Ukrainian farmers will harvest about 56 million tons of early grain crops and 21 million tons of oilseeds in the 2025 season, according to Deputy Minister of Economy, Environment, and Agriculture Taras Vysotsky.

“In principle, in terms of early grain crops, production is expected to be around 26 million tons, which is slightly less than last year. The decrease is due to the fact that in the southeastern regions, the yield of winter wheat and rye is, unfortunately, lower due to drought,” he said on Ukrainian Radio.

Speaking about the corn harvest, which will begin in September, the deputy minister noted that the harvest is also expected to be good. At the same time, corn crops in the southeast — parts of Dnipropetrovsk, Kirovohrad, Mykolaiv, and Odesa regions — have been virtually lost. However, the main corn belt of Ukraine — Sumy, Chernihiv, Poltava, Kyiv regions and further west, despite late sowing and late emergence, thanks to precipitation and optimal temperature conditions, has produced good plants.

“Ultimately, the corn harvest will be quite good on a national scale. We can talk about about 28 million tons, which is more than last year,” Vysotsky said, adding that the final forecast figure of 56 million tons of gross grain harvest is in line with last year’s level.

According to him, farmers will receive about 21 million tons of oilseeds in 2025, which corresponds to the 2024 figure. The production structure will include slightly more sunflower and less soybeans.

The deputy minister also noted favorable purchase prices for agricultural products.

“From a farmer’s point of view, prices are high, really good. Even now, at the time of harvest, they are not falling and are holding steady. Where there were no force majeure circumstances and no losses, these prices are really worthy as a result of working the land,” he stressed.

Speaking about livestock products, Vysotsky noted the stable situation with the production of all types of meat, eggs, and milk.

He recalled that due to the cold spring, horticulture suffered losses in the 2025 season.

“Yes, there were losses in orchards, in the early group, but for late varieties, the indicators may be slightly better and at the level of last year. In the domestic market of Ukraine, a decrease in apple prices is expected in the near future. Currently, they are holding steady because last year’s harvest is being sold. The cost includes long-term storage. But starting in September, the situation will change and stabilize by the end of October. Depending on the final harvest, the prices will be completely different,“ Vysotsky said.

According to him, the situation with vegetables is similar.

”We are approaching the mass harvest (of vegetables – IF-U). We see that the price is reacting and will decline. But there are no prerequisites for it to fall below cost. Vegetables will be more affordable for consumers, but with a normal economic effect for the producer,” Vysotsky concluded.

In 2025-2026 marketing year (MY), the Association “Ukroliyaprom” forecasts the production of oilseeds in the amount of 22 mln tons of oilseeds, which can be fully processed at domestic oil extraction plants (OEP), the press service of the association reports.

According to the industry association, in the current season Ukraine can harvest 13.0 mln tons of sunflower, 3.0 mln tons of rapeseed and 6.0 mln tons of soybeans.

“With the current capacities in Ukraine (excluding the temporarily occupied territories and the war zone), the entire harvest can be processed domestically,” Ukroliyaprom emphasized and added that they are hopeful about this after the adoption of the soybean-rape amendments, which provide for the introduction of an export duty on rapeseed and soybeans.

At the same time, the association said that they do not expect farmers and cooperatives to send the entire soybean and rapeseed crop for processing at the first stage.

Ukroliyaprom predicts that in 2025/26 MY, the mills will be able to process 1.5-1.6 mln tons of rapeseed and 3-3.2 mln tons of soybeans.

On July 16, the EBA highly appreciated the adoption of the draft law No. 13157 “On Amendments to the Tax Code of Ukraine in connection with the adoption of the Law of Ukraine ”On Integrated Prevention and Control of Industrial Pollution“ in the second reading, which contained ”soybean-rape” amendments. They provide for the establishment of an export duty on rapeseed and soybean seeds in the amount of 10% from the 1st day of the month following the adoption of the law.

“The adoption of this draft law in terms of establishing an export duty on rapeseed and soybeans will increase their processing and increase exports of high value-added products. Finally, Ukraine has created conditions for maximum processing of major oilseeds (sunflower, soybean, rapeseed) at domestic facilities,” the business association emphasized.

Ukroliyaprom reminded that since 1998 it had considered the introduction of a duty on oilseed exports as its main goal, which has finally been achieved. From now on, the industry association proclaimed the main task to maximize the processing of rapeseed and soybean seeds starting from 2025/26 MY.

As reported, the Ministry of Agrarian Policy and Food forecasted the harvest of rapeseed at 3 mln tonnes, soybean – 5.7 mln tonnes, sunflower – 20 mln tonnes in 2025 MY.

The business community, united by the American Chamber of Commerce in Ukraine (the Chamber), is concerned about the potential risks associated with the possible return to the practice of imposing export duties and/or quotas on oilseeds.

The duty-free trade regime with the European Union (EU), which is the main buyer of Ukrainian oilseeds, is a guarantee of Ukraine’s rapid and successful recovery. At the same time, the introduction of customs or other trade restrictions by Ukraine could jeopardize negotiations on the renewal of the free trade area with the EU, in particular due to the risk of mirror restrictions on Ukrainian exports.

In addition, experts from the Chamber’s member companies consider it necessary to recall that the experience of introducing export duties on soybeans and rapeseed in 2017, which were subsequently abolished in 2020, showed that such measures do not lead to a significant increase in oil production. Instead, such restrictions cause financial losses for agricultural producers and lead to a corresponding reduction in oilseed crops.

Therefore, the Chamber calls on the Government and members of parliament not to allow the reintroduction of export duties and/or quotas on oilseeds and not to support such initiatives.

Source: https://interfax.com.ua/news/press-release/1080636.html

Due to Russia’s full-scale invasion and its desire to use food as a weapon, transporting grain and oilseeds from Ukraine to other countries has become extremely difficult. Since 2022, logistics issues have had to be significantly revised in order to find safer shipping routes and options. Despite the dire circumstances created by the Russian Federation, Ukrainians are ensuring food security for many countries, particularly in Europe.

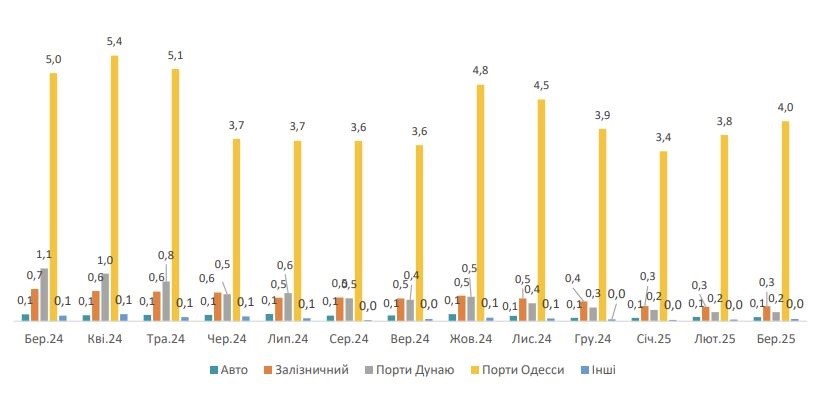

In March 2025, Kyiv exported a total of 4.7 million tons of grain and oilseeds and their processed products. This is 7% more than in the previous month.

“How does Ukraine transport grain and oilseeds, as well as products made from them? The lion’s share goes to the seaports of the Odesa region. This figure is 4 million tons. By rail – 300,000 tons, through the river ports of the Danube – 200,000 tons. It is also exported by road. The volume reaches 100,000 tons,” said grain market analyst Oleksandr Korenitsyn.

Exports of grain crops, oilseeds, and processed products, million tons

Let’s look at the prices of the main agricultural crops that Ukraine exports to world markets. In April 2025, the price of wheat (France, FOB) was 244 USD/ton. Note that this is 3 USD more than in March of this year and 29 USD more than in the same period of 2024. The price of wheat (Ukraine, 2nd class, CPT) in April 2025 was USD 211/t (central regions), which is USD 4 more than in March 2025 and USD 75 more expensive than a year ago. In ports, the price was 229 USD/t, which is 7 USD higher than in the previous month and 65 USD more expensive than in April 2024, according to the International Grains Council.

As for corn (USA, FOB), the price as of April 2025 was USD 211/t. This amount is USD 4 higher than in the previous month and USD 19 higher than in April 2024. The price of corn (Ukraine, CPT) in the central regions is 206 USD/t, thus increasing by 11 USD over the month and by 89 USD over the year; ports – 222 USD, which is 12 USD more than in March 2025 and 78 USD higher than in April 2024.

As noted by Oleksandr Korenitsyn, the price of barley (France, FOB) was 229 USD in April 2025, which is 1 USD less than in March of this year and 26 USD more than in the same period last year. The price of barley (Ukraine, CPT) was USD 195 in the central regions, which is USD 8 more than in March 2025 and USD 102 higher than in April 2024; in ports, it was USD 215 (the price rose by USD 5 per month and USD 85 over the year).

“Another important crop for Ukraine and the world that should be mentioned is sunflower. The price of its seeds in the EU (Rotterdam, FOB) in April this year was 730 USD/t. There has been an increase in price over the last month – by 7 dollars, as well as an increase over the year – by 273 dollars. Meanwhile, the cost of sunflower seeds (Ukraine, CPT) for the central regions was 537 USD/t. The price rose by 10 USD per month and 221 USD per year. For ports, the cost is $512 per ton, which is $6 more than last month and $194 more than last year,” said expert Oleksandr Korenitsyn.

We would like to add that the cost of sunflower oil (Ukraine, FOB) in April was $1,140 per ton. It should be noted that among the key factors that could destabilize further pricing on the world market and affect food security in Europe and the world are Russia’s military actions on the territory of Ukraine.

EUROPE, full-scale Russian invasion, grain exports, Korenitsyn, LOGISTICS, Odessa ports, OILSEEDS, PRICES, UKRAINE, VOLUME

In 2024, Agrotrade harvested more than 236 thsd tonnes of grains and oilseeds, the company’s press service reported on Facebook.

According to the report, the harvest of wheat amounted to 95.5 thousand tons, corn – 53 thousand tons, winter rapeseed – 38.3 thousand tons, sunflower – 36.6 thousand tons, soybeans – about 13 thousand tons, hemp – 96 tons, barley – 78 tons.

“This year, soybeans suffered the biggest yield losses, in particular, due to drought. In general, abnormal weather conditions affected all crops, but we are satisfied with the results of the season. Rapeseed and corn even outperformed the forecasts, while sunflower and wheat yields remained within the plan,” said Oleksandr Ovsyanyk, Director of Agrotrade’s Agricultural Department.

The agricultural holding is confident that due to effective management, adaptation of technologies and professionalism, it will be able to maintain stable positions in the agricultural market.

Agrotrade Group is a vertically integrated holding company with a full agro-industrial cycle (production, processing, storage and trade of agricultural products). It cultivates over 70 thousand hectares of land in Chernihiv, Sumy, Poltava and Kharkiv regions. Its main crops are sunflower, corn, winter wheat, soybeans and rapeseed. It has its own network of elevators with a one-time storage capacity of 570 thousand tons.

The group also produces hybrid seeds of corn and sunflower, barley, and winter wheat. In 2014, a seed plant with a capacity of 20 thousand tons of seeds per year was built on the basis of Kolos seed farm (Kharkiv region). In 2018, Agrotrade launched its own brand Agroseeds on the market.

The founder of Agrotrade is Vsevolod Kozhemiako.

Ukraine’s grain harvest in 2025-2026 marketing year will be at the level of 55-65 million tons, grain exports – 40-50 million tons, and oilseeds harvest will also exceed last year’s and is expected to be at the level of 24 million tons, predicts Sergiy Feofilov, general director of information and analytical agency UkrAgroConsult.

“Rapeseed and sunflower will remain the most marginal, while corn will show stable margin growth due to the recovery of demand,” he explained in an interview published on the agency’s website.

The expert believes that in 2025 agrarians will emphasize the development of processing and increase exports of value-added products (oil, meal, flour, fodder), which will reduce dependence on logistics costs and increase revenues.

According to Feofilov, the focus of trade will shift to North Africa, Asia and the Middle East, where demand for grains and oilseeds is growing, and Ukraine can respond to these challenges by expanding its markets.

The head of “UkrAgroConsult” expressed confidence that this year the key issues for Ukrainian farmers will remain the increase in the share of high value-added products in exports, trends in the growth of lending to farms, adaptation of agricultural technologies to climate change, rising prices for resources and increasing number of sudden requests.

The issues of security, energy independence, increasing the profitability of farmers, adaptation to environmental standards, harmonization of Ukrainian legislation to European legislation, international cooperation, restoration and improvement of logistics chains will also be relevant, summarized Feofilov.