Ukraine’s negative foreign trade balance in goods in January-April 2025 increased by 48.5% compared to the same period in 2024, reaching $11.512 billion from $7.755 billion, according to the State Statistics Service (Gosstat).

According to its data, exports of goods from Ukraine during the specified period compared to January-April 2024 decreased by 6.9% to $13.312 billion, while imports increased by 12.6% to $24.824 billion.

The statistics agency specified that in April 2025, compared to March 2025, seasonally adjusted exports decreased by 4.4% to $3.369 billion, and imports decreased by 2.3% to $6.529 billion.

The seasonally adjusted foreign trade balance in April 2025 was negative at $3.161 billion, as it was in the previous month at $3.163 billion.

The export-to-import coverage ratio in January-February 2025 was 0.54 (in January-April 2024, it was 0.65).

The State Statistics Service reported that foreign trade operations were conducted with partners from 217 countries around the world.

Earlier, the Experts Club information and analytical center released a video analysis of the Ukrainian and global economies, more details here –

https://youtu.be/LT0sE3ymMnQ?si=0Cstf1AY9xZ4Dxxx

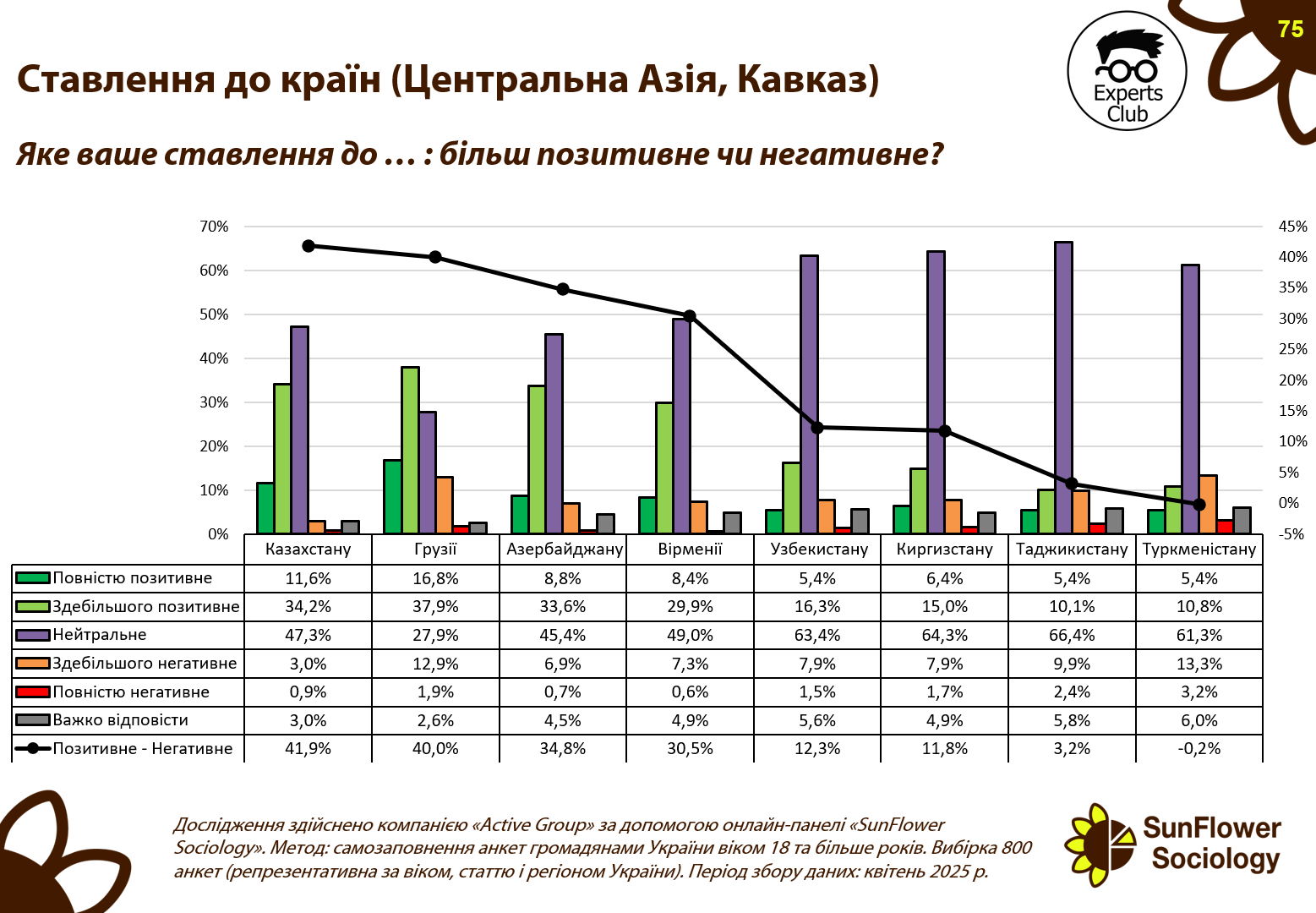

A survey conducted by Active Group in partnership with Experts Club found that among South American countries, Ukrainians have the highest level of sympathy for Argentina. According to data published in April 2025, 8.4% of respondents expressed a completely positive attitude toward this country, and another 29.3% expressed a mostly positive attitude. Thus, Argentina has the highest positive balance in the region — 34.6%.

Brazil came in second place in terms of support, with a total of 33.3% positive ratings (6.4% completely positive, 26.9% mostly positive) and a balance of 23.9%. Chile shows rather restrained sympathy: 4.3% of respondents were completely positive, 15.1% mostly positive, giving a balance of 13.3%. Peru, Bolivia, and Uruguay were at or slightly above 10% positive balance.

It is particularly noteworthy that for Bolivia this figure is 8.6%, despite a fairly high level of neutral attitudes — 70.5%.

The situation is much worse for Colombia, which has the lowest balance in the region — minus 4.5%. 18.1% of respondents expressed a mostly negative opinion, which significantly outweighs the total 14.6% of positive perceptions. Venezuela also has a negative balance of minus 2.1%, mainly due to political instability and negative associations in the media.

Most South American countries are perceived by Ukrainians as mostly neutral. In Paraguay, Suriname, Guyana, and Uruguay, the level of neutrality ranges from 71% to 74%. This indicates weak emotional contact and insufficient presence of these countries in Ukraine’s information space.

“Latin American countries remain largely outside the scope of active Ukrainian interest, which creates both challenges and opportunities. Where the level of neutrality is high, there is room for diplomacy, cultural exchange, and building a positive image,” comments Maxim Urakin, PhD in Economics and founder of Experts Club.

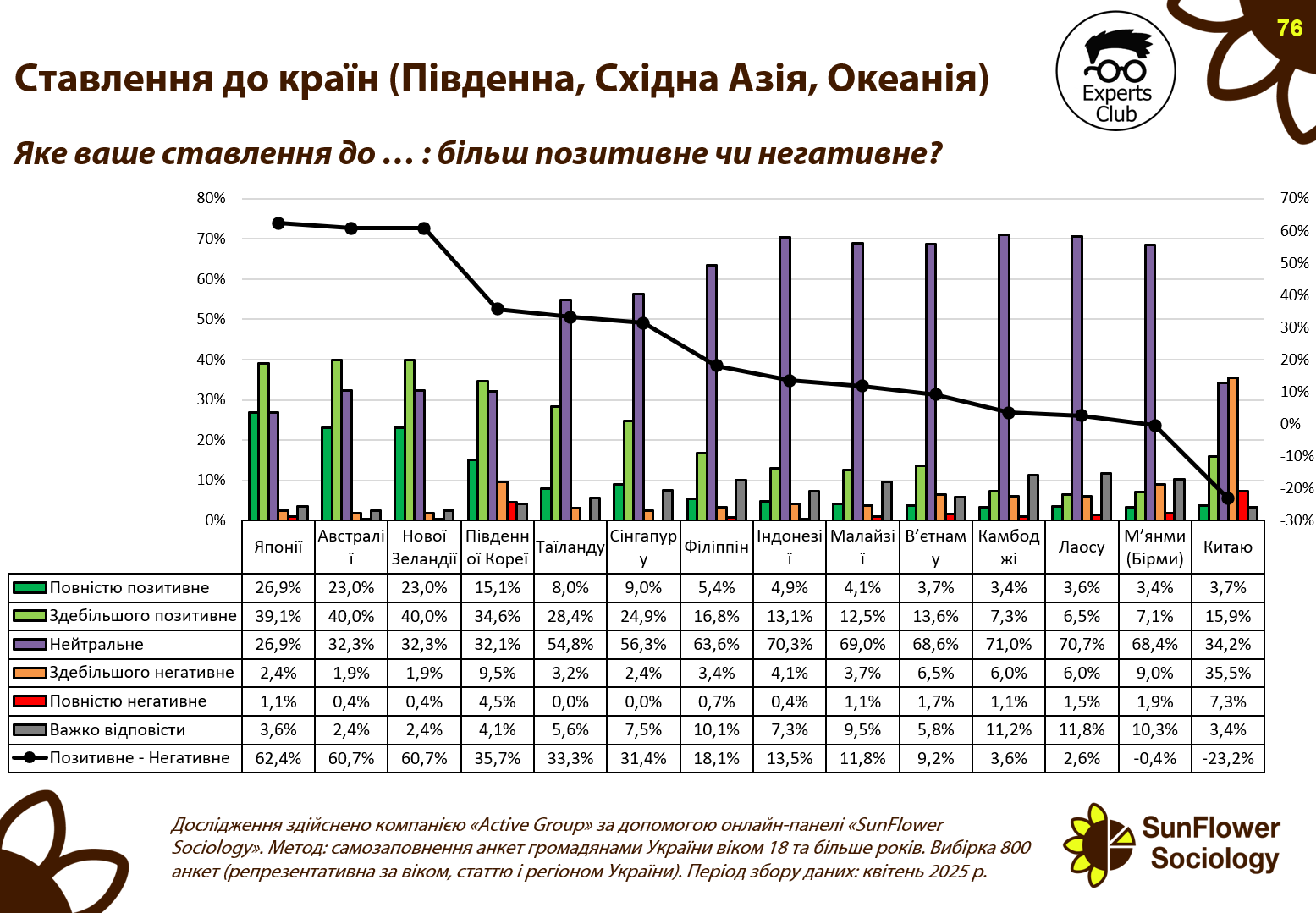

According to new sociological data published by Active Group in collaboration with Experts Club in April 2025, Ukrainian public opinion on South and East Asian countries and Oceania varies significantly. Japan, Australia, and New Zealand are in favor, while China and some countries in Southeast Asia show either a negative or neutral balance.

Japan received the highest positive rating among the countries in the region, with 62.4% of Ukrainians having a positive attitude towards it, including 26.9% who are completely positive and 39.1% who are mostly positive. It is followed by Australia and New Zealand with an identical net balance of 60.7%. In Australia, 23% of respondents chose the completely positive option, in New Zealand — the same, while more than 40% in each country gave a “mostly positive” rating.

South Korea, with 15.1% completely positive ratings and 34.6% mostly positive, has a respectable balance of 35.7%, although lower than the leaders. Thailand (36.4% positive perception) and Singapore (33.8%) also hold relatively high positions thanks to their stable image associated with tourism and development.

In contrast, countries such as Indonesia, Malaysia, Vietnam, Cambodia, Laos, and Myanmar are dominated by neutral assessments — over 60% — indicating limited awareness or an information vacuum. In all these countries, the positive balance does not exceed 10%.

Despite its economic weight, China has one of the worst images among Ukrainians in the region: 15.9% expressed a mostly positive opinion, but 35.5% rated China neutrally, and the negative balance was -23.2%. This reflects a certain distrust that has formed against the backdrop of geopolitical events and the information background.

“It is particularly interesting that even Ukraine’s economically important partners, such as China (its largest trading partner), receive low support ratings among Ukrainians. This indicates that Ukrainian society values moral support above real trade and does not recognize “neutrality” if it is not accompanied by humanitarian gestures,” comments Maxim Urakin, PhD in Economics and founder of Experts Club.

Thus, the results indicate that there is significant potential for countries in the region, particularly Southeast Asia, to improve their image in Ukraine through cultural diplomacy, tourism marketing, and economic cooperation.

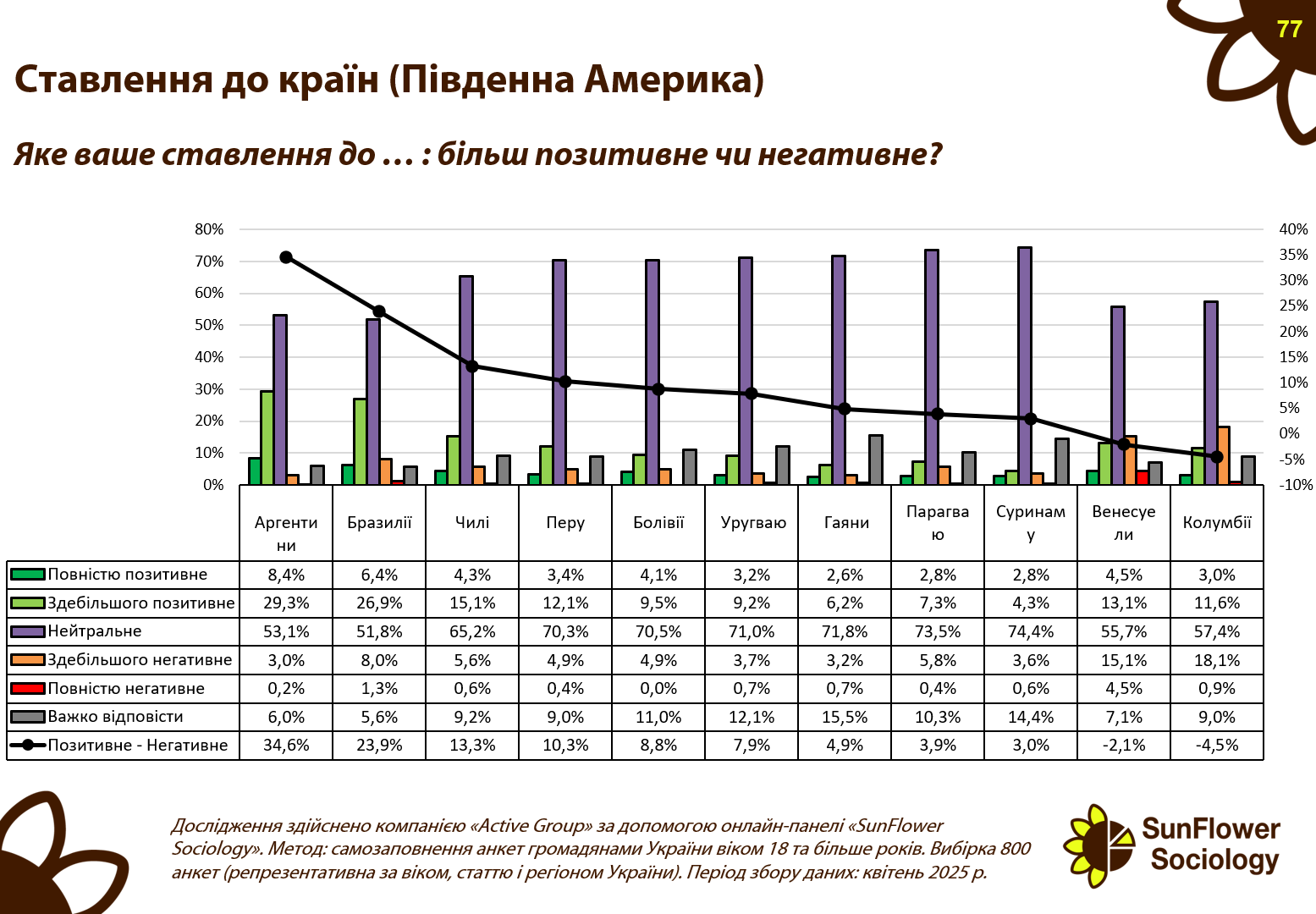

In April 2025, Active Group, in collaboration with the Experts Club think tank and the SunFlower Sociology platform, conducted a survey on the attitudes of Ukrainian citizens toward Central Asian and Caucasian countries. The results show a predominantly neutral or moderately positive perception of the region, with Georgia and Kazakhstan as clear leaders in terms of favorability.

Georgia received the largest share of positive ratings: 16.8% of Ukrainians said they had a completely positive attitude, and another 37.0% said they were mostly positive. Together, this forms a positive balance of 40%. Kazakhstan has a similar level of sympathy: 11.6% completely positive, 34.2% mostly positive, with a net balance of 41.9%. Azerbaijan ranks third with a total positive rating of 42.4%, although neutral assessments significantly prevail there — 45.4%.

In contrast, the countries of Central Asia are dominated by neutral responses: 63.4%, 64.3%, 66.4%, and 61.3% in Uzbekistan, Kyrgyzstan, Tajikistan, and Turkmenistan, respectively. All of them have a balance of sympathy below 12%, and Turkmenistan even shows zero support (-0.2%), mainly due to low awareness.

On the other hand, 8.4% have a completely positive attitude towards Armenia and 29.9% have a mostly positive attitude, putting it in fourth place with a balance of 35.5%.

“Despite their shared Soviet heritage, Ukrainian society views Central Asian countries mostly through the prism of caution or indifference. At the same time, the examples of Georgia and Kazakhstan demonstrate that close intergovernmental ties and a positive media presence can significantly influence public opinion,” comments Maxim Urakin, PhD in Economics and founder of Experts Club.

Thus, the study’s conclusions indicate that in a region with potential for interaction with Ukraine, the key factor is not only historical memory, but also contemporary diplomatic and cultural activity.

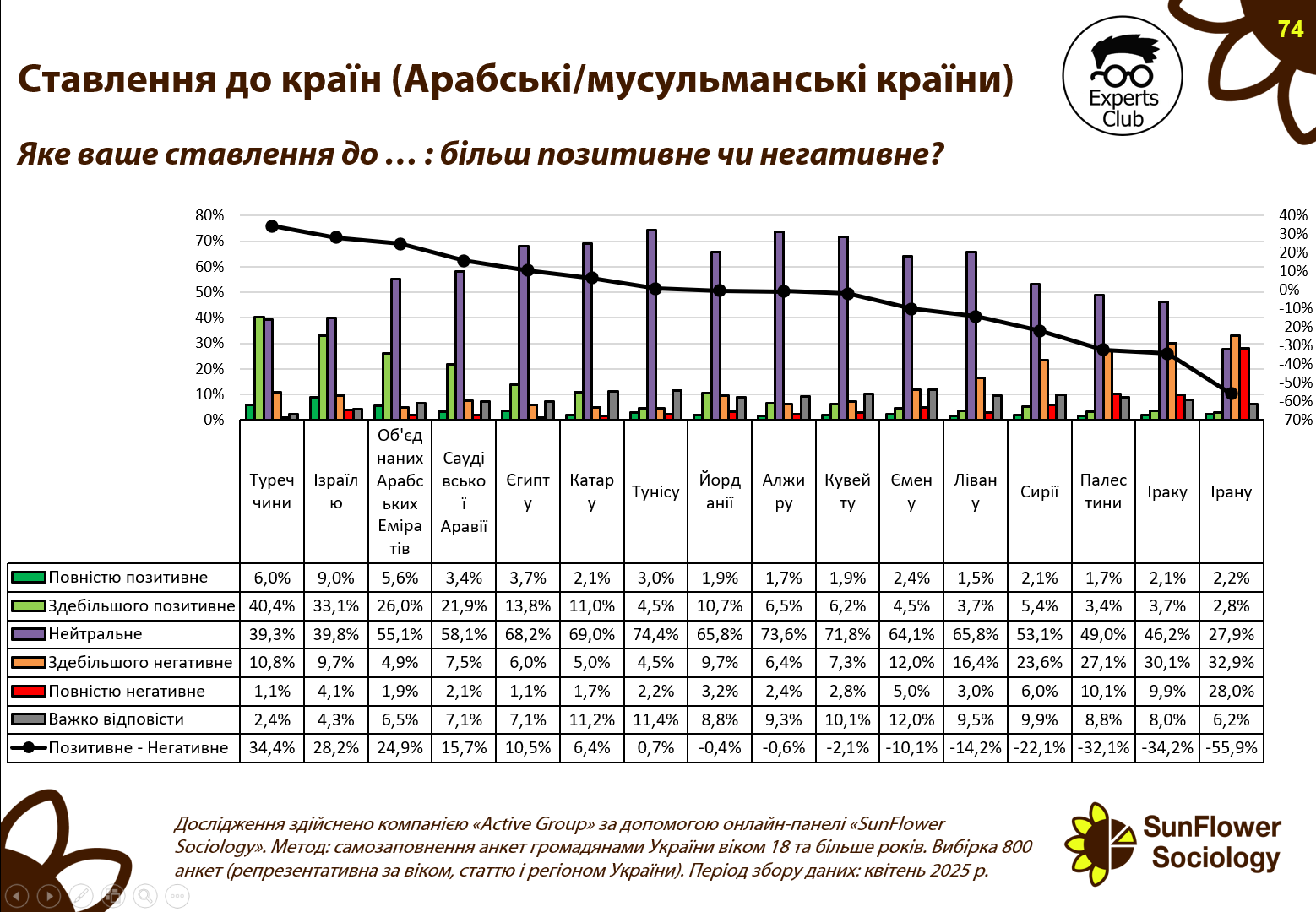

The results of the latest sociological survey conducted by Active Group in collaboration with the Experts Club analytical center and the SunFlower Sociology platform show that Ukrainians generally have a cautious or wary attitude toward Arab and Muslim countries. The survey covered 800 respondents in April 2025.

The most positive attitude among those surveyed was toward Turkey — 6% of Ukrainians expressed a completely positive attitude, and another 40.4% — mostly positive. The overall positive balance is 34.4%. Israel was the second most popular country among Ukrainians, with 9% of respondents expressing a completely positive attitude and 33.1% expressing a mostly positive attitude, although the positive balance here is slightly lower at 28.2%.

Next in terms of favorability are the United Arab Emirates (with a total positive rating of 24.9%) and Saudi Arabia (15.7%). It should be noted that almost 69% of Ukrainians took a neutral position on Saudi Arabia, which is one of the highest figures among all countries surveyed.

As for Egypt, Qatar, Tunisia, Jordan, Algeria, and Kuwait, neutral or indifferent assessments dominate, with a positive balance ranging from 6.5% to -3.6%. Attitudes toward Syria, Palestine, Iraq, and Iran are even more critical, with negative views outweighing positive ones by tens of percentage points. For example, Iran has the lowest score, with only 2.2% of responses being entirely positive, 7.2% mostly positive, and a full 30.1% negative, giving a net balance of -55.9%. The situation is similar for Iraq (-34.2%) and Palestine (-32.1%).

“Mass neutrality, and in some cases open negativity, towards many Muslim countries indicates a lack of information links, as well as an ambiguous perception of the role of these states in global politics. Against this backdrop, Turkey and Israel have the opportunity to strengthen humanitarian and economic ties with Ukraine,” comments Maxim Urakin, PhD in Economics and founder of Experts Club.

Thus, the data emphasizes that the depth of ties and real actions of countries in times of trial determine the level of public trust in Ukraine — even in geographically remote regions.

Ukrainian citizens demonstrate the highest level of sympathy toward Canada, Great Britain, Sweden, Denmark, and the Netherlands. These are the results of a study conducted by Active Group in collaboration with the Experts Club think tank and the SunFlower Sociology platform in April 2025. Canada came out on top in terms of positive image: 40.6% of Ukrainians expressed a completely positive attitude, with another 35.7% expressing a mostly positive attitude. The overall positive balance was a record 73.5%.

The United Kingdom ranks second with a total positive rating of 68.6%. Sweden, Denmark, and the Netherlands are also at the top of the ranking with similarly high levels of positive perception — over 68% of the total positive rating.

France and Germany remain strong, but their positions are less clear-cut. In France, the share of “mostly positive” attitudes is particularly high at 47.7%, although only 26.4% view it as “completely positive.” In Germany, 23.7% of respondents indicated a completely positive attitude, but the level of distrust has increased, with 7.9% of Ukrainians assessing it negatively.

The US elicited a mixed reaction: only 6.7% of Ukrainians rated this country completely positively, while 26.5% expressed a negative attitude. The image balance in the US is one of the lowest among Western partners — only 5.3%. Ukrainians showed a similar level of disappointment with Central European countries: Hungary has the worst image of all, with only 4.1% of completely positive responses and as many as 47.7% negative, giving a net image balance of -43.6%. Slovakia also has a negative rating of -14.8%.

“These results are not only a reflection of public opinion, but also a benchmark for diplomatic activity. Countries with high levels of support have the best conditions for strengthening bilateral ties with Ukraine in the humanitarian, security, and economic spheres,” comments Maxim Urakin, PhD in Economics and founder of Experts Club.

Overall, the survey results clearly demonstrate that international support for Ukraine in difficult times directly shapes citizens’ trust. Ukrainians’ attitudes are not only based on historical or cultural ties, but also depend to a large extent on the specific actions of foreign states during the war.