Qatar seeks a sustainable investment partnership with Ukraine, the Minister of Commerce and Industry, Acting Minister of Finance of Qatar H E Ali bin Ahmed Al Kuwari said during the second meeting of the joint commission on economic, trade and technical cooperation between the two countries.

“In August 2020, the Qatari company QTerminals signed an agreement with the Ukrainian side on the concession for Olvia seaport in Mykolaiv. In the next five years, it is planned to invest in the development of the Ukrainian port and infrastructure. We will continue to expand the investment partnership,” he said.

“Today’s meeting of the commission is a necessary tool to achieve this goal,” he added.

Following the meeting, the co-chairs of the commission namely Minister of Commerce and Industry of Qatar H E Ali bin Ahmed Al Kuwari and Ukrainian Minister of Finance Serhiy Marchenko signed a protocol on amending the agreement between the governments of Ukraine and Qatar on avoidance of double taxation and prevention of tax evasion in relation to income tax.

The parties also discussed further steps in the development of bilateral relations and defined promising areas of cooperation, in particular, attracting investments, developing entrepreneurship and cooperation in tourism, agriculture, infrastructure, energy, health care, and financial sector, the report said.

“The meeting reaffirmed the desire of the two states to intensify economic activity. Despite the COVID-19 pandemic, we are seeing an upward trend in bilateral trade and hope to continue this positive trend. One of our top priorities is to attract investment in the economies of the two countries and strengthen business cooperation,” Marchenko said.

The Ministry of Finance recalled the first meeting of the joint commission on cooperation between Ukraine and Qatar took place in 2018.

An influential official and businessman from Saudi Arabia, Abdulrahman Alolaya, arrived in Ukraine on an unofficial business visit.

He is the CEO of the TaibahVally investment campaign and one of the leaders of the national investment program “Saudi Vision 2030”, which is looking for the most profitable and innovative areas for investment. The Sovereign Wealth Fund of Saudi Arabia, which finances the program, is one of the largest investment funds in the world.

The meeting took place at the Ministry of Digital Transformation. The guest was told about the developments in the field of digital state. Alexander Bornyakov, Deputy Minister of Digital Transformation for IT Development, promised to provide a list of the most successful Ukrainian startups and promote cooperation in every possible way.

“Ukraine is very interesting for us, because it has a lot of experience in modern technologies, there are highly qualified personnel and interesting startups. At the same time, the investment market is in the early stages of development and this is a good period for investing,” said Abdulrahman Alolaya.

Abdulrahman Alolaya also visited the offices of several Ukrainian technology companies, including UNITCity.

“Ukraine has a large number of interesting IT services. However, the weak marketing of these services to the Arab market leads to the fact that they do not know about it. We want to fix it,” said Ukrainian businessman Oleksandr Chechuga. He and his partners invited an Arab investor to Ukraine. Dmitry Buravel and Alexander Chechuga are co-owners of the Ukrainian company BlockHunter, which work with block chain technologies, develops electricity storage systems; Roman Movchan is the owner and CEO of PrimeBerry, one of the largest producers and exporters of berries. These companies have already managed to enter the Saudi market and are ready to help other Ukrainian startups.

More guests from Saudi Arabia were interested in Ukrainian developments in the fields of education, block chain and digital government services.

The debut International Defense Investment Forum, dedicated to the search for new directions in the development of Ukraine’s defense industry, which featured about 20 investment projects, was held in Kyiv at the Sikorsky Challenge (National Technical University of Ukraine “Ihor Sikorsky Kyiv Polytechnic Institute”) on Thursday.

“The authorities have an understanding of the existing problems and the need to take all measures aimed at improving the current investment climate in the country,” Deputy Prime Minister for Strategic Industries Oleh Urusky said, opening the forum.

He said that the recently adopted laws On Defense Procurement should remove excessive secrecy in the defense industry and ensure transparency of procurement and On the peculiarities of reforming the state-owned defense industry should facilitate the attraction of investment and private business in the sector, according to which on the basis of Ukroboronprom two holding companies will be created.

Urusky also said that the Ministry for Strategic Industries of Ukraine has developed a Strategy for the Development of Ukraine’s Defense Industry until 2030. According to him, given the nature of modern wars and conflicts, the main directions in the development and production of domestic weapons and military equipment were: automated control systems; rocket and space technology; high-precision means of destruction, ammunition and products of special chemistry; means of electronic warfare; unmanned platforms and shock robotics; “soldier of the future” equipment.

During the forum, which was attended by a delegation from the UAE led by the Mariam bint Mohammed Saeed Hareb Almheiri, about 20 investment projects were presented in three areas: high-precision weapons and ammunition; robotic equipment: air, ground and marine components; automation of control and communication system.

In particular, “Shock unmanned aerial vehicle complex with barrage ammunition ST-35 Thunder (LLC NPP Athlon Avia), Organization of lines for the production of large caliber cartridges 12.7×99; 12.7×108; 14,5х114 for small arms (LLC Stiletto Ukraine) and Unmanned robotic platforms Scorpion 2 and Dwarf scout (LLC Infocom).

Among other projects – “Universal robotic remote-controlled combat module/Project ACHILLES” (LLC Diamond Defense Systems), Light BPAK battlefield Yatagan-2 with a swarm function (LLC First Contact).

Deputy Minister of Economy, Trade Representative of Ukraine Taras Kachka and U.S. Trade Representative Katherine Tai agreed to hold a Trade and Investment Council.

“We talked about the need to strengthen dialogue on climate change, non-tariff rules for industrial and food products both in the context of strengthening the World Trade Organization (WTO) and on the bilateral track. We agreed to hold a Council on Trade and Investment and talk,” Kachka wrote on Facebook on Wednesday following a discussion with Tai on key trade issues held on May 11.

During the conversation, Tai expressed support for the idea of free production of vaccines (waiver), he said.

“We expressed our support. Ukraine is ready to act as a compressor of the waiver initiative and to convince the EU that it is necessary,” Kachka said.

With regard to duties on metallurgical products, the United States, according to Kachka, is ready to seek an individual approach to metal trading in order to overcome the problem of overcapacity.

“We explained that the duties and the EU measures applied later ended in the opposite direction in terms of overcapacity [excess capacity]. In general, Ukraine is more likely a partner of the West in transforming metallurgy,” Ukrainian trade representative added.

The State Regional Development Fund will finance 297 investment programs and projects worth UAH 4.3 billion in 2021, according to the decision of the Cabinet of Ministers.

The resolution of April 12 was published on the government’s website.

According to the document, the largest number of projects is planned to be financed in Ternopil region – 24 projects for UAH 142 million, Luhansk region – 19 projects for UAH 177 million, Cherkasy region – 19 projects for UAH 95 million, and Donetsk region – 17 projects for UAH 561 million.

In Kyiv, it is planned to finance four projects worth UAH 256 million, including UAH 175.8 million allocated for the first phase of the construction of Bortnychi aeration station, as well as the reconstruction of its pumping station.

According to the resolution, in general, Kyiv region will receive UAH 154 million for the implementation of 11 projects.

Earlier, the government changed the procedure for selecting investment projects of the fund, in particular, it changed the deadlines for some stages in the current edition, the assessment and preliminary selection of investment programs and projects should be completed no later than August 1 of the year, which comes before the planned one, instead of May 1.

According to experts of Kyiv School of Economics (KSE), this will make it possible to better predict the situation both in terms of budgeting and for competitors who will be able to better understand their needs and opportunities in future budget periods.

In addition, for large construction projects worth over UAH 100 million, the implementation period was allowed to be extended from four to five years. For such projects, the lower cost limit is also doubled up to UAH 10 million.

“This will provide for more flexibility in planning the budget for long-term projects and reduce the number of potential long-term construction projects,” the KSE said on its Telegram channel.

However, the government did not make amendments regarding the requirements for the timing of the publication of the protocols after the meeting of the commissions or broadcasting of such meetings, the KSE said.

“Lack of publicity and transparency, on the one hand, does not contribute to trust in this tool, and this increases the likelihood of losing motivation for the authors of potentially good projects. On the other hand, it creates threats to influence the final list of objects and the amount of funding,” the KSE said.

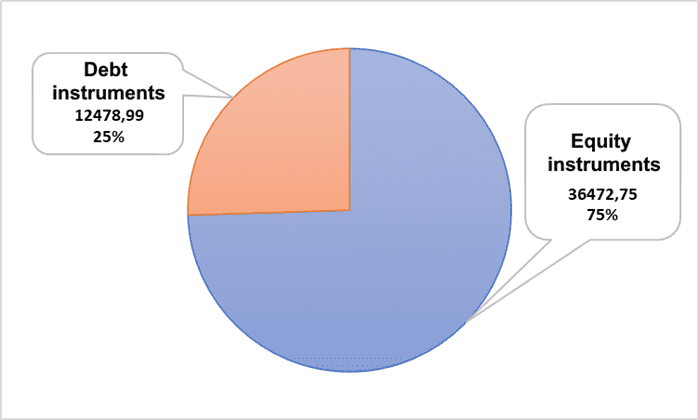

Foreign direct investment in the economy of Ukraine as of 09/30/2020 (balance, $ million).

NBU