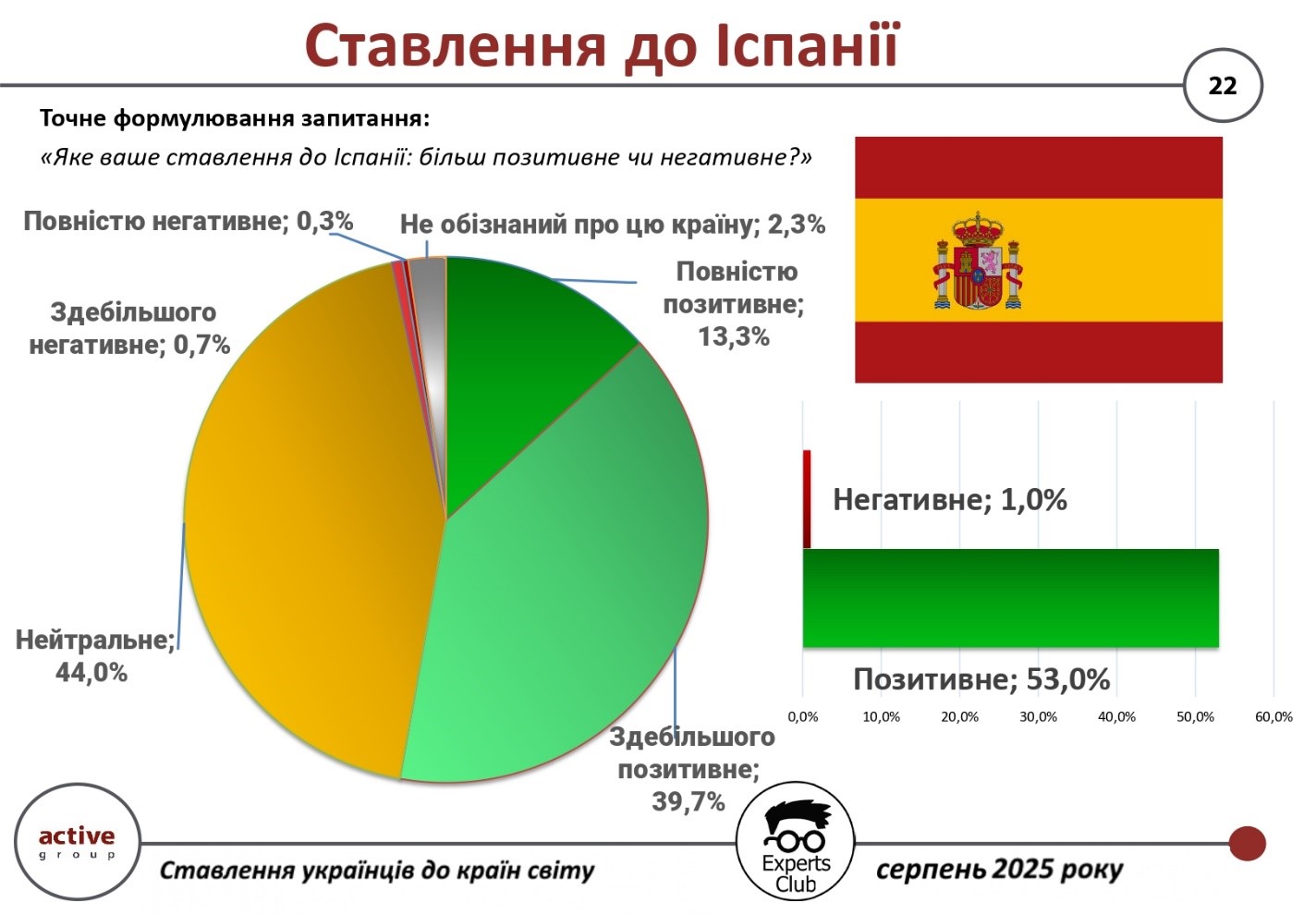

Spain is one of those countries that are perceived by Ukrainians almost unconditionally positively, and the level of negative assessments of it remains minimal. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the survey, 53.0% of Ukrainian citizens have a positive attitude towards Spain (39.7% – mostly positive, 13.3% – completely positive). Only 1.0% of respondents expressed a negative attitude (0.7% – mostly negative, 0.3% – completely negative). At the same time, 44.0% of respondents are neutral, and 2.3% said they were not sufficiently aware of the country.

“Spain demonstrates one of the highest shares of positive assessments among Ukrainians, and this is no coincidence. In the first half of 2025, the volume of trade between our countries amounted to more than $1.44 billion, of which exports from Ukraine amounted to $975.7 million and imports from Spain amounted to about $460.4 million. The positive balance of more than $515 million indicates the profitability of cooperation and that Ukraine has a competitive position in the Spanish market,” said Maksym Urakin, founder of Experts Club.

In his turn, Alexander Poznyi, co-founder of Active Group, emphasized that the high level of sympathy on the part of Ukrainians is also politically and culturally based.

“Spain actively supports Ukraine on international platforms, provides humanitarian aid and creates favorable conditions for Ukrainian migrants. At the same time, cultural openness and traditional ties between our peoples strengthen this positive image. Therefore, the level of distrust or criticism of Spain in Ukrainian society is practically absent,” he added.

The survey was part of a comprehensive study of international sympathies and antipathies of Ukrainians in the current geopolitical context.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Poznyi, SOCIOLOGY, SPAIN, TRADE, URAKIN

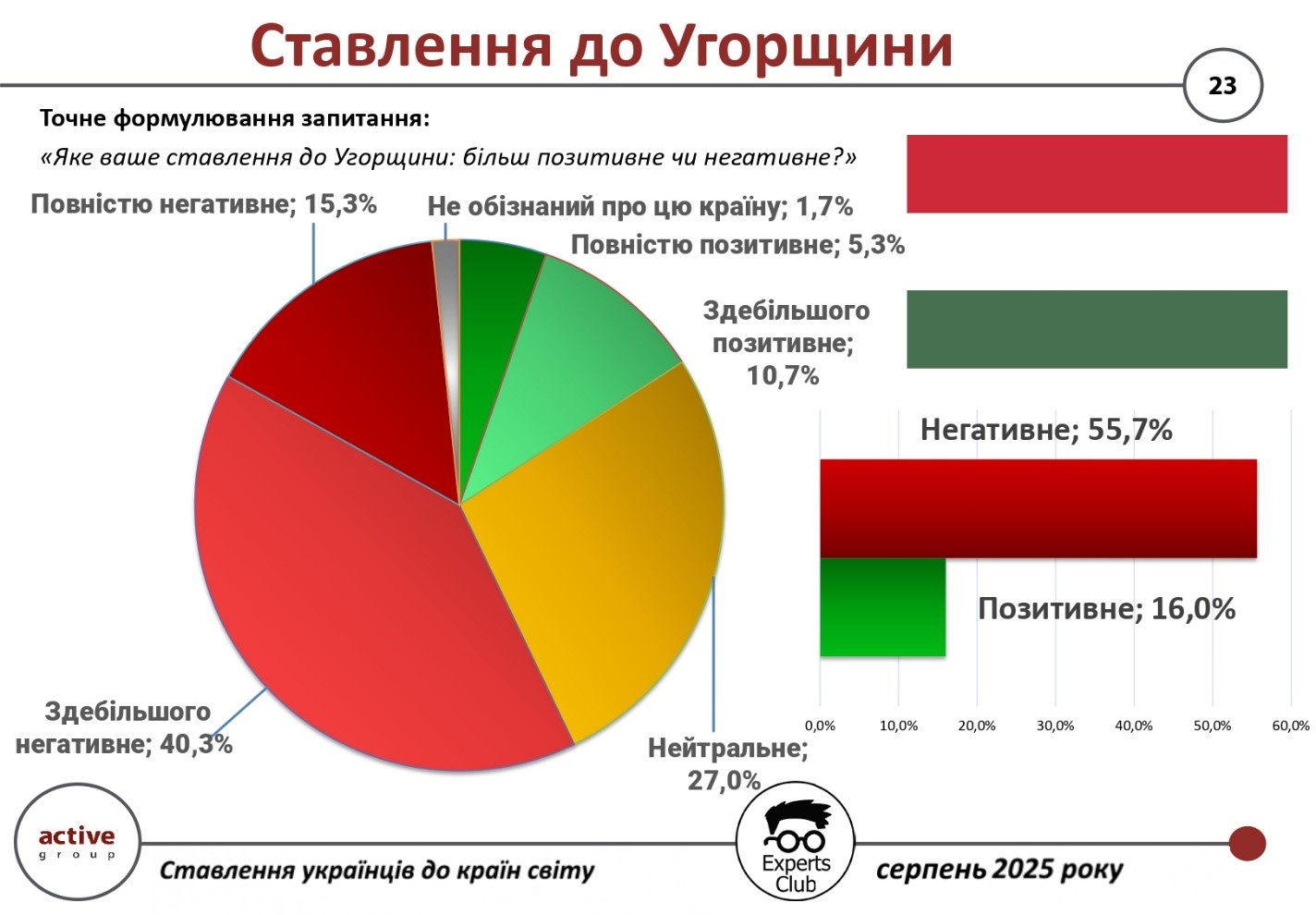

The attitude of Ukrainians towards Hungary is one of the most critical among all EU countries. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical centerin August 2025.

According to the survey, 55.7% of Ukrainian citizens have a negative attitude towards Hungary (40.3% – mostly negative, 15.3% – completely negative). Only 16.0% of respondents expressed a positive attitude (10.7% – mostly positive, 5.3% – completely positive). Another 27.0% of respondents took a neutral position, and 1.7% said they did not know the country well enough to form their own opinion.

“Ukrainians perceive Hungary ambiguously due to a number of political factors. This directly affects the level of trust in society. Nevertheless, if we look at the economic component, in the first half of 2025, the volume of trade between Ukraine and Hungary exceeded $1.52 billion, of which exports from Ukraine amounted to $652 million and imports to almost $874 million. The negative balance of more than $221 million indicates a certain asymmetry in relations, but at the same time demonstrates that Hungary remains a prominent partner in our market,” said Maksym Urakin, founder of Experts Club.

In his turn, Active Group co-founder Oleksandr Poznyi emphasized that the sociological results do not mean complete rejection of cooperation.

“More than half of the citizens do demonstrate a critical attitude towards Hungary, but a quarter of respondents remain neutral, and one in six Ukrainians assesses Hungary positively. This means that there is still potential for restoring trust at the level of interpersonal contacts, cultural ties, and business relations. In the future, these factors may become the basis for mitigating the current negative assessments,” he added.

The survey was part of a broader study of international sympathies and antipathies of Ukrainians in the context of the current geopolitical situation.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, HUNGARY, Poznyi, SOCIOLOGY, TRADE, URAKIN

Ukrainians have a mostly positive attitude toward the Czech Republic, which is an important partner in the European Union and one of the main destinations for labor migration. This is evidenced by the results of a survey conducted by Active Group in cooperation with the Experts Club.

According to the survey, 62% of Ukrainians expressed a positive attitude towards the Czech Republic (40.7% – mostly positive and 21.3% – completely positive). Neutral attitudes were expressed by 33% of respondents, while negative opinions accounted for only 3.3%. Another 2% of respondents admitted that they did not have sufficient information about the country.

Thus, the Czech Republic is among the countries that have a consistently high level of positive perception among Ukrainians, on par with other Central European countries.

According to the State Customs Service of Ukraine, in 2024, trade between Ukraine and the Czech Republic reached USD 1.64 billion. THIS IS A SIGNIFICANT INCREASE. At the same time, Ukrainian exports amounted to USD 478.7 million, and imports from the Czech Republic amounted to USD 1.16 billion. The negative balance amounted to $683.5 million.

Ukraine’s exports to the Czech Republic are mainly ferrous metals, machinery, and agricultural products. Imports from the Czech Republic consist mainly of automotive machinery, equipment, electronics, and pharmaceuticals.

“The positive attitude of Ukrainians toward the Czech Republic is explained not only by historical proximity but also by Prague’s active support for Ukraine. At the same time, economic relations between the two countries are characterized by a significant imbalance – imports from the Czech Republic significantly exceed exports. This creates prospects for the development of new areas of cooperation, especially in the fields of high technology, investment projects, and energy,” emphasized Maksym Urakin, founder of Experts Club, economist.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, CZECH REPUBLIC, DIPLOMACY, EXPERTS CLUB, Pozný, SOCIOLOGY, TRADE, URAKIN

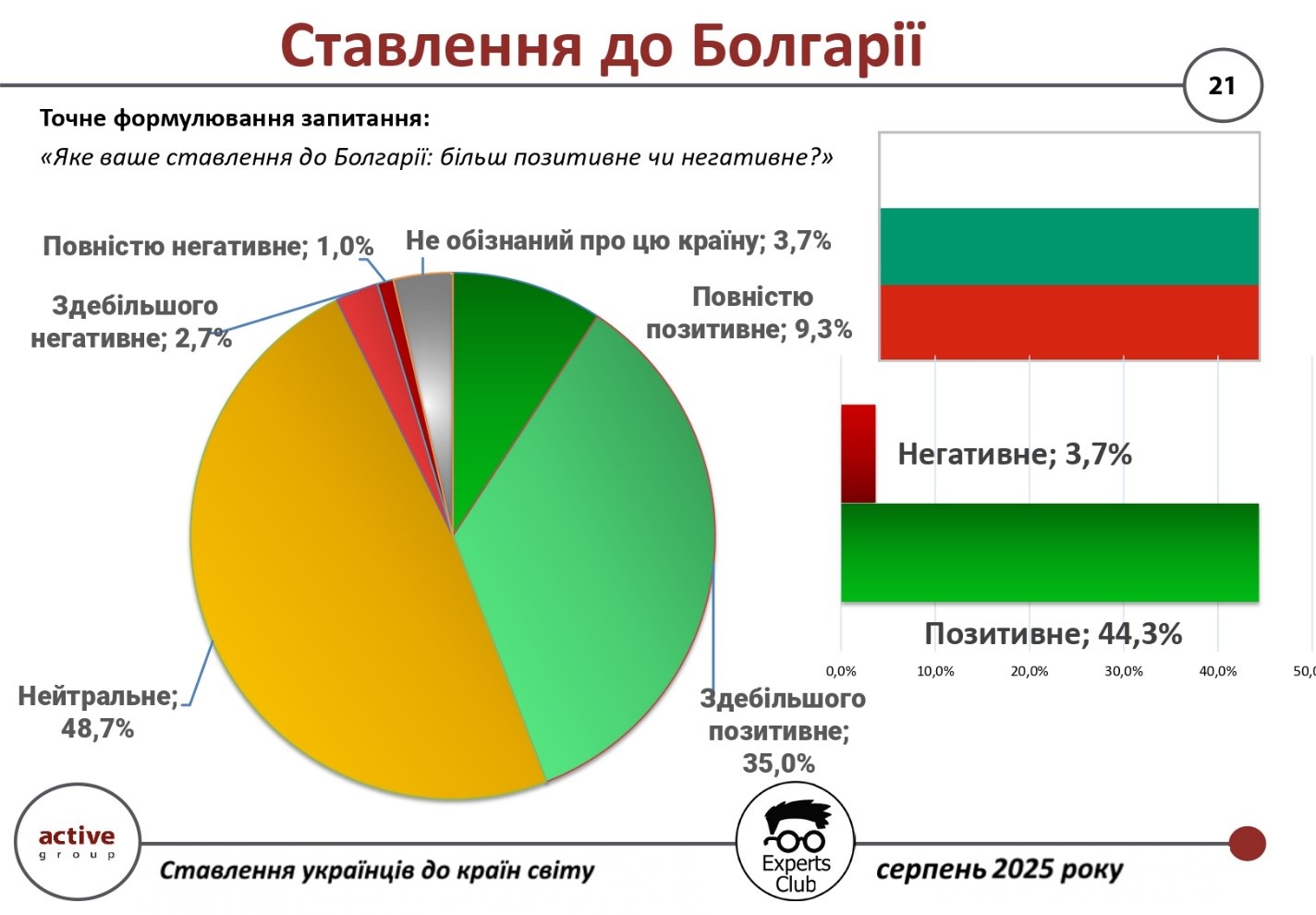

Bulgaria is perceived by Ukrainians mostly positively, although a significant number of citizens remain neutral. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the survey, 44.3% of Ukrainians have a positive attitude towards Bulgaria (35.0% – mostly positive, 9.3% – completely positive). Only 3.7% of respondents expressed a negative attitude (2.7% – mostly negative, 1.0% – completely negative). At the same time, 48.7% of citizens are neutral, and 3.7% admitted that they do not know enough about this country.

“For Ukrainians, Bulgaria is not only an EU member state but also a significant economic partner. In the first half of 2025, the volume of bilateral trade amounted to more than $1.53 billion, of which Ukrainian exports amounted to $558.6 million and imports from Bulgaria amounted to almost $980 million. The negative balance of $421.5 million demonstrates an asymmetry in relations, but against the background of the total volume, it confirms the importance and sustainability of economic ties,” said Maxim Urakin, founder of Experts Club.

In his turn, Oleksandr Poznyi, co-founder of Active Group, drew attention to the fact that the sociological picture shows a friendly but at the same time restrained attitude of Ukrainians.

“Almost half of the citizens have a neutral position on Bulgaria, and this is due to the relatively limited presence of this country in the public and information space of Ukraine. At the same time, positive assessments outnumber negative ones by almost ten to one, which indicates the existence of trust and good potential for further development of relations,” he added.

The survey was part of a broader study analyzing international sympathies and antipathies of Ukrainians in the current geopolitical environment.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, BULGARIA, DIPLOMACY, EXPERTS CLUB, Poznyi, SOCIOLOGY, TRADE, URAKIN

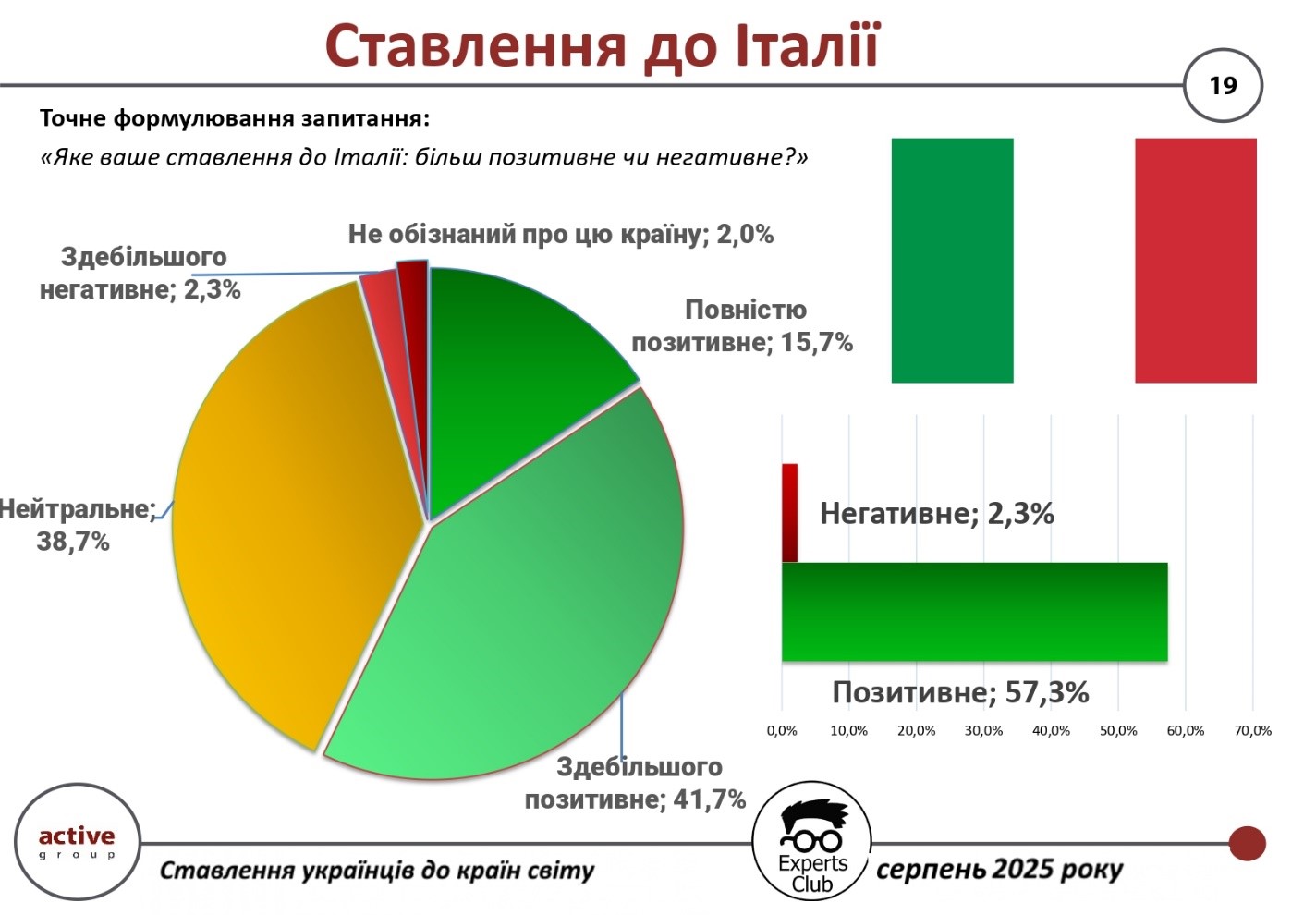

Italy traditionally enjoys a high level of trust among Ukrainians, combining cultural proximity and pragmatic economic cooperation. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the survey, 57.3% of Ukrainian citizens have a positive attitude towards Italy (41.7% – mostly positive, 15.7% – completely positive). Only 2.3% of respondents expressed a negative attitude, while 38.7% remain neutral. Another 2.0% said they did not know enough about the country.

“For Ukrainians, Italy is associated with a warm culture, support during the war and significant diaspora contacts. But an even more important factor is the economic one: in the first half of 2025, the total trade between Ukraine and Italy amounted to more than $2.38 billion, of which exports from Ukraine amounted to $1.17 billion and imports from Italy to $1.21 billion. The negative balance of $40 million is insignificant and indicates a relative balance of economic relations,” said Maksym Urakin, founder of Experts Club.

In turn, Alexander Poznyi, co-founder of Active Group, emphasized that the positive attitude of Ukrainians goes beyond economic calculations.

“For most citizens, Italy is also a country associated with cultural openness, historical ties and solidarity in difficult times. That is why more than half of Ukrainians demonstrate a positive attitude, and the low level of negative assessments confirms the friendly nature of relations. In the future, this creates preconditions for even closer cooperation in both political and economic dimensions,” he added.

The survey was part of a broader study of international sympathies and antipathies of Ukrainians in the current geopolitical environment.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, ITALY, Poznyi, SOCIOLOGY, TRADE, URAKIN

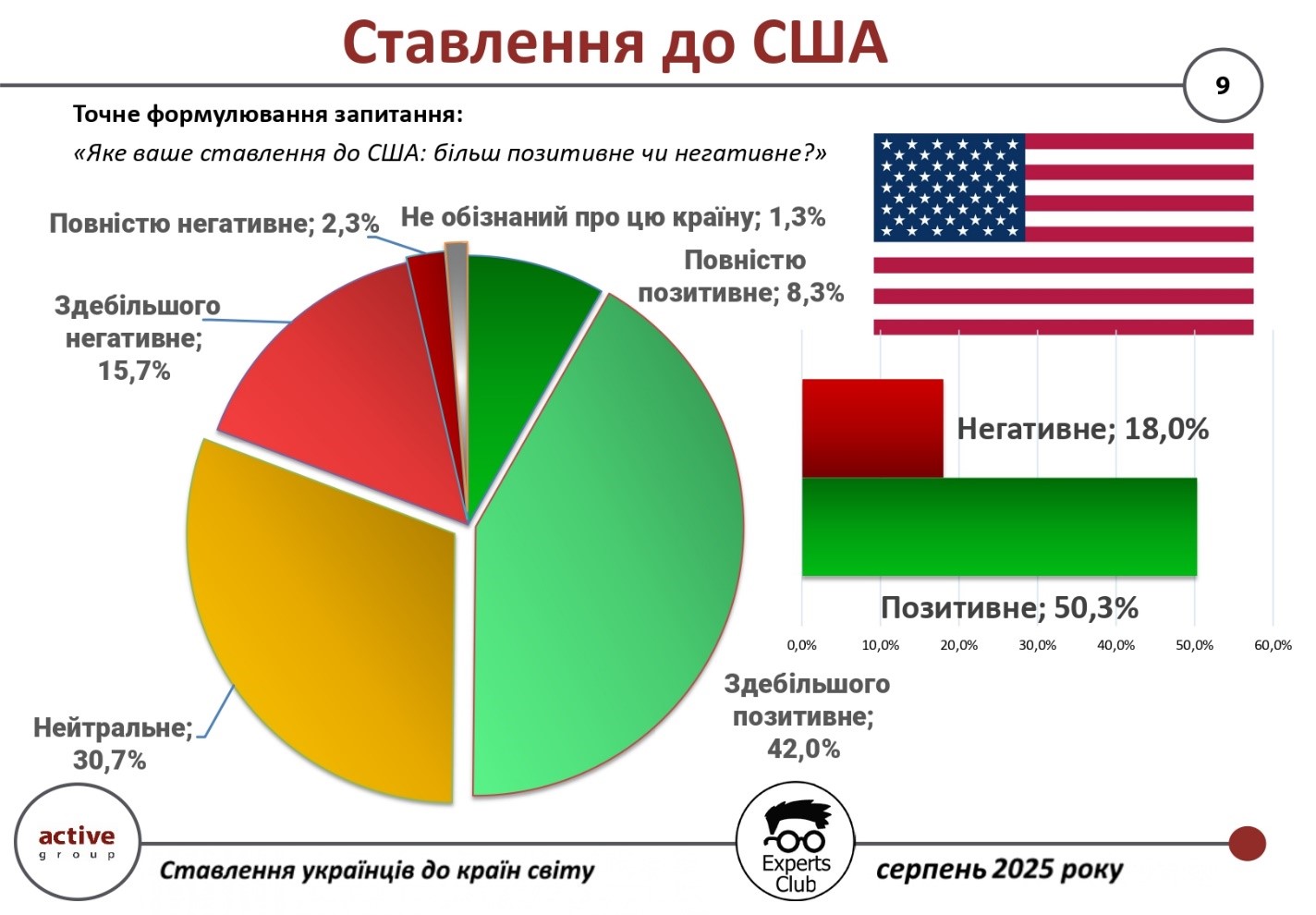

The United States remains the main strategic partner in the world for Ukrainians, but there is still a significant segment of critical and neutral attitudes in society. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the survey, 50.3% of Ukrainian citizens have a positive attitude towards the United States (42.0% – mostly positive, 8.3% – completely positive). Only 18.0% of respondents expressed a negative attitude (15.7% – mostly negative, 2.3% – completely negative). Another 30.7% of Ukrainians are neutral, and 1.3% said they were not sufficiently aware of the country.

“The United States remains a key ally for Ukraine in the military, political, and diplomatic spheres. However, the trade and economic dimension is also worth noting: in the first half of 2025, bilateral trade exceeded $2.85 billion, of which exports from Ukraine amounted to $544.5 million and imports from the United States exceeded $2.31 billion. The negative balance of $1.77 billion shows a high level of dependence on American goods, but at the same time indicates the scale of cooperation and the importance of the United States for our economy,” said Maksym Urakin, founder of Experts Club.

In his turn, Oleksandr Poznyi, co-founder of Active Group, emphasized that sociological indicators reflect a complex but stable system of trust.

“Ukrainians highly appreciate the US assistance in the war and international politics. Despite some critical assessments, half of the citizens perceive the United States positively, and almost a third remain neutral. This means that the United States continues to be the No. 1 country for Ukrainian society in the security dimension, and economic cooperation only strengthens this position,” he added.

The survey was part of a comprehensive study of international sympathies and antipathies of Ukrainians in the current geopolitical environment.

The full video is available here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Poznyi, SOCIOLOGY, TRADE, URAKIN, USA